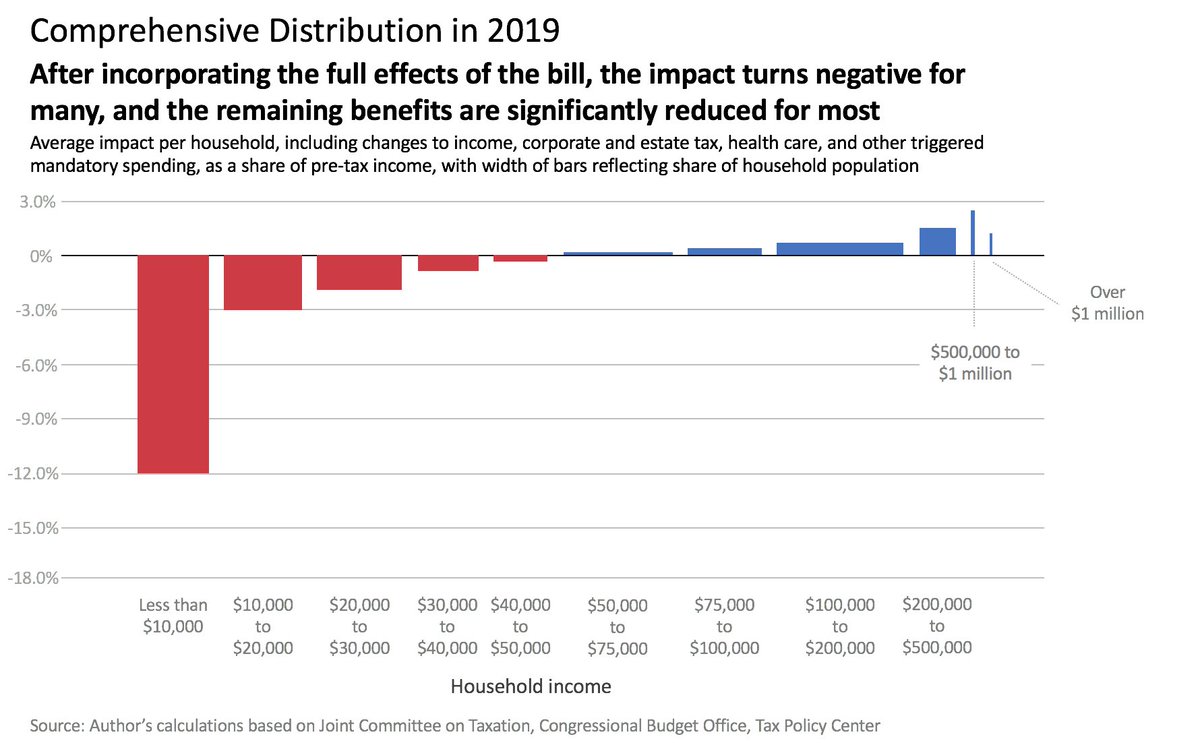

HEADS UP: Here are 10 things I’ll bet you didn’t know about the GOP tax scam, but that should get you super angry when you find out:

1) GOP tax scam cuts Medicare! Yup, it does. By $28 billion NEXT YEAR alone.

• • •

Missing some Tweet in this thread? You can try to

force a refresh