1/ Most people think #Bitcoin’s PoW is "wasteful." I explore how everything is energy, money is energy, subjective use of energy, and PoW's costs relative to existing governance systems

For a deeper dive, my Medium post: medium.com/@danhedl/pow-i…

TL;DR - check out this thread 👇

For a deeper dive, my Medium post: medium.com/@danhedl/pow-i…

TL;DR - check out this thread 👇

2/ The idea of “work” being energy started when the French Mathematician Gaspard-Gustave de Coriolis introduced the idea of energy being “work done.” A long time ago, the work done in the economy was entirely human. That work was powered by food.

3/ Thousands of years ago, our energy usage increased when we domesticated animals which could labor in our place. Those new laborers also had to be fed. Large amounts of food were required to meet the energy demand, and our prosperity increased alongside.

4/ In the last few hundred years, we built great machines which produced work. Both machines and nature produce work through the utilization of energy (first law of thermodynamics). We have an economy based not on money, but on work and energy.

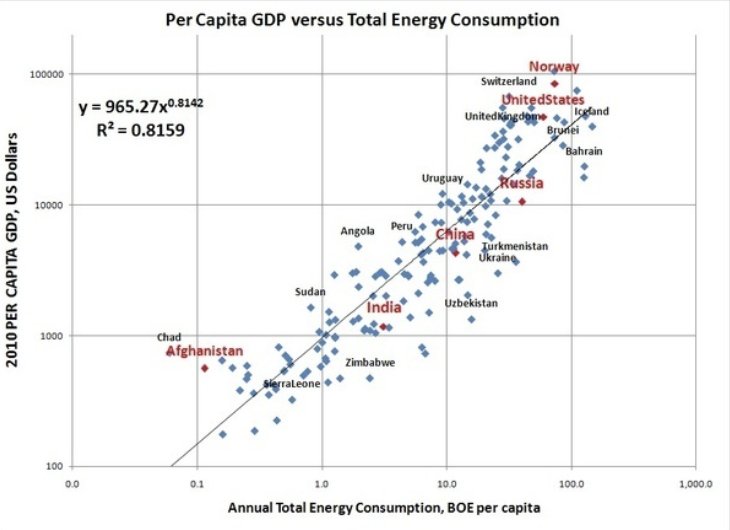

5/ All things in our lives are closely linked to the price of energy. The cost of any good largely reflects the energy used in producing that good. Money, which is the representation of the work required to generate goods and services, can also be viewed as stored energy.

6/ In the early 20th century, people were interested in replacing gold or the dollar with "the energy dollar” or “units of energy.” The concept was popular due to its sound money characteristics. The flaw? It could not be transmitted or stored easily.

7/ “that in order to make a man/woman covet a thing, it is only necessary to make the thing difficult to attain.” - Mark Twain

#Bitcoin’s PoW was originally invented as a measure against email spam. Only later did Satoshi adapt it to be used in digital cash. @hugohanoi

#Bitcoin’s PoW was originally invented as a measure against email spam. Only later did Satoshi adapt it to be used in digital cash. @hugohanoi

8/ What PoW mining does under the hood, is use dedicated machines (ASICs) to convert electricity into Bitcoins (via block reward). #Bitcoin has a capitalistic voting mechanism, “money risked, votes gained” through the energy/ASICs used to generate hashes (votes). @Truthcoin

9/ When Satoshi designed PoW, he fundamentally changed how consensus between humans is formed from political votes to apolitical votes (hashes) via the conversion of energy. It's the most simplistic and fair way for the physical world to validate something in the digital world.

10/ #Bitcoin is a super commodity, minted from energy, the fundamental commodity of the universe. PoW transmutes electricity into digital gold. The fact that PoW is “costly” is a feature, not a bug. @dergigi

11/ Historically, securing something meant building a physical wall around whatever is valuable. Bitcoin’s ledger is secured by the sum of all energy expended to build a digital wall. It would take an equivalent amount of energy to tear it down (unforgeable costliness)@NickSzabo4

12/ “Electricity consumption per transaction” is a poor KPI, here's why:

- The energy spent is per block, not per transaction

- The economic density of a #Bitcoin transaction is increasing (Segwit, Lightning)

- Should be defined by security of economic history @LaurentMT

- The energy spent is per block, not per transaction

- The economic density of a #Bitcoin transaction is increasing (Segwit, Lightning)

- Should be defined by security of economic history @LaurentMT

13/ The rate of ASIC efficiency improvement is slowing. As efficiency gains slow we can expect an increase in manufacturer competition as margins narrow. All-in mining cost will shift from the upfront cost of ASIC hardware to the ongoing energy costs to operate @derek_hsue

14/ The cost of #Bitcoin mining becomes the lowest (excess) value of electricity. This may solve a problem with renewable energy sources that have predictable capacity that is otherwise wasted, like hydro and flared methane.

15/ Aluminum was a popular means of "exporting" electricity from a country with abundant renewable energy resources that are stranded (ex: Iceland). As aluminum manufacturing matured over the decades, the kWh per Kg of aluminum produced became more efficient.

16/ PoW is the buyer of last resort for all electricity, creating a floor that incentivizes the building of new energy producing plants around disparate energy sources that would have otherwise been left untapped. @TuurDemeester

17/ “Imagine a 3D topographic map of the world with cheap energy hotspots being lower and expensive energy being higher. I imagine #Bitcoin mining being akin to a glass of water poured over the surface, settling in the nooks and crannies, and smoothing it out.” - @nic__carter

18/ “Energy used for PoW will stop growing when marginal return from burning a kWh of energy through PoW = the marginal return from selling that kWh to the grid… the "Nakamoto point” which will use between 1-10% of the world's energy.” - @dhruvbansal

19/ Some complain that #Bitcoin mining doesn’t accomplish “anything useful” like finding prime numbers. Bitcoin is already doing something useful for society. It isn’t rational to ask miners to perform a function that is altruistic without incentives. @aantonop

20/ Everything requires energy. Claiming that one usage of energy is more or less wasteful than another is completely subjective since all uses have paid market rate to utilize that electricity. #bitcoin

21/ #Bitcoin’s utilization of the electrical capacity consumes magnitudes less electricity than existing fiat systems which not only have power requirements banking infrastructure, but the military and political machina. The energy tradeoff is a “net positive” outcome.

22/ With #Bitcoin mining as an incentive to find cheaper energy, it brings us closer to a Kardeshev Type I energy civilization (Curr: ~0.72). Reaching Type I increases the standard of living for everyone. @martindale

23/ The pressure to find cheap energy sources will accelerate the effort to build fusion reactors. The fuel for fusion (primarily deuterium) exists abundantly in the Earth’s ocean which could potentially supply the world's energy needs for millions of years.

24/ “Water, water, everywhere, Nor any drop to drink.” - Samuel Taylor Coleridge

Fusion power and other cheaper energy sources, will solve major problems for humanity like fresh water shortages. Desalination stations requires large amounts of energy.

Fusion power and other cheaper energy sources, will solve major problems for humanity like fresh water shortages. Desalination stations requires large amounts of energy.

25/ Via #Bitcoin, is the trustless settlement of $1.34T between counterparties annually with the added benefit of cheaper energy for all, worth the $4.5B in current mining costs? I think the answer is a resounding yes.

https://twitter.com/nic__carter/status/1028698889153593344

• • •

Missing some Tweet in this thread? You can try to

force a refresh