#SkyeBank - The Rise, The Fall, The Bridge

To understand what happened on the 21/09/18, you need to go back to the beginning. I'll like to categorize it under 3 headings.

1. Before The Acquisition of MBL

2. During the Acquisition of MBL

3. After the acquisition of MBL

A THREAD!

To understand what happened on the 21/09/18, you need to go back to the beginning. I'll like to categorize it under 3 headings.

1. Before The Acquisition of MBL

2. During the Acquisition of MBL

3. After the acquisition of MBL

A THREAD!

With the help of timelines and publicly available data, I'll try to answer these questions.

1. What led to the takeover?

2. What role did the CBN play leading up to the decision?

3. What role did insider related loans play to bring the bank down?

4. What's the end game?

#SkyeBank

1. What led to the takeover?

2. What role did the CBN play leading up to the decision?

3. What role did insider related loans play to bring the bank down?

4. What's the end game?

#SkyeBank

Questions 1 & 2 will be answered implicitly within the thread. While questions 3 & 4 will be answered directly. The resource for this thread came from publicly available materials available online from the CBN, NSE & other resource centers like @proshare & @Nairametrics #SkyeBank

It's remarkable that the evidence has been right before our eyes for years but we fail to pay attention and ask the right questions. Hopefully with what's in this thread, we will begin to ask those very important questions.

Stay with me. This will be a very long thread. #SkyeBank

Stay with me. This will be a very long thread. #SkyeBank

BEFORE THE ACQUISITION OF MAINSTREET BANK LIMITED

2005

Skye bank was the product of the merger of 5 banks namely; Prudent Bank, EIB, Bond Bank, Reliance Bank and Cooperative Bank. It was listed in the NSE in November of the same year.

#SkyeBank

2005

Skye bank was the product of the merger of 5 banks namely; Prudent Bank, EIB, Bond Bank, Reliance Bank and Cooperative Bank. It was listed in the NSE in November of the same year.

#SkyeBank

2009

In Aug 2009, the CBN recapitalized 5 banks (including Afribank) to the tune of N400 Billion on the back of huge non-performing loans said to be over 40%. The % of NPL to total loans ranged from 19% - 48%. All 5 banks were below the minimum capital adequacy ratio. #SkyeBank

In Aug 2009, the CBN recapitalized 5 banks (including Afribank) to the tune of N400 Billion on the back of huge non-performing loans said to be over 40%. The % of NPL to total loans ranged from 19% - 48%. All 5 banks were below the minimum capital adequacy ratio. #SkyeBank

2011

After the failed attempt of recapitalising Afribank, the CBN announced its nationalization and handed it over to the AMCON to manage through a capital injection program. Afribank was renamed MainStreet Bank otherwise known as a “Bridge Bank”. #SkyeBank

After the failed attempt of recapitalising Afribank, the CBN announced its nationalization and handed it over to the AMCON to manage through a capital injection program. Afribank was renamed MainStreet Bank otherwise known as a “Bridge Bank”. #SkyeBank

A bridge bank is a bank created by a central bank to operate a failed bank until a buyer can be found for its operations. Thus through an aggressive debt management program, AMCON was the vehicle used to grow MainStreet (formerly Afribank) back to financial stability. #SkyeBank

2014

AMCON announced that it was taking bids for sale of 100% if it’s stake in MBL. #Skyebank emerged the preferred bidder with a bid of N126 Billion. It paid the initial 20% deposit (N26B) and on Oct 31, paid the balance of N100Billion ahead of the Nov 3 deadline to acquire MBL

AMCON announced that it was taking bids for sale of 100% if it’s stake in MBL. #Skyebank emerged the preferred bidder with a bid of N126 Billion. It paid the initial 20% deposit (N26B) and on Oct 31, paid the balance of N100Billion ahead of the Nov 3 deadline to acquire MBL

#SkyeBank emerged as one of the eight Systematically Important Banks (SIB) in Nigeria whose "distress, because of their size, complexity and systemic interconnectedness, would cause significant disruption to the financial system ”. In other words, they're “too big to fail”.

Why did #SkyeBank acquire MBL? According to the bank, it did to "achieve an inorganic growth and address structural concerns in its preferred area of commercial banking business". It mentioned the low NPL ratio of 4.3% and the brand loyalty and branch network in the SS and SE.

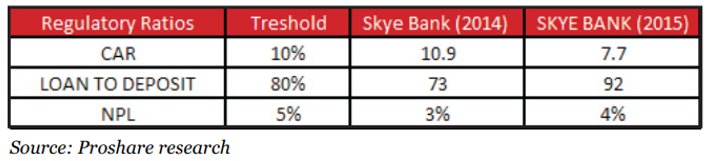

But even in 2014, there were warning signs..one of which was the rapidly reducing capital adequacy ratio of the bank. An issue that was acknowledged by the CBN itself. However strong these concerns were, it didn’t stop the CBN from giving its “no objection” to the deal. #SkyeBank

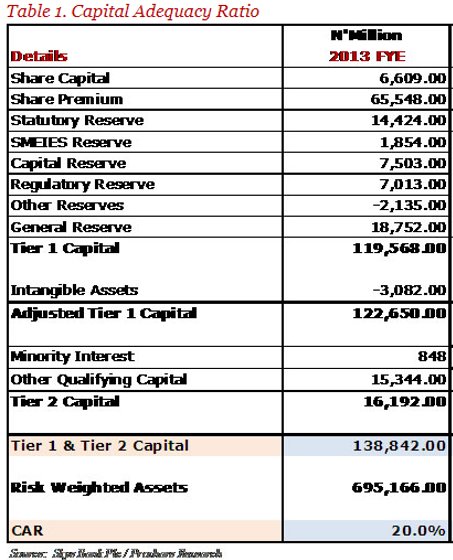

Let me pause here to talk about the Capital Adequacy ratio. CAR is basically the proportion of the bank’s tier 1 & tier 2 equity (Qualifying capital) as a proportion of its risk weighted assets (loans). It's the proportion of a bank’s equity in relation to its exposure. #SkyeBank

The CBN in its wisdom set the Capital Adequacy Ratio (CAR) for domestic banks at 10% while regional and international banks was set at 15%. For Systematically Important banks (SIBs) the CAR was set at 15% + an additional capital surcharge of 1% making it 16%. #SkyeBank

At the time of acquisition of MBL the CAR of SkyeBank was 11% (from 20% in 2013). 1% higher than minimum requirement and lower than their ranking as a SIB. By the time of integration of both banks in June 2015, their CAR had fallen to 7.7% way below regulatory standard. #SkyeBank

DURING THE ACQUISITION

2014

At the time of bidding, the net asset of MBL was N69 Billion (N67B at FYE). Skye bank however, bid N126 Billion for it. This shows that the purchase consideration paid by Skye Bank was well above the net asset of MBL by about N59 billion. #SkyeBank

2014

At the time of bidding, the net asset of MBL was N69 Billion (N67B at FYE). Skye bank however, bid N126 Billion for it. This shows that the purchase consideration paid by Skye Bank was well above the net asset of MBL by about N59 billion. #SkyeBank

This raised a lot of eyebrows because at the time, market capitalization for #SkyeBank was < N40B while Tier 1 + Tier 2 Capital was not sufficient to support d bid. Going by its financials as at Dec 2013, it only had a max headroom of N26bn of Tier 1 Capital to fund acquisition.

Meaning it needed to raise additional N100Bn to be able to buy MBL. This didn't seem to bother the professional advisers engaged by AMCON as they approved #SkyeBank as the preferred bidder. In a way, u can't blame them. Their job was to find a bidder. It was CBN job to approve.

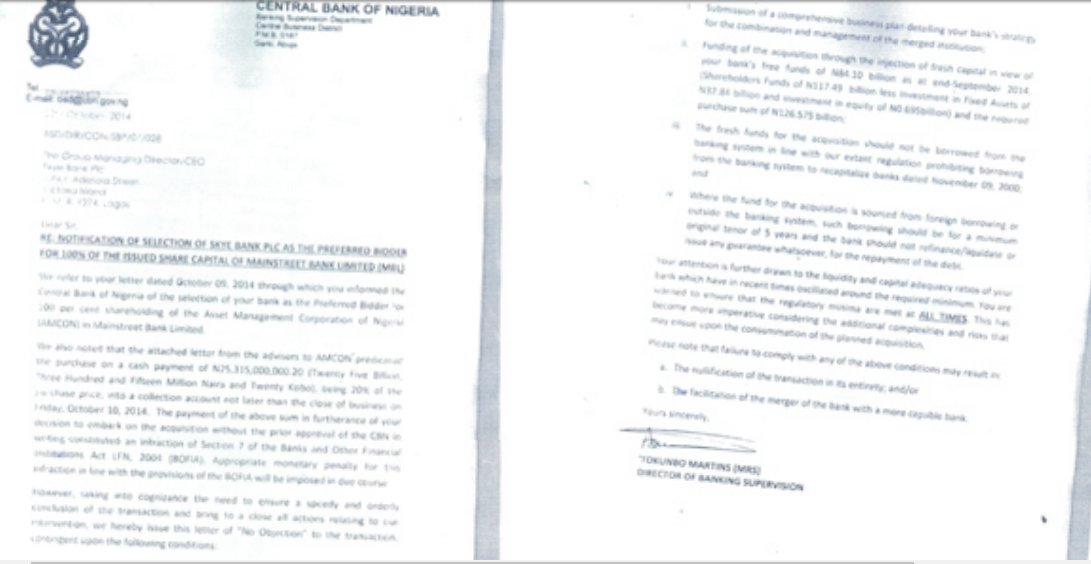

In Oct 2014, CBN wrote a letter to #SkyeBank communicating its “No Objection” to its selection as d Preferred Bidder. The letter reiterated that fresh funds shdn't be borrowed from d banking system in line with existing regulation prohibiting such borrowing to recapitalize banks.

There was another thing the CBN letter also acknowledged - the poor capital adequacy level of #Skyebank. Curiously, this self admission which many will call a RED FLAG, did not stop the CBN from approving the acquisition.

Let me digress a little to talk about the Tier 1 and Tier 2 Capital. Tier 1 is basically made up of your share capital, premium and reserves while Tier 2 is made up of other qualifying capital part of which could be debt. These are balance sheet items. #Skyebank.

The assumption typically is that capital cld be used in acquisition but it must stay within CAR otherwise d regulator will not approve. In the case of #SkyeBank their Capital could only pay for the 20% deposit while the options to pay the balance N100B was to raise equity or debt

But either option had challenges. If they decided to go the route of raising Equity, they would face time constraints for processing the necessary approvals from shareholders, CBN, SEC and NSE. Which will prevent them from meeting the deadline to pay the balance. #SkyeBank

If they decide to raise debt, there was the regulatory constraint that caps tier 2 capital at a max of 33% of tier 1 capital. Since they already raised N30 Billion through a Commercial Paper Programme, there was little room left. #SkyeBank

Will be right back. Stay Tuned.

Will be right back. Stay Tuned.

• • •

Missing some Tweet in this thread? You can try to

force a refresh