Whoa. If Ripple Co. really thinks paying to get XRP listed is not centralization of a cryptocurrency and/or a "common enterprise" a security, I think very soon they will be proven wrong.

Time to finish that medium post I keep ignoring.

Time to finish that medium post I keep ignoring.

External Tweet loading...

If nothing shows, it may have been deleted

by @LilyKatz view original on Twitter

:2: Fuck it. I'm tweeting it.

Here is the headline + introduction.

Here is the headline + introduction.

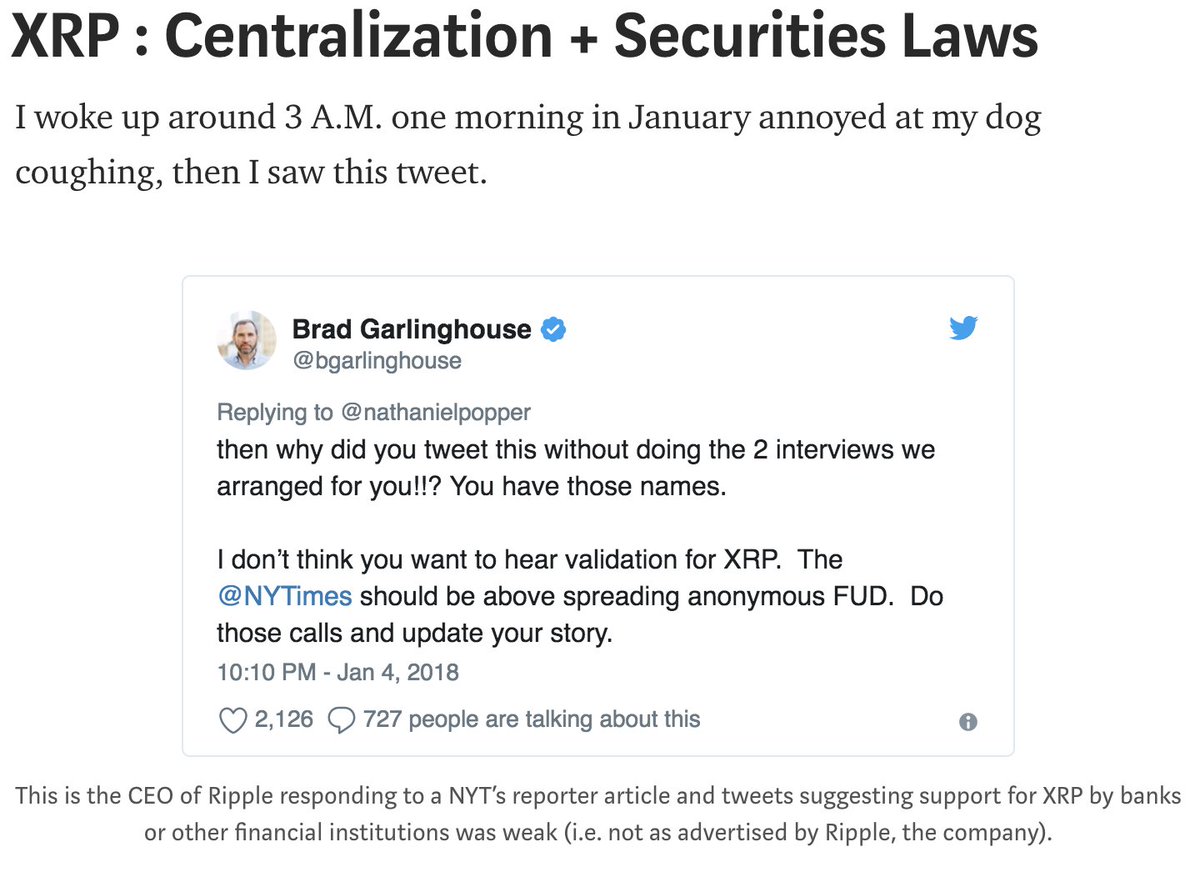

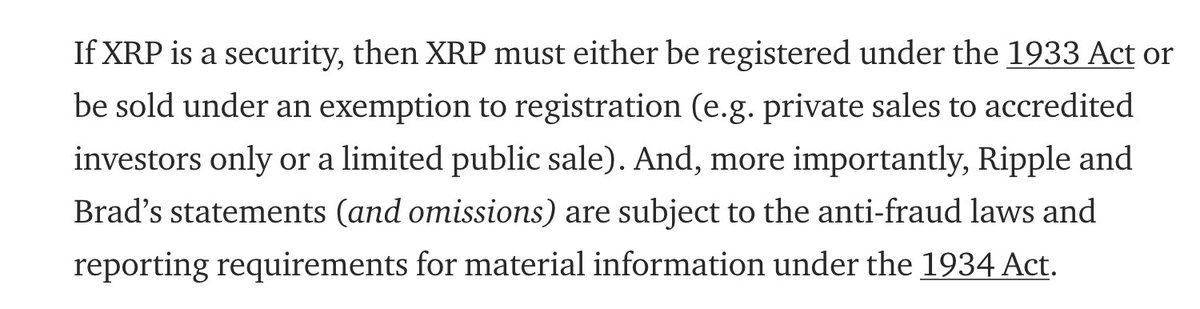

:3: XRP is a security. Ripple Co is the issuer. Brad Garlinghouse, Chris Larsen, and other Ripple Co executives are subject to the anti-fraud laws under SEC jurisdiction.

Including those tweets above and many more.

Including those tweets above and many more.

:4: There. I said it. A supposed decentralized cryptocurrency can be a security with enough centralization.

:5: For the record, I believe the "security" analysis needs to be looked at both at issuance and later as the network and token evolves.

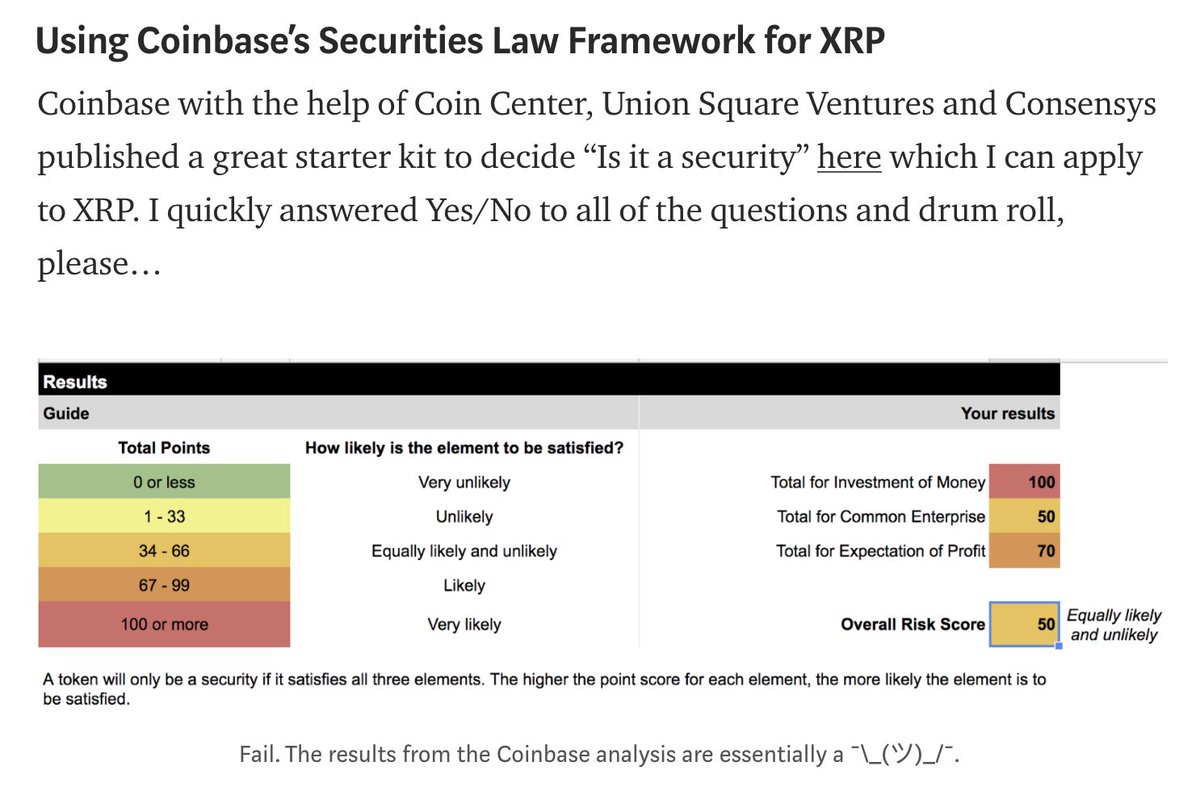

:6: @coinbase's, @coincenter, and Union Square Ventures put together a spreadsheet to perform a "security" analysis on newly issued tokens but the analysis completely forgets to look at elements of centralization post issuance.

coinbase.com/legal/securiti…

coinbase.com/legal/securiti…

:7: I ran the numbers with their spreadsheet. It was a wash. XRP was a 50/50 chance of being a security with their criteria.

:8: So...I decided to look at what really maters for the "common enterprise" element of a security in a supposed decentralized cryptocurrency. Is it DECENTRALIZED?!?!?

:9: XRP is definitely not decentralized. Ripple Co creates the common enterprise.

:10: Ripple Co initially distributed all of XRP for money. This is the "investment of money" element of Howey Test.

:11: However, they no longer sell XRP to users. Now they just tell you 10 different ways to buy and include FAQs on setting up exchange accounts. All because FinCEN fined them years ago for being unlicensed MSB exchange.

:12: XRP is being promoted as an investment by the creator of the XRP code.

Exhibit A:

Exhibit A:

External Tweet loading...

If nothing shows, it may have been deleted

by @LilyKatz view original on Twitter

:13: Exhibit B-Z are any where you look in Ripple Co's website or press releases. These are part of the "with an expectation of profit" element of the Howey Test.

:14: Then, the SEC only needs "solely from the efforts from a third party or promoter" (aka "common enterprise") element of the Howe Test.

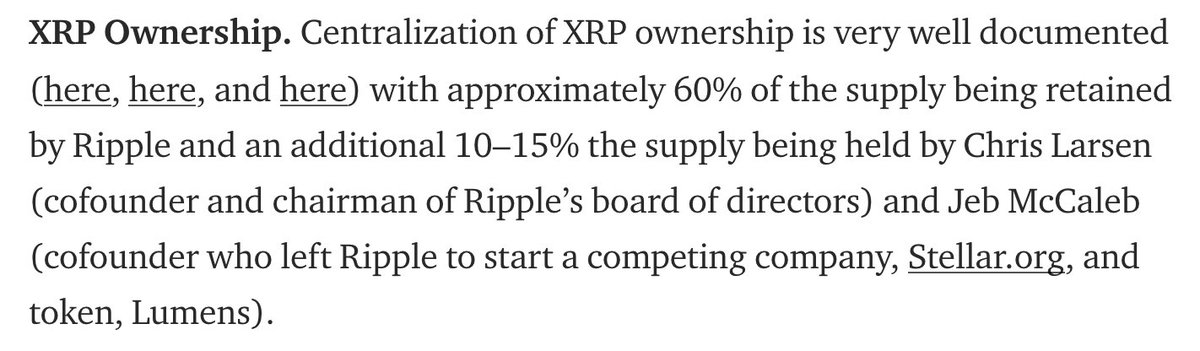

:15: Ripple Co and founders control more than ~60% of the XRP in existence.

Control is general 10% of voting power in traditional finance.

Control is general 10% of voting power in traditional finance.

:16: Ripple Co even controls the inflation / dilution rate of XRP.

:17: Ripple Co is the creator of the code.

:18: Ripple Co is owner of the github account.

:19: Ripple Co is essentially says what validators are good vs. bad which is essential to determining which XRP transactions are valid.

:20: I am not sure what else you need people.

:21: Search #xrpthestandard on twitter and run an analysis of Ripple Co + team promoting this hashtag.

:22: Look at all IP (patents, trademarks, and copyright) for any items related to XRP.

:23: Even @haydentiff is sick of defending XRP from decentralization arguments.

External Tweet loading...

If nothing shows, it may have been deleted

by @haydentiff view original on Twitter

:24: And, I love Tiffany's style! But, she is the best case for decentralization. However, while she is mighty + amazing (and I'm sorry for bringing you into this, Tiffany). This is not enough.

:25: Security analysis is a spectrum. XRP is the blinding security white light.

/end

/end

One, more for good measure.

External Tweet loading...

If nothing shows, it may have been deleted

by @abrkn view original on Twitter

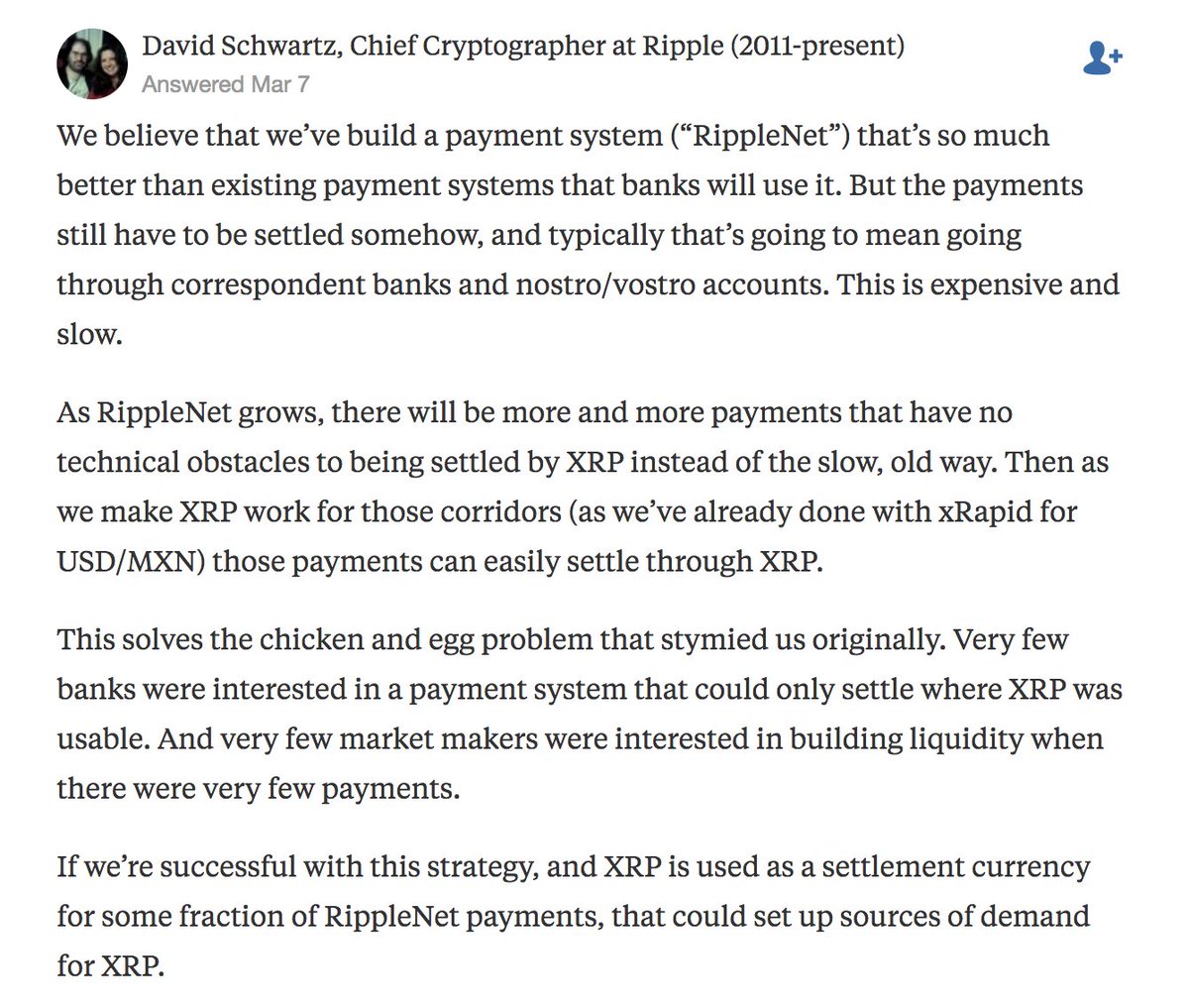

Ok, one more I promise this is it. Even Ripple Co's chief cryptographer is promoting the rise of XRP price on Quora.

quora.com/If-banks-use-R…

quora.com/If-banks-use-R…

, if you ever get that interview with Brad, ask about any of this thread.

, see thread above.

Almost forgot. This is not legal or financial advice. Do your own homework.

• • •

Missing some Tweet in this thread? You can try to

force a refresh