The God of #Options #Greeks is often disregarded and has no mercy, especially on #Options #expiration day.

A #Thread on #Gamma.

#OptionsGreeks

1/n

A #Thread on #Gamma.

#OptionsGreeks

1/n

The primary feature of #Options is their non-linear payout.

Most traders understand that #OptionsPricing is dependent on the price of the underlying, but the response is non-linear. #Gamma is the variable that describes this non-linearity.

#OptionsGreeks

2/n

Most traders understand that #OptionsPricing is dependent on the price of the underlying, but the response is non-linear. #Gamma is the variable that describes this non-linearity.

#OptionsGreeks

2/n

Loosely, if #Delta is the speed of the #Options position, #Gamma is the acceleration.

#OptionsGreeks

3/n

#OptionsGreeks

3/n

#Gamma also describes how stable the position's #Option #Delta is.

A high #Gamma means the options delta can change fiercely with a small change in the price of the underlying.

#OptionsGreeks

4/n

A high #Gamma means the options delta can change fiercely with a small change in the price of the underlying.

#OptionsGreeks

4/n

Long options positions (calls or puts) always have a positive #Gamma.

Short options always have a negative #Gamma.

A Futures position has a zero #Gamma, as the #Delta is always 1 and never changes.

#OptionsGreeks

5/n

Short options always have a negative #Gamma.

A Futures position has a zero #Gamma, as the #Delta is always 1 and never changes.

#OptionsGreeks

5/n

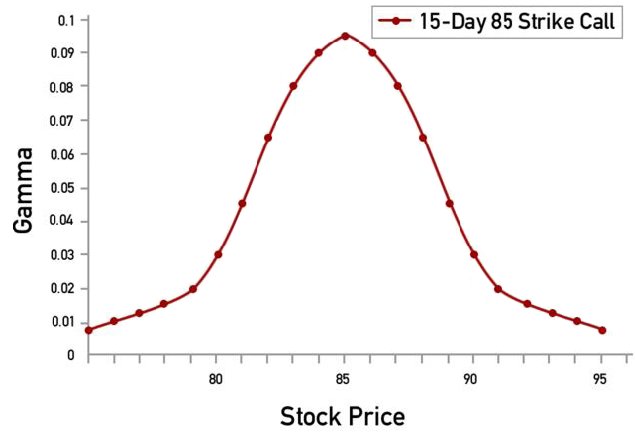

Some call it #MountGamma.

This is how #Gamma changes across strikes from ITM, ATM to OTM.

See the peak of the #MountGamma at the ATM strike.

#OptionsGreeks

6/n

This is how #Gamma changes across strikes from ITM, ATM to OTM.

See the peak of the #MountGamma at the ATM strike.

#OptionsGreeks

6/n

The #Gamma peak for ATM strikes means that the #OptionsPricing is most sensitive to smaller changes in stock price for ATM options.

I like the word #fiercely sensitive.

#OptionsGreeks

7/n

I like the word #fiercely sensitive.

#OptionsGreeks

7/n

So what makes #Expiration day so intense?

This is what happens to #Gamma as we get closer to #expiration.

#Gamma spikes at ATM strikes.

#OptionsGreeks

8/n

This is what happens to #Gamma as we get closer to #expiration.

#Gamma spikes at ATM strikes.

#OptionsGreeks

8/n

Some might say big deal, we'll just do more #OptionSelling as the position goes against us on expiration.

The trader is then faced with the classic negative #Gamma #OptionsTrading problem.

#OptionsGreeks

8/n

The trader is then faced with the classic negative #Gamma #OptionsTrading problem.

#OptionsGreeks

8/n

The Negative #Gamma Trading Conundrum:

For fun we'll use the $BankNifty and hypothetical 31-May expiry.

$BankNifty opens at 26300 and a fancy options trader named Sunjay sells a far OTM #strangle at 25500PE/27000PE at 10AM for a princely sum of ₹10.

#OptionsGreeks

9/n

For fun we'll use the $BankNifty and hypothetical 31-May expiry.

$BankNifty opens at 26300 and a fancy options trader named Sunjay sells a far OTM #strangle at 25500PE/27000PE at 10AM for a princely sum of ₹10.

#OptionsGreeks

9/n

Immediately after stabilizing at open, at noon there is news of Italy default. Dow futures get slammed, World markets are in a tizzy.

Our $BankNifty tanks by 400 points.

The #Strangle that Sunjay sold at ₹10 is now trading at ₹80.

#OptionsGreeks

10/n

Our $BankNifty tanks by 400 points.

The #Strangle that Sunjay sold at ₹10 is now trading at ₹80.

#OptionsGreeks

10/n

But Sunjay is a smart and smooth trader. No panic. He has seen this scenario play out several times.

He calmly closes his 27000CE which is now almost ₹0.05 and with the BN at 25800, he holds his 25500PE and sells the 26100CE to balance his position.

#OptionsGreeks

11/n

He calmly closes his 27000CE which is now almost ₹0.05 and with the BN at 25800, he holds his 25500PE and sells the 26100CE to balance his position.

#OptionsGreeks

11/n

Nothing happens for the next hour and markets stabilize.

Sunjay's #strangle net price is now back down to ₹60. He aims to close this out at 0 today.

#OptionsGreeks

12/n

Sunjay's #strangle net price is now back down to ₹60. He aims to close this out at 0 today.

#OptionsGreeks

12/n

At 2pm, things change. Turns out Italy will get bailed out after all. Markets swing back and buying starts furiously.

BN spot turns back 300 points in the same 5M candle and is close to the 26100CE, now trading close to ₹100 itself.

What does Sunjay do?

#OptionsGreeks

13/n

BN spot turns back 300 points in the same 5M candle and is close to the 26100CE, now trading close to ₹100 itself.

What does Sunjay do?

#OptionsGreeks

13/n

This is a work of fiction. Names, characters, are either the products of the author’s imagination or used in a fictitious manner. Any resemblance to actual persons, living or dead, or actual events is purely coincidental.

TBC

TBC

• • •

Missing some Tweet in this thread? You can try to

force a refresh