Late Friday @USOCC sneaked out a profoundly troubling one-page order on bank sponsorship of payday loans. The Trump admin is rescinding a 2002 restriction on #RentABank partnerships with the notorious payday lender @ACECash. Reactions in this thread: occ.gov/static/enforce…

1/ Throughout most of American history nearly every state had state interest rate caps prohibiting payday loans. In 1978 the Supreme Court controversially held the state interest rate cap of a bank’s home state applies when the bank “export’s” its loans across state lines.

2/ This decision sparked a race to the bottom in credit card lending where SD, DE, and UT eliminated their usury laws to attract banking jobs. Now, state usury limits effectively no longer apply to banks. But state usury laws DO apply to payday loan companies.

3/ In the late 90s and early 2000s, a handful of sleazy banks teamed up with payday lenders to make payday loans in states with usury limits in exchange for a fee from the payday lender. This led to thousands of #RentABank payday loan stores in states that did not want them.

4/ Eventually @USOCC and @FDICgov bowed to public pressure and cracked down on these #RentABank relationships effectively ending them through orders prohibiting these partnerships. Until now…

5/ The @USOCC decision to lift the order against @ACECash is further evidence the Trump administration is moving to wipe out very popular state protections against payday loans. @USOCC already rescinded its guidance restricting deposit advance products a/k/a bank-payday loans.

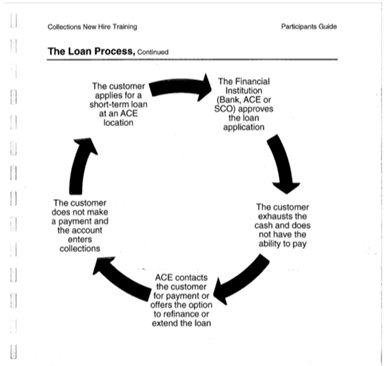

6/ @ACECash is a predatory company that actively manipulates its borrowers into long-term debt traps. Take a close look at this chart from an @ACECash training manual showing how the company works to keep suffering families on a hamster wheel of triple digit interest rate debt.

7/ State regulators, AGs, legislators, faith leaders, advocates, and the public who want to protect state usury law should realize #RentABank payday loans, likely disguised as a new “fintech” products, are on the threshold of invading your state. There is nothing new about usury.

8/ This means if AR, AZ, CT, DC, GA, MD, MA. MT, NH, NJ, NY, NC, PA, & VT want to keep their states free of payday loans, they need to start fighting now. This is especially galling for AR, AZ, MT, MD, & OH that voted for state usury limits in public referendums.

9/ Reputable banks and credit unions that want to provide decent products that actually work for their customers and protect the reputation of the banking industry should also be upset that the @USOCC appears poised to take a giant step backward.

10/ @USOCC @BryanKHubbard announced the decision made on 2/14 on a Friday night because they know it is deeply unpopular, they want to prevent press coverage, and stop mobilization. Other than one short article by @laliczl, the strategy is working. wsj.com/articles/gover…

11/ Ironically, @realdonaldtrump supporters do NOT support payday lending. How do I know? In the last election, South Dakota had a ballot measure limiting interest rates to no more than 36%. This ballot measure beat @potus by 14 points with 75% approval. ballotpedia.org/South_Dakota_P….

12/ The Friday night @USOCC announcement proves @realdonaldtrump is repaying his supporters by quietly working behind the scenes to unleash predatory payday lenders like @ACECash. #PaydayLoanPresident. Please RT.

• • •

Missing some Tweet in this thread? You can try to

force a refresh