This was caused mainly by impairment of loans to the tune of N529billion and transactions in suspense to the tune of N280 billion, (relating to BS and P/L manipulations from 2006 to 2016 and direct fraudulent cash withdrawals by known individuals). #Skyebank

- Evidence of inappropriate financial reporting. The Forensic Audit revealed that the Bank operated 2 sets of books and this was responsible for the regulators/auditors inability to detect d massive losses & infractions, particularly the balance of N280b in suspense a/c #Skyebank

- Unsustainable high cost to income ratio. #SkyeBank was significantly oversized in terms of branches and personnel compared to industry standards and was incurring huge expenditure in keeping its size. This compounded the bank's negative capital position.

2017

Despite the CBN’s best intentions, the liquidity ratio of #Skyebank didn't improve. It fell short of the regulatory standard. The bank found it difficult to do normal banking business as it was shut out of the lucrative FX market + it had to deal with loads of litigation.

Despite the CBN’s best intentions, the liquidity ratio of #Skyebank didn't improve. It fell short of the regulatory standard. The bank found it difficult to do normal banking business as it was shut out of the lucrative FX market + it had to deal with loads of litigation.

The board however aggressively chased after debtors and in June 2017 announced that it had recovered N60 billion from debtors. It also embarked on a cost optimization programme aptly tagged 'Sustainable Value Improvement Project' to reduce the high cost to income ratio. #Skyebank

In spite of all its effort, the bank could not overcome the perception and confidence issues that affected the flow of business to it. Profitability and adequacy ratio remind low and the negative equity issue persist. #Skyebank

2018

In Sept, The CBN finally took the decision to revoke the license of #Skyebank and create a bridge bank to take over its assets and liabilities. The irony of the matter is that a bank that once bought a bridge bank is itself in need of a bridge to turn around its fortunes.

In Sept, The CBN finally took the decision to revoke the license of #Skyebank and create a bridge bank to take over its assets and liabilities. The irony of the matter is that a bank that once bought a bridge bank is itself in need of a bridge to turn around its fortunes.

The CBN announced it was further injecting N786 Billion into the bank bringing it to a total of N1.476 Trillion committed to rescuing this Systematically Important “too big to fail” bank. #Skyebank

So far, I have tried to answer the questions:

1. What led to the takeover of the bank?

2. What role did the regulator play in leading up to this decision?

I will now attempt to answer the question:

3. What role did insider related loans play to bring the bank down?

#Skyebank

1. What led to the takeover of the bank?

2. What role did the regulator play in leading up to this decision?

I will now attempt to answer the question:

3. What role did insider related loans play to bring the bank down?

#Skyebank

Four individuals / entities accounted for over N446 Billion of insider related loans drawn from #SkyeBank. They are:

1. Tunde Ayeni: (Former Board Chairman)

- N89.4B Loan used to acquire Ibadan Disco, Yola Disco & Nitel

- N29.5B Discovered in suspense a/c & directly linked to him

1. Tunde Ayeni: (Former Board Chairman)

- N89.4B Loan used to acquire Ibadan Disco, Yola Disco & Nitel

- N29.5B Discovered in suspense a/c & directly linked to him

-$6.8m: Diverted into his law firm & utilized for personal use. Never paid back

2. Festus Fadeyi (Father of Dr Jason Fadeyi Non-Exec Director)

- $616m (N191B): For Pan Oceanic Grp

3. Jide Omokere Grp

-N110B: For AEDC (N56B), Cedar Oil/Gas (N22b), Real Banc Ltd (N31B) #SkyeBank

2. Festus Fadeyi (Father of Dr Jason Fadeyi Non-Exec Director)

- $616m (N191B): For Pan Oceanic Grp

3. Jide Omokere Grp

-N110B: For AEDC (N56B), Cedar Oil/Gas (N22b), Real Banc Ltd (N31B) #SkyeBank

4. Forte Oil Shares

- N11.6 Billion: Alleged illegal conversion of 46.4million shares in Forte Oil Plc, paid for by Afribank. Case is in court.

- N12.8 Billion: Owed by AP to Afribank

#SkyeBank

- N11.6 Billion: Alleged illegal conversion of 46.4million shares in Forte Oil Plc, paid for by Afribank. Case is in court.

- N12.8 Billion: Owed by AP to Afribank

#SkyeBank

Needless to say that the bank will be in a much better position if it didn’t have to deal with these NPL.

This is what has happened and it brings me to the last question.

4. What is the end game?

There are many reasons why we must ask this question.

#SkyeBank

This is what has happened and it brings me to the last question.

4. What is the end game?

There are many reasons why we must ask this question.

#SkyeBank

1. So far we understand that CBN has committed N1.4Tr to rescuing this bank. When u realise that the deposit base of the bank in July 2016 when the CBN took over was N1.08Tr, you begin to wonder. Why bother? Won't it have been cheaper to liquidate & pay off depositors? #SkyeBank

2. From available evidence, it's clear that the case of #SkyeBank is not that of Corporate Governance Failure of the Bank, but rather a case of Governance failure of the regulator. Clearly at d time of the bid didn't not meet regulatory standards to qualify as d preferred bidder.

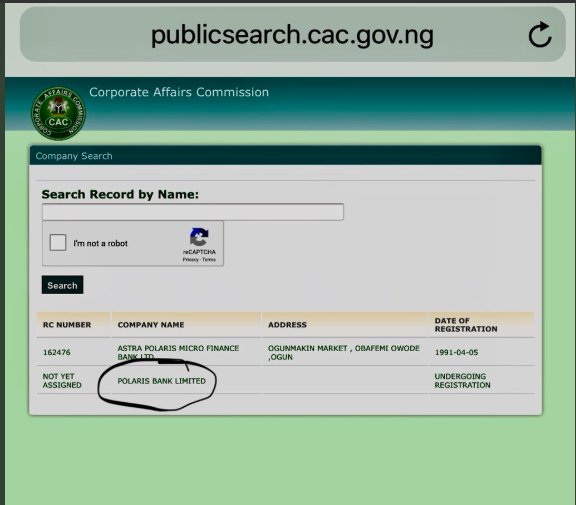

3. The agile observations of some observers clearly shows that at the time of announcement of Polaris Bank as the Bridge Bank, it was not incorporated in Nigeria. So in essence, the CBN has committed N786B to a non-existing organization. What exactly is the game here? #SkyeBank

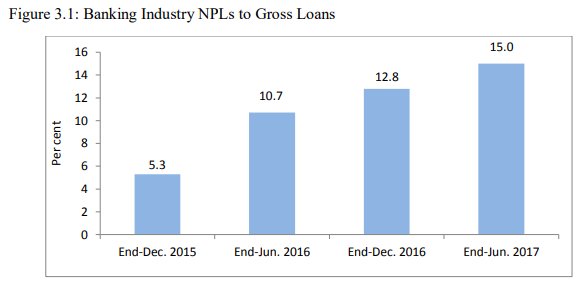

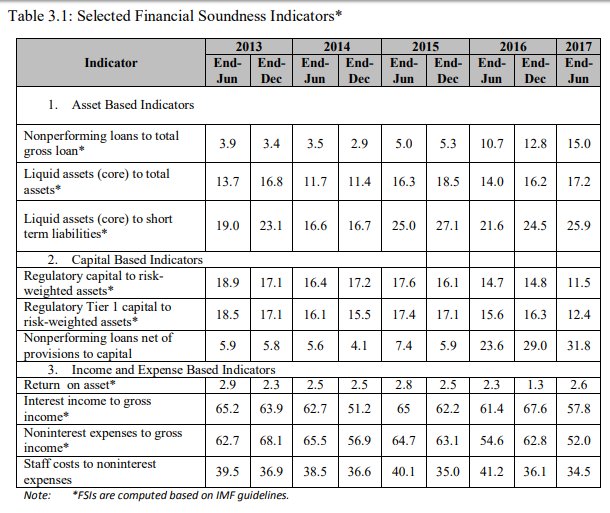

Industry wide, the NPL ratios has consistently seen a decline from 3.9% in 2013 to 15% in 2017. If you take note that the regulatory standard for NPL, is 5%, then a 200% increase is a screaming amber light. We're indeed in a banking crisis. We have just not declared it. #SkyeBank

Another indicator is that the industry average for Capital Adequacy is barely hovering above the regulatory benchmark. Banks are struggling and it's not only #SkyeBank, there are many banks struggling as well. I'll refrain from mentioning them for obvious reasons. #SkyeBank

If the end game is not to stabilize the market, increase profitability, manage credit risk, and bring back confidence to the financial system, then whatever is going on is a joke on us and the market at large. It's time to remove the veil and ask the right questions. #SkyeBank

Resources for this thread came from

cbn.gov.ng/Out/2018/RSD/C…

cbn.gov.ng/out/2015/bsd/1…

proshareng.com/admin/upload/r…

nairametrics.com/cbn-the-three-…

nairametrics.com/meaning-of-cap…

proshareng.com/admin/upload/r…

proshareng.com/news/Monetary%…

proshareng.com/news/Mergers%2…

guardian.ng/politics/reps-…

nigeriannewsdirect.com/eight-cbns-imp…

cbn.gov.ng/Out/2018/RSD/C…

cbn.gov.ng/out/2015/bsd/1…

proshareng.com/admin/upload/r…

nairametrics.com/cbn-the-three-…

nairametrics.com/meaning-of-cap…

proshareng.com/admin/upload/r…

proshareng.com/news/Monetary%…

proshareng.com/news/Mergers%2…

guardian.ng/politics/reps-…

nigeriannewsdirect.com/eight-cbns-imp…

Correction :

"Clearly at the time of the bid, the bank did not meet regulatory standards to qualify as the preferred bidder."

"Clearly at the time of the bid, the bank did not meet regulatory standards to qualify as the preferred bidder."

*CORRECTION:

The NPL rose from 3.9% to 15% not declined.

The NPL rose from 3.9% to 15% not declined.

• • •

Missing some Tweet in this thread? You can try to

force a refresh