Thread

Comments by Paal Kibsgaard, Schlumberger Chairman & CEO

1- "Still, the well-established market consensus that the #Permian can continue to provide 1.5 million barrels per day of annual production growth for the foreseeable future is now starting to be called into question"

Comments by Paal Kibsgaard, Schlumberger Chairman & CEO

1- "Still, the well-established market consensus that the #Permian can continue to provide 1.5 million barrels per day of annual production growth for the foreseeable future is now starting to be called into question"

2- "In fact, so far in the third quarter, the hydraulic fracturing market has already softened significantly more than we expected in spite of the overall rig count holding up relatively well."

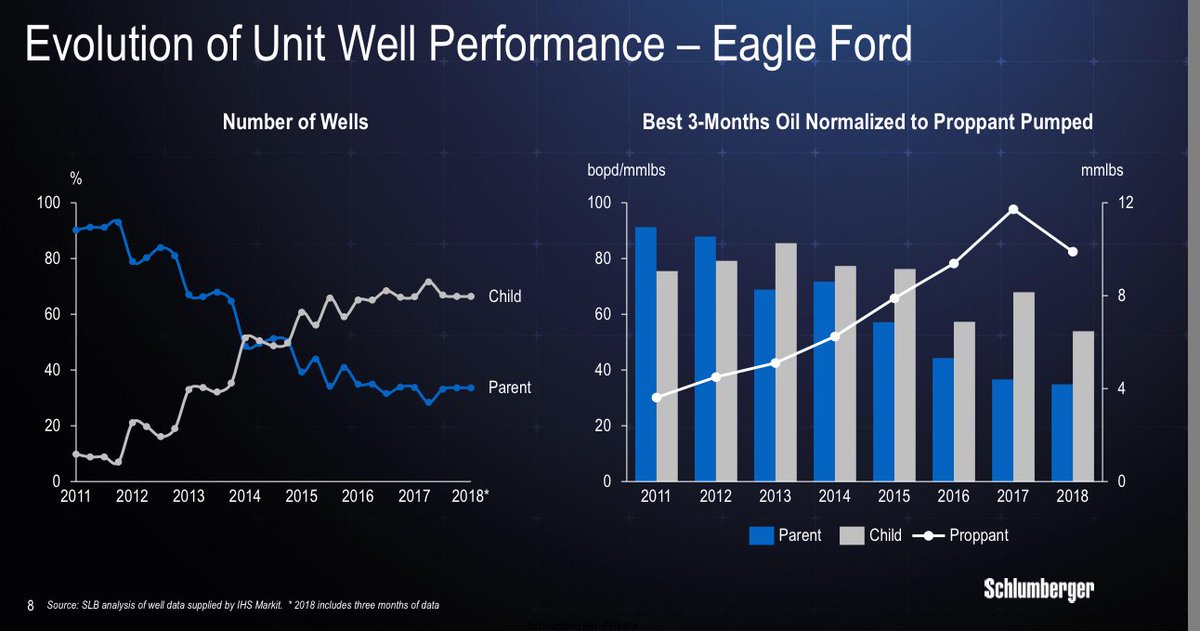

3- "Still, what is already clear is that unit well performance, normalized for lateral length and pounds of proppant pumped, is dropping in the Eagle Ford as the percentage of child wells continues to increase."

#Oil #Permian #EagleFord #shale

#Oil #Permian #EagleFord #shale

WOW💥

4- "These production headwinds have, in recent years, been overcome by drilling longer laterals and pumping ever greater volumes of sand and water.

However, the use of these remedies seems to be coming to an end, both from a technical and commercial standpoint."

#shale

4- "These production headwinds have, in recent years, been overcome by drilling longer laterals and pumping ever greater volumes of sand and water.

However, the use of these remedies seems to be coming to an end, both from a technical and commercial standpoint."

#shale

another WOW

5- "Today, the percentage of child wells being drilled in the Eagle Ford has already reached 70% and, in the 3-year period since this percentage broke the 50% level, we have seen a steady reduction in unit well productivity"

#shale #oil #EagleFord

5- "Today, the percentage of child wells being drilled in the Eagle Ford has already reached 70% and, in the 3-year period since this percentage broke the 50% level, we have seen a steady reduction in unit well productivity"

#shale #oil #EagleFord

This is big! 💥

6- "In the Midland Wolfcamp basin of the Permian, the percentage of child wells has just reached 50%, & we are already starting to see a similar reduction in unit well productivity already seen in the Eagle Ford." See next

6- "In the Midland Wolfcamp basin of the Permian, the percentage of child wells has just reached 50%, & we are already starting to see a similar reduction in unit well productivity already seen in the Eagle Ford." See next

Kibsgaard reaches the following conclusion:

7- "This suggests that the Permian growth potential could be lower than earlier expected."

#Permian #Shale #oil

7- "This suggests that the Permian growth potential could be lower than earlier expected."

#Permian #Shale #oil

E&P investment

8- "The increase in activity we currently see is still focused on the existing production base, while investments into new FIDs for larger developments and eventually more exploration activity to address the record low reserves replacement is still to come".

8- "The increase in activity we currently see is still focused on the existing production base, while investments into new FIDs for larger developments and eventually more exploration activity to address the record low reserves replacement is still to come".

9- "....any major demand worries are premature at this stage.

Furthermore, even if 2019 demand growth was to come in 20% lower than the 1.5 million barrels per day currently projected, we still expect to see consistent draws in global oil inventories throughout next year"

Furthermore, even if 2019 demand growth was to come in 20% lower than the 1.5 million barrels per day currently projected, we still expect to see consistent draws in global oil inventories throughout next year"

10- this slide regarding point 5 above about the impact of Parent-Child wells in the Eagle Ford. #Shale #EagleFord $SLB

12- For the record, as I indicated in the past, the threat to global oil demand from #TradeWars and #Currency devaluation in the #emergingeconomies is SERIOUS . I am NOT as optimistic about demand growth as $SLB. But, if I am correct, we might see a production cut!

#oil #OPEC

#oil #OPEC

@chigrl hey... look ....I am capitalizing some words 👆 😂😂😂

• • •

Missing some Tweet in this thread? You can try to

force a refresh