$DO | Is close to completing its nearly 2yr inverted H&S bottom. The stock is up 30% since we first covered it in Feb macro-ops.com/withering-wage…. Its got a solid BS & is trading at just over 5x FCF.

I'm longer term (6m+) bullish oil but still think we see a sizable retrace soon.

I'm longer term (6m+) bullish oil but still think we see a sizable retrace soon.

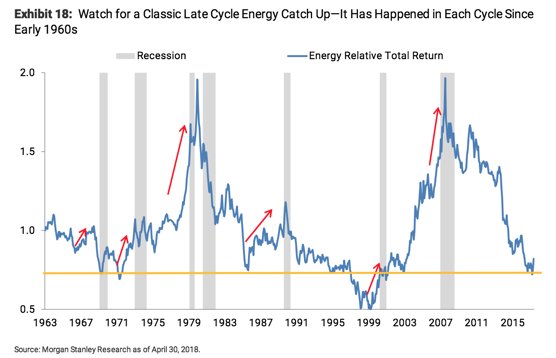

$USO typically performs well later in the cycle, especially on a relative basis.

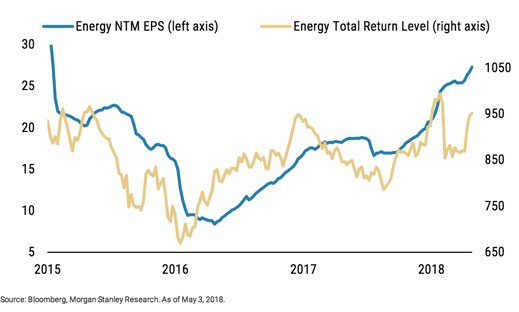

Earnings for the sector are strongly trending higher.

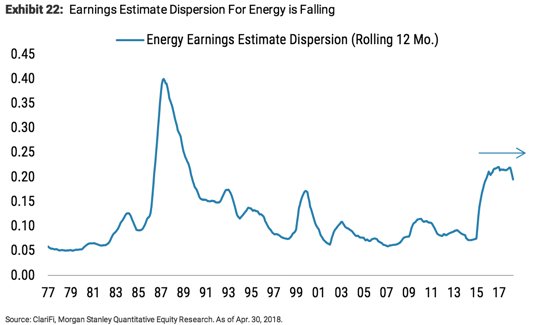

And sector earnings dispersion is coming down as fundamentals across the sector have broadly improved. Rising tide lifts all boats kind of deal can start bring more flows and momentum players back into the sector.

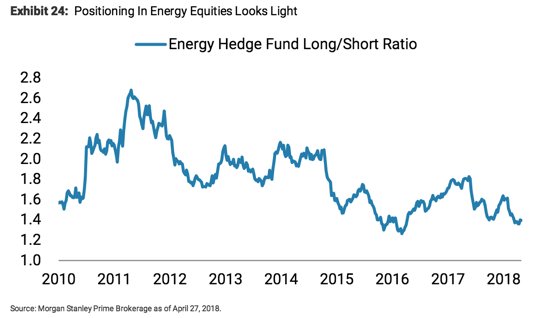

Long positioning is still very light.

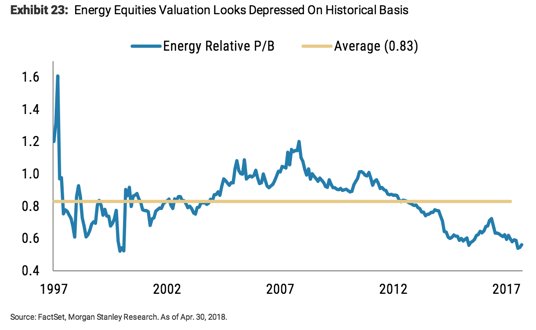

And valuations are near record lows.

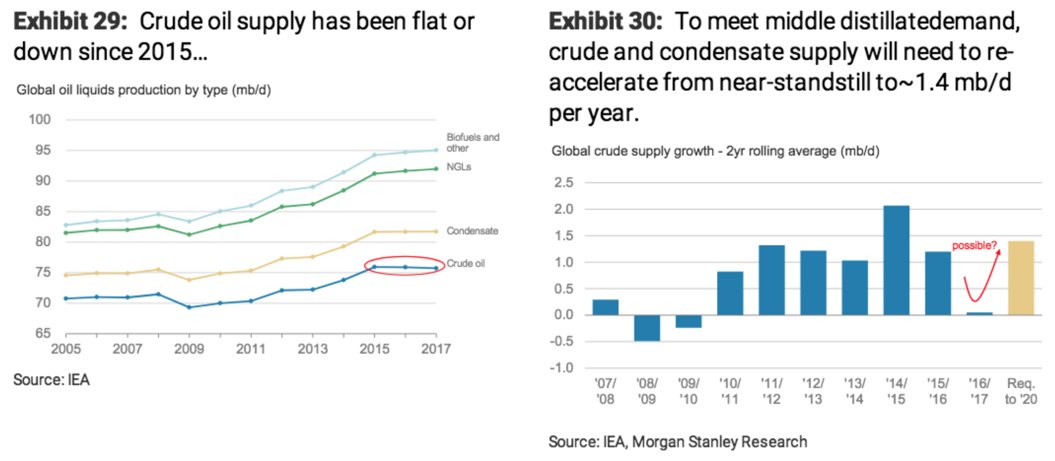

Market fundamentals have largely balanced / tip bullish. Big Q remains impact from deceleration in Chinese consumption.

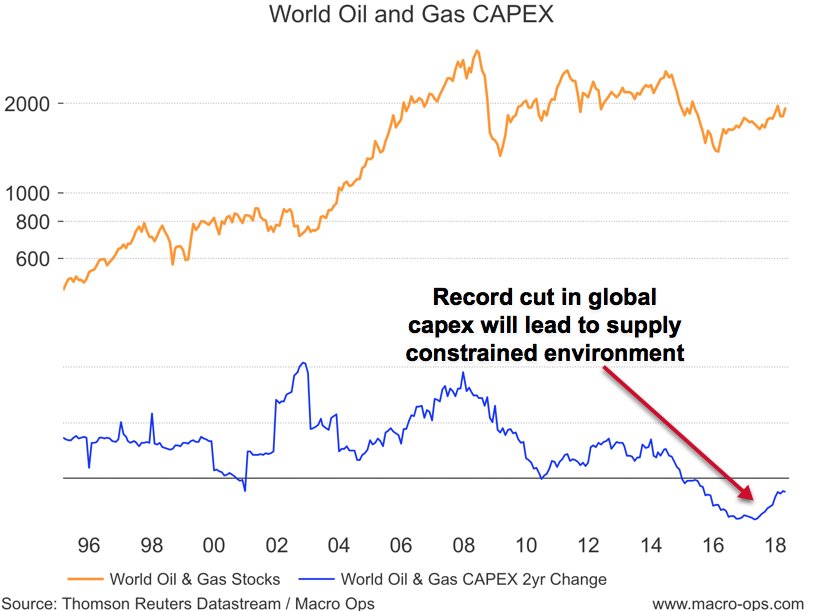

But record reductions in global capex over the last few years nearly ensure we remain in a supply tight environment over next few years . #OOTT

• • •

Missing some Tweet in this thread? You can try to

force a refresh