1/ I believe celebrating innovation leads to more innovation. It leads to more investment in the space, more entrepreneurs, more talent to join those co's, etc.

With that goal, we put out an annual list of the 25 most innovative consumer/retail companies called the CircleUp25.

With that goal, we put out an annual list of the 25 most innovative consumer/retail companies called the CircleUp25.

2/ Here is this year’s list of the #CircleUp25. We used #Helio and a panel of industry experts to identify the winners.

forbes.com/sites/ryancald…

forbes.com/sites/ryancald…

3/ Ancient Nutrition: @ancientnutr / Jordan Rubin, Josh Axe

Pioneered natural, easy to use bone broth powders. Seeing growth as strong as I've ever seen in the category over the last 20 years.

[Disc: I'm an exceptionally small investor]

Pioneered natural, easy to use bone broth powders. Seeing growth as strong as I've ever seen in the category over the last 20 years.

[Disc: I'm an exceptionally small investor]

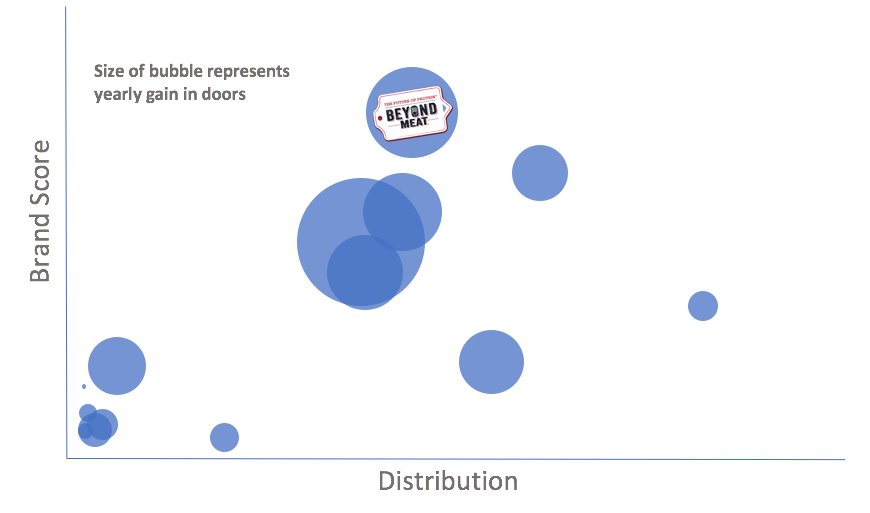

4/ Beyond Meat: @BeyondMeat / Ethan Brown

In an increasingly crowded space, Beyond Meat is looking like a winner. According to Helio: The co has the strongest brand score of co's tracked in the meat alternatives category. Seeing big distribution gains.

In an increasingly crowded space, Beyond Meat is looking like a winner. According to Helio: The co has the strongest brand score of co's tracked in the meat alternatives category. Seeing big distribution gains.

5/ Boochcraft: @Boochcraft / Adam Hiner, Andrew Clark, Todd Kent

Boochcraft took inspiration from craft beer industry to make one of first high-alcohol content kombucha. The drink is organic, non-GMO, locally sourced, gluten-free & has all of health benefits regular kombucha.

Boochcraft took inspiration from craft beer industry to make one of first high-alcohol content kombucha. The drink is organic, non-GMO, locally sourced, gluten-free & has all of health benefits regular kombucha.

6/ Brandless: @brandless / @idoleffler, @TinaSharkey

P&G and Unilever are getting disrupted. Brandless has them clearly in their sites. The most recent $240m might help.

bloomberg.com/news/articles/…

P&G and Unilever are getting disrupted. Brandless has them clearly in their sites. The most recent $240m might help.

bloomberg.com/news/articles/…

7/ Brew Dr. Kombucha: @brewdrkombucha / Matt Thomas

Brew Dr. Kombucha takes an innovative approach by removing the alcohol without the use of heat, preserving the beverage’s health benefits and live, active cultures.

Brew Dr. Kombucha takes an innovative approach by removing the alcohol without the use of heat, preserving the beverage’s health benefits and live, active cultures.

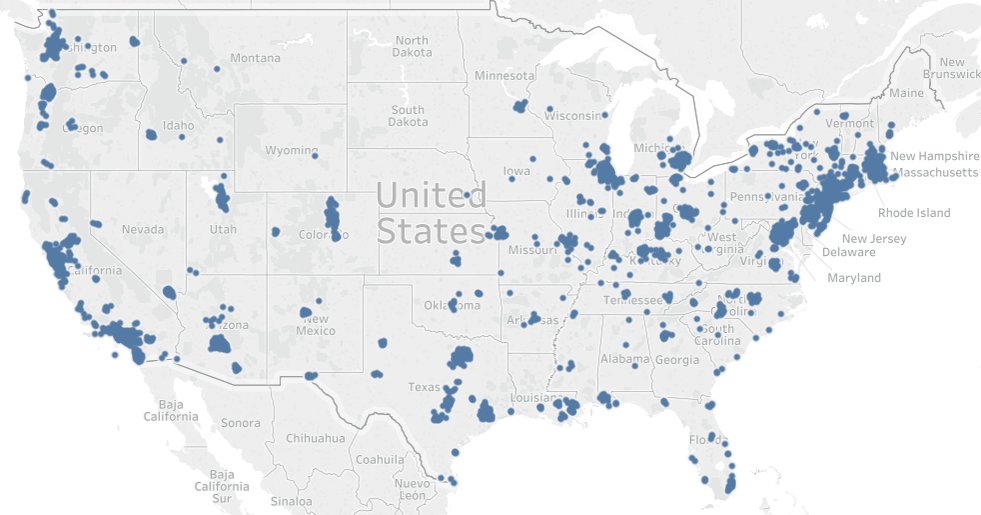

8/ Caulipower: @CAULIPOWERED / @gailfbecker

Distribution is critical in CPG. Helio shows today how in the course of a year, the brand has grown quickly and spread to major distribution areas across the country.

Distribution is critical in CPG. Helio shows today how in the course of a year, the brand has grown quickly and spread to major distribution areas across the country.

9/ Cece’s Veggie Noodle Co: @cecesveggieco / Mason Arnold

Simple wins. Veggie Noodle is a simple good for you snack. First pre-packaged USDA organic spiralized vegetables available in Zucchini, Sweet Potato, Butternut, and Beet.

Simple wins. Veggie Noodle is a simple good for you snack. First pre-packaged USDA organic spiralized vegetables available in Zucchini, Sweet Potato, Butternut, and Beet.

10/ Credo Beauty: @credobeauty / Annie Jackson

The health & beauty industry is dominated by toxic ingredients. Helio highlights the clean label of a sample shampoo found on @Credobeauty – which only stocks clean label products

The health & beauty industry is dominated by toxic ingredients. Helio highlights the clean label of a sample shampoo found on @Credobeauty – which only stocks clean label products

11/ Daily Harvest: @DlyHarvest / @RachelDrori

Daily Harvest is bringing farm-frozen ingredients in pre-portioned, no-cook recipes to your doorstep. Also first time ever a CPG PE firm (VMG) has co-invested with a tech VC firm (Lightspeed). Congrats @ataussig @jeremysliew

Daily Harvest is bringing farm-frozen ingredients in pre-portioned, no-cook recipes to your doorstep. Also first time ever a CPG PE firm (VMG) has co-invested with a tech VC firm (Lightspeed). Congrats @ataussig @jeremysliew

12/ Farmhouse Culture: @FrmhouseCulture / Kathryn Lukas

Farmhouse Culture is a leader in category for making probiotic-rich foods and beverages. Originally founded as a line of Krauts, the company has since expanded to include fermented vegetables, a probiotic drink line, etc

Farmhouse Culture is a leader in category for making probiotic-rich foods and beverages. Originally founded as a line of Krauts, the company has since expanded to include fermented vegetables, a probiotic drink line, etc

13/ Four Sigmatic: @FourSigmatic / Tero Isokauppila

Medicinal mushrooms have been on several lists as a trend to watch in 2018 and the global mushroom market is expected to hit $50 billion dollars within the next 5 years.

Medicinal mushrooms have been on several lists as a trend to watch in 2018 and the global mushroom market is expected to hit $50 billion dollars within the next 5 years.

14/ Herbivore Botanicals: @herbivorebeauty / Julia Wills, Alex Kummerow

Since co-founders Julia and Alex started Herbivore Botanicals out of their kitchen, the brand has become a d2c powerhouse that is now widely available at the likes of Sephora and Space.NK in the UK.

Since co-founders Julia and Alex started Herbivore Botanicals out of their kitchen, the brand has become a d2c powerhouse that is now widely available at the likes of Sephora and Space.NK in the UK.

15/ Health Warrior: @HealthWarrior / @dangluck, Nick Morris, Shane Emmett

The company makes “super snack” Chia Bars—with chia seeds as the #1 ingredient—and Superfood Protein Bars—packed with 10g plant protein from chia, quinoa, oats, and peas.

The company makes “super snack” Chia Bars—with chia seeds as the #1 ingredient—and Superfood Protein Bars—packed with 10g plant protein from chia, quinoa, oats, and peas.

16/ Hims: @wearehims / @AndrewDudum

As the latest d2c darling, hims follows in the footsteps of DTC brands like Casper and Warby Parker that have skyrocketed to success with their quirky and approachable branding.

As the latest d2c darling, hims follows in the footsteps of DTC brands like Casper and Warby Parker that have skyrocketed to success with their quirky and approachable branding.

17/ LOLA: @mylolatweet / @friedgal, @kieroyale

LOLA is challenging the lack of transparency in feminine hygiene with 100% organic cotton tampons. In a world where many brands start are now starting out as d2c, LOLA is helping to lead the charge in their space.

LOLA is challenging the lack of transparency in feminine hygiene with 100% organic cotton tampons. In a world where many brands start are now starting out as d2c, LOLA is helping to lead the charge in their space.

18/ MM.LaFleur: @mmlafleur / @smlafleur, Miyako Nakamura

The wardrobe solution for professional women. MM.LaFleur creates luxury apparel and accessories with the same attention to detail as a high-end fashion house.

The wardrobe solution for professional women. MM.LaFleur creates luxury apparel and accessories with the same attention to detail as a high-end fashion house.

19/ Naadam Cashmere: @NaadamCashmere / Matt Scanlan, Diederik Rijsemus, Hadas Saar

For disrupting the cashmere industry. By cutting out the middleman and purchasing directly from herders, Naadam responsibly sources & produces luxury knitwear.

For disrupting the cashmere industry. By cutting out the middleman and purchasing directly from herders, Naadam responsibly sources & produces luxury knitwear.

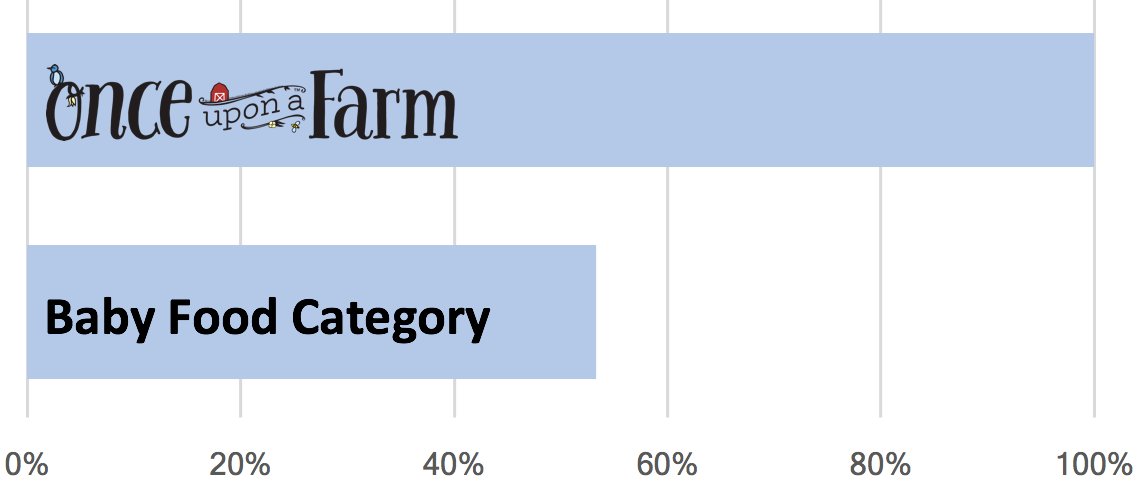

20/ Once Upon a Farm: @onceuponafarm / @arijraz, @jforakerceo, Cassandra Curtis, Jennifer Garner

Product uniqueness - in a way that matters to the consumer- is critical. Once Upon a Farm has that- and a great brand, and an amazing team.

Product uniqueness - in a way that matters to the consumer- is critical. Once Upon a Farm has that- and a great brand, and an amazing team.

21/ Rothys: @rothys / Roth Martin, Stephen Hawthornthwaite

It’s clear that being mission-aligned has propelled this year’s list of consumer brands to success. Rothy's, which are made from recycled water bottles once destined for the landfill, has catapulted into the spotlight.

It’s clear that being mission-aligned has propelled this year’s list of consumer brands to success. Rothy's, which are made from recycled water bottles once destined for the landfill, has catapulted into the spotlight.

22/ Spindrift: @spindriftfresh / Bill Creelman

Spindrift is America’s first sparkling beverages made with real, fresh squeezed fruit. And it tastes really good- did we mention that?

Spindrift is America’s first sparkling beverages made with real, fresh squeezed fruit. And it tastes really good- did we mention that?

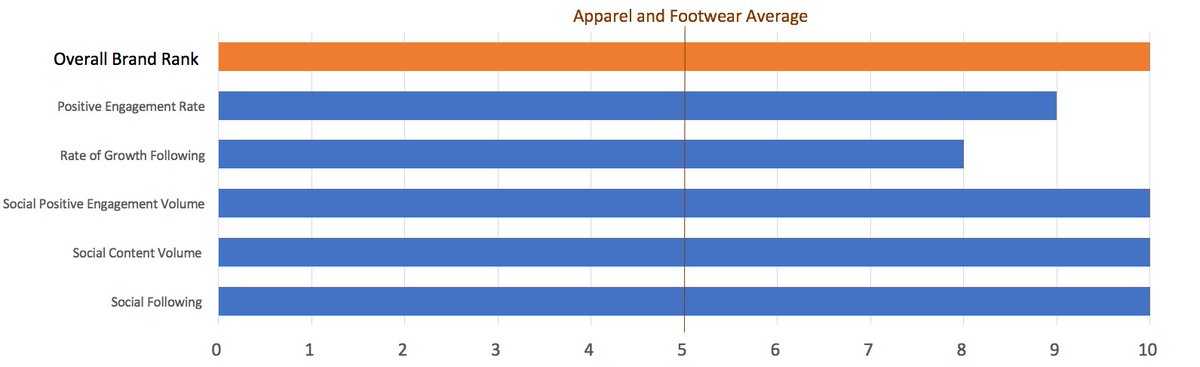

23/ ThirdLove: @ThirdLove / @heidizaks @dspector

#Helio flagged the strong ways in which ThirdLove’s brand is resonating with its consumers across a variety of factors.

#Helio flagged the strong ways in which ThirdLove’s brand is resonating with its consumers across a variety of factors.

24/ Urban Remedy: @UrbanRemedy / @NekaPasquale Paul Coletta

Urban Remedy is a plant-based organic food brand that embodies the belief that Food is Healing. The co makes ready-to-eat, certified organic salads, bowls, wraps, juices, nut milks, and shakes delivered to your door.

Urban Remedy is a plant-based organic food brand that embodies the belief that Food is Healing. The co makes ready-to-eat, certified organic salads, bowls, wraps, juices, nut milks, and shakes delivered to your door.

25/ Vital Proteins: @vitalproteins / Kurt Seidensticker

Collagen peptides are here to stay. Sourced from pasture-raised cows in Brazil and New Zealand and wild-caught fish in Hawaii, Vital Proteins is making collagen accessible with their colorful branding and availability.

Collagen peptides are here to stay. Sourced from pasture-raised cows in Brazil and New Zealand and wild-caught fish in Hawaii, Vital Proteins is making collagen accessible with their colorful branding and availability.

26/ Vive Organic: @vive_organic / @KWithycombe, Wyatt Taubman, JR Simich

Vive Organic packs the highest quality ingredients into Wellness Shots to deliver the closest possible match to a living plant. Their shots are cold pressed––not heated––made without artificial colors

Vive Organic packs the highest quality ingredients into Wellness Shots to deliver the closest possible match to a living plant. Their shots are cold pressed––not heated––made without artificial colors

27/ Youth to the People: @youthtotheppl /Greg Gonzalez, Joe Cloyes

YTTP was founded on the principle that the products we put on our skin should be as whole, clean and packed with nutrients as the best foods we eat. And they are building products that do exactly that.

YTTP was founded on the principle that the products we put on our skin should be as whole, clean and packed with nutrients as the best foods we eat. And they are building products that do exactly that.

• • •

Missing some Tweet in this thread? You can try to

force a refresh