#BTC

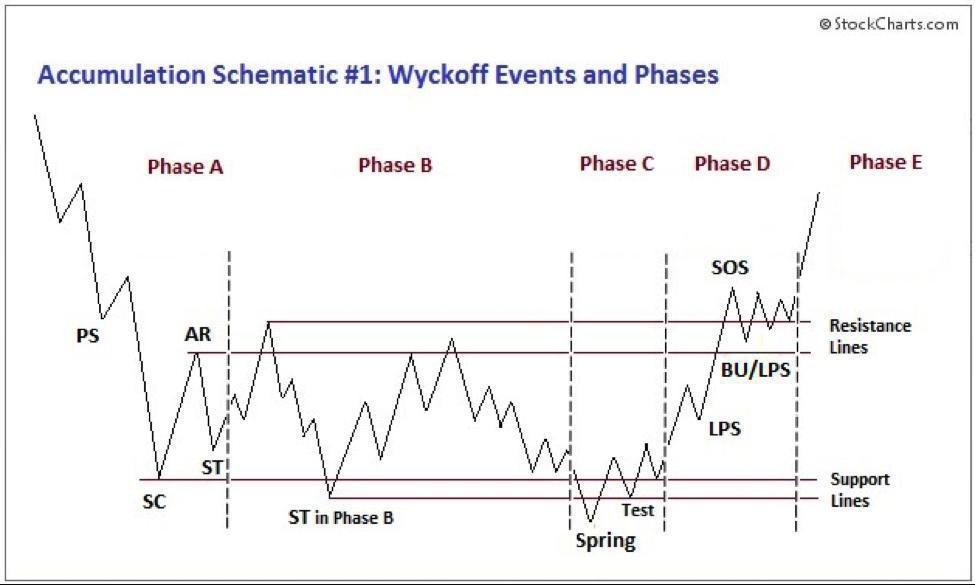

Wyckoff update

Full detailed description of first and third laws of Wyckoff (supply & demand and effort vs. result)

Wyckoff update

Full detailed description of first and third laws of Wyckoff (supply & demand and effort vs. result)

Completed Wyckoff structure. Looks scary similar.

p.s. this model was designed almost a century ago, people didn't have calculators and were drawing charts by hand using pencil and ruler.

p.s. this model was designed almost a century ago, people didn't have calculators and were drawing charts by hand using pencil and ruler.

"It takes a while for a pro to accumulate a position in advance of a big move – buying too many shares at once would cause the price to rise too quickly"

Wyckoff (1937)

Wyckoff (1937)

"He prefers to do this while the market is weak, dull, inactive and depressed. To the extent that they are able, he, and the other interests with whom he works, bring about the very conditions which are most favorable for accumulation of stocks at low prices"

Wyckoff (1937)

Wyckoff (1937)

"The whole move is manufactured. Its purpose is to make money for inside interests — those who are operating in the stock in a large way. And this can only be done by fooling the public, or by inducing the public to fool themselves."

Wyckoff (1937)

Wyckoff (1937)

"By keeping the stock low and depressed, he discourages other people from buying it and induces more short selling. He may, by various means, spread bearish reports on the stock. All this helps him to buy."

Wyckoff (1937)

Wyckoff (1937)

"Now, the pro has accumulated a huge position in the stock, and he needs to find someone to sell it to. By now, people have seen the surge, and they think something's coming"

Wyckoff (1937)

Wyckoff (1937)

"Then, the news hits, and the pro can instantly unload 20-30k shares as people rush in to buy. To finish unwinding his position, the pro does the exact same thing he did at the bottom – he works that stock up and down in a range until he's sold it all"

Wyckoff (1937)

Wyckoff (1937)

Now, the stock is in "weak hands" – everyone bought it on bullish news after a rally. So, it's time to go short. The pro can initiate a big short position, but fool people by putting on good-sized buy orders, supporting the stock and inducing people to keep buying.

Wyckoff (1937)

Wyckoff (1937)

"Then, he pulls out the rug – canceling all his buy orders and leading a raid on the stock. That's how it's done – played in both directions"

Source: Wyckoff (1937)

Source: Wyckoff (1937)

[Read this thread to understand the logic of market maker. Mister Wyckoff run the trading floor at his time.

All that you call manipulation or nonsense is just the game of big players. Learn how to play along them, and not to blame it all on manipulation.]

Edward Morra 2018

All that you call manipulation or nonsense is just the game of big players. Learn how to play along them, and not to blame it all on manipulation.]

Edward Morra 2018

• • •

Missing some Tweet in this thread? You can try to

force a refresh