Okay, I think I figured out what is Trump's ultimate game in this escalated US-China trade tensions and I think he will get it. Will share my thoughts in a thread soon! 😎

1) What is Trump's ultimate game? RECIPROCAL TRADE & INVESTMENT. Pissed off about higher tariffs vs the US & non-tariff barriers. Regarding #China 🇨🇳, doesn't like forced tech transfers, Chinese industrial overcapacity, gov subs. But how to get this? Investment+Trade policy

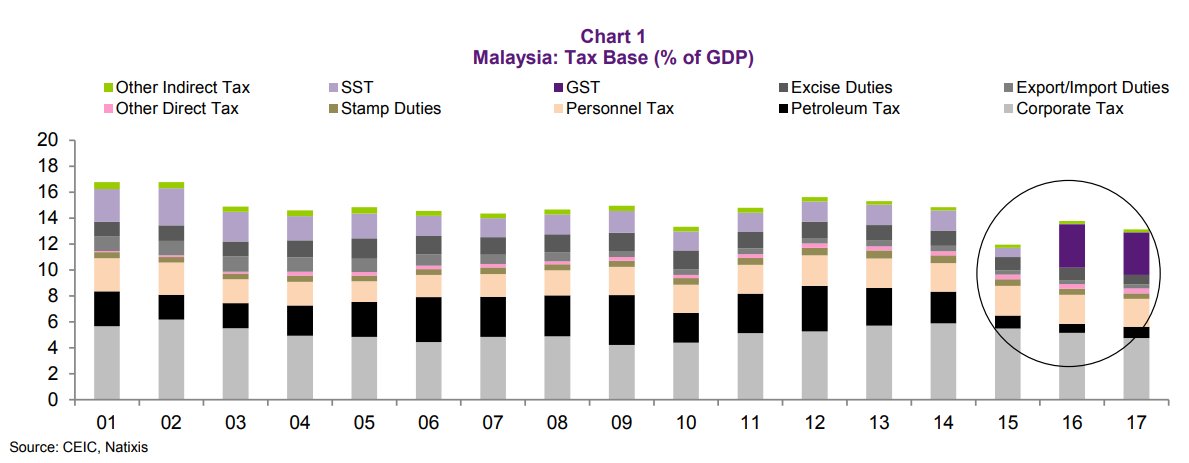

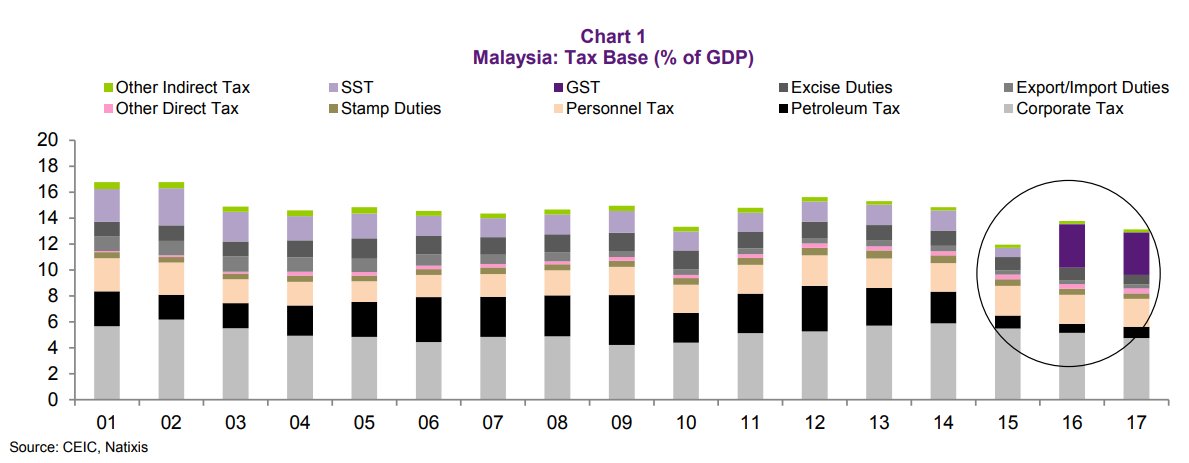

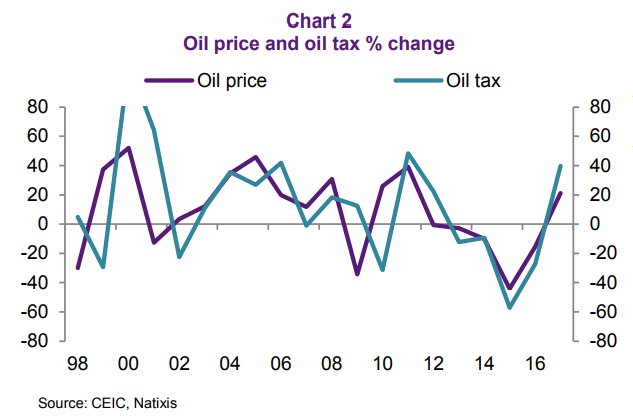

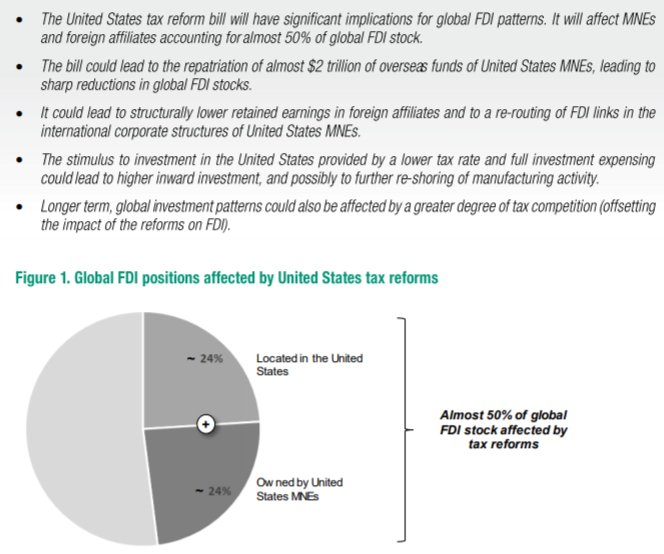

2)Implemented #taxreforms that impacts 50% of global FDI stock & favors US as a destination; USD2trn of REPATRIATION of funds, lower retained earnings of foreign affiliates; higher INVESTMENT in the US b/c of expensing, re-shoring of manufacturing. Basically, good for earnings💪

3) After making the US a more attractive place to invest, he makes it MORE expensive to invest elsewhere, esp for those that want to sell to the US or want to leave the US because of CHEAPER costs elsewhere. How? THREATS OF TARIFFS & threats are credible b/c they are consistent

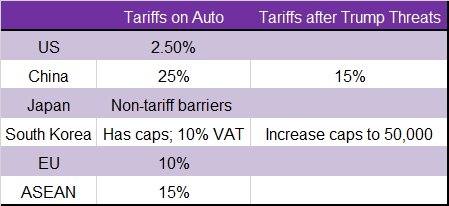

4) Despite negative academic/media/international leaders (EU, Japan, Korea, China, etc) reaction, he ignores continues to ESCALATE trade tensions. Why? Simple, he is getting results. Look at automobiles. US tariff is 2.5% while China was 25% (dropped to 15%) ; EU 10%; ASEAN 15%

5) And although it seems that everyone thinks he's going on the WRONG track, his base loves it. In fact, he is getting bi-partisan support for his trade stance. As a result, approval ratings are rising. So he is basically has ZERO incentive to back down. Incentive says ESCALATE

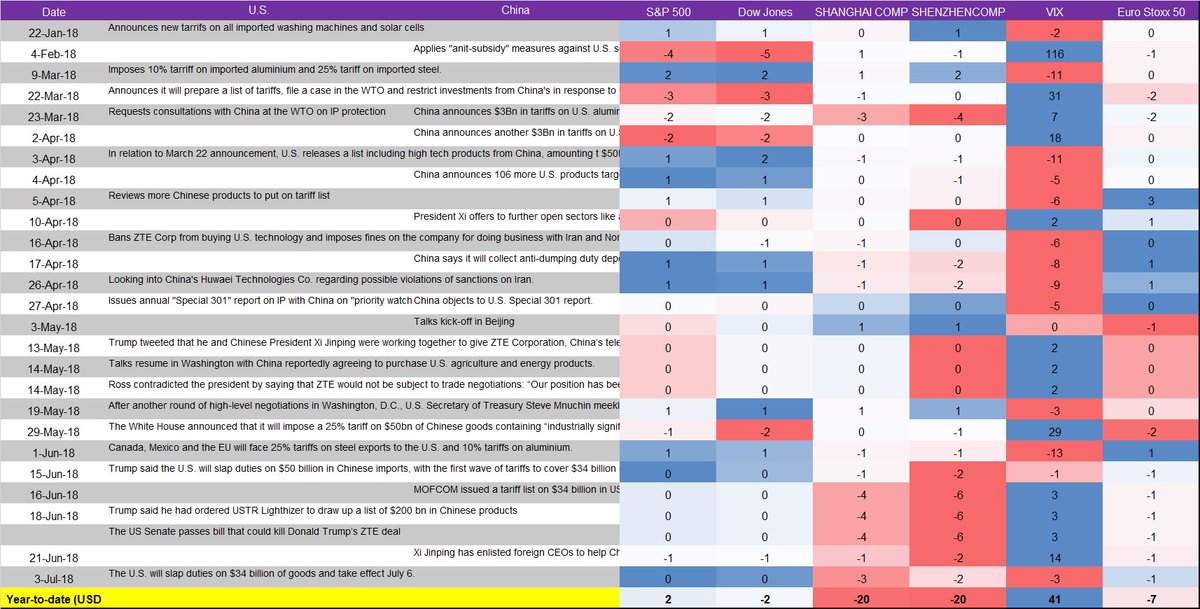

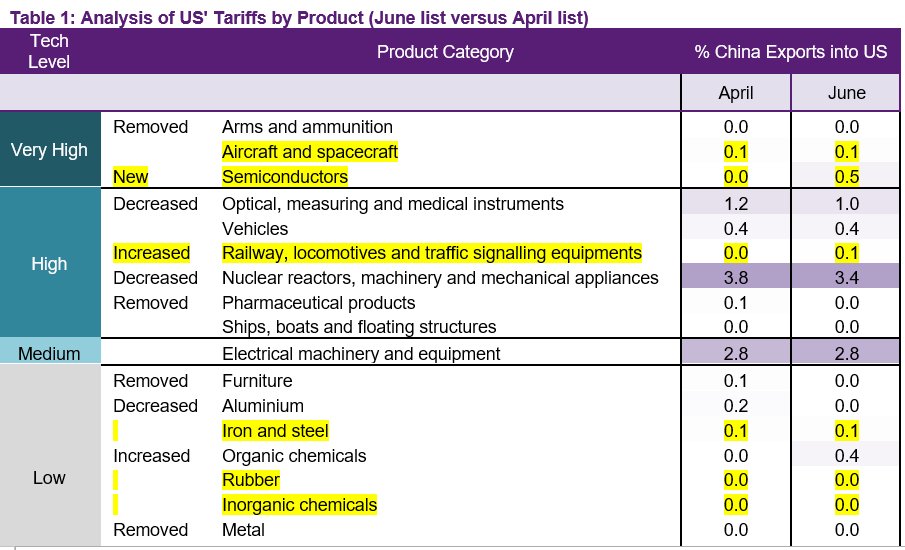

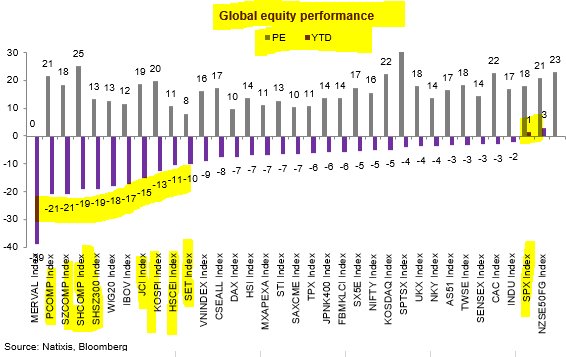

6) Give the strong economy, higher approval ratings, good results so far, & relatively muted stock reaction (SPX still up ytd despite correction) vs. the massive drop elsewhere (China equities -20%-ish in USD), @realDonaldTrump is putting 25% tariff on 34bn of goods. See Table

7) Impact? 34bn is 6.5% of China's exports to the US & 0.3% of GDP covering things like Chinese semiconductor. If China retaliates w/ 34bn, then that is 26% of US merchandise exports (the US exports a lot of services) & 0.2% of GDP covering things like US soybeans. What's next???

8) ESCALATION: US 34bn -> China 34bn -> US 16bn -> China 16bn -> US 200bn -> China 200bn. So at this level, it's 2% of China GDP and 1.3% of US GDP. Big but not catastrophic, then why is the equity market for China and Asia correcting so much??? See table. 🤔

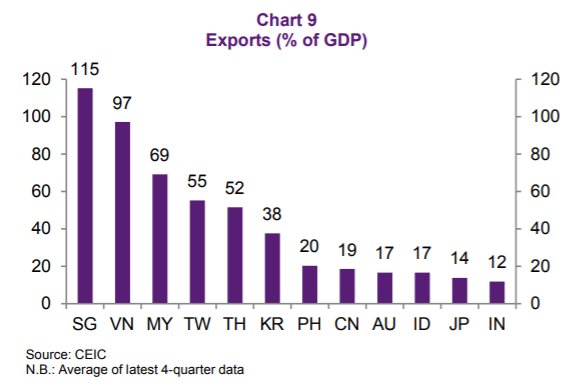

9) B/c Asia is very exports exposed (Korea merchandise exports is 40% of GDP) & both Korea and Taiwan are massive semiconductor producers & they exports to China & China exports to the US. But there is more to this. I think markets have not priced in the impact on INVESTMENT 🇨🇳

10) The USD34bn not scary but threat of escalated tariffs point to something else -> impact on INVESTMENT & SUPPLY CHAIN in Asia. If a firm invests in China to access China as a MASSIVE market, then no impact b/c goal is to sell to China. But if invest to arbitrage costs, then...

11) As a former FDI expert at the World Bank & self-appointed at HSBC, I can tell you that when tariffs rise for exports from China to the US, Asian firms that want to sell to the US will not invest in new factories in China if the goal is to tell to the US unless terms favorable

12) So what? This is not only about trade but also about investment, which goes back to pt1 about @realDonaldTrump 's beef about China & how TRADE & INVESTMENT go together. China is trying to re-balance its econ (de-risk of excessive leverage that depends on short-term funding..

13)...So Chinese equities correct b/c firms are facing DOMESTIC stress (tighter liquidity/high leverage/more stringent regulation/margin compression) + EXTERNAL pressure (trade tensions w/ the US, EU less tolerance of China industrial policy,etc). LIQUIDITY squeeze is happening.

14) Not just a short-term story but a medium term trend. China extended its RMB balance sheet onshore MASSIVELY. Thanks to capital controls, this is contained for now. But interest rate differentials will put pressure. & EXTERNAL capital'll be scarcer given reduced foreign funds

Btw, here is @Trinhnomics ranting about this thread on @BBCBusiness & I really tried to convey it as much but defo ran out of time. It should be replayed every hr on the station. And yes, my makeup was not on pt! Didn’t have lipstick at home! Issues...drive.google.com/open?id=1Y3LVP…

Happy #Monday ! Let's recap #tradewars impact on #SPX #dowjones #Eurostoxx #nk225 #KOSPI #HSI #Shcomp #Shenzhen #UST #VIX . Bottom line: Impact larger on China 🇨🇳 🇺🇸 vs. US (-20% vs. +3%) & Asia (#Korea down -11). UST-10yr up 43bps ytd despite risk-off. Why?🤔

A common narrative for experts in the media is a) NO ONE WINS in a trade-war ; b) WE'LL SEE. @realDonaldTrump is doing what China has been doing - makes it very expensive foreigners to export/sell goods to 🇨🇳via HIGH TARIFFS so they bring production onshore via FDI (e.g. autos)

China can get foreign firms to set up shop: a) force foreign firms to do joint-ventures; b)extract tech + state-led initiative that wipes out foreign foreign firms (e.g. telecom where China successfully dominate); c) protect domestic players while argue for open markets elsewhere

The divergence in US equity vs. China comes from @realDonaldTrump is going for INVESTMENT via #taxreforms + making it very expensive to sell to the US (tariffs) unless invest onshore (RECIPROCAL TRADE + INVESTMENT). FDI data will show this. Will escalate until he gets concessions

• • •

Missing some Tweet in this thread? You can try to

force a refresh