This coming week is make-or-break for the GOP tax scam. If you have any interest in fighting this disastrous bill, follow along for a state-of-play update. Short version: we CAN still stop this thing. 1/

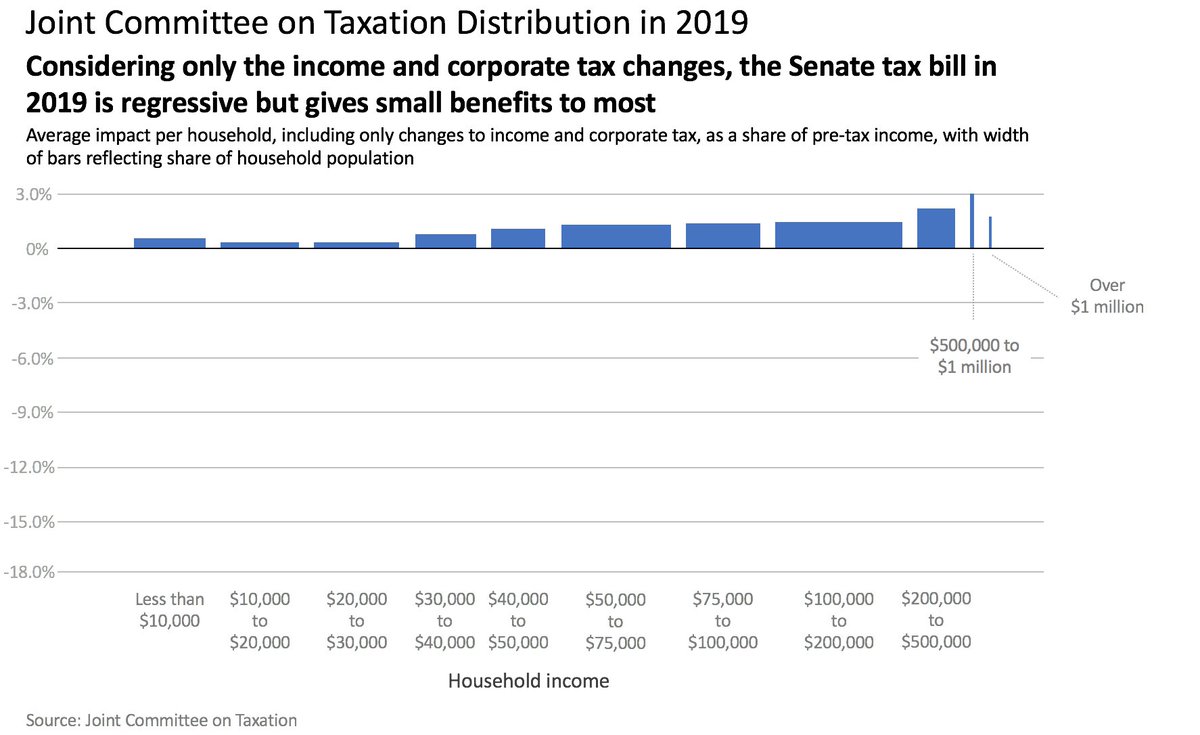

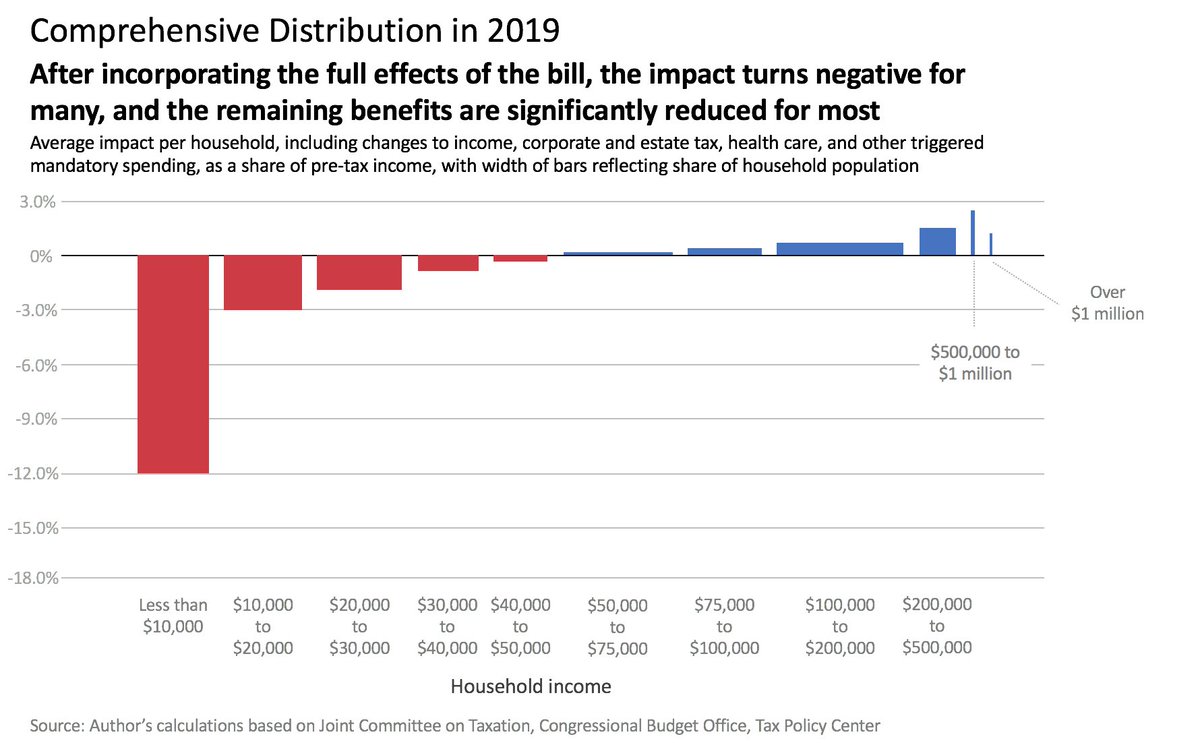

Here’s where we are: Both the Senate & House have passed versions of the GOP tax scam. They have a lot in common (huge tax cuts for the wealthy & corporations, tax hikes on millions of middle class families) but aren’t identical. 2/

• • •

Missing some Tweet in this thread? You can try to

force a refresh