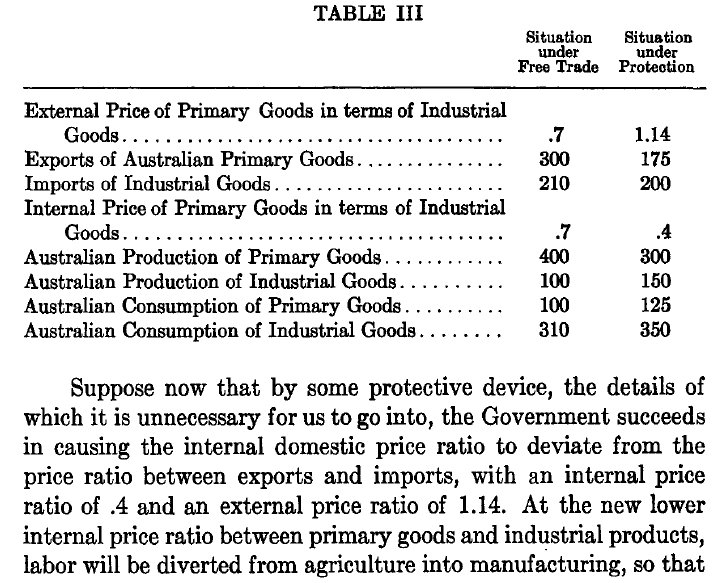

A few tweets on Al Roth's presidential address on "marketplaces, markets and mechanism design #ASSA2018

Mechanism design is what we do as theorists. Market design is what we do when we intervene in real markets to improve them. Practical market design part of economic engineering, which means details matter. Marketplace design ever better term than market design (more applied)

The rule of markets adapt to new technologies. Think about Amazon and Uber. Amazon plucked an existing trade on new technology, but Uber is really a consequence of new technologies creating a new market, not a commodity market.

Uber is not a commodity market but a matching market, where you care who you’re dealing with, so that price don’t do all the work. You can’t choose all you want, you also have to be chosen (labor is also matching market)

Takes as an example of matching markets AEA job market. Can become congested when too many time consuming tasks. Congestion is a consequence of having successfully created a thick market. Solved through building signaling mechanisms

In kidney market, some people don’t wish to participate themselves & even think such marketplaces shouldn’t be allowed to operate at all.

Has EJMR made AEA job market repugnant?

Yes, see CSWEP session:

AEA is addressing this by reforming JOE information

Has EJMR made AEA job market repugnant?

Yes, see CSWEP session:

External Tweet loading...

If nothing shows, it may have been deleted

by @Undercoverhist view original on Twitter

AEA is addressing this by reforming JOE information

Sometimes markets fail to become thick. On such case is unraveling (when job offers come too early and you have to commit before other offers become available).

That’s the case with clerks, law associates, college athletes, colleges. Private equity even hire 2 years in advance!

That’s the case with clerks, law associates, college athletes, colleges. Private equity even hire 2 years in advance!

Example of medical job market. Creating of centralized clearinghouse resulted in declining rates of participation among married couples. Roth famously solved the problem through applying Gale-Shapley deferred acceptance algorithm which produces stable matching, fast acceptance

Still not working well for couples (you can’t be happier than your spouse). Created a mechanism that allow them to consume *pairs* of jobs.

But thicker market raised new problems: meds began to apply to lots of places, creating interview congestion. So he introduced signaling

But thicker market raised new problems: meds began to apply to lots of places, creating interview congestion. So he introduced signaling

Roth talks about repugnant transactions and how to organize a kidney market. Moneyless kidney exchange seemed *fair* (no definition of fairness given here). Became the basis of kidney exchange chains.

Rising transplants, good (no definition of *good* either)

Rising transplants, good (no definition of *good* either)

Roth now wants to make kidney market thicker by making it more global (inviting foreigners to participate in US chains. Though this raises issues of global health insurance, they could be invited for free).

But this create bigger repugnance issues, therefore bigger resistance

But this create bigger repugnance issues, therefore bigger resistance

Roth seems frustrated by such resistance. Same with drug markets or immigrant settlements, he argues.

In the end, what encourages or inhibit centralized markets? Computer science for the former, he suggests.

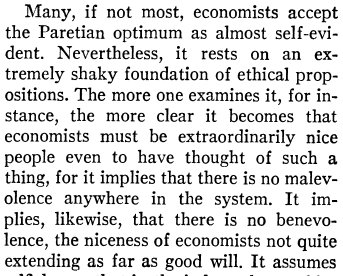

(me, fumbling) HOW ABOUT LIGHT ETHICAL FOUNDATIONS as inhibitor?

In the end, what encourages or inhibit centralized markets? Computer science for the former, he suggests.

(me, fumbling) HOW ABOUT LIGHT ETHICAL FOUNDATIONS as inhibitor?

Roth's presidential address was cool, but also has important ethical stakes. Yet non were mentioned.

Like others, I'm frustrated by the ethical shyness of market designers.

See for instance the debate b/w Roth and Sandel on repugnance: hbs.edu/faculty/confer…

Like others, I'm frustrated by the ethical shyness of market designers.

See for instance the debate b/w Roth and Sandel on repugnance: hbs.edu/faculty/confer…

• • •

Missing some Tweet in this thread? You can try to

force a refresh