11/

Sounds good, right? But there's a catch... This change is FANTASTIC for the uber-wealthy.

For the 'merely' affluent taxpayer though? Not so much😕

Specifically, whereas Biden's proposed top rate didn't kick in until AGI exceeded $1 million, the bill would "re-align"...

Sounds good, right? But there's a catch... This change is FANTASTIC for the uber-wealthy.

For the 'merely' affluent taxpayer though? Not so much😕

Specifically, whereas Biden's proposed top rate didn't kick in until AGI exceeded $1 million, the bill would "re-align"...

12/

..the capital gains brackets with the ordinary income tax brackets (make them start at the same $ amounts).

Great for remembering where brackets begin, but...

...it means the top cap gains bracket would start at 'just' $400k for single filers and $450k for joint filers...

..the capital gains brackets with the ordinary income tax brackets (make them start at the same $ amounts).

Great for remembering where brackets begin, but...

...it means the top cap gains bracket would start at 'just' $400k for single filers and $450k for joint filers...

13/

So if you're income is $4 million and consists of a lot of capital gains, you have to be feeling pretty good right now.

But if your income is between $400k/$450k and $1 million and you have capital gains, you'd MUCH prefer the Biden plan to this bill (at least for this)

So if you're income is $4 million and consists of a lot of capital gains, you have to be feeling pretty good right now.

But if your income is between $400k/$450k and $1 million and you have capital gains, you'd MUCH prefer the Biden plan to this bill (at least for this)

14/

By the way, one thought that occurs to me is that this bill would DRAMATICALLY re-increase the marriage penalty.

While present today, the TCJA really reduced the its impact. This bill does the complete opposite.

Two high earners could soon save A LOT of 💰 being "single."

By the way, one thought that occurs to me is that this bill would DRAMATICALLY re-increase the marriage penalty.

While present today, the TCJA really reduced the its impact. This bill does the complete opposite.

Two high earners could soon save A LOT of 💰 being "single."

15/

Back to capital gains...

One big question has been when the effective date of any change would be. The Biden Budget called for making changes to the top rate retroactive to April of this year.

That, in my opinion, was never going to happen (see 👇)

forbes.com/sites/jeffreyl…

Back to capital gains...

One big question has been when the effective date of any change would be. The Biden Budget called for making changes to the top rate retroactive to April of this year.

That, in my opinion, was never going to happen (see 👇)

forbes.com/sites/jeffreyl…

16/

In fact, I've gone on record throughout this year saying that if they did made the top rate retroactive, I'd eat my weight in Tax Code pages.

Those precious books on my shelf are safe, as instead of retro, the bill proposes making the change effective after introduction...

In fact, I've gone on record throughout this year saying that if they did made the top rate retroactive, I'd eat my weight in Tax Code pages.

Those precious books on my shelf are safe, as instead of retro, the bill proposes making the change effective after introduction...

17/

So what does that mean? Simply put, today was the day. If you sold something today, or before today, congratulations!

Under this proposal, you've locked in a top rate of 20% on your gain.

Sell tomorrow, or in the future, and your rate will be as high as 25%, EXCEPT...

So what does that mean? Simply put, today was the day. If you sold something today, or before today, congratulations!

Under this proposal, you've locked in a top rate of 20% on your gain.

Sell tomorrow, or in the future, and your rate will be as high as 25%, EXCEPT...

18/

in the situation where you entered into a binding contract BEFORE THE END OF THE DAY that is not materially modified.

(I'll understand if you need to take a break here to go call your attorney😜).

If such a contract is in place (today), the maximum rate of 20% applies...

in the situation where you entered into a binding contract BEFORE THE END OF THE DAY that is not materially modified.

(I'll understand if you need to take a break here to go call your attorney😜).

If such a contract is in place (today), the maximum rate of 20% applies...

19/

...Continuing our theme of increased tax rates, Section 138203 of the bill is a real killer for high-income owner/employees of S corps.

Under current law, S corp profits are not subject to either employment taxes or the net investment tax. The bill would change that...

...Continuing our theme of increased tax rates, Section 138203 of the bill is a real killer for high-income owner/employees of S corps.

Under current law, S corp profits are not subject to either employment taxes or the net investment tax. The bill would change that...

20/

for high earners. Specifically, single filers w/ MAGI in excess of $400k/joint filers w/ income in excess of $500k would have S corp profits subject to the 3.8% surtax...

Thats in ADDITION to ⬆ top ordinary rate discussed earlier... So true top rate goes from 37% to 43.4%!

for high earners. Specifically, single filers w/ MAGI in excess of $400k/joint filers w/ income in excess of $500k would have S corp profits subject to the 3.8% surtax...

Thats in ADDITION to ⬆ top ordinary rate discussed earlier... So true top rate goes from 37% to 43.4%!

21/

*Did you pick up on that one? #DadJoke!

BTW, the very next section of the bill also limits the max 199A deduction (the 20% pass-through deduction) to no more than:

- $500k for joint filers

- $400k for single filers

Let me be 100% crystal clear, this is a cap on...

*Did you pick up on that one? #DadJoke!

BTW, the very next section of the bill also limits the max 199A deduction (the 20% pass-through deduction) to no more than:

- $500k for joint filers

- $400k for single filers

Let me be 100% crystal clear, this is a cap on...

22/

...on the DEDUCTION, not a phaseout based on the amount of income an individual has. Pres. Biden's plan called for the deduction to be phased out for those w/ income above $400k.

This is another win for lobbyists and the uber-wealthy.

OK... 1 more on the income tax side...

...on the DEDUCTION, not a phaseout based on the amount of income an individual has. Pres. Biden's plan called for the deduction to be phased out for those w/ income above $400k.

This is another win for lobbyists and the uber-wealthy.

OK... 1 more on the income tax side...

23/

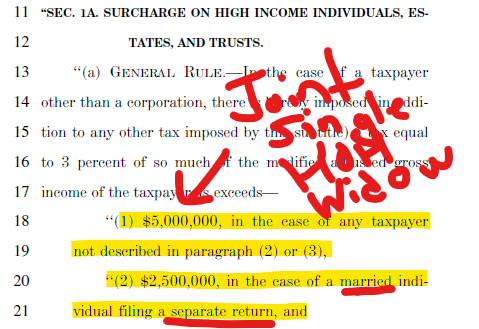

In a provision that will be applicable to an EXTRAORDINARILY small group of people-taxpayers (more on this in a moment), ultra- (ultra-, ultra-) high-income taxpayers would be subject to a new 3% surtax.

It would apply to taxpayers w/ MAGI over the thresholds highlighted👇

In a provision that will be applicable to an EXTRAORDINARILY small group of people-taxpayers (more on this in a moment), ultra- (ultra-, ultra-) high-income taxpayers would be subject to a new 3% surtax.

It would apply to taxpayers w/ MAGI over the thresholds highlighted👇

24/

Since those are MAGI limits, below-the-line deductions - like large charitable contributions - won't do anything to reduce the surtax.

But now...back to that whole "people-taxpayer" thing...

The same surtax that applies to the exclusive club of multi-million $ earners...

Since those are MAGI limits, below-the-line deductions - like large charitable contributions - won't do anything to reduce the surtax.

But now...back to that whole "people-taxpayer" thing...

The same surtax that applies to the exclusive club of multi-million $ earners...

25/

...also hits trusts at 'just' $100,000 of income. That a lot of income to be generated from investments (e.g., interest and dividends)

But now consider that most non-spouse beneficiaries, including trusts, have to empty IRAs, 401ks, etc. w/in 10 years.

Not nearly as...

...also hits trusts at 'just' $100,000 of income. That a lot of income to be generated from investments (e.g., interest and dividends)

But now consider that most non-spouse beneficiaries, including trusts, have to empty IRAs, 401ks, etc. w/in 10 years.

Not nearly as...

26/

hard to have $100,000 of income (held in the trust) when you're looking at (forced) large retirement account distributions!

This could be (yet) another reason for retirement account owners w/ large accounts being left to discretionary trusts to convert more during life...

hard to have $100,000 of income (held in the trust) when you're looking at (forced) large retirement account distributions!

This could be (yet) another reason for retirement account owners w/ large accounts being left to discretionary trusts to convert more during life...

27/

...in an effort to minimize even greater tax erosion after death thanks to the lousy trust tax brackets (+ surtax threshold?).

OK, time to pivot away from rates, deductions, surtaxes, etc. to talk about this bill's ALL-OUT ATTEMPT TO ELIMINATE SOME FAV PLANNING STRATEGIES.

...in an effort to minimize even greater tax erosion after death thanks to the lousy trust tax brackets (+ surtax threshold?).

OK, time to pivot away from rates, deductions, surtaxes, etc. to talk about this bill's ALL-OUT ATTEMPT TO ELIMINATE SOME FAV PLANNING STRATEGIES.

28/

Let's talk #crypto, shall we?

I've pounded the table for years about opportunities to take advantage of crypto losses. In short, there's no wash sale rule... at least not yet.

If enacted, the bill makes crypto subject to wash sales 1/1/22

CC: @TR401

Let's talk #crypto, shall we?

I've pounded the table for years about opportunities to take advantage of crypto losses. In short, there's no wash sale rule... at least not yet.

If enacted, the bill makes crypto subject to wash sales 1/1/22

CC: @TR401

https://twitter.com/CPAPlanner/status/1395810797377437697?s=20

29/

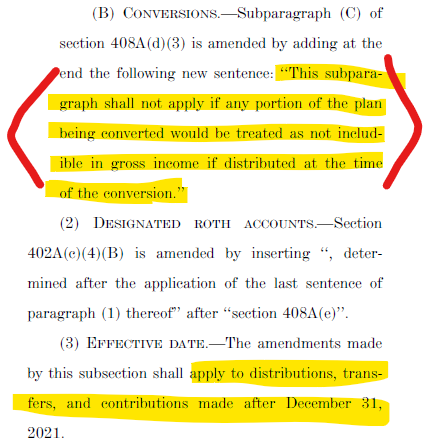

Speaking of planning strategies that may go by the wayside, say goodbye to a whole lot of Roth conversion planning for some clients.

Let's start with Section 138311 of the bill, which does a few things. First, it eliminates all Roth conversions for high-income taxpayers...

Speaking of planning strategies that may go by the wayside, say goodbye to a whole lot of Roth conversion planning for some clients.

Let's start with Section 138311 of the bill, which does a few things. First, it eliminates all Roth conversions for high-income taxpayers...

30/

...Just how high does one's income have to be to be prohibited from making a Roth conversion. In short, you cannot be a taxpayer in the highest ordinary income tax bracket (so single filers a/ $400k+, joint filers w/ $450k+).

Here's the really interesting/sneaky thing...

...Just how high does one's income have to be to be prohibited from making a Roth conversion. In short, you cannot be a taxpayer in the highest ordinary income tax bracket (so single filers a/ $400k+, joint filers w/ $450k+).

Here's the really interesting/sneaky thing...

31/

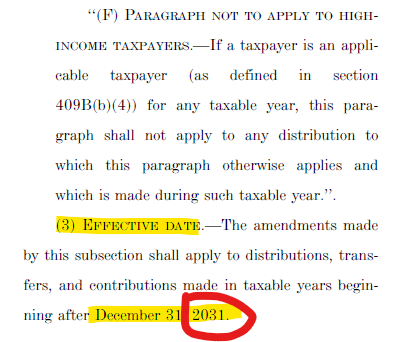

Check out the effective date of the change!👇

Now, just about everything in this bill that applies to high-income/net worth taxpayers 'kicks in' on January 1, 2022 (w/ some, like cap gains rate changes to take effect earlier!).

So, why would this one be delayed so long?🤔

Check out the effective date of the change!👇

Now, just about everything in this bill that applies to high-income/net worth taxpayers 'kicks in' on January 1, 2022 (w/ some, like cap gains rate changes to take effect earlier!).

So, why would this one be delayed so long?🤔

32/

Only logical reason is its part of a budget/numbers game.

Keeping Roth conversions for high earners 'alive' for 10 years (even incentivizing more conversions w/ a "Buy now while supplies last" rule) brings in $ now!

This reduced the net cost of the bill. Shrewd, but smart.

Only logical reason is its part of a budget/numbers game.

Keeping Roth conversions for high earners 'alive' for 10 years (even incentivizing more conversions w/ a "Buy now while supplies last" rule) brings in $ now!

This reduced the net cost of the bill. Shrewd, but smart.

33/

But wait... it gets worse😲

If passed, effective January 1, 2022, after-tax amounts in retirement accounts will no longer be eligible for conversion to Roth accounts. Period.

To be clear, that means there's a really good chance THE BACK-DOOR ROTH IS 💀after this year.

But wait... it gets worse😲

If passed, effective January 1, 2022, after-tax amounts in retirement accounts will no longer be eligible for conversion to Roth accounts. Period.

To be clear, that means there's a really good chance THE BACK-DOOR ROTH IS 💀after this year.

34/

In case I haven't sufficiently upset those w/ large income and large IRAs yet, let's move on to some other proposed changes to retirement accounts that would both limit future contributions and require additional distributions for some.

Section 138301 would prevent any...

In case I haven't sufficiently upset those w/ large income and large IRAs yet, let's move on to some other proposed changes to retirement accounts that would both limit future contributions and require additional distributions for some.

Section 138301 would prevent any...

35/

...new contributions from being made to any IRA or Roth IRA of a taxpayer who:

1) Has AGI above $400k single/$450k joint

AND

2) Has total retirement accounts valued at more than $10MM

Wait... hold up...🤦♂️

This is really, really dumb and unnecessary...

...new contributions from being made to any IRA or Roth IRA of a taxpayer who:

1) Has AGI above $400k single/$450k joint

AND

2) Has total retirement accounts valued at more than $10MM

Wait... hold up...🤦♂️

This is really, really dumb and unnecessary...

36/

Look, I get it, we're trying to stop the ultra-wealthy from stockpiling more money in retirement accounts. That makes sense. You only need so much for "retirement."

This, however, is a really dumb way to do it.

1) This ONLY APPLIES TO IRA and Roth IRAs!!! So...

Look, I get it, we're trying to stop the ultra-wealthy from stockpiling more money in retirement accounts. That makes sense. You only need so much for "retirement."

This, however, is a really dumb way to do it.

1) This ONLY APPLIES TO IRA and Roth IRAs!!! So...

37/

...contributions can still be made to 401(k)s, SEP IRAs, pension plans, etc. (MUCH higher contribution limits).

This is an unnecessary rule. Stopping someone w/ $10 million in retirement accts from putting in $6k more is like trying plug the Titanic's leak w/ a wine cork.

...contributions can still be made to 401(k)s, SEP IRAs, pension plans, etc. (MUCH higher contribution limits).

This is an unnecessary rule. Stopping someone w/ $10 million in retirement accts from putting in $6k more is like trying plug the Titanic's leak w/ a wine cork.

38/

Having said that, there's more up the Dems' sleeves when it comes to reigning in the retirement accounts of the uber-wealthy.

Specifically, Section 138302 of the bill would create new RMDs for individuals w/ high retirement account balances.

Here's the deal...

Having said that, there's more up the Dems' sleeves when it comes to reigning in the retirement accounts of the uber-wealthy.

Specifically, Section 138302 of the bill would create new RMDs for individuals w/ high retirement account balances.

Here's the deal...

39/

Anyone w/ income in excess of the thresholds noted above for contributions

AND

w/ $10MM - $20MM in total retirement accounts would be required to distribute 50% of the excess over $10MM.

So, have $17MM in retirement accounts, you now have a $3.5MM RMD...

Anyone w/ income in excess of the thresholds noted above for contributions

AND

w/ $10MM - $20MM in total retirement accounts would be required to distribute 50% of the excess over $10MM.

So, have $17MM in retirement accounts, you now have a $3.5MM RMD...

40/

"But wait, there's more."🤦♂️

If income is over threshold + total retirement account balances exceed $20MM, 100% of excess over $20MM must be distributed as an RMD too!

So, if I'm reading this right, if you had $23MM in IRAs, youd have a $3MM + (50% x $10MM) = $8MM RMD!💸

"But wait, there's more."🤦♂️

If income is over threshold + total retirement account balances exceed $20MM, 100% of excess over $20MM must be distributed as an RMD too!

So, if I'm reading this right, if you had $23MM in IRAs, youd have a $3MM + (50% x $10MM) = $8MM RMD!💸

41/

In case you're wondering, yes, there IS an order of operations.

If you have to take an RMD b/c your income and account balances exceed the applicable thresholds, you have to take the money from Roth IRAs first, then plan Roth accounts, then anything else.

Few comments...

In case you're wondering, yes, there IS an order of operations.

If you have to take an RMD b/c your income and account balances exceed the applicable thresholds, you have to take the money from Roth IRAs first, then plan Roth accounts, then anything else.

Few comments...

42/

First, WTF is w/ this income requirement?

Unless I'm reading it wrong (which is entirely possible at this point), we're saying that if you're a joint filer w/ $449,990 and $1 BILLION in retirement accounts, you're A-OK.

But if you have $10 more you have an RMD of $985MM??

First, WTF is w/ this income requirement?

Unless I'm reading it wrong (which is entirely possible at this point), we're saying that if you're a joint filer w/ $449,990 and $1 BILLION in retirement accounts, you're A-OK.

But if you have $10 more you have an RMD of $985MM??

43/

I realize that this applies to a really small sliver of the population, but boy does it create an incentive to keep income below the limits.

For biz owners, convert to C corp, keep it all in corp and off your personal return??? Maybe?

The "and income above" is just dumb👎

I realize that this applies to a really small sliver of the population, but boy does it create an incentive to keep income below the limits.

For biz owners, convert to C corp, keep it all in corp and off your personal return??? Maybe?

The "and income above" is just dumb👎

44/

Also... while I'm not "crying the blues" for folks w/ $20MM+ in accts, I can't help but point out flaws/unfairness when I see it.

Consider which is "worse":

A) Bob, who contributed $5k to a Roth IRA + grew it to $9MM

B) Mary, who converted $25MM to Roth and has $26MM

🤔

Also... while I'm not "crying the blues" for folks w/ $20MM+ in accts, I can't help but point out flaws/unfairness when I see it.

Consider which is "worse":

A) Bob, who contributed $5k to a Roth IRA + grew it to $9MM

B) Mary, who converted $25MM to Roth and has $26MM

🤔

45/

Recognizing that both Bob and Mary are extremely fortunate and in the top echelon of net worth for US households...

I think I could make a pretty good argument that Bob's ~9MM of tax-free growth is a bigger revenue/fairness issue than Mary's $1MM of growth.

Moving on...

Recognizing that both Bob and Mary are extremely fortunate and in the top echelon of net worth for US households...

I think I could make a pretty good argument that Bob's ~9MM of tax-free growth is a bigger revenue/fairness issue than Mary's $1MM of growth.

Moving on...

46/

Actually, this is a good time to take a quick break from the technical to say "Thank you!" to everyone who submitted suggestions for tonight's tweetstorm (plenty more to come by the way).

I ultimately went with the Office b/c:

1) It's just F'ing awesome

2) Volume of GIFS

Actually, this is a good time to take a quick break from the technical to say "Thank you!" to everyone who submitted suggestions for tonight's tweetstorm (plenty more to come by the way).

I ultimately went with the Office b/c:

1) It's just F'ing awesome

2) Volume of GIFS

47/

Ok, back to the 'grind.' Let's wrap up retirement accts before we pivot to estate planning (didn't forget about that, did you?).

You can probably thank @propublica for some of the RMD stuff above, as well as Sections 138313 through 138315... propublica.org/article/lord-o…

Ok, back to the 'grind.' Let's wrap up retirement accts before we pivot to estate planning (didn't forget about that, did you?).

You can probably thank @propublica for some of the RMD stuff above, as well as Sections 138313 through 138315... propublica.org/article/lord-o…

48/

Their kick-ass reporting revealed, for the first time in detail, how Thiel turned a few thousand $ of Roth contributions into a $5 BILLION tax-free kitty.

That didn't sit well with a lot of folks on Capitol Hill, and now they're trying to make sure it doesn't happen again.

Their kick-ass reporting revealed, for the first time in detail, how Thiel turned a few thousand $ of Roth contributions into a $5 BILLION tax-free kitty.

That didn't sit well with a lot of folks on Capitol Hill, and now they're trying to make sure it doesn't happen again.

49/

Section 138313 would extend the statute of limitations for Prohibited Transactions and valuation issues to 6 years (double current 3-year statute).

I can't help but picture someone at IRS right now doing their best Liam Neeson... "I will look for you... I will find you..."

Section 138313 would extend the statute of limitations for Prohibited Transactions and valuation issues to 6 years (double current 3-year statute).

I can't help but picture someone at IRS right now doing their best Liam Neeson... "I will look for you... I will find you..."

50/

Hey, we've reached the big 5-0 on the storm, and still plenty left.

Section 138314 is many self-directed IRA owners' worst nightmare.

Wow. Actually, as I read this now, it's going to be worse for a lot of people than I realized upon my first quick pass. I'll explain...

Hey, we've reached the big 5-0 on the storm, and still plenty left.

Section 138314 is many self-directed IRA owners' worst nightmare.

Wow. Actually, as I read this now, it's going to be worse for a lot of people than I realized upon my first quick pass. I'll explain...

51/

Under the current Prohibited Transaction rules, an individual can't invest IRA $ in a company in which they own > 50% (either directly or indirectly).

The 50% threshold leaves the door open to Peter Thiel-like situations. See my article👇kitces.com/blog/roth-ira-…

Under the current Prohibited Transaction rules, an individual can't invest IRA $ in a company in which they own > 50% (either directly or indirectly).

The 50% threshold leaves the door open to Peter Thiel-like situations. See my article👇kitces.com/blog/roth-ira-…

52/

To crack down on these types of situations, the bill would lower the 50% threshold to 10% for privately companies.

Also, officers, directors, and persons with similar positions would be prohibited from investing IRA $ into such companies.

2 more points b4 commentary...

To crack down on these types of situations, the bill would lower the 50% threshold to 10% for privately companies.

Also, officers, directors, and persons with similar positions would be prohibited from investing IRA $ into such companies.

2 more points b4 commentary...

53/

1) In order to be an IRA, the above requirements must be met (semantics, but semantics matter w/ tax legislation. It's no longer a prohibited transaction)!

2) In general this change is effective beginning next year, but there's a 2-year window for current 'bad' investments.

1) In order to be an IRA, the above requirements must be met (semantics, but semantics matter w/ tax legislation. It's no longer a prohibited transaction)!

2) In general this change is effective beginning next year, but there's a 2-year window for current 'bad' investments.

54/

OK, now let me share some observations about this:

- Best I can tell, this applies ONLY to IRAs. So for those who want to invest in their own company, ROBS via 401(k) (the name says it all) still seems viable?

- The change away from a PT is actually a really smart move...

OK, now let me share some observations about this:

- Best I can tell, this applies ONLY to IRAs. So for those who want to invest in their own company, ROBS via 401(k) (the name says it all) still seems viable?

- The change away from a PT is actually a really smart move...

55/

...on the part of drafters. It helps the IRS in situations where they catch the problem outside of the statute of limitations.

Essentially, it's a "Well, IRAs can't have this investment, so you didn't really have an IRA to begin with... and so you still don't now."

Clever.

...on the part of drafters. It helps the IRS in situations where they catch the problem outside of the statute of limitations.

Essentially, it's a "Well, IRAs can't have this investment, so you didn't really have an IRA to begin with... and so you still don't now."

Clever.

56/

Finally, there's that transition rule...

The text is below, and it's not exactly crystal clear. I can read it 2 ways.

Either a) If you have 'bad' investments, you have 2 years to rid your IRA of them, or b) you can only buy more of an existing 'bad' investment for 2 years

Finally, there's that transition rule...

The text is below, and it's not exactly crystal clear. I can read it 2 ways.

Either a) If you have 'bad' investments, you have 2 years to rid your IRA of them, or b) you can only buy more of an existing 'bad' investment for 2 years

57/

I THINK it's the latter.

Candidly, for many biz owners who were counting on their IRAs for capital, that's bad enough. Two years can go by fast.

And while it could be the former, it's hard to imagine the IRS would essentially force a firesale of taxpayers' businesses.

I THINK it's the latter.

Candidly, for many biz owners who were counting on their IRAs for capital, that's bad enough. Two years can go by fast.

And while it could be the former, it's hard to imagine the IRS would essentially force a firesale of taxpayers' businesses.

58/

Lastly on the retirement acct front, Section 138315 makes clear that IRA owners are disqualified persons with respect to their own IRAs.

Not entirely sure why this is necessary, as this seemed clear before. Either way, IF there was any doubt, this would put that to bed.

Lastly on the retirement acct front, Section 138315 makes clear that IRA owners are disqualified persons with respect to their own IRAs.

Not entirely sure why this is necessary, as this seemed clear before. Either way, IF there was any doubt, this would put that to bed.

59/

Ok... I lied. I forgot about one more retirement account-related change that's in a separate part of the bill.

Section 138503 of the bill shuts down another perceived loophole in the law that has been nagging the IRS for years (see Hellweg v Comm👇)

casetext.com/case/hellweg-v…

Ok... I lied. I forgot about one more retirement account-related change that's in a separate part of the bill.

Section 138503 of the bill shuts down another perceived loophole in the law that has been nagging the IRS for years (see Hellweg v Comm👇)

casetext.com/case/hellweg-v…

60/

In the Hellweg case the Tax Court allowed the taxpayer's Roth IRA-owned a business (a DISC) to receive commissions from another business owned directly by the taxpayers.

The bill would explicitly ban this sort of value-shifting technique beginning 2022.

👀Wow! I missed...

In the Hellweg case the Tax Court allowed the taxpayer's Roth IRA-owned a business (a DISC) to receive commissions from another business owned directly by the taxpayers.

The bill would explicitly ban this sort of value-shifting technique beginning 2022.

👀Wow! I missed...

61/

another IRA provision. And this one could be REALLY significant for some advisors and IRA owners.

And (spoiler alert), I think it's a💩rule.

Section 138312 would prohibit IRAs from owning any security if the issuer has income, assets, education, or licensing requirements.

another IRA provision. And this one could be REALLY significant for some advisors and IRA owners.

And (spoiler alert), I think it's a💩rule.

Section 138312 would prohibit IRAs from owning any security if the issuer has income, assets, education, or licensing requirements.

62/

That means, for instance, no private placements in IRAs (even if it is a completely third-party investment).

Many public-but-non-traded investments also require investors to have certain levels of income/assets. They would seem to be prohibited investments by this as well.

That means, for instance, no private placements in IRAs (even if it is a completely third-party investment).

Many public-but-non-traded investments also require investors to have certain levels of income/assets. They would seem to be prohibited investments by this as well.

63/

I get that we're trying to protect investors. I applaud + support that effort.

But this is NOT the right way.

Nothing inherently wrong w/ Private Placements or similar investments. And if they're 3rd party they don't have the same potential for abuse.

In short, Congress:

I get that we're trying to protect investors. I applaud + support that effort.

But this is NOT the right way.

Nothing inherently wrong w/ Private Placements or similar investments. And if they're 3rd party they don't have the same potential for abuse.

In short, Congress:

64/

By the way, just to be clear. Not as if I'm a raving fan of private placements or anything like that.

It's just that there are people who might have a desire to invest in a legit, 3rd party offering. I see no reasonable rationale for gov't to ban them from doing so.

OK...

By the way, just to be clear. Not as if I'm a raving fan of private placements or anything like that.

It's just that there are people who might have a desire to invest in a legit, 3rd party offering. I see no reasonable rationale for gov't to ban them from doing so.

OK...

65/

I think we're really, truly done w/ the retirement account stuff.

So, with that, let's pivot to estate taxes/planning.

There are a few really significant changes proposed here. Let's start with the exemption amount.

Section 138207 does what I've been predicting would...

I think we're really, truly done w/ the retirement account stuff.

So, with that, let's pivot to estate taxes/planning.

There are a few really significant changes proposed here. Let's start with the exemption amount.

Section 138207 does what I've been predicting would...

66/

...happen. It unwinds the changes made by the TCJA.

Essentially, it halves the current gift and estate tax exemption amounts beginning in 2022.

Notably, "we're 'just' eliminating the handout to the rich R's created in 2017" would seem an easier sell to moderate Senate Ds.

...happen. It unwinds the changes made by the TCJA.

Essentially, it halves the current gift and estate tax exemption amounts beginning in 2022.

Notably, "we're 'just' eliminating the handout to the rich R's created in 2017" would seem an easier sell to moderate Senate Ds.

67/

In what is likely a related move to try and head off the "Oh, but what about the farmers!?" argument often trotted out (mostly by Rs) when the estate tax exemption may be reduced...

Section 138208 of the bill DRAMATICALLY increases the maximum allowable reduction for...

In what is likely a related move to try and head off the "Oh, but what about the farmers!?" argument often trotted out (mostly by Rs) when the estate tax exemption may be reduced...

Section 138208 of the bill DRAMATICALLY increases the maximum allowable reduction for...

68/

...real property used in a family farm or family biz.

At a high level, for estate tax purposes, instead of FMV, the property can be valued based on actual use (often much less), subject to a maximum reduction.

The max reduction would go from about $1.2MM today, to $11.7MM.

...real property used in a family farm or family biz.

At a high level, for estate tax purposes, instead of FMV, the property can be valued based on actual use (often much less), subject to a maximum reduction.

The max reduction would go from about $1.2MM today, to $11.7MM.

69/

70/

Section 138209 deals with Grantor trusts and would significantly change the estate-planning 'game' as we know it today.

At a high level, it appears to target strategies like intentionally defective grantor trusts (IDGTs), where assets are out of the estate, but still...

Section 138209 deals with Grantor trusts and would significantly change the estate-planning 'game' as we know it today.

At a high level, it appears to target strategies like intentionally defective grantor trusts (IDGTs), where assets are out of the estate, but still...

71/

...are controlled by the Grantor in some way (and generally taxable at the Grantor level).

You might think of this as the "All or Nothing Provision."

Speaking as Congress, "The choice is yours taxpayer. Either keep control but it's in your estate, or TRULY give it up."

...are controlled by the Grantor in some way (and generally taxable at the Grantor level).

You might think of this as the "All or Nothing Provision."

Speaking as Congress, "The choice is yours taxpayer. Either keep control but it's in your estate, or TRULY give it up."

72/

And you can kiss swap powers goodbye too.

That, along w/ the "All or Nothing" provision would be effective as of enactment.

So if you were thinking about creating a would-be-impacted trust, you may have only precious few days/weeks to have it drafted + funded.

Good luck😬

And you can kiss swap powers goodbye too.

That, along w/ the "All or Nothing" provision would be effective as of enactment.

So if you were thinking about creating a would-be-impacted trust, you may have only precious few days/weeks to have it drafted + funded.

Good luck😬

73/

One more here on the estate tax front (I think😜)...

Section 138210 would eliminate valuation discounts (e.g., "minority ownership") for non-business assets.

The change would also be effective as of enactment, so this is another one where quick action may be worth it.

One more here on the estate tax front (I think😜)...

Section 138210 would eliminate valuation discounts (e.g., "minority ownership") for non-business assets.

The change would also be effective as of enactment, so this is another one where quick action may be worth it.

74/

OK, heading into the closing stretch here...

Section 138205 makes permanent the limit on excess business losses. This was already law through 2025, so not particularly massive news or impactful today.

FYI: Excess losses = >$500k joint filers / >$250k single filers.

The...

OK, heading into the closing stretch here...

Section 138205 makes permanent the limit on excess business losses. This was already law through 2025, so not particularly massive news or impactful today.

FYI: Excess losses = >$500k joint filers / >$250k single filers.

The...

75/

...basic premise of the provision is that if you have losses from a business, you can only offset a limited amount of other income (e.g., interest, retirement account distributions, etc.) w/ those losses.

That, ladies and gents, is just about it for the "big stuff" in...

...basic premise of the provision is that if you have losses from a business, you can only offset a limited amount of other income (e.g., interest, retirement account distributions, etc.) w/ those losses.

That, ladies and gents, is just about it for the "big stuff" in...

76/

in Subtitle I. That said, there are definitely some worthwhile items in Subtitle H too, beginning w/ enhancements to the Child Tax Credit, such as:

- Advanced payments of the credit would continue in 2022 (have to imagine monthly checks in an election year play well)...

in Subtitle I. That said, there are definitely some worthwhile items in Subtitle H too, beginning w/ enhancements to the Child Tax Credit, such as:

- Advanced payments of the credit would continue in 2022 (have to imagine monthly checks in an election year play well)...

77/

That said, monthly payments would continue beyond 2022, as Section 137103 creates a monthly $250 ($300 if <6) Child Tax Credit through 2025.

Has a series of tie-breakers determine who gets the credit that might be more complicated than NFL playoff tiebreakers (you decide👇)

That said, monthly payments would continue beyond 2022, as Section 137103 creates a monthly $250 ($300 if <6) Child Tax Credit through 2025.

Has a series of tie-breakers determine who gets the credit that might be more complicated than NFL playoff tiebreakers (you decide👇)

78/

CTC would also be permanently refundable.

The current Child and Dependent Care Credit rules (for 2021) would also be made permanent, creating much larger potential credits ( See👇), available at higher incomes, and fully refundable...

CTC would also be permanently refundable.

The current Child and Dependent Care Credit rules (for 2021) would also be made permanent, creating much larger potential credits ( See👇), available at higher incomes, and fully refundable...

79/

With respect to healthcare/coverage, Section 138507 would extend the current "if you get unemployment benefits during the year, you can get 'Obamacare credits' as if you're income was 'only' 150% of poverty level" rule through 2025.

And of course, no bill breakdown would...

With respect to healthcare/coverage, Section 138507 would extend the current "if you get unemployment benefits during the year, you can get 'Obamacare credits' as if you're income was 'only' 150% of poverty level" rule through 2025.

And of course, no bill breakdown would...

80/

...be complete without talking a little bit about what's NOT in the bill.

A big one (not) there is the step-up in basis. For now, it appears it may 'live' on (Get it!? It's almost 4AM, so you have to cut me some slack).

There's also nothing to address Social Security...

...be complete without talking a little bit about what's NOT in the bill.

A big one (not) there is the step-up in basis. For now, it appears it may 'live' on (Get it!? It's almost 4AM, so you have to cut me some slack).

There's also nothing to address Social Security...

81/

...despite the fact that the Trust Fund is now expected to be depleted a year sooner than was previous anticipated (2033 vs 2034), thanks to the impact of COVID-19 on wages and SE income.

So while this bill could significantly increase taxes for affluent families, there...

...despite the fact that the Trust Fund is now expected to be depleted a year sooner than was previous anticipated (2033 vs 2034), thanks to the impact of COVID-19 on wages and SE income.

So while this bill could significantly increase taxes for affluent families, there...

82/

...could very well be more pain to come for those high-income individuals who have substantial EARNED income (wages and/or SE income).

Of course, this bill is FAR from law. It might get there, or it might end up going down in flames.

After all, Ds can afford less than...

...could very well be more pain to come for those high-income individuals who have substantial EARNED income (wages and/or SE income).

Of course, this bill is FAR from law. It might get there, or it might end up going down in flames.

After all, Ds can afford less than...

83/

...less than a handful of defectors in the House. And in the Senate, the margins are even tighter, as just a single "nay" vote would scuttle the whole bill.

I expect to see changes, but this is the best indication yet of what a final piece of legislation MIGHT look like...

...less than a handful of defectors in the House. And in the Senate, the margins are even tighter, as just a single "nay" vote would scuttle the whole bill.

I expect to see changes, but this is the best indication yet of what a final piece of legislation MIGHT look like...

84/

I would be remiss if I didn't take care of a few housekeeping items before wrapping up.

First, if you're an advisor or CPA and want even more (😵💫) you can check out my full write-up on the bill Weds at Kitces.com and/or join me for a webinar there at 3EDT.

I would be remiss if I didn't take care of a few housekeeping items before wrapping up.

First, if you're an advisor or CPA and want even more (😵💫) you can check out my full write-up on the bill Weds at Kitces.com and/or join me for a webinar there at 3EDT.

85/

Advisors looking to model impacts of proposed changes may want to check out @Holistiplan. They'll be working on updating scenario analyses in the coming days/weeks.

If you're a consumer looking for help, I'd invite you to check out my colleagues👇 buckinghamstrategicwealth.com

Advisors looking to model impacts of proposed changes may want to check out @Holistiplan. They'll be working on updating scenario analyses in the coming days/weeks.

If you're a consumer looking for help, I'd invite you to check out my colleagues👇 buckinghamstrategicwealth.com

86/

With that, I think we've come to the end of this storm. It's after 4AM here and I have an article to write tomorrow!

If you see any errors or something big I missed, please let me know. Thanks in advance!

I leave you w/ the immortal words of Michael Scott

'Hammer Out!🔨👊

With that, I think we've come to the end of this storm. It's after 4AM here and I have an article to write tomorrow!

If you see any errors or something big I missed, please let me know. Thanks in advance!

I leave you w/ the immortal words of Michael Scott

'Hammer Out!🔨👊

• • •

Missing some Tweet in this thread? You can try to

force a refresh