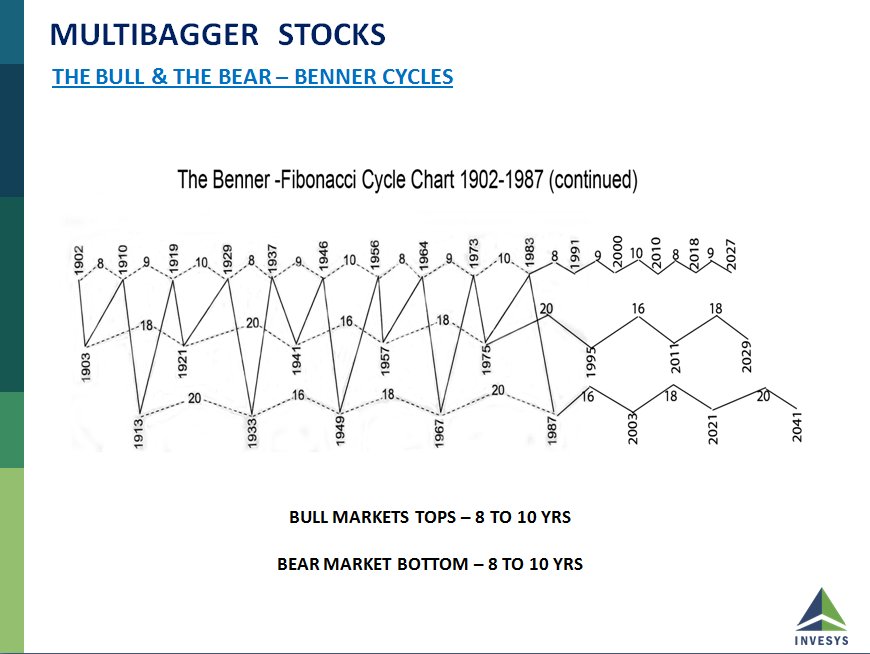

Pulling Out Two Slides At #DECMA Presentation In March This Year Detailing #Cycles Of Stock Market and Where We Are At Current Juncture! The #BennerFibonacci Time Cycles Point That Major Stock Market Cycles Happen With 8-10 Year Difference Between Consecutive Tops & Bottom (1/n)

We Had Major Market Tops In SENSEX at 1992, Followed By 2000 (8Yr), Followed By 2008(8Yr).. Now We are in 2018 (10 yrs). There Are Intermediate Corrections Also In-Between. The Difference -Correction After Benner Time Cycle is Complete Are Severe With Index Dropping 40-50% (2/n)

Had This Hypothesis Since Last Year That Sometime We Are Going To Face This TimeCycle in 2018. Jan-Feb Correction Looked Like Beginning, But That Was Not To Be,. Now We Have Some Kind Of Confirmation Of Beginning Of Correction On Monthly Charts. We Are In Initial Stage (3/n)

The First Sign of Monthly Correction Is Index Closing Below 10SMA On Monthly OverBought Charts. The Month Is Yet To Close, But It's an Early Indication. These Correction On Monthly Run For 12 to 18 Months, So We Can Expect Current Correction to Last Till 2019 End-Early 2020 (4/n)

However, It's Not One Way Street. There Are Sharp PullBacks In Between, Lasting 3-4 Months. The Maximum Damage Is Inflicted In last 3-6 Months Of Correction. However, We Have Already Seen Much Damage In Smallcap Space. Now Last Part. Where Does These Corrections End? (5/n)

Well, Looking At Data On All World Indices Bear Market & Our Own Market, These Corrections Run Till 10 year Average Price On Index. Converting That To Quarterly Charts, It Comes To 40 Quarter SMA. Below SENSEX Chart For Same. 2000-2001 & 2008-09 Correction Ran Till Those Levels-6

Currently , That Level on Sensex is 23400 & 7000 On Nifty. As Time Progress, These SMA Rise. Considering That, I am Expecting Correction To Run Till Nifty 7000-8000 & Sensex 25000-30000. Now This Is Hypothesis & May Turn Wrong Too . Accept or Reject At Your Discretion (7/7)

• • •

Missing some Tweet in this thread? You can try to

force a refresh