1/ Here are the slides from my talk at #BH2018 Baltic Honey Badger by Hodl Hodl

My goal is to explain:

- why stocks/ securities are a foundation of global commerce

- how ledgers work now

- why Cypherpunks, Bitcoiners & free market economists should care

Past, Present & Future

My goal is to explain:

- why stocks/ securities are a foundation of global commerce

- how ledgers work now

- why Cypherpunks, Bitcoiners & free market economists should care

Past, Present & Future

2/ Understanding the problems and how ledgers currently work is key to addressing some major points people often ask about:

- the value of a blockchain or token

- why a database can’t be used

- the value of a blockchain or token

- why a database can’t be used

3/ Securities tokens will include many scams & many low quality offerings - if a securities token revolution occurs it may bring with it a large number of fraudulent & low quality offerings just like the ICO wave

However legit securities themselves are a key part of economics

However legit securities themselves are a key part of economics

4/ I think Cypherpunks should care about this for a lot of reasons

Anyone who cares about commerce, the economy or Austrian economics should care a lot about the capital markets

Why do I care? It starts with my mom, a former waitress who became a stockbroker in 1977

Anyone who cares about commerce, the economy or Austrian economics should care a lot about the capital markets

Why do I care? It starts with my mom, a former waitress who became a stockbroker in 1977

5/ I pretty much grew up in a brokerage firm - I played with the Quotron computer, read the pink sheets after school

Got my first job at 14 at Dean Witter, became a broker at 19 or so and eventually ran my own firm — then an RIA then I got into crypto

Got my first job at 14 at Dean Witter, became a broker at 19 or so and eventually ran my own firm — then an RIA then I got into crypto

6/ if secutities is in your DNA you might think about things differently than if currency is your main focus

Most important is that current and secutities are VERY different

Features which make Bitcoin good money are irrelevant or counterproductive for securities

Most important is that current and secutities are VERY different

Features which make Bitcoin good money are irrelevant or counterproductive for securities

7/ Trust and trust assumptions are very important in evaluating money

Scarcity, limited supply etc are also key for currency...but not for securities

All that matters for a security is what the terms of the agreement are and how it can be enforced

Scarcity, limited supply etc are also key for currency...but not for securities

All that matters for a security is what the terms of the agreement are and how it can be enforced

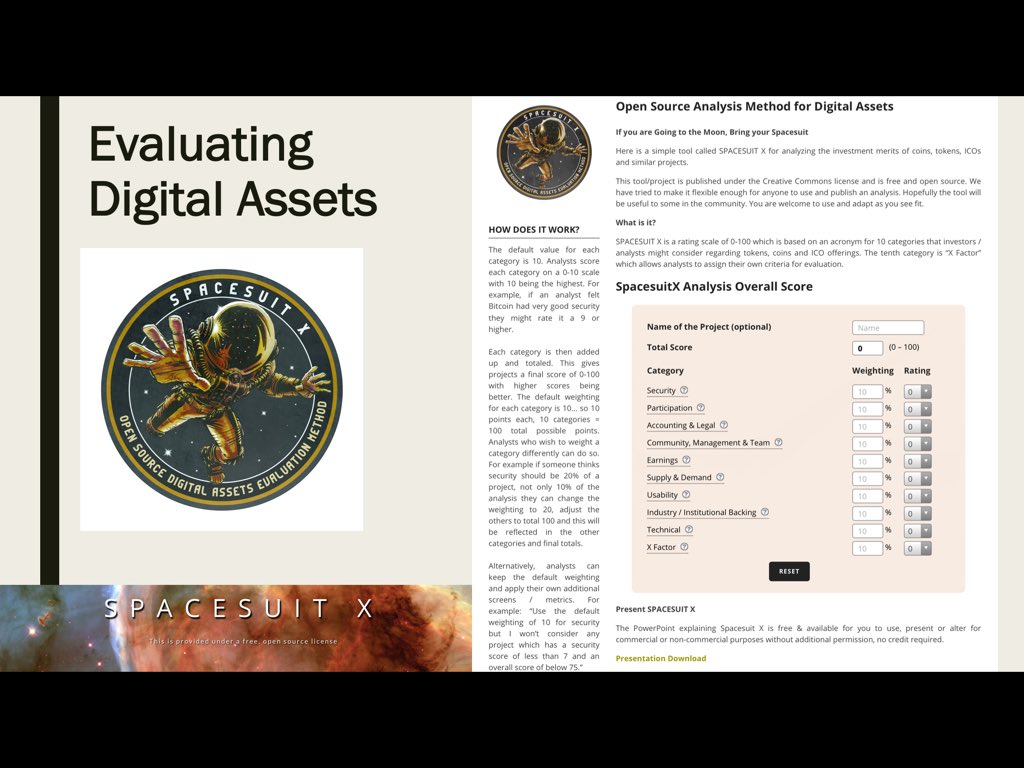

8/ When evaluating digital assets there are many layers: first you should categorize if it’s a stock or other security, an illegal security, utility, collectible, protocol etc.

Then you can evaluate chain strength, security etc. then you eval other items

Here’s a cheat sheet

Then you can evaluate chain strength, security etc. then you eval other items

Here’s a cheat sheet

9/ This is called Spacesuitx @spacesuit_x and is Free and Open Source

It’s yours! Use it, copy, make it into an analysis business, fund, issue reports etc.

Hopefully the tool gives some ideas to think about when you evaluate digital assets

It’s yours! Use it, copy, make it into an analysis business, fund, issue reports etc.

Hopefully the tool gives some ideas to think about when you evaluate digital assets

10/ Let’s get back to one key type of digital asset: securities

The first publicly tradable company was the Dutch East India Company, aka VOC

Prior to this, shipping expeditions were funded one by one - if your ship sunk you lost

This invention spread risks in a better way

The first publicly tradable company was the Dutch East India Company, aka VOC

Prior to this, shipping expeditions were funded one by one - if your ship sunk you lost

This invention spread risks in a better way

11/ From a financial perspective, the results were interesting

1100+ people contributed about $300k each in today’s dollars

This spread risk in a way which had never been done before

VOC used this capital to do things no one had done

This caused rapid growth

1100+ people contributed about $300k each in today’s dollars

This spread risk in a way which had never been done before

VOC used this capital to do things no one had done

This caused rapid growth

12/ Eventually VOC became larger (in today’s value) than several of the world’s largest companies combined

A new form of sharing risk and trading that risk / agreement forever changed the way capital and business worked

A new form of sharing risk and trading that risk / agreement forever changed the way capital and business worked

13/ The idea of spreading risk among more than one investor was revolutionary

Thousands of companies followed the model of VOC

It seems normal now, but it was an amazing innovation and remains a fundamental part of global economics

Thousands of companies followed the model of VOC

It seems normal now, but it was an amazing innovation and remains a fundamental part of global economics

14/ with a proliferation of stocks and other securities came markets - many are still in existence today

15/ these markets have used whatever tech has been available

Generally when better tech comes along capacity and volume increases

Generally when better tech comes along capacity and volume increases

16/ for most of their history, markets have been run by pen and paper

Inventions like the ticker tape increased efficiency

Inventions like the ticker tape increased efficiency

17/ Here are traders at the Baghdad stock exchange after the US invasion

If you are a stockbroker and have customers and stocks and your whole world is on fire - what do you do?

You make trades & discover prices - even by whiteboard

Markets don’t stop for anyone

Ever

If you are a stockbroker and have customers and stocks and your whole world is on fire - what do you do?

You make trades & discover prices - even by whiteboard

Markets don’t stop for anyone

Ever

18/ Pen & paper isn’t scalable in global markets

Understanding the problem means understanding how the ledgers work today

Contrary to what many think it’s NOT your issuer (like Apple) who keeps track of the ledger of who owns shares

That’s done by a complex settlement system

Understanding the problem means understanding how the ledgers work today

Contrary to what many think it’s NOT your issuer (like Apple) who keeps track of the ledger of who owns shares

That’s done by a complex settlement system

20/

If you own Apple stock...how do you know you really own it?

You trust a custodian of a broker...but how do you know they have the stock?

Brokers don’t share ledgers with each other OR the securities issuer

They trust 3rd parties like DTCC & Euroclear

If you own Apple stock...how do you know you really own it?

You trust a custodian of a broker...but how do you know they have the stock?

Brokers don’t share ledgers with each other OR the securities issuer

They trust 3rd parties like DTCC & Euroclear

21/ Since brokers don’t trust each other with their ledger and the issuer doesn’t have the ledger, who does?

It used to be handled by a combo of bearer assets and internal ledgers

In the late 1960s it became consolidated with trusted 3rd parties

It used to be handled by a combo of bearer assets and internal ledgers

In the late 1960s it became consolidated with trusted 3rd parties

22/

The settlement of securities caused scaling issues: it used to be settled by messengers delivering physical shares

The system could not track real ownership by 1996 so Wall St put all ownership of stocks in one name: Cede & Co then set up ways to claim this

The settlement of securities caused scaling issues: it used to be settled by messengers delivering physical shares

The system could not track real ownership by 1996 so Wall St put all ownership of stocks in one name: Cede & Co then set up ways to claim this

25/ there are drawbacks of this system

For example when Dole Foods was acquired, the company thought they had 36 million shares outstanding but 49 million shares worth of claims came in

For example when Dole Foods was acquired, the company thought they had 36 million shares outstanding but 49 million shares worth of claims came in

26/ Bloomberg explains it well here:

You don’t own your shares

You own a claim on a claim to these shares

You don’t own your shares

You own a claim on a claim to these shares

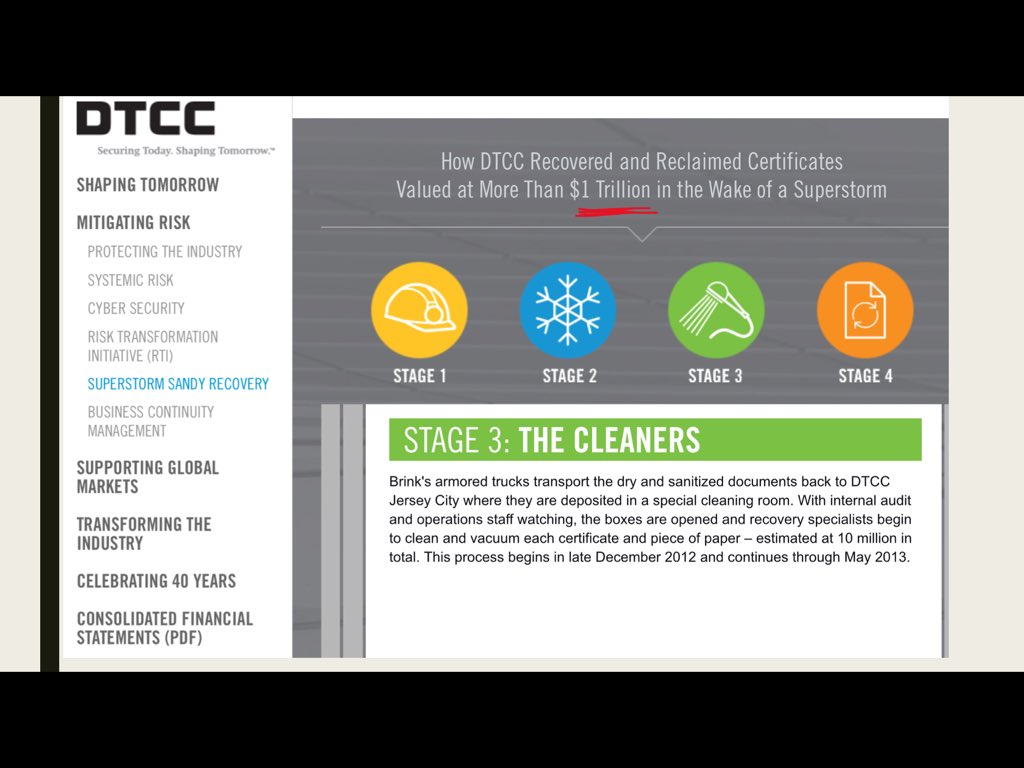

27/ There are other issues with trust of a centralized third party

Millions of shares were nearly destroyed by Hurricane Sandy for example

Millions of shares were nearly destroyed by Hurricane Sandy for example

28/ It took a year and a half of specialists in secure rooms with water vacuums & dryers to recover the shares

The value: over $1 trillion

This may seem antiquated but DTCC is actually techncailly advanced - they do what is possible based on how the ledgers work

The value: over $1 trillion

This may seem antiquated but DTCC is actually techncailly advanced - they do what is possible based on how the ledgers work

29/ We can do better

The ledger is already distributed - but we can eliminate the need for the trusted third parties and have tokens trade and settle just like Bitcoin or any other crypto

The ledger is already distributed - but we can eliminate the need for the trusted third parties and have tokens trade and settle just like Bitcoin or any other crypto

30/ You can use the power of a trustless distributed ledger whether the blockchain knows your token exists or not

On this video I created a real security using Bitcoin, Open Dime & a pen

On this video I created a real security using Bitcoin, Open Dime & a pen

32/ This tech works

It has been employed, tested & proven

Securities tokens have been issued on Bitcoin & other chains

I believe this will continue & increase

Regulation is clear imho: (in the US that means following existing SEC regs)

issues will still need work:

It has been employed, tested & proven

Securities tokens have been issued on Bitcoin & other chains

I believe this will continue & increase

Regulation is clear imho: (in the US that means following existing SEC regs)

issues will still need work:

33/ What could this mean for the future?

Unlocking trillions in capital and making a million businesses publicly traded

It will shake and transform the foundations for all we know about how capital formation and the global economy works

I think it will be massive

Unlocking trillions in capital and making a million businesses publicly traded

It will shake and transform the foundations for all we know about how capital formation and the global economy works

I think it will be massive

34/ Imho the best way to do this is with trustless, open source systems

If you want to work on this let’s do it

We are setting up a series of workshops in the NH countryside (or Seacoast) an hour from Boston

BlockchainNH.com is one conference coming up in a couple weeks

If you want to work on this let’s do it

We are setting up a series of workshops in the NH countryside (or Seacoast) an hour from Boston

BlockchainNH.com is one conference coming up in a couple weeks

/ thanks for reading

• • •

Missing some Tweet in this thread? You can try to

force a refresh