Next, It obtained a bridge financing of N100 billion from 4 banks. The bridge financing was reportedly backed by MBL AMCON Bonds that were due for redemption shortly after the closing of the transaction. Stay with me because this is where it gets interesting. #Skyebank

According to Section 159 (1) & (2) of CAMA

(1) Financial assistance includes a gift, guarantee, security or indemnity, loan, any form of credit & financial assistance given by a coy, net assets of which are thereby reduced to a material extent or which has no net assets #Skyebank

(1) Financial assistance includes a gift, guarantee, security or indemnity, loan, any form of credit & financial assistance given by a coy, net assets of which are thereby reduced to a material extent or which has no net assets #Skyebank

(2a)where a person is acquiring or is proposing to acquire shares in a company, it shall not be lawful for d company or any of its subsidiaries to give financial assistance directly or indirectly for d purpose of that acquisition before or same time as the acquisition takes place

(2b) where a person has acquired shares in a coy and any liability has been incurred for d purpose of this acquisition, it shall not be lawful for d coy or its subsidiaries to give financial assistance directly or indirectly for d purpose of reducing or discharging the liability.

In layman’s language, it simply means that it is unlawful to use the assets of a company to buy its own shares. This was exactly what #SkyeBank did.

#SkyeBank borrowed money from 4 banks, used the money to pays AMCON for the N100 Billion balance for the MBL acquisition, AMCON then redeems MBL AMCON Bonds and Skye bank takes the cash to pay the four banks. Put in another way, MBL was acquired by using its own money. #SkyeBank

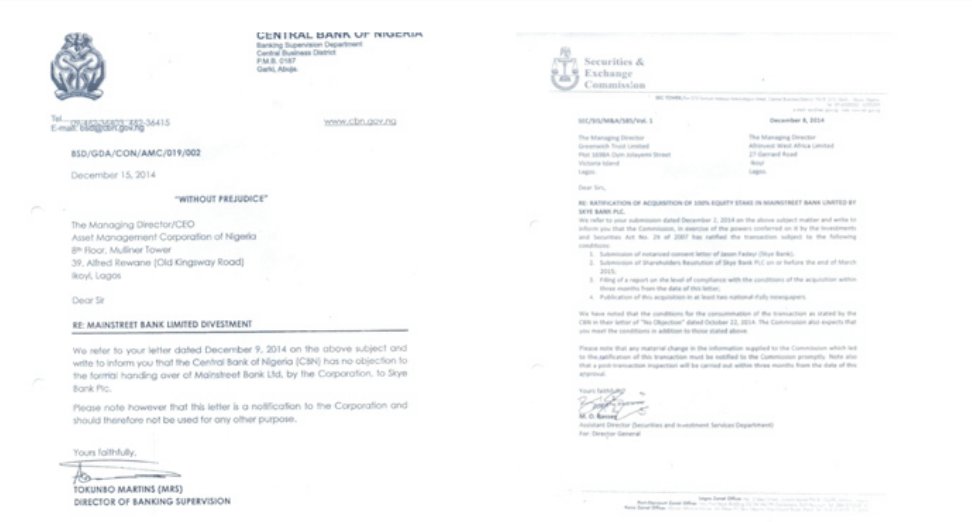

In summary, it would appear that the presence of a weak CAR and poor profitability ratio of the #Skyebank was not enough to pull the plug on the deal. It certainly didn't stop the SEC and CBN in Dec 2014 from issuing a letter ratifying the sale and acquisition of MBL from AMCON.

AFTER ACQUISITION OF MAINSTREET BANK

2015

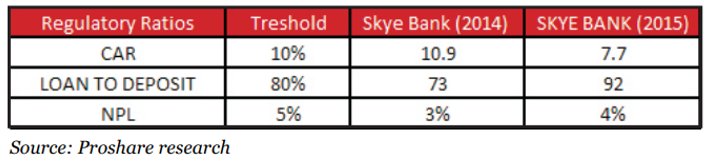

Following the acquisition, the indicators coming out from #SkyeBank showed clearly that something wasn’t right. Apart from falling below regulatory standard in terms of Capital Adequacy (7.7%) and Loan to Deposit (92%) in 2015...

2015

Following the acquisition, the indicators coming out from #SkyeBank showed clearly that something wasn’t right. Apart from falling below regulatory standard in terms of Capital Adequacy (7.7%) and Loan to Deposit (92%) in 2015...

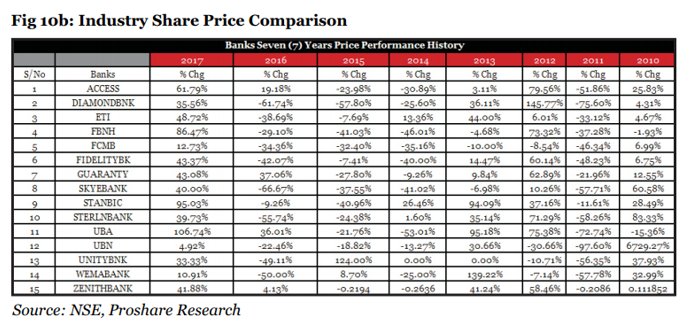

....interbank peer comparison showed that it was the only bank that made a loss (N40B) and had a negative profitability ratio. In fact between June 2014 when it bid for MBL and Dec 2015 when it had completed 6 mths post integration, it had lost 55% of its share value. #SkyeBank

So what happened after the acquisition?

1. In October of 2015, the House of Reps ordered the investigation of the sale of some banks by AMCON. One of those banks was MainStreet Bank. The Adhoc committee raised several issues among which were... #SkyeBank

1. In October of 2015, the House of Reps ordered the investigation of the sale of some banks by AMCON. One of those banks was MainStreet Bank. The Adhoc committee raised several issues among which were... #SkyeBank

-The MBL HQ in Lagos was among the list of property schedule of MBL warehoused by the CBN but that the property was transferred to an individual and #SkyeBank as the purchaser of MBL now became a tenant. Skye bank responded by saying that the property at No 51/55 Broad Street....

....was represented to #SkyeBank at the time of the bid, and in the books of MBL as a freehold property. The book value of the property at the time of acquisition was stated at N1.2billion. SkyeBank had valued it at N5.5 billion in arriving at their purchase consideration for MBL

After acquisition, they discovered that the property is actually on a Building Lease and the landlord had served a demand notice for payment for a renewed term. In short they ended up being tenants in the building they thought they owned. #SkyeBank

- It's on record that as at Nov 3, 2014 MBL confirmed the receipt of N121 Billion from AMCON being the AMCON bond redemption. While this amount was in the kitty of MBL as at the time #SkyeBank acquired it, how will they justify the N126 Billion paid for the acquisition of MBL.

A little footnote here. #SkyeBank paid the balance for the purchase of MBL on the 31st of Oct 2014 before the AMCON bond redemption maturity on the 3rd November. Coincidence? Or did they factor this into their purchase consideration in bidding N126 Billion for MBL?

2. #SkyeBank found itself offsetting a stream of tax liabilities not covered by its due diligence. Another question mark on their due diligence

3. The bank delayed in making available its Q4 2015 and Q1 2016 Annual Financial reports. That sent alarm bells ringing in the market.

3. The bank delayed in making available its Q4 2015 and Q1 2016 Annual Financial reports. That sent alarm bells ringing in the market.

2016

By 2016, things took a turn for the worse. TSA didn't help since the #Skyebank was heavily dependent on public sector funds. It lost N125 Billion to TSA alone. Add the fact of the N127B of its own money used to acquire the bank and several other payments tied to the same...

By 2016, things took a turn for the worse. TSA didn't help since the #Skyebank was heavily dependent on public sector funds. It lost N125 Billion to TSA alone. Add the fact of the N127B of its own money used to acquire the bank and several other payments tied to the same...

...then you're beginning to get the picture of why the following low performance ratios was not a surprise.

- liquidity ratio at 8% as opposed to the regulatory min of 30%;

- CAR 10.48% vs. 16% (for SIBs);

- Loan to Deposit Ratio of 98% vs recommendation ratio of 80%

#Skyebank

- liquidity ratio at 8% as opposed to the regulatory min of 30%;

- CAR 10.48% vs. 16% (for SIBs);

- Loan to Deposit Ratio of 98% vs recommendation ratio of 80%

#Skyebank

By March 2016, #Skyebank requested for a 4 weeks extension to file its 2015 Audited report.

By May 2016, it remained unable to release its Q4'15 & Q1'16 earnings reports, long after the expiration of the extension of the grace period, without any rational reasons for the delay.

By May 2016, it remained unable to release its Q4'15 & Q1'16 earnings reports, long after the expiration of the extension of the grace period, without any rational reasons for the delay.

The market was getting restless and analyst were issuing sell recommendations.

By July 2016, the CBN sacked the board and took control of the mgt. In reality the CBN had little option. It had sanctioned the deal that ultimately was the death kernel for this bank. #Skyebank

By July 2016, the CBN sacked the board and took control of the mgt. In reality the CBN had little option. It had sanctioned the deal that ultimately was the death kernel for this bank. #Skyebank

It gave the new board these mandates.

-Stabilize the Bank

-Achieve the mandatory key regulatory ratio requirements.

-Turn around and return the Bank to profitability.

-Improve the quality of its risk assets

#Skyebank

-Stabilize the Bank

-Achieve the mandatory key regulatory ratio requirements.

-Turn around and return the Bank to profitability.

-Improve the quality of its risk assets

#Skyebank

The CBN injected about N690 billion into #Skyebank and gave it a waiver on CRR for two years. All to help the new board meet its mandate. SEC and NSE was also assisting too. For one, it retained its listing status despite not submitting its 2016 report and Q1/Q2 in 2017 as well.

The task of the new board was first to stop the bleeding by getting the CBN to guarantee all deposits. The CBN take-over had resulted in a run on the bank and deposits level fell by over 23% between July 2016 – March 2017 from N1.08 Trillion to N829 Billion. #Skyebank

The new board also engaged the services of two professional accountancy firms – PwC & KPMG to handle routine audit, forensic audit and review of banking operations. These engagements revealed the following:

- A negative capital position of N690 billion as at Dec 2016. #Skyebank

- A negative capital position of N690 billion as at Dec 2016. #Skyebank

• • •

Missing some Tweet in this thread? You can try to

force a refresh