1/ I don’t think there is any type of scam or fraud behind @bitfinex, #Tether, and $USDT reserves. Today’s report gave the market the most important information they needed (reserves are there), yet doubters want more. Here is why I don’t think there is fraud with #Tether:

2/ The hit on Bitfinex is that they are printing $USDT with no backing. This would mean that Bitfinex is knowingly committing fraud and market manipulation for in the crypto space, all while the biggest spotlight is on them. This seems extremely unlikely to me for many reasons.

3/ First let’s take a look at Occum’s Razor: “a problem-solving principle that, when presented with competing hypothetical answers to a problem, one should select the answer that makes the fewest assumptions.” Let’s take facts and not assumptions.

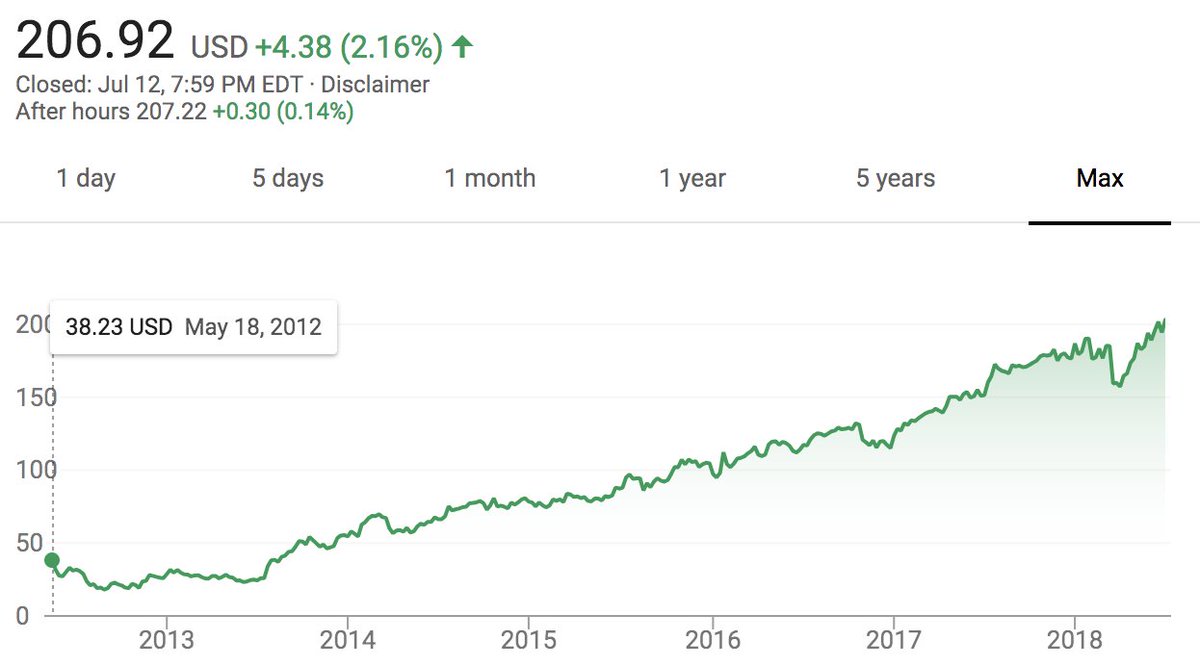

4/ Bitfinex is a highly profitable company (and was well before Tether existed). Bloomberg estimates that Bitfinex is making around $500mn a year in exchange fees alone. Why commit a complex, unnecessary fraud when you’re company is already making insane amounts of money?

5/ Bitfinex was founded in 2012 when Bitcoin prices were $100. We can assume the founders held and do hold very large amount of Bitcoin. Again, if you are already holding personal extreme wealth, why commit a complex, unnecessary fraud?

6/ Crypto trading volume, despite price being on a 60-90% dip across the board, is still near an all time high. While ideally price would be on the rise, exchanges are rather indifferent to the daily up and down swings in prices, they still make money in both directions.

7/ Bitfinex employees nearly 100 employees according to LinkedIn. In the proposed #USDT scam, Bitfinex would have to be masking the scam to employees. Any feud or unhappy employee would expose it. If not, we’re assuming nearly all employees are in on it…again, very unlikely.

8/ The most likely answer to the criticism of no full audit is that Bitfinex wants to hide their bank connections. They fear governments will try to shut them down. If the banks are exposed, that will happen. This is the risk in holding $USDT, not that there are false reserves.

9/ Smaller, unnknown banks are taking in these large deposits because they can earn a lot off them. At the same time, $USDT is providing a nice fiat onramp for some crypto customers.

10/ The burden of proof when it comes to claiming scam is on the people claiming scam. There has been no direct evidence to date that reserves don’t exist and Occum’s Razor would lead us the fact that the reserves are fine and there isn’t some grand scheme taking place.

Damn, if only I knew how to spell Occam.

• • •

Missing some Tweet in this thread? You can try to

force a refresh