This is a thread to help people understand the issues surrounding the recent fine imposed by the CBN on 4 banks and the request that they should refund $8.1 Billion in "illegally repatriated" dividends. This will be long, but let’s start from the beginning. #MTNRefund

A THREAD!

A THREAD!

This issue first come into the open in Sept 2016 when Senator Dino raised a motion accusing MTN of illegal repatriation of $13.92 billion to its parent company through 4 banks between 2006 - 2016 with the help of the Minister of Industry, Trade and Inv, Oke Enelamah. #MTNRefund

The Senate then mandated its Committee on Banking, Insurance and other Financial Institutions to carry out a holistic investigation on compliance with the Foreign exchange (monitoring and miscellaneous) Act by MTN Nigeria & Others. #MTNRefund

The Minister of Communication Mr Adebayo Shittu warned the Senate “to Protect MTN and that the action could scare away investors while the Minister of Industry & Trade Dr. Enelamah dismissed the allegations as baseless since he did not own any shares in MTN as alleged. #MTNRefund

In one of the interesting testimonies, the CEO of MTN NG, Mr Moolman admitted that it failed to comply with the law requiring issuance of CCI within 24hrs of conversion because it was a mere “administrative requirement”. I'll come to this later #MTNRefund

premiumtimesng.com/news/headlines…

premiumtimesng.com/news/headlines…

In Oct 2016, it was further reported (or was it rumored) that the CBN had ordered the stop of dividend payouts to MTN. It seems that this was the first hint of an investigation by the CBN on this particular issue. #MTNRefund guardian.ng/news/sharehold… .

In Nov 2017, the Senate eventually cleared MTN of the allegation of illegally repatriating $13.92 Billion and also exonerated the Minister of Industry and Trade Dr Enelamah of any wrong doing. We thought the matter was closed. But we were wrong. #MTNRefund

Fast Forward to 29/08/18. The CBN revealed that 4 banks have been fined over N5Bn for their role in the illegal remit of $8.1Bn dividend using “irregular” CCI in violation of the Foreign Exchange Act 1995 & the Foreign Exchange Manual. They were asked to refund the $8b #MTNRefund

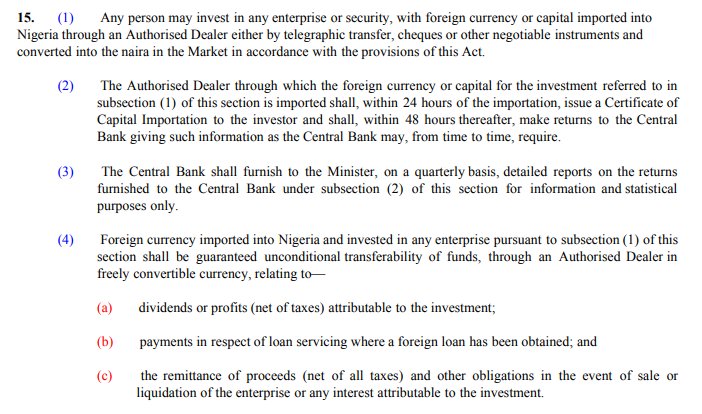

What does the FX Act/Manual Says? The act (and memorandum 22 of the manual) prescribes that any foreign capital imported into Nigeria for the purpose of investment must be converted to Naira within 24 hours of its arrival and CCI issued by the authorized dealer (Bank). #MTNRefund

The Certificate for Capital Importation (CCI) can either come in form of Cash or it can come in the form of Equipment imported into the country. Either way, the requirements and process for the issuance is well spelt out in the Foreign Exchange act and manual.

#MTNRefund

#MTNRefund

So what is the CBN’s case against the banks and MTN?

According to the CBN, their investigation revealed the following:

1. That MTN shareholders invested and imported $402m in MTN Nigeria between 2001 – 2006.

There seem to be no dispute about this from all parties.

#MTNRefund

According to the CBN, their investigation revealed the following:

1. That MTN shareholders invested and imported $402m in MTN Nigeria between 2001 – 2006.

There seem to be no dispute about this from all parties.

#MTNRefund

2. The CBN claims that the investments was carried out through the transfer of cash & importation of equipment evidenced by CCI issued by the 4 banks.

This means that indeed CCIs where issued to confirm that MTN imported $402m into d country. No dispute here as well

#MTNRefund

This means that indeed CCIs where issued to confirm that MTN imported $402m into d country. No dispute here as well

#MTNRefund

3. According to the CBN, the CCI issued by the banks showed that out of $402m, $59m was invested as Shareholders loan while $343m came in as Equity. How did the CBN know this? Because when CCIs are issued, you have to indicate whether it is for “Loan”, or for “Equity”. #MTNRefund

4. According to CBN, a review of the 2007 financial of MTN revealed that instead of Equity of $343m & shareholders loan of $59m, what they found was $2.9m Equity & $399m shareholders loan in accordance to their Shareholders agreement but not in accordance with the CCI. #MTNRefund

Is this unusual and evidence of fraudulent misrepresentation? Not really. The bank could have made a honest mistake of ticking the wrong box on the CCI eventhough this is very unlikely because they should have acted on instructions contained in MTN's board resolution. #MTNRefund

5. The CBN went further to say that following a request by SCB to convert the shareholders loan to Preference Shares, an approval-in-principle was issued by CBN subject to a final approval on the condition that -

a. Implementation of decision in item 5B of their BR and #MTNRefund

a. Implementation of decision in item 5B of their BR and #MTNRefund

b. An undertaking that no remittance will be made to the shareholder in form of interest/principal payments from the date of the loan to the date of the conversion. Was this undertaken implied or was it by writing? We don’t know. Whichever way, it seems SCB ignored it. #MTNRefund

My Apologies. It appears that I muddle up the thread.

See the correct continuation below

See the correct continuation below

https://twitter.com/yinkanubi/status/1035562454787473411

• • •

Missing some Tweet in this thread? You can try to

force a refresh