"Such carry trades have been a source of support for EM currencies" ft.com/content/af31b7… @ft ... carry trades bis.org/publ/work510.p… @BIS_org #EmergingMarkets "comprehensive database that combines bond issuance data with firm-level balance sheet data"

External Tweet loading...

If nothing shows, it may have been deleted

by @AxelMerk view original on Twitter

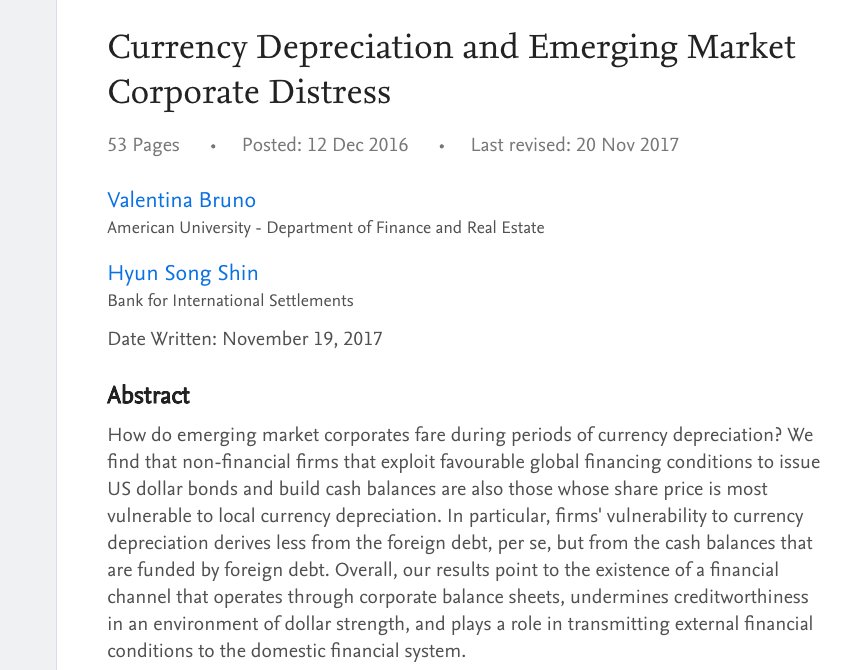

"non-financial firms that exploit favourable global financing conditions to issue US dollar bonds and build cash balances are also those whose share price is most vulnerable to local currency depreciation" papers.ssrn.com/sol3/papers.cf… #LiabilityDollarisation

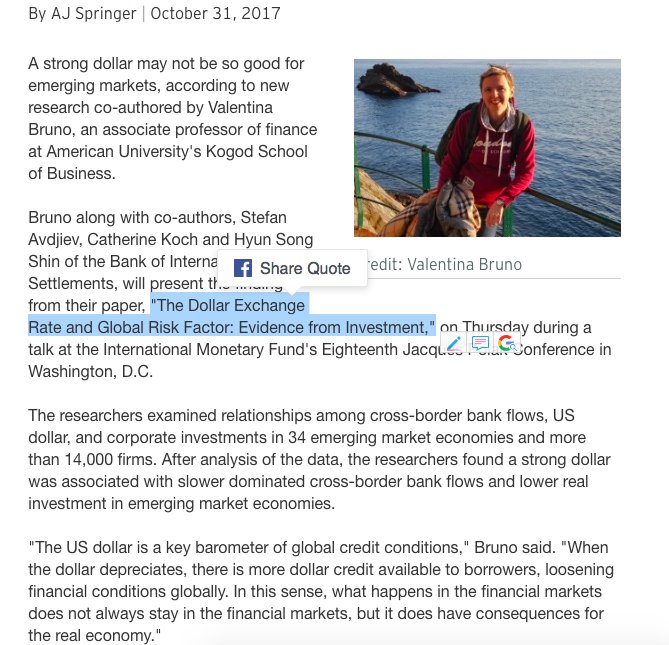

"firms have continued to load up on dollar-denominated debt since the 'taper tantrum'” economist.com/news/leaders/2… Study Finds a Weak Dollar is Good for Emerging Market Assets newswise.com/articles/study…

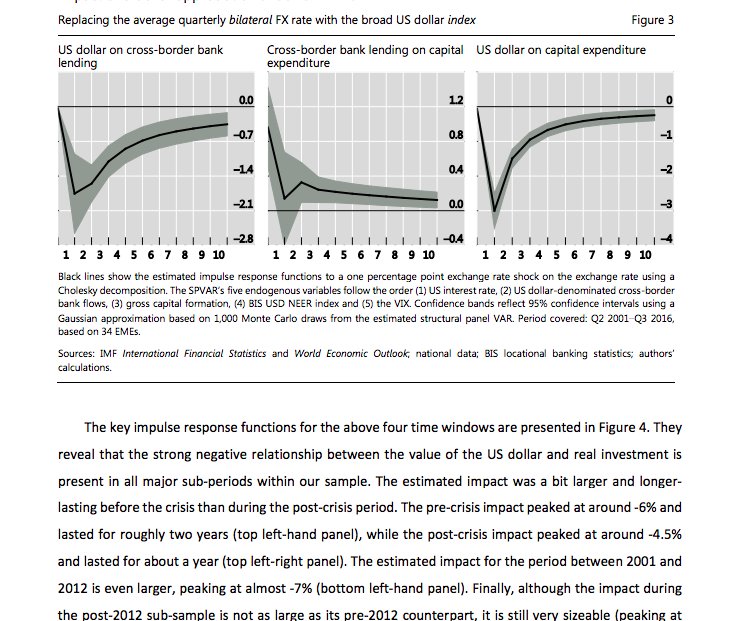

"The Dollar Exchange Rate and Global Risk Factor: Evidence from Investment," #ARCPolak @IMFNews @BIS_org american.edu/media/news/201… @KogodBiz

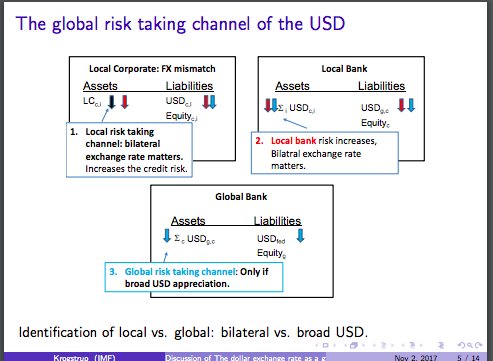

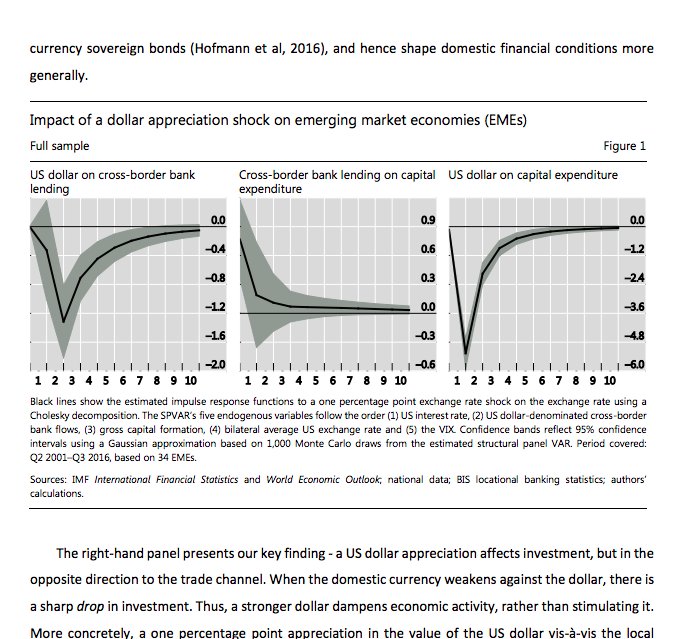

"The Dollar Exchange Rate as a Global Risk Factor: Evidence from Investment" #EmergingMarkets #StrongDollar papers.ssrn.com/sol3/papers.cf… Valentina Bruno, Hyun Song Shin, Catherine Koch, Stefan Avdjiev

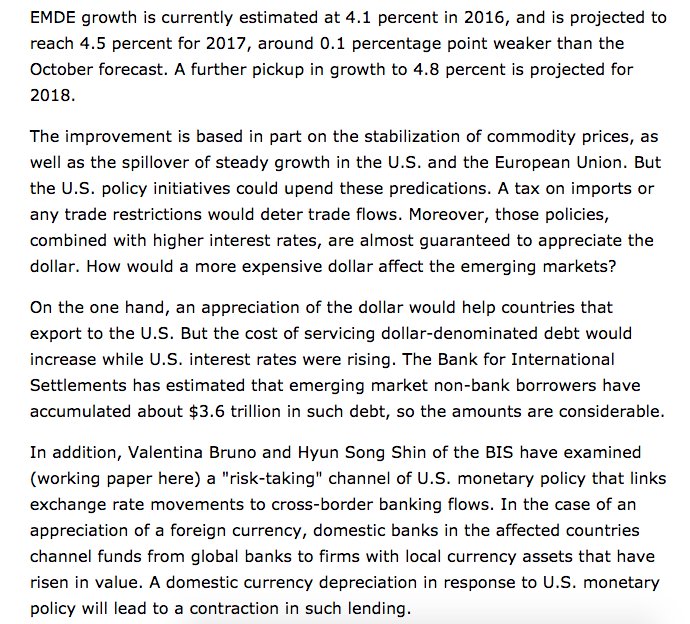

"Valentina Bruno and Hyun Song Shin of the @BIS_org have examined (working paper here) a "risk-taking" channel of U.S. monetary policy that links exchange rate movements to cross-border banking flows" #StrongDollar #EmergingMarkets @SeekingAlpha seekingalpha.com/article/405495…

"The dollar’s strength is a problem for the world" @TheEconomist A study by Bruno & Shin "found that those #EmergingMarkets companies able to borrow in dollars act like surrogate financial firms" economist.com/news/finance-a… @KogodBiz @BIS_org @HyunSongShin

"continued dollar appreciation would be “a double whammy” for emerging market currencies." #EmergingMarkets #StrongDollar ft.com/content/de4654…

#IMF #ARCPolak #ARCPolak2017 The Dollar Exchange Rate as a Global Risk Factor: Evidence from Investment imf.org/en/News/Semina… #EmergingMarkets #StrongDollar

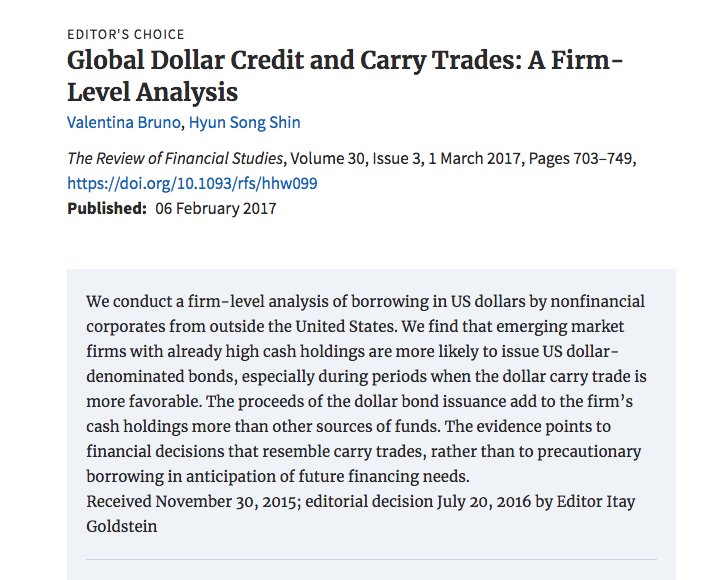

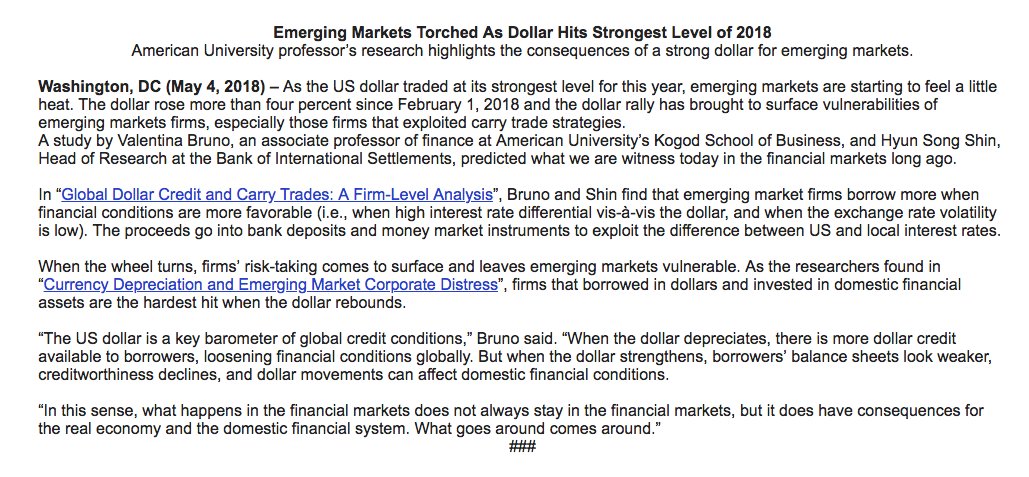

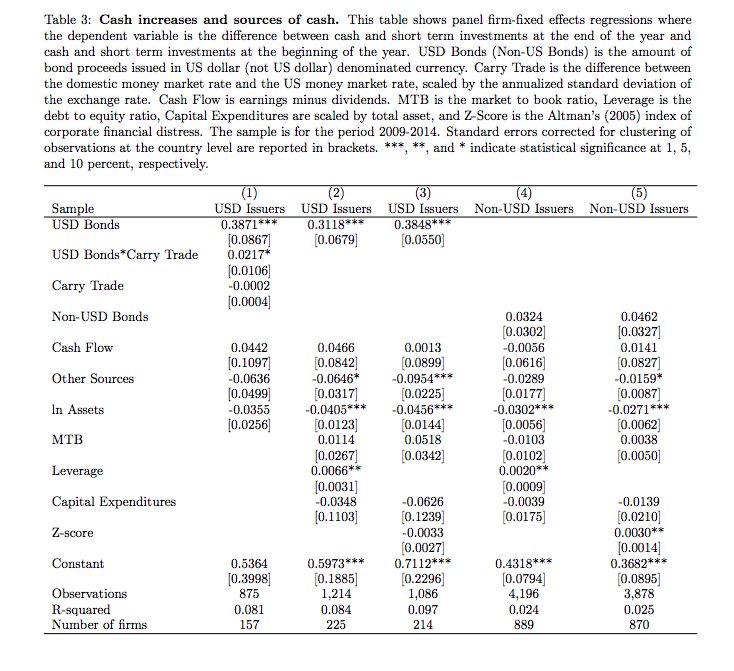

In “Global Dollar Credit and Carry Trades: A Firm-Level Analysis”, Bruno and Shin find that emerging market firms borrow more when financial conditions are more favorable academic.oup.com/rfs/article-ab… @OUPAcademic @BIS_org @KogodBiz #StrongDollar #EmergingMarkets #CarryTrade

“Currency Depreciation and #EmergingMarkets Corporate Distress”, firms that borrowed in dollars and invested in domestic financial assets are the hardest hit when the #dollar rebounds. papers.ssrn.com/sol3/papers.cf… @BIS_org @KogodBiz @HyunSongShin

External Tweet loading...

If nothing shows, it may have been deleted

by @AxelMerk view original on Twitter

External Tweet loading...

If nothing shows, it may have been deleted

by @AxelMerk view original on Twitter

External Tweet loading...

If nothing shows, it may have been deleted

by @tracyalloway view original on Twitter

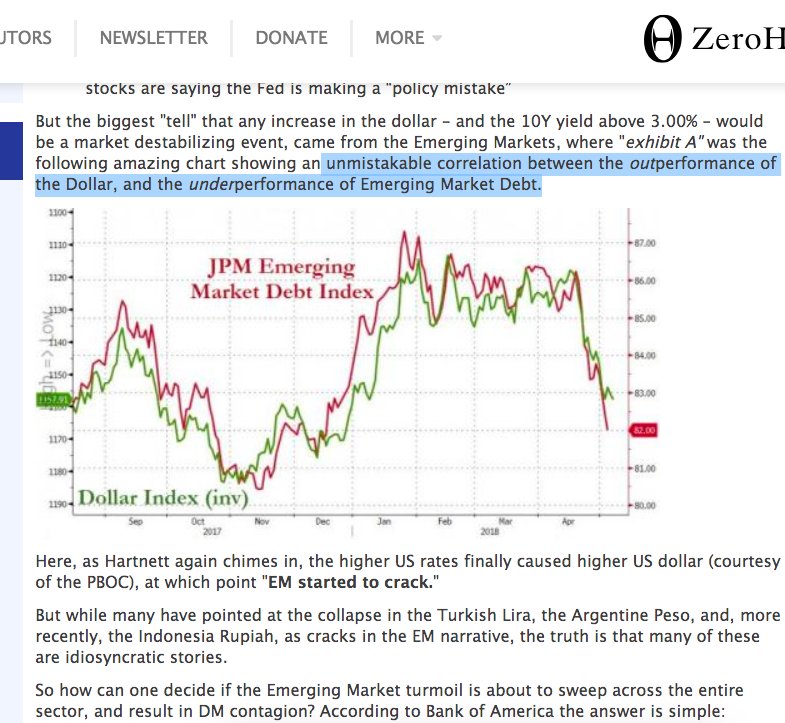

"unmistakable correlation between the outperformance of the Dollar, and the underperformance of #EmergingMarkets Debt." @zerohedge zerohedge.com/news/2018-05-0…

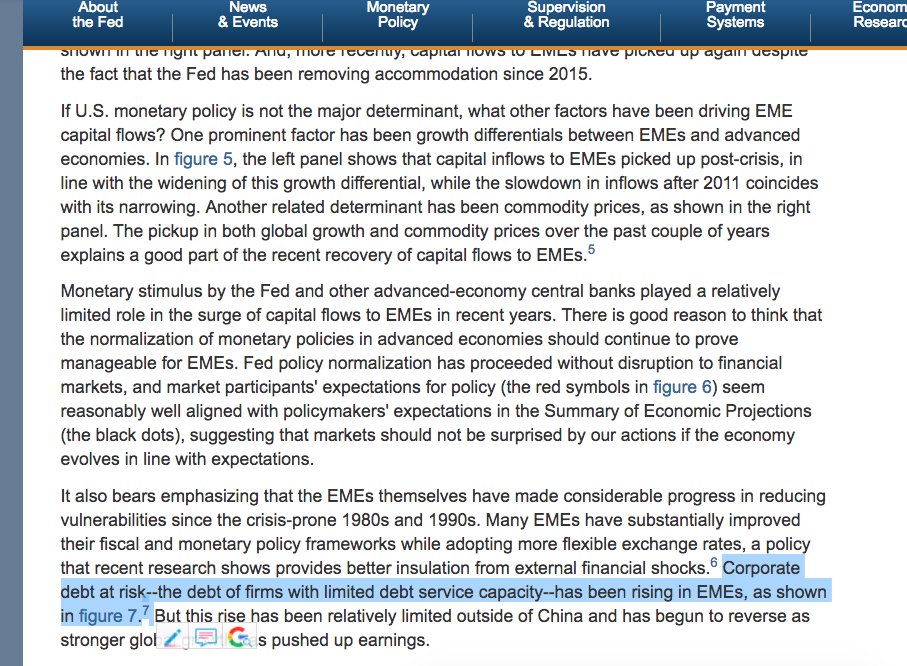

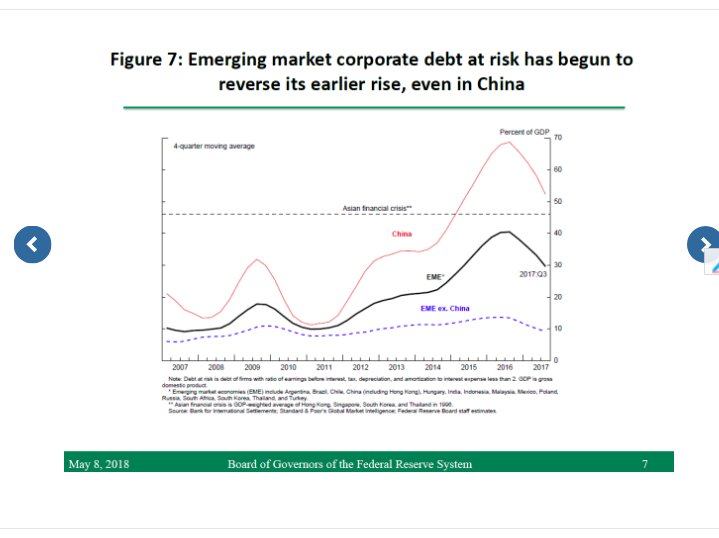

"Corporate debt at risk--the debt of firms with limited debt service capacity--has been rising in EMEs, as shown in figure 7.7 " @federalreserve federalreserve.gov/newsevents/spe… #EmergingMarkets

External Tweet loading...

If nothing shows, it may have been deleted

by @KathyJones view original on Twitter

#EmergingMarkets debt @IIF

External Tweet loading...

If nothing shows, it may have been deleted

by @IIF view original on Twitter

External Tweet loading...

If nothing shows, it may have been deleted

by @johnauthers view original on Twitter

External Tweet loading...

If nothing shows, it may have been deleted

by @IIF view original on Twitter

External Tweet loading...

If nothing shows, it may have been deleted

by @Brad_Setser view original on Twitter

unroll please

unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh