🔥 HOT TAKE 🔥 OVER HALF OF THE REMAINING NON-MINTED BITCOIN ARE ALREADY SPOKEN FOR.

Keep reading before you tell me I’m wrong.

👇👇👇

medium.com/coinshares/hal…

Keep reading before you tell me I’m wrong.

👇👇👇

medium.com/coinshares/hal…

2/ When I meet with legacy investors I often get asked “who in the world owns this stuff?” This is usually followed by “ok, and who will?”

What these people *really* want to understand is potential future demand, or the classic concept of Total Addressable Market (TAM).

What these people *really* want to understand is potential future demand, or the classic concept of Total Addressable Market (TAM).

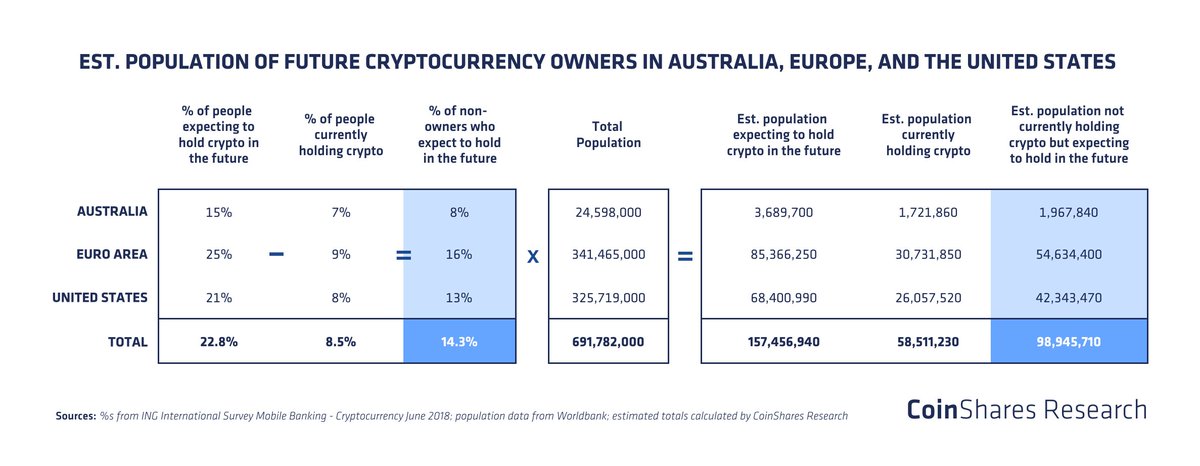

3/ A few weeks ago I came across this survey from @ING_news -->

It caught my eye because for the first time I can remember - due to results and sample size (14,828) - I have what I need to build a data-driven base to start determining potential TAM.

https://twitter.com/ING_news/status/1011519389248651264

It caught my eye because for the first time I can remember - due to results and sample size (14,828) - I have what I need to build a data-driven base to start determining potential TAM.

4/ Applying these results (imperfect, I know - see chart), we can calculate that roughly 99 million ppl across the US, EU and Australia expect to own #crypto in the future but don’t currently.

5/ At today’s prices ($6500), if these ppl each put as little as £100 in #bitcoin, that would amount to increased demand of ~1.9 M bitcoins.

Said differently, roughly half of the remaining non-minted supply.

Said differently, roughly half of the remaining non-minted supply.

6/ So why doesn’t price reflect this? #bitcoin prices are down 52% YTD and 68% from ATHs reached in Dec '17

Even worse... THE VALUE PROPOSITION HASN’T CHANGED!!! If anything, @lightning, market maturation, regulatory clarity + increased awareness are all muy bueno.

Again —>

Even worse... THE VALUE PROPOSITION HASN’T CHANGED!!! If anything, @lightning, market maturation, regulatory clarity + increased awareness are all muy bueno.

Again —>

7/ As the market slumps, the new questions I’m hearing: “why should I buy now?” or “why not risk it and wait for lower prices?”

My take - entry point timing is a dangerous game to play. @Melt_Dem did a 🔥 job covering this on @CNBCFastMoney —>

My take - entry point timing is a dangerous game to play. @Melt_Dem did a 🔥 job covering this on @CNBCFastMoney —>

https://twitter.com/CNBCFastMoney/status/1029126354250489856

8/ A few charts to illustrate…

$AMZN - 9 years to recover from 2000 peak price ($106); now at $1871

$MSFT - 17 years to recover from peak ($58); now at $107

$AMZN - 9 years to recover from 2000 peak price ($106); now at $1871

$MSFT - 17 years to recover from peak ($58); now at $107

9/ If you bought after the pullback in 2000, you were in great shape and there were clearly some values to be had. If you bought at the peak, I hope you #HODLed.

So why did companies that are so clearly viable in hindsight, take so long to reclaim their high valuations from Y2K?

So why did companies that are so clearly viable in hindsight, take so long to reclaim their high valuations from Y2K?

10/ Because they needed a new narrative, bruh.

When you come down from great heights, the "growth story" is harder to see… and most people then (and now) are investing in the (future) growth story.

When you come down from great heights, the "growth story" is harder to see… and most people then (and now) are investing in the (future) growth story.

11/ Also worth noting: suspending disbelief is harder in a bear market - but ironically, this is where most of the valuable #BUIDLing gets done...

H/T @lopp for the gif

H/T @lopp for the gif

12/ Which brings us to today. Fallen from the peak, 2017’s “growth story” became over-hyped… perhaps now, as with 2014, it's time for a new one?

Side bar - go read @nic__carter’s “Visions of Bitcoin” if you haven’t already. Well worth your time —>

Side bar - go read @nic__carter’s “Visions of Bitcoin” if you haven’t already. Well worth your time —>

https://twitter.com/nic__carter/status/1023631563110735872

13/ These narratives matter because they drive motivation and interest in the ecosystem --> which attracts users and talent --> who strengthen the ecosystem, improve on the open source software, and build easier points of access to the digital asset

14/ This influx of talent, time and money leads to: 1) new adoption and 2) new liquidity. Et voilà.

Network effects are a beautiful thing.

Network effects are a beautiful thing.

15/ Have some of these narratives proven inaccurate? Sure. Will many still come true? Maybe.

The point is that each narrative attracts more people — for different reasons — into the space. And each wave of talent = 📈 value in the space and new access points for everyone else.

The point is that each narrative attracts more people — for different reasons — into the space. And each wave of talent = 📈 value in the space and new access points for everyone else.

16/ Again, all muy bueno. Our issue is with the latest "institutions cometh" narrative which has been driving a similar cycle.

Let's be clear: in our opinion, each Bitcoin speculation hype-cycle since inception in 2009 to date, has been driven by individual buyers.

Let's be clear: in our opinion, each Bitcoin speculation hype-cycle since inception in 2009 to date, has been driven by individual buyers.

17/ We believe this narrative slightly misses the point.

Institutions will drive new layers of access; and bring a bit more liquidity, no doubt.

...but the reason they’ll help drive the next bull run is consistent with every growth cycle that came before:

Institutions will drive new layers of access; and bring a bit more liquidity, no doubt.

...but the reason they’ll help drive the next bull run is consistent with every growth cycle that came before:

18/ New attraction, from new masses, will drive new demand; and this increasing demand will be filled through access points created on the back of the last cycle.

The more people who want to play in the sandbox, the bigger the sandbox (and more sand) you need.

The more people who want to play in the sandbox, the bigger the sandbox (and more sand) you need.

19/ With institutions, consumers can now gain exposure through established brands that they already know & generally trust.

Over the past 2 years, we've seen slow growth in institutional interest & participation in the space. This has led to an significant increase in 2 things:

Over the past 2 years, we've seen slow growth in institutional interest & participation in the space. This has led to an significant increase in 2 things:

20/ Trust — as consumers can access crypto through counterparties they perceive as safe and familiar (e.g. @Fidelity)

Access — as institutions are given the tools to integrate with cryptocurrencies, they in turn render access to their clients

Access — as institutions are given the tools to integrate with cryptocurrencies, they in turn render access to their clients

21/ Sure, you can buy through an exchange like @coinbase or @krakenfx. But for consumers, these are new, unproven entities; often with a different setup and unfamiliar owners; and you have to move money into them.

Even with the best user experience, it's a bit painful.

Even with the best user experience, it's a bit painful.

22/ When institutions gain more access, they in turn create more access points for retail investors who are uncomfortable leaving their traditional financial surroundings or have capital "locked up" in the legacy financial system.

23/ So while institutional access is great, we suspect retail demand will continue driving the market in the mid-term, albeit through bigger "institutional-sized plumbing."

in other words... INCREASING ACCESS IS THE GOOD NEWS!!!

in other words... INCREASING ACCESS IS THE GOOD NEWS!!!

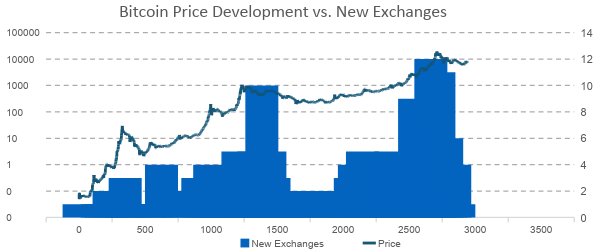

24/ Don't take my word for it - quarterly growth rates in #btc market cap and # of exchanges shows a 72% correlation. While this correlation doesn't prove causality, it shows that access points & market value are undoubtedly linked, at least historically.

25/ However, there is a distinct difference between previous bull runs and 2017...

The 2017 run DID catch the interest of institutional players, who are now increasingly recognizing Bitcoin's value proposition and are responding to their customer's demand for access to #crypto.

The 2017 run DID catch the interest of institutional players, who are now increasingly recognizing Bitcoin's value proposition and are responding to their customer's demand for access to #crypto.

26/ As institutions like @GoldmanSachs, @DeutscheBank and @jpmorgan begin offering access to #bitcoin products for their clients, we are seeing more major players enter the space with @ICE_Markets / @NYSE announcing plans to offer physical access to bitcoin through @Bakkt.

27/ @Bakkt's stated intention to create an "open and regulated, global ecosystem for digital assets," and partnerships with @Starbucks, @Microsoft, @BCG are interesting for two reasons:

28/ One - part of the offering includes physically-settled #Bitcoin Futures, which unlike the financially-settled @CMEGroup / @CBOE Futures will require the delivery of actual bitcoin on expiry. Subject to CFTC approval, these futures will launch in Nov 2018.

29/ Two - @Bakkt aims to help institutions spend digital assets through development of merchant and consumer applications. We assume @Starbucks will spearhead this effort, which, if successful, will further drive #Bitcoin awareness through increased points of sale accepting #btc

30/ If you’re still with me, and wondering “so what, ryan?” Then consider this…

One - #crypto awareness keeps rising, with hundreds of millions of ppl now having heard of cryptocurrencies.

One - #crypto awareness keeps rising, with hundreds of millions of ppl now having heard of cryptocurrencies.

31/ Two - 99m ppl in Western economies alone are estimated to be seeking exposure to #crypto. If each put £100 into #bitcoin at current prices, that equates to demand for ~1.9 million bitcoins, or more than 10% of minted supply.

32/ Three - Major established financial institutions are already providing institutional-grade access to #bitcoin products to millions of clients across the world.

33/ Four - In every previous #bitcoin bull cycle, increased access points that were created in the preceding “build” cycle added to the convenience and capacity for new capital to enter the market. I believe we are seeing this cycle repeat, and yet again in larger magnitude.

34/ Five - Trying to beat the timing game is risky business. Waiting for institutional money to lead the charge might leave you behind while the retail train leaves the station.

35/ If you’ve made it this far, there’s probably no need to read my Medium post. But for good measure and a more shareable format of the above —> medium.com/coinshares/hal…

• • •

Missing some Tweet in this thread? You can try to

force a refresh