"#Macroprudential policies could be increased to enhance the resilience of the financial system" brookings.edu/research/finan… in "Financial conditions and GDP growth-at-risk" Adrian, Liang, et al. @BrookingsInst @IMFNews

GaR: "growth at risk" and general equilibrium models with macrofinancial linkages brookings.edu/wp-content/upl… @BrookingsInst @IMFNews @MacroFinanceSoc Liang, Adrian, et al

"A structural model would be needed to evaluate how #macroprudential policies could be used to affect GaR. In aspiration, #macroprudential policies could aim to tighten financial conditions when conditional expected growth and GaR are relatively high ... " brookings.edu/wp-content/upl…

"A related important benefit of developing a GaR measure is that #FinancialStability risks can be expressed in a common metric that can be used by all #macroeconomic policymakers. A common #metric can promote greater #coordination" ... brookings.edu/wp-content/upl… ...

"It [GaR = growth at risk] may also improve greater accountability for #macroprudential policymakers by providing a #metric in terms that are better understood by other policymakers." brookings.edu/wp-content/upl… @IMFNews @BrookingsInst

"The GaR [growth at #risk] measure ultimately could help in developing #macroprudential policies." brookings.edu/wp-content/upl… @BrookingsInst @IMFNews

"The GaR measure ... can provide an objective gauge for downside risks to expected growth and thus whether #macroprudential policy interventions are needed ..." brookings.edu/wp-content/upl… @BrookingsInst @IMFNews

"The GaR measure ... a metric of whether interventions have been successful.

For example, it could be used to help calibrate a countercyclical capital buffer, severity of stress tests, or borrower #LTV or #DTI

ratios ... "

brookings.edu/wp-content/upl… @BrookingsInst @IMFNews

For example, it could be used to help calibrate a countercyclical capital buffer, severity of stress tests, or borrower #LTV or #DTI

ratios ... "

brookings.edu/wp-content/upl… @BrookingsInst @IMFNews

"estimating [with the GaR #metric] the interplay of #financial conditions and the conditional distribution in a continuous fashion has the advantage that it could become more relevant to #policy making on a regular basis" brookings.edu/wp-content/upl… @IMFNews @BrookingsInst

"Being able to express [with the GaR #metric] #risks arising from the #financial sector in the same terms as used in models for other #macroeconomic #policies will ... foster more effective consultation and #coordination." brookings.edu/wp-content/upl…

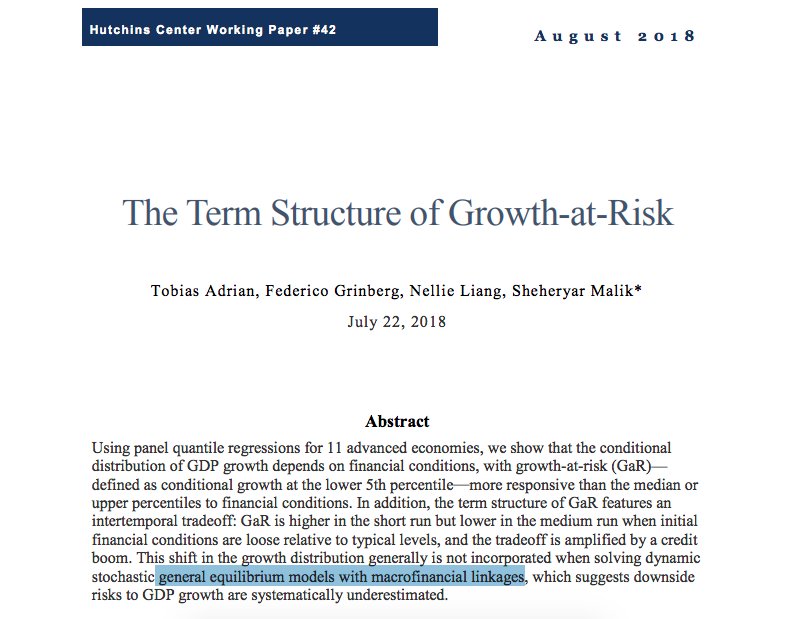

Adrian, Grinbeg, Liang, Malik @IMFNews @BrookingsInst GaR "The Term Structure of Growth-at-Risk" new #metric for #centralbanking #policy and #macroeconomic-#financial coordination "important role of #financial conditions (#FCI) for the modeling" brookings.edu/wp-content/upl…

@threadreaderapp unroll please

@threadreaderapp unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh