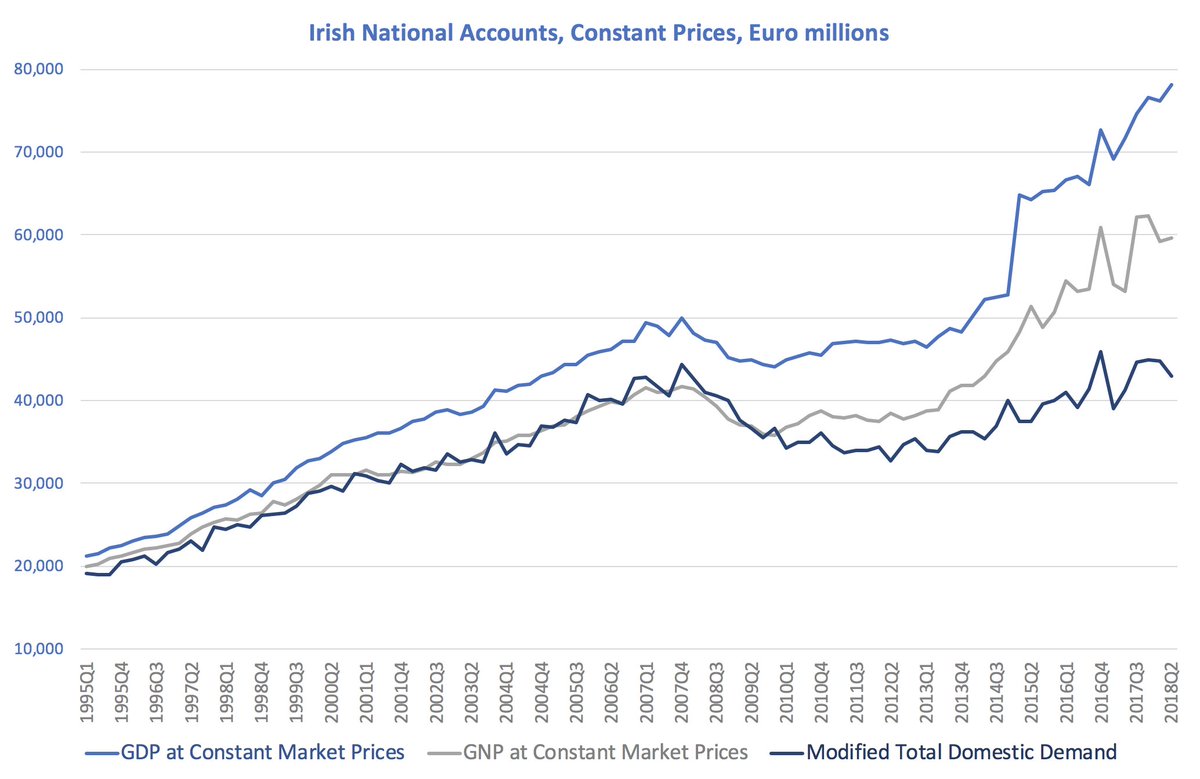

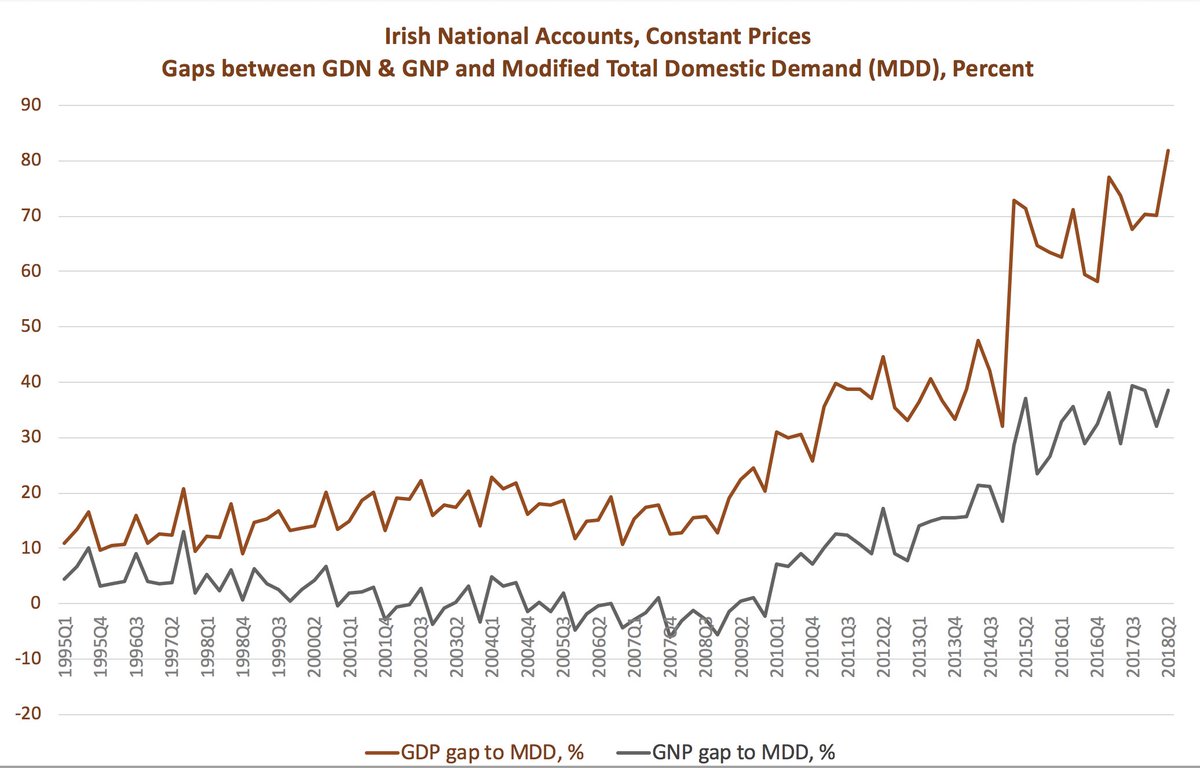

Why GDP and GNP should NOT be used as reference points for measuring the size of #Ireland economy? Two charts: 1) The two measures are not even on-trend with the real demand, 2) The gap between MNCs-shenanigans in Irish Nat. Accounts & the real domestic demand is MASSIVE 82% +

+ So for all my learned friends, esp in the likes of @CatoInstitute @FraserInstitute @danieljmitchell et al: what your Indices of Economic Freedom rankings for #Ireland reflect is the vast transfer of economic power from the residents of Ireland to Multinational Corporates. +

+ As long as you continue to reference Irish GDP as a base for your Indices, you will miss the true extent of over-regulation, over-taxation, cronyism, corruption imposed onto ordinary Irish people, businesses, & entrepreneurs, by the monopolization of Irish policies & politics+

+ at the hands of Multinational & domestic rent seekers. So, my request to you all: stop aiding and abetting the equivalent of the 'Curse of Oil' that MNCs-centric Irish economic policies are sustaining in Ireland. This is NOT Economic Freedom. It is Economic Servitude.

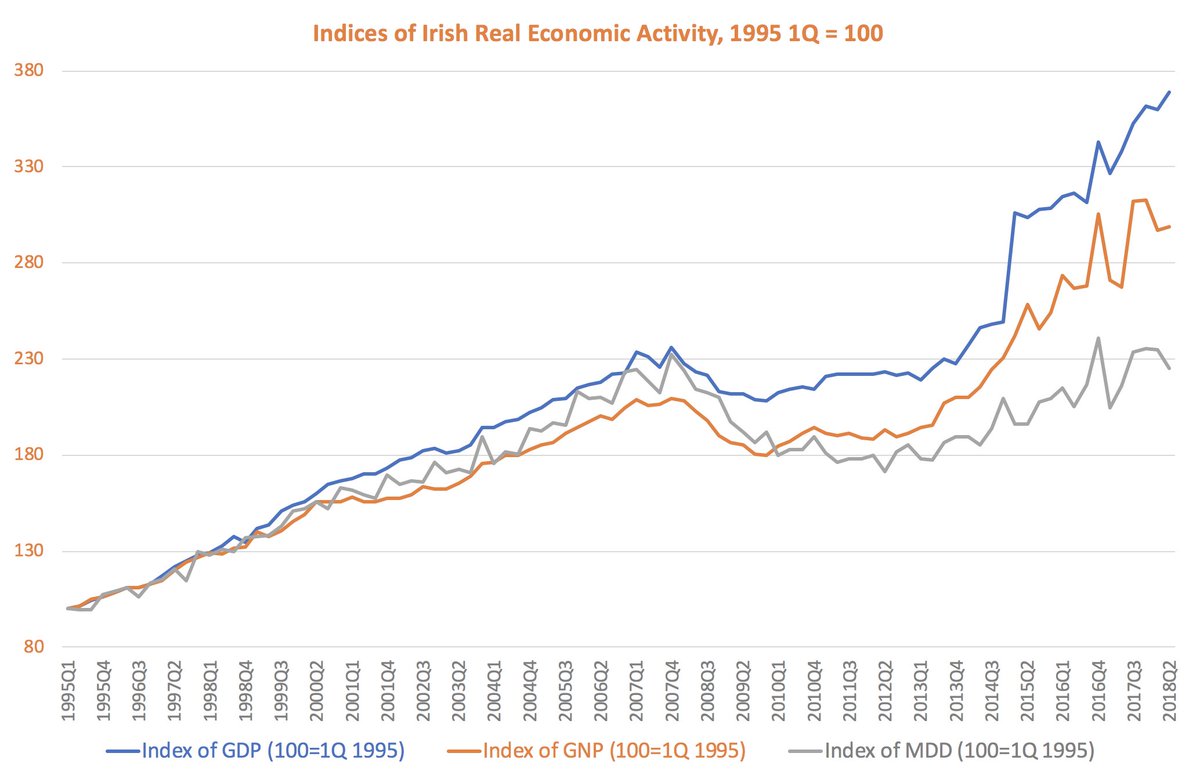

+ Adding to the above, here is an index chart for #Irish #GDP, #GNP and #DomesticDemand showing that Ireland's real economy has struggled to rise above pre-crisis peak of 4Q 2007 in real terms, despite deflation & the massive rebound in GDP: +

+ Over 1995-2Q 2018, Irish economy growth - annualized real terms clocked massive 5.751%pa in GDP terms, respectable 4.830%pa in GNP terms, & much weaker (though still decent by international comparatives with similar economies) 3.705%pa in Modified Domestic Demand. These +

+ figures are based on 1H 1995 comparatives to 1H 2018 figures. Which means that over the last 23 years, GDP grew 3.62 times, GNP expanded 2.96 times and Domestic Demand rose 2.31 times. Compare: 3.62 times growth with MNCs against 2.31 times domestic growth. In other words, +

+ Stripping out tax & capital shenanigans of the Multinationals, Irish economy grew, over the last 23 years, some 36% SLOWER than if Multinationals accounting trickery was included in the figures (or under official GDP measure). And, yet, Ireland's EU bills, country debt levels,+

+ nation's civil & public services provisions are ALL internationally compared to & based on absurd GDP fig. It is as if economists & policymakers worldwide simply decided to use Classical Greek to communicate particle physics findings. Ionesco & Pirandello would have been proud.

+ I dare say, I cannot expect @CatoInstitute @FraserInstitute @Heritage et al to come back to me on these, even though this data - official accounts - completely demolishes their (and others') methodology for international comparatives. Their analysts will continue for years to +

+ come validate with external stamps of approval domestic policies of Irish authorities that take close to 50 cents of each euro earned above ~EUR21,750 from the paycheques of ordinary Irish women & men, as long as MNCs can live in the 'black box' land of tax codes w effective +

+ tax rates of < 11%. Why? Because my pro-market co-thinkers cannot recognize the simple truth about the economy - ANY economy - freedom & liberty are NOT created for the corporates. They are created for people. One cannot have a market economy & personal liberty where one is +

+ facing asymmetric treatment to their income to that of capital gains earners or corporations.

+ In modern economy, real economic & social value added is created by people, via labour, creativity, imagination, participation, risk-taking, etc etc etc. Even technological capital is dependent on people. Yet, our tax, policy-making & governance institutions remain entrenched +

+ in purely Coasean view that firms/corporations create value, & are necessary & sufficient source of all private value-added. This view is false today and is becoming increasingly detrimental to the modern economic development. That is one of the key lessons from a small, +

+ rapidly modernizing economy, like Ireland. And it is brought forth by the disparity between the corporate economy-focused national accounts system based on GDP & GNP. It is a major failure of the international accounting & statistical standards that we still imagine that a +

+ tangible improvement in economy or society comes from a tax dodging holding company shoving few zeroes worth of paper assets into an Excel ledger with 'Ireland' written on the top line. Worse, yet, when smart, educated men & women of the 'analysts' community applaud such a +

+ trick of numbers as a real measure of progress in the society. And much worse than that, when domestic policymakers pat each other on the back for the learned men & women of 'international analysts' community' approval of their policies of making such an Excel entry possible.

+ @paulkrugman smartly called this 'Leprechaun Economics', but alas, the joke is on the Irish people who are paying through the nose for the clientelism & corporatism underlying the 'Resource Curse of MNCs'.

• • •

Missing some Tweet in this thread? You can try to

force a refresh