Thought of arranging my earlier tweets on #mp_amt in serial order. Hope it would be useful-

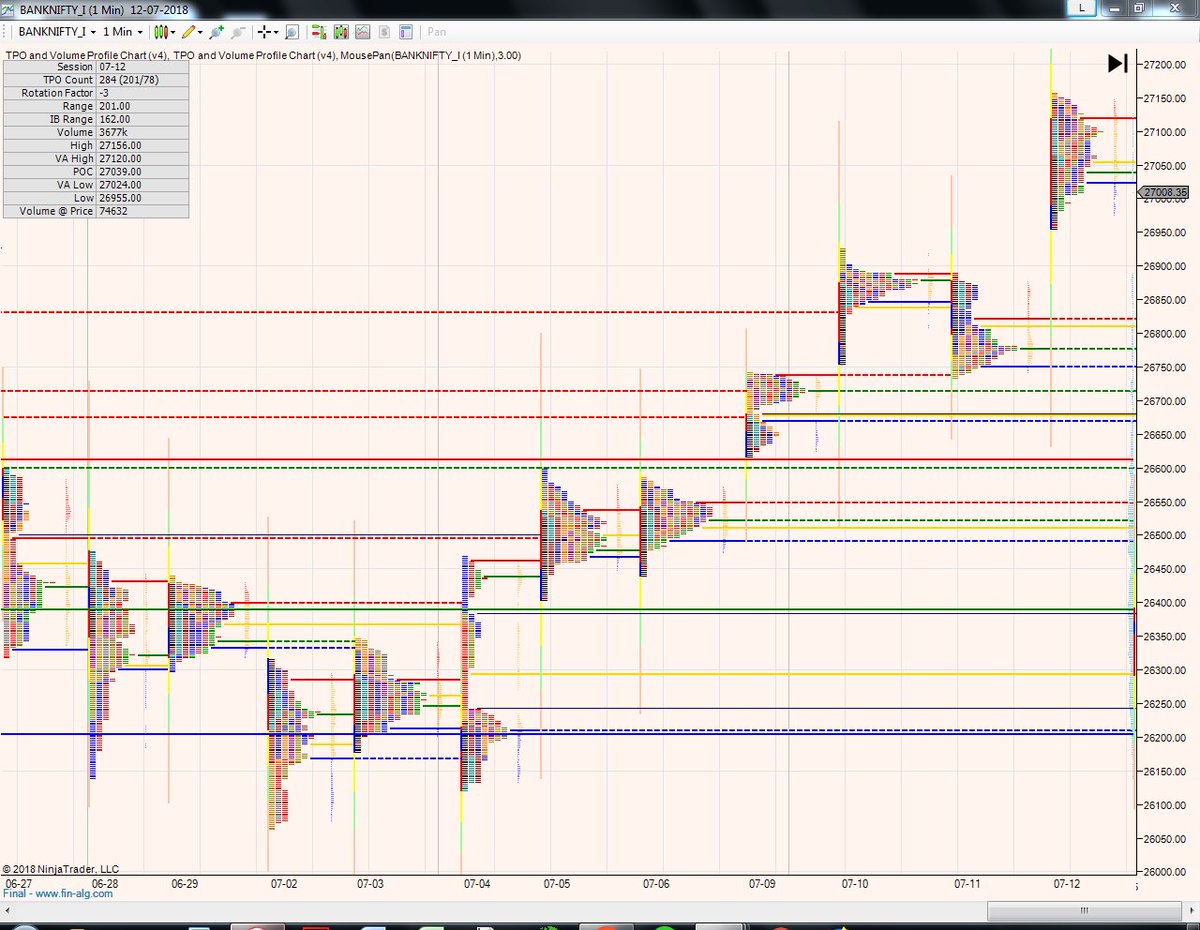

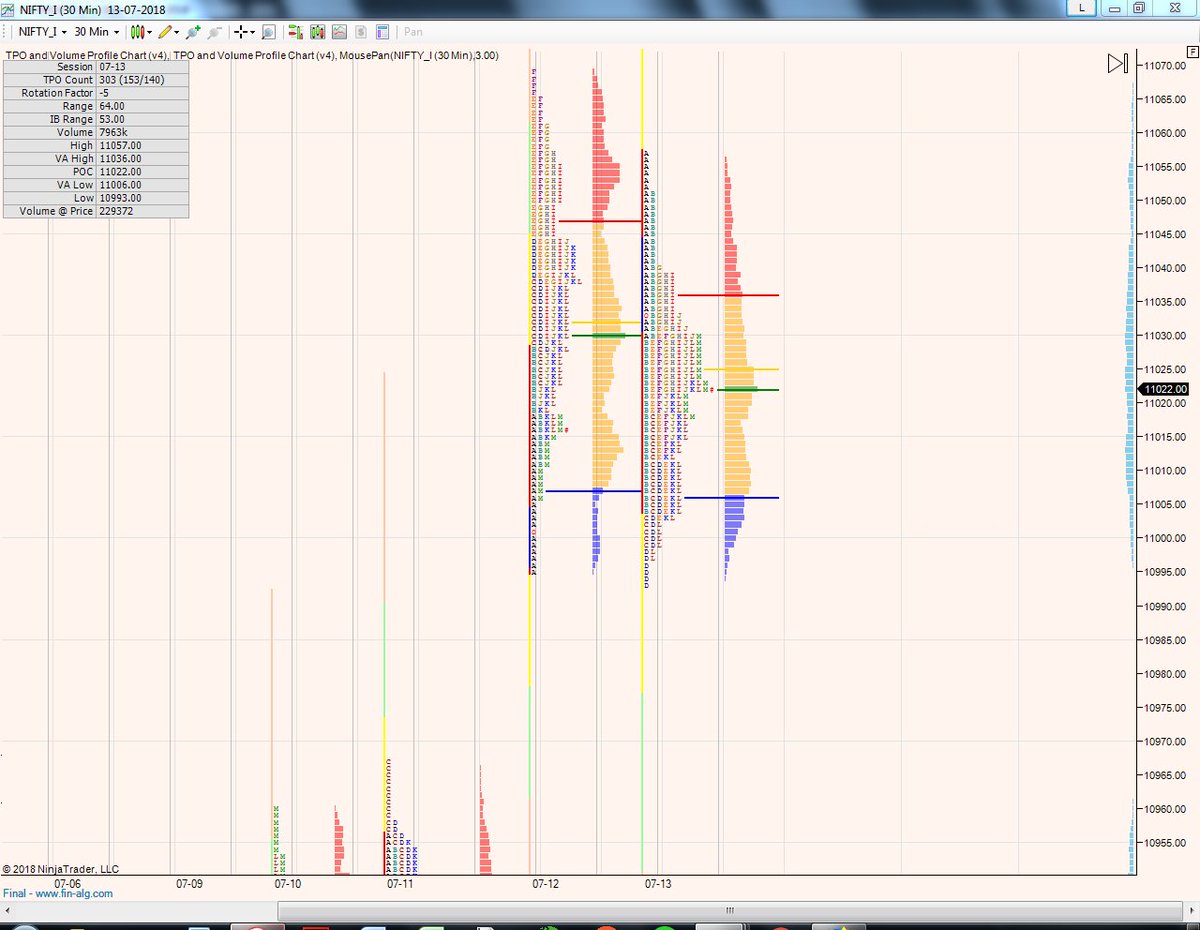

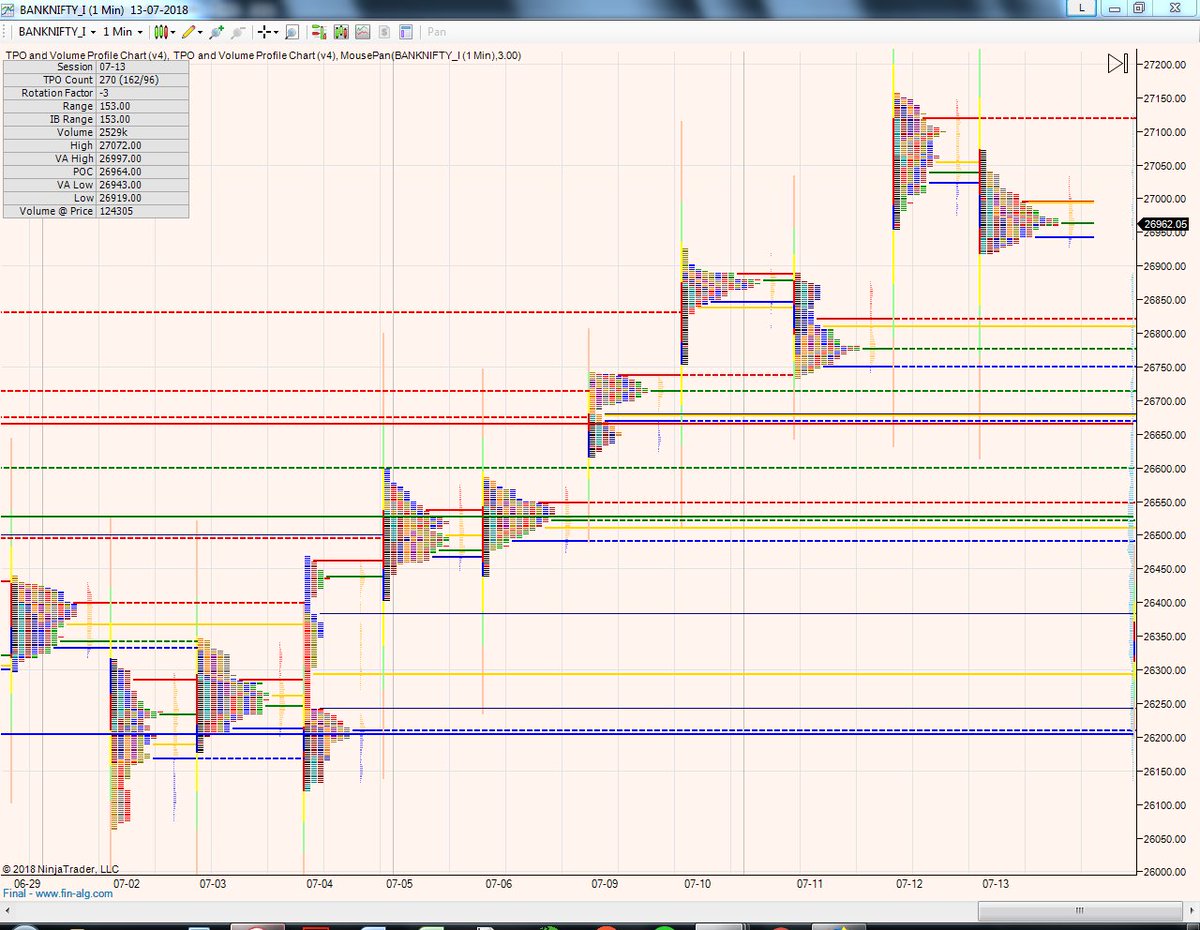

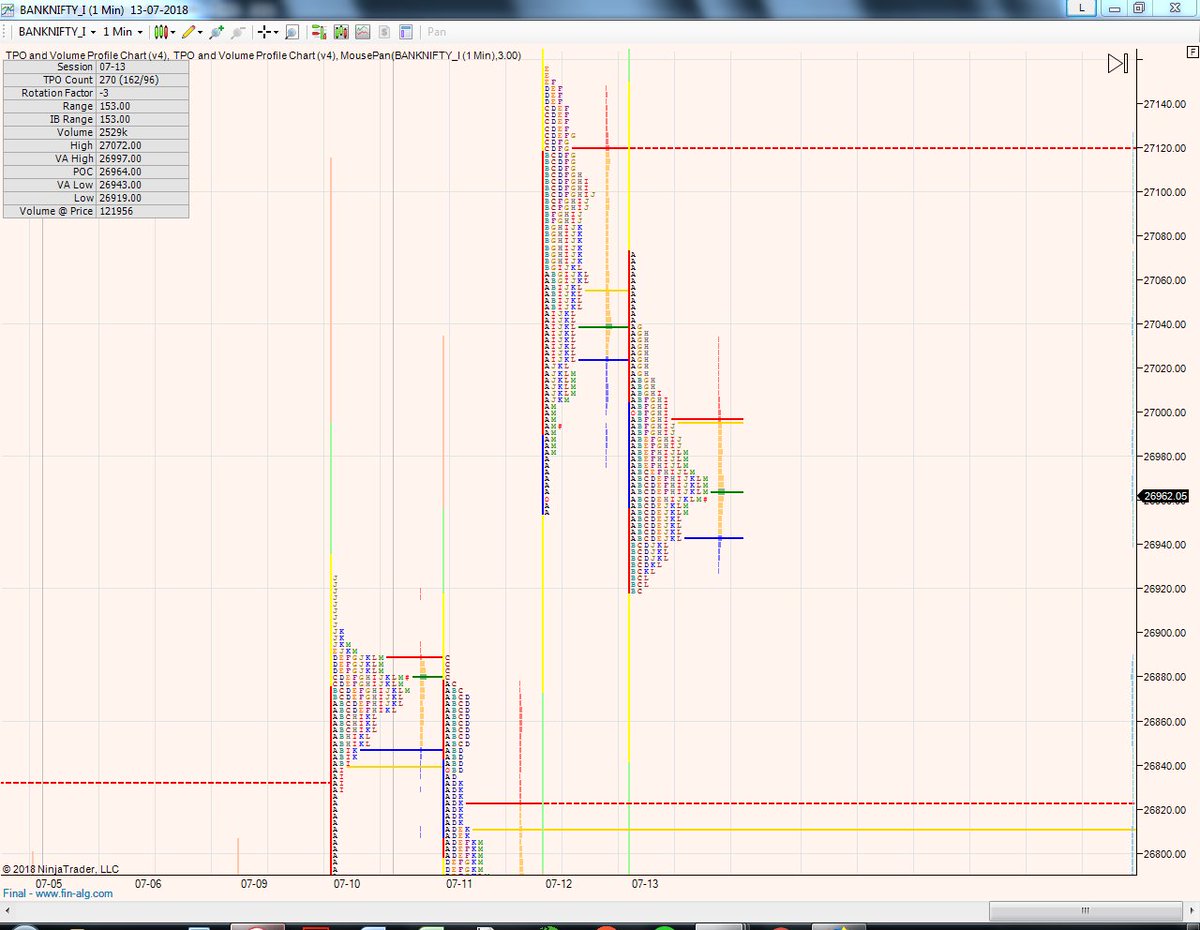

#mp_amt

#LearningTogether

#mp_amt

#LearningTogether

1. A beginners take on #AMT, #MarketProfile & #OrderFlow

https://twitter.com/IMRiskManager/status/788385728874938368

• • •

Missing some Tweet in this thread? You can try to

force a refresh