So... It's out! The Financial Secrecy Index 2018, the @TaxJusticeNet ranking of secrecy jurisdictions globally financialsecrecyindex.com

(I'll thread some of the #FSI2018 media coverage here)

(I'll thread some of the #FSI2018 media coverage here)

Great Guardian piece from @davidtpegg, highlighting #FSI2018 call for a UN convention theguardian.com/business/2018/…

From Israel, #FSI2018 calcalist.co.il/world/articles…

Malta Today on #FSI2018: maltatoday.com.mt/business/busin…

Not forgetting Malta's Independent: independent.com.mt/articles/2018-… #FSI2018

From Italy, @sole24ore on #FSI2018:

Paradisi fiscali: Svizzera, Usa e Cayman i più opachi. Italia promossa in trasparenza ilsole24ore.com/art/mondo/2018…

Paradisi fiscali: Svizzera, Usa e Cayman i più opachi. Italia promossa in trasparenza ilsole24ore.com/art/mondo/2018…

Luxembourg's @lequotidien on #FSI2018: Le Luxembourg dans le top 10 du classement mondial sur l’opacité financière lequotidien.lu/economie/le-lu…

Οι Έλληνες προτιμούν τις offshore στις Βρετανικές Παρθένους Νήσους... αλλά κρύβονται στα παραδείσια Κέιμαν news247.gr/eidiseis/oikon… #FSI2018

From @swissinfo_en: Switzerland ranked ‘global capital of bank secrecy’

swissinfo.ch/eng/tax-justic… #FSI2018

swissinfo.ch/eng/tax-justic… #FSI2018

AFP / La Presse, Canada on #FSI2018 lapresse.ca/affaires/econo…

Rethread

External Tweet loading...

If nothing shows, it may have been deleted

by @alexcobham view original on Twitter

From west Africa, Ouestaf on #fsi2018: ouestaf.com/Secret-bancair…

Guernsey Press - #10 in #FSI2018 (mainly sharing this for the outraged comments) guernseypress.com/news/2018/01/3…

Le Temps, Switzerland - #1 on #FSI2018, "en tête du classement des paradis fiscaux"

letemps.ch/economie/2018/…

letemps.ch/economie/2018/…

Die Presse, Austria - # on #FSI2018

diepresse.com/home/wirtschaf…

"Nicht nur Palmen werfen Schatten", not only palm trees cast shadows! Thanks to @AttacAustria

diepresse.com/home/wirtschaf…

"Nicht nur Palmen werfen Schatten", not only palm trees cast shadows! Thanks to @AttacAustria

Pagina 12, Argentina - the 'first world' hiding places of Argentinian money

pagina12.com.ar/92619-guaridas…

pagina12.com.ar/92619-guaridas…

La Prensa, Panama - #12 in #FSI2018 with small scale but high secrecy

impresa.prensa.com/economia/Suiza…

impresa.prensa.com/economia/Suiza…

Ultima Hora, Ecuador

ultimahoraec.com/ee-uu-es-el-se…

ultimahoraec.com/ee-uu-es-el-se…

Cayman News leads on the US (#2) overtaking Cayman (#3) in #FSI2018 caymannewsservice.com/2018/01/us-ove…

Business Hilights, Nigeria on the risks revealed by #FSI2018

businesshilights.com.ng/anxiety-over-a…

businesshilights.com.ng/anxiety-over-a…

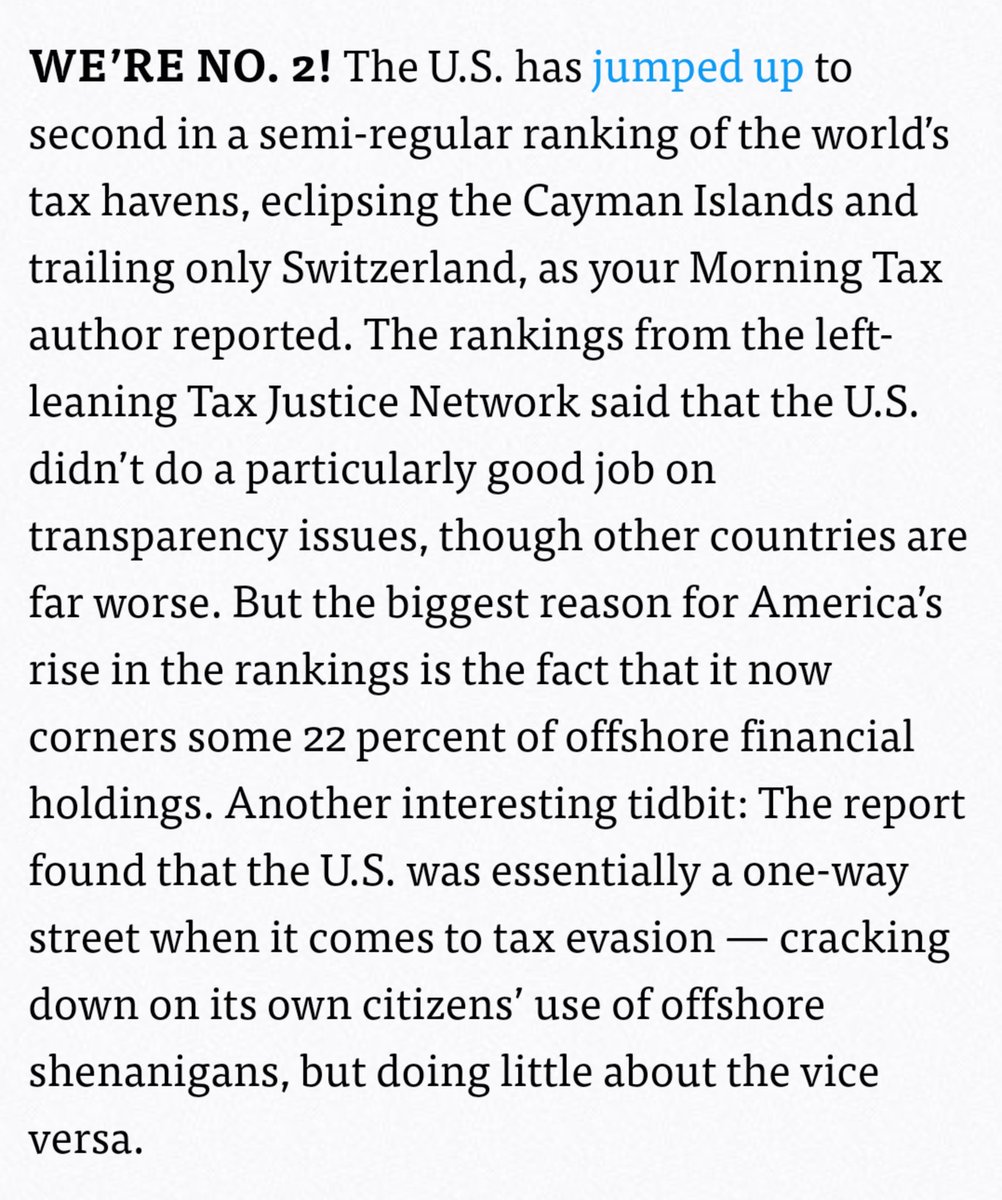

From the #2 on #fsi2018, @politico picks up an important feature of US' one-way secrecy

politico.com/newsletters/mo…

politico.com/newsletters/mo…

Times of India - #32 on #fsi2018 - highlights relative rankings of Mauritius, Singapore

m.timesofindia.com/business/india…

m.timesofindia.com/business/india…

From Economia in the UK - #23 on #FSI2018 but responsible for the biggest global secrecy network

economia.icaew.com/en/news/januar…

economia.icaew.com/en/news/januar…

Galway Daily, Ireland - #26 on #FSI2018: MEP @mattcarthy supports @TaxJusticeNet call for a UN convention against financial secrecy

galwaydaily.com/news/midlands-…

galwaydaily.com/news/midlands-…

Wort, Luxembourg - #6 on #FSI2018 - with a really impressive follow-up piece, laying out all the data to show just why that ranking was received

wort.lu/fr/economie/cl…

wort.lu/fr/economie/cl…

And some strident criticism on Cayman 27 TV - getting two different ministers on camera to object to ranking #3 on #FSI2018

cayman27.ky/2018/02/minist…

cayman27.ky/2018/02/minist…

unroll. That will do for now!

• • •

Missing some Tweet in this thread? You can try to

force a refresh