The @ONS has released new analysis of the impact of the UK's #ageing population today.

So how is wealth used in retirement and how is it passed down? Here’s what IFS Associate Director Rowena Crawford found in a recent report ifs.org.uk/publications/1… (1/6)

So how is wealth used in retirement and how is it passed down? Here’s what IFS Associate Director Rowena Crawford found in a recent report ifs.org.uk/publications/1… (1/6)

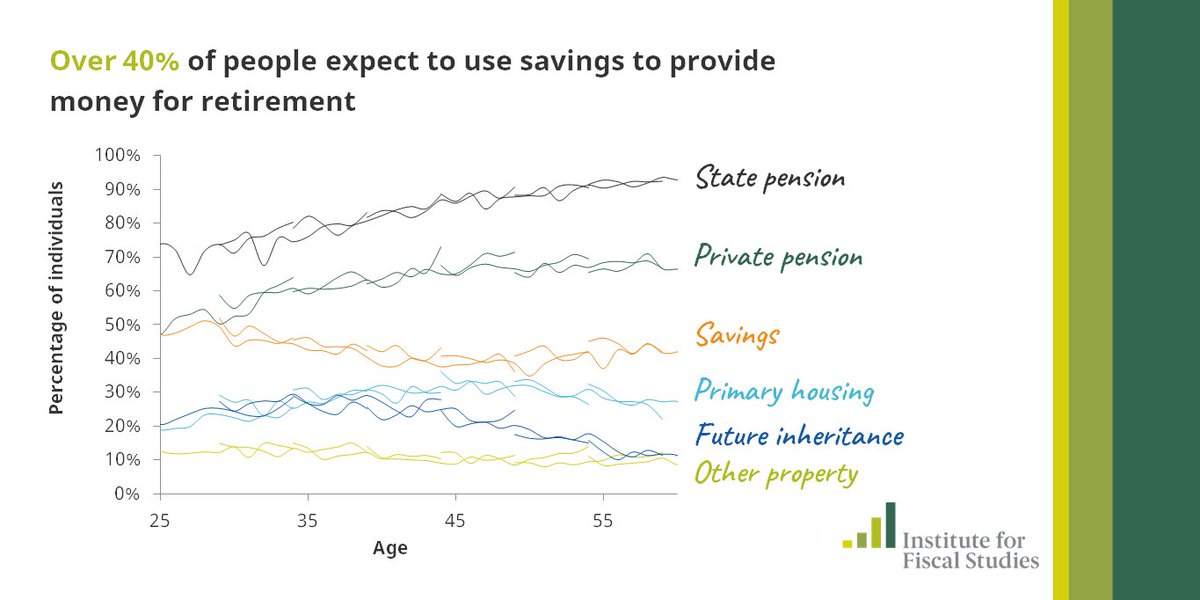

We find that working age individuals expect to draw on many sources for money in #retirement, not just state and private pensions (2/6)

On current trends, two-fifths of home owners at age 50 would be expected to move house before they die. Few currently move for financial reasons, but on average wealth is released when people move (3/6)

Financial wealth is used in retirement, but only slowly. Observed behaviour suggests that on average individuals would draw down just 31% between ages 70 and 90 (4/6)

Multiple property ownership is becoming more common among older people than in the past, and these properties tend to be held onto throughout retirement (5/6)

Retired people look set to bequeath rather than use most of their wealth. But inheritances are typically only received after both parents have died, when recipients are relatively old themselves.

📚 Catch up on our work on savings, pensions and wealth ifs.org.uk/research/79

📚 Catch up on our work on savings, pensions and wealth ifs.org.uk/research/79

• • •

Missing some Tweet in this thread? You can try to

force a refresh