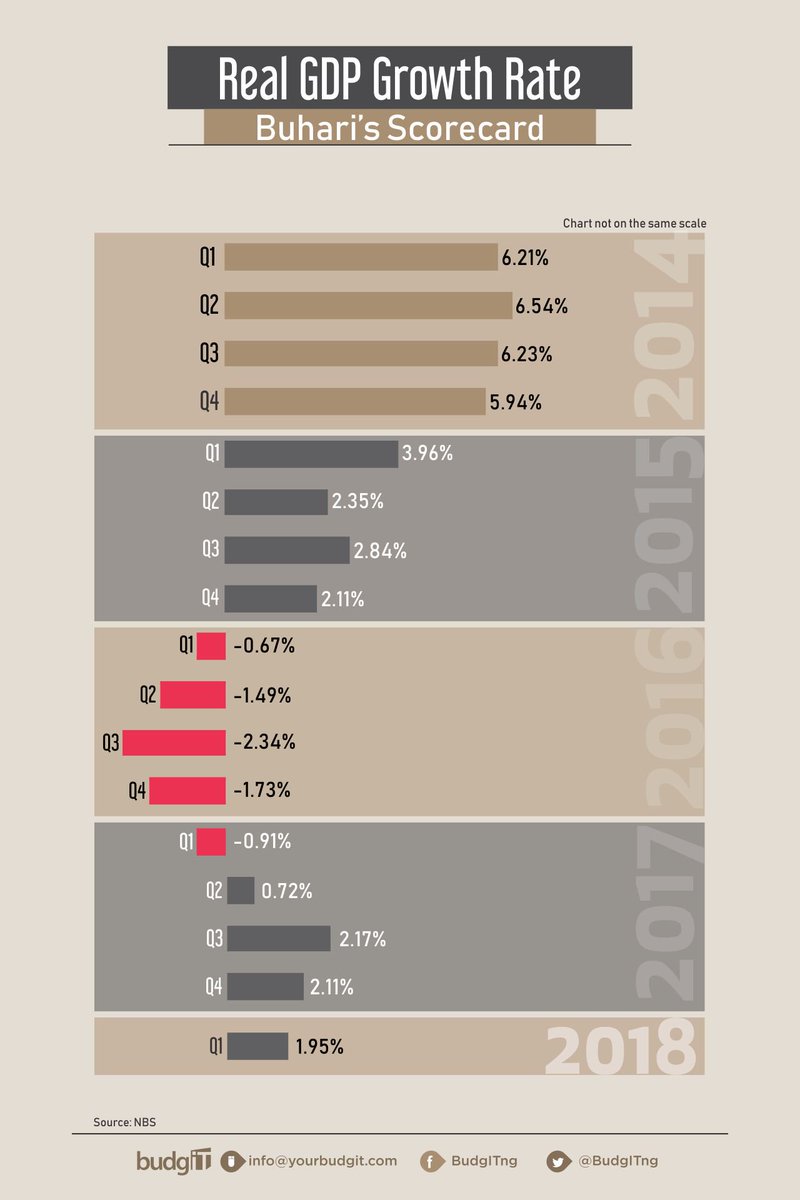

THREAD: Here is the review of the performance of the current administration of @NGRPresident @MBuhari. We present few charts to show the economic directions, with recent growth less than 2%.

#DemocracyDay

#DemocracyDay

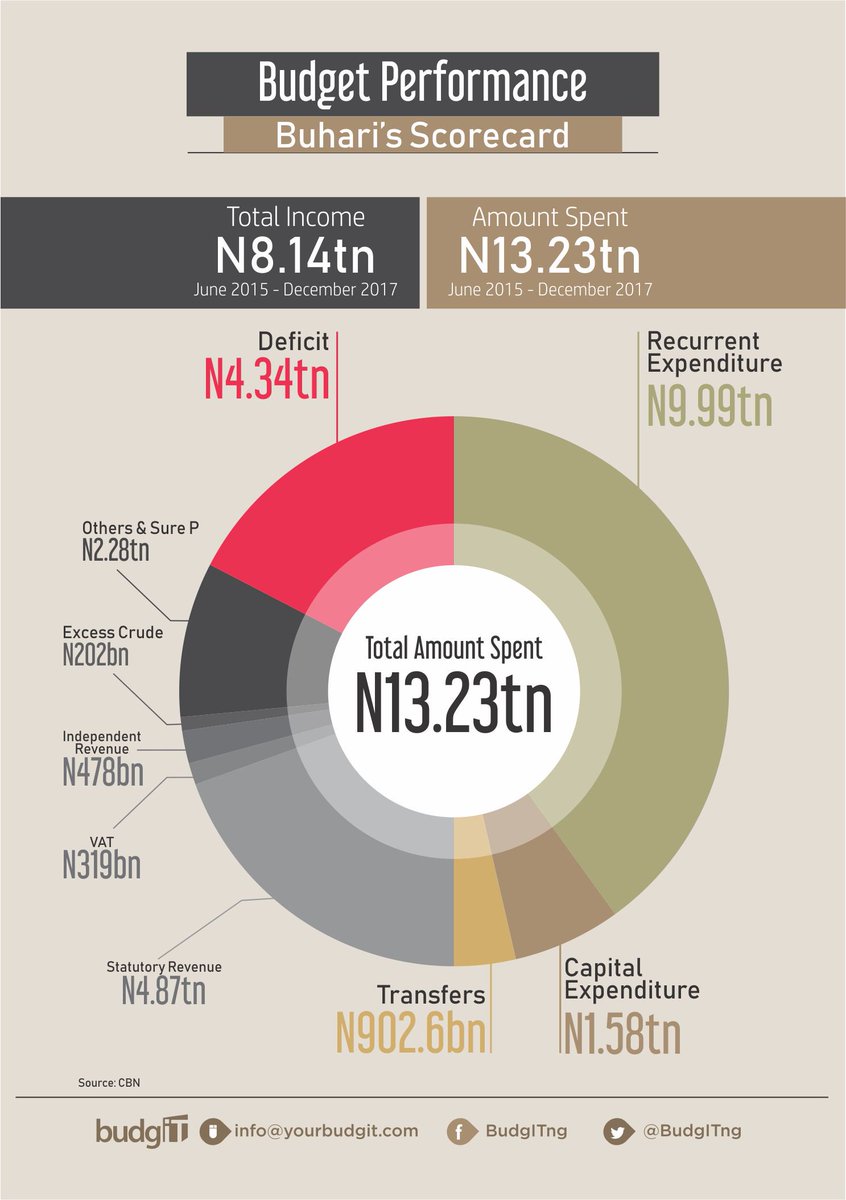

From June 2015 to December 2017, FG has spent N13.23tn, with only 12% (N1.58tn) going to capital expenditure. Source: CBN

#DemocracyDay

#DemocracyDay

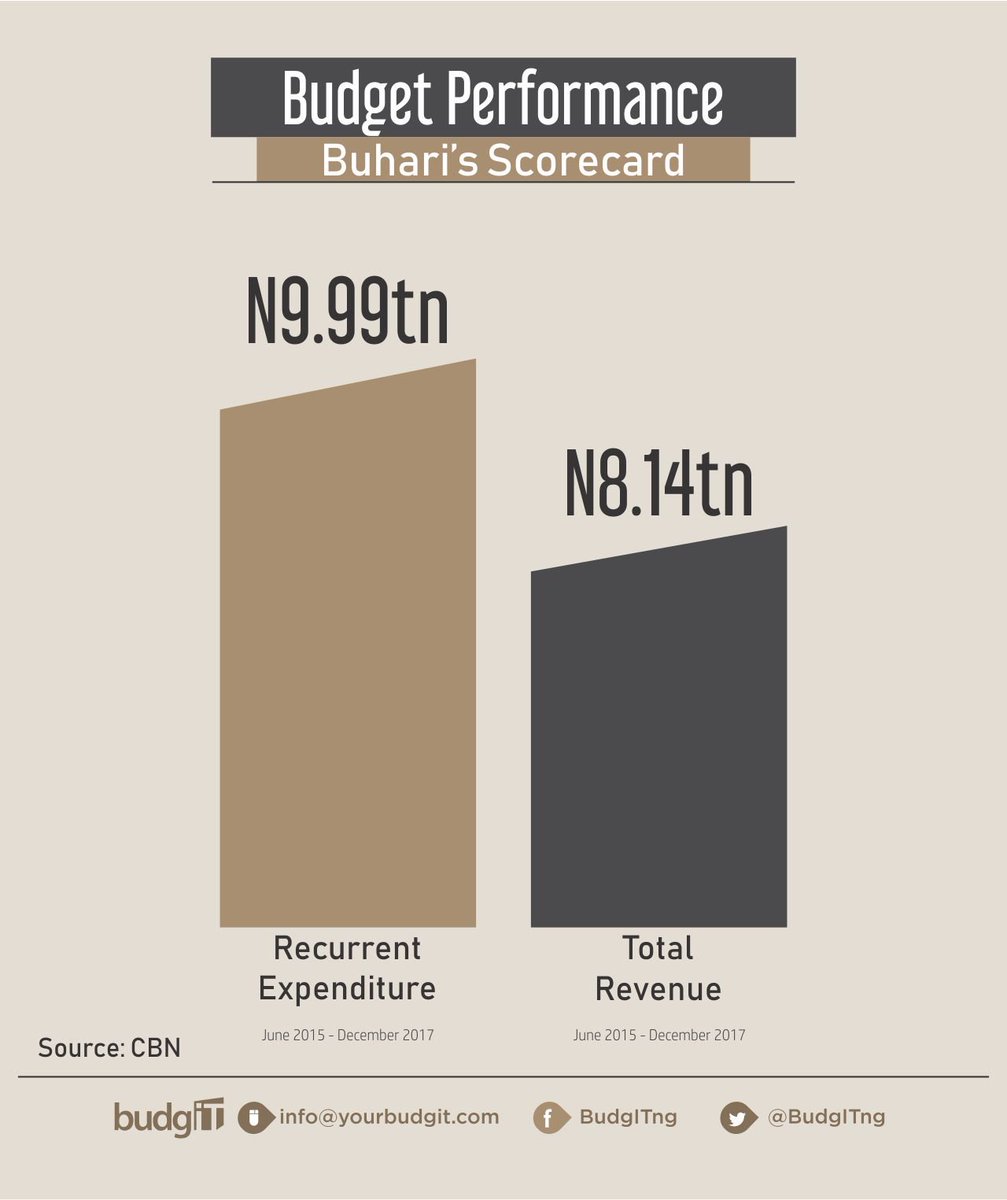

FG has spent more on recurrent expenditure than revenue collected. This is shows that contrary to the Fiscal Responsibility Act, FG is borrowing to fund recurrent expenditure.

#DemocracyDay

#DemocracyDay

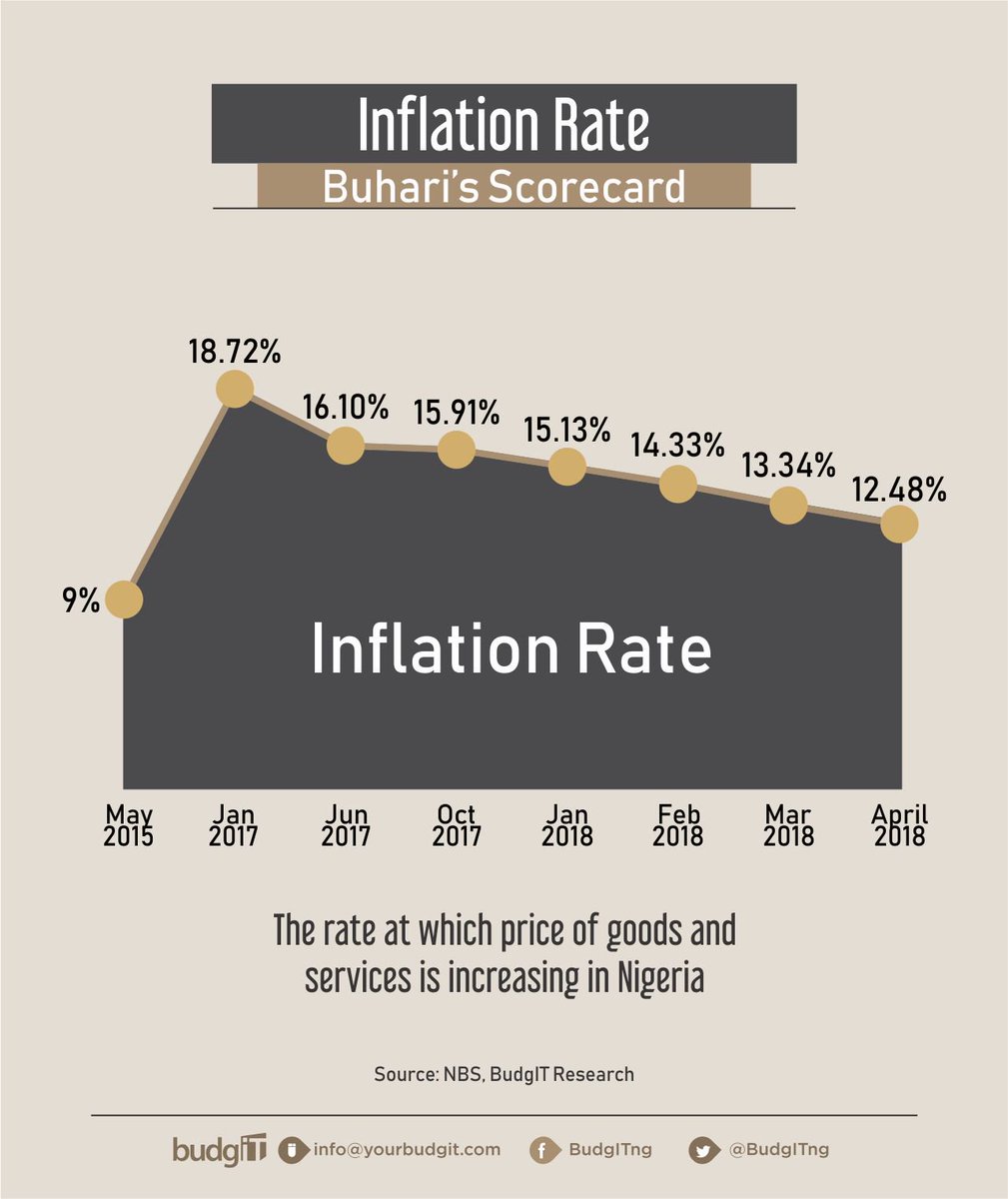

The rate of inflation is going down after a peak of 18.72% in January 2017. Inflation has slowed down to 12.48%.

#DemocracyDay

#DemocracyDay

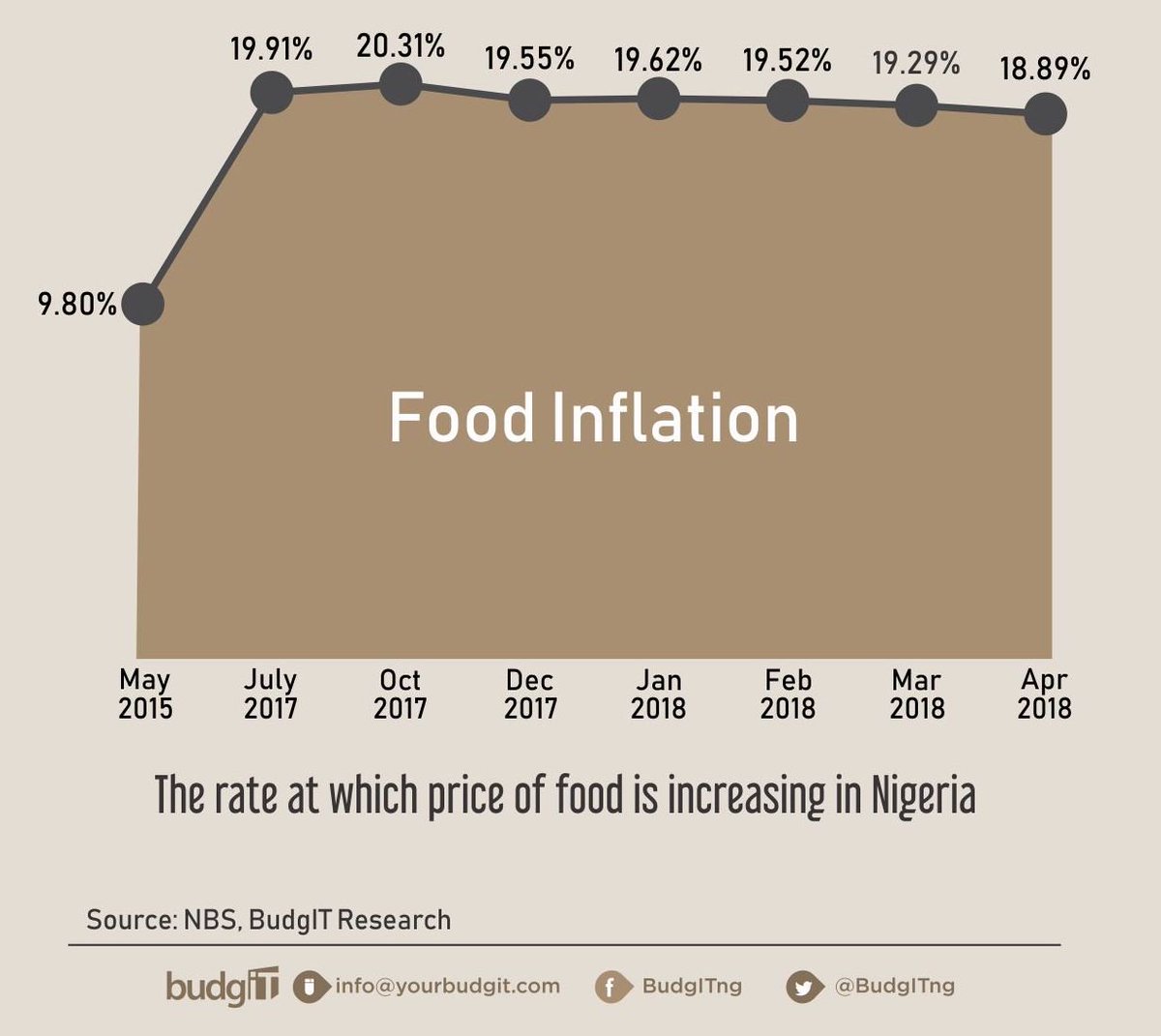

Food inflation is not seeing the same change as recent rates still hold firm at 18.89%. Why is the price of food rising at double-digit in Nigeria?

#DemocracyDay

#DemocracyDay

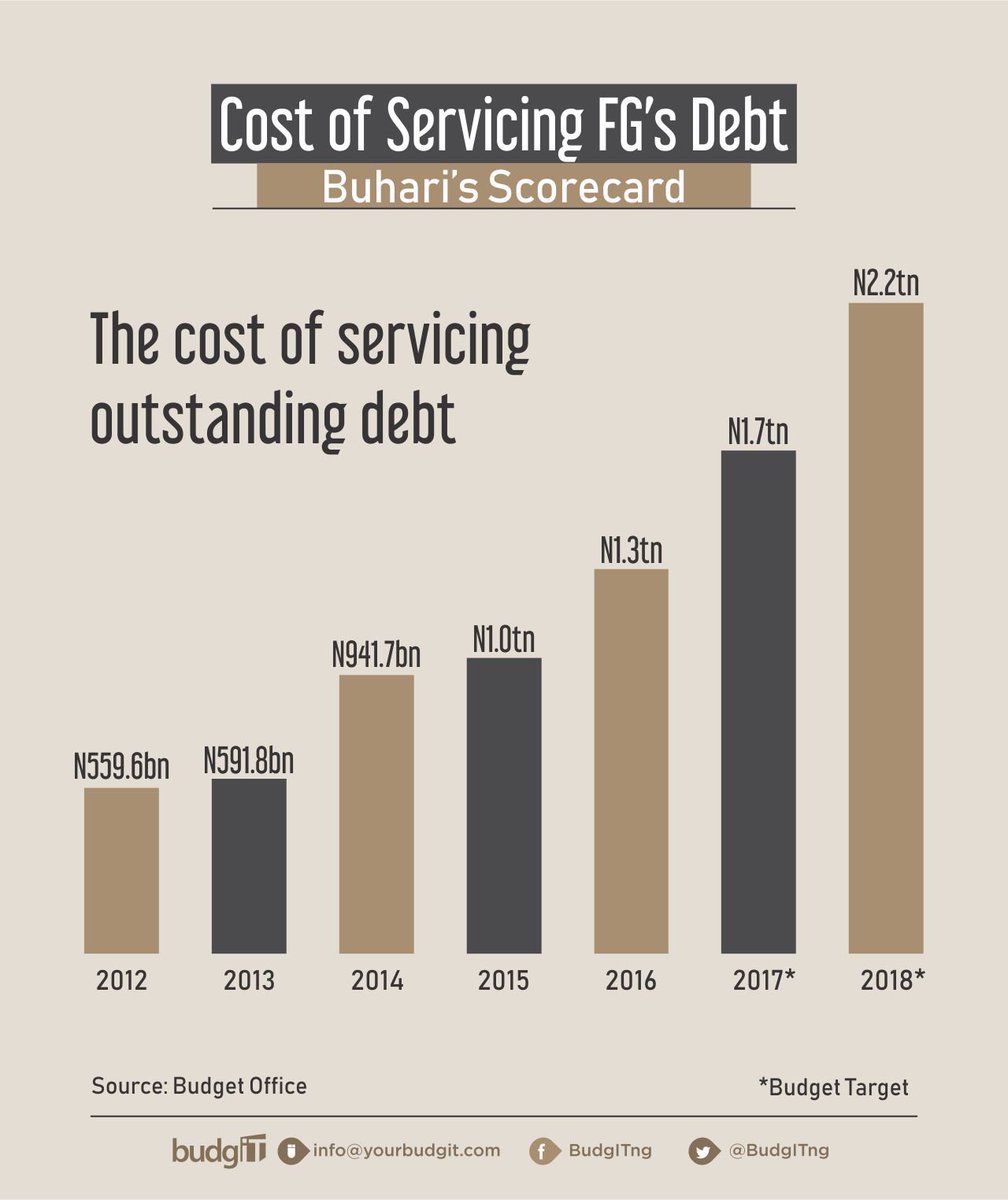

Nigeria needs to worry on its size of debt servicing as it reaches over 35% of public revenues. N2.2tn is budgeted to service debts in 2018.

#DemocracyDay

#DemocracyDay

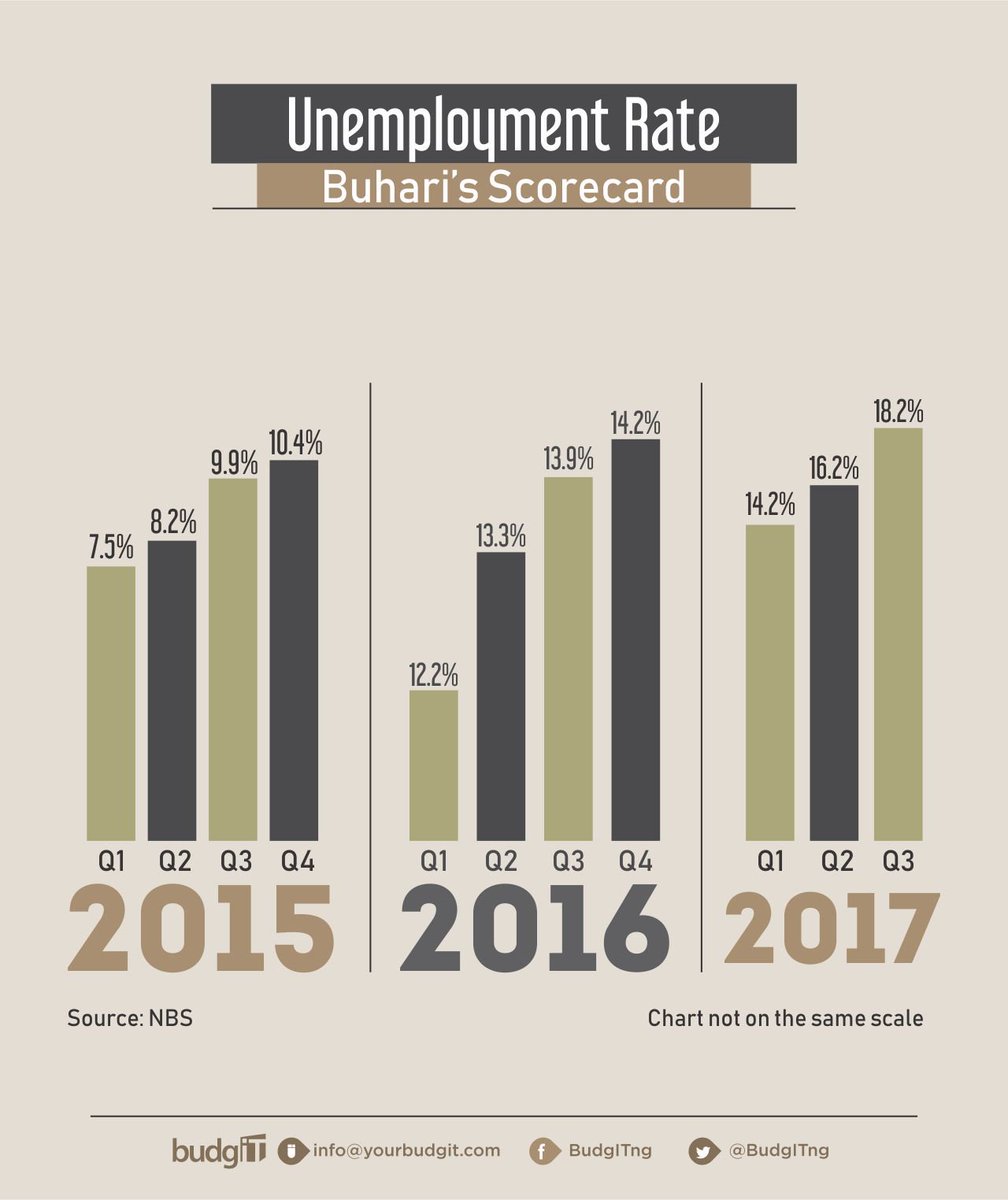

There are more people out of job in Nigeria in the current administration. This administration economic policies has doubled the rate of unemployment in Nigeria. We need to ask questions.

#DemocracyDay

#DemocracyDay

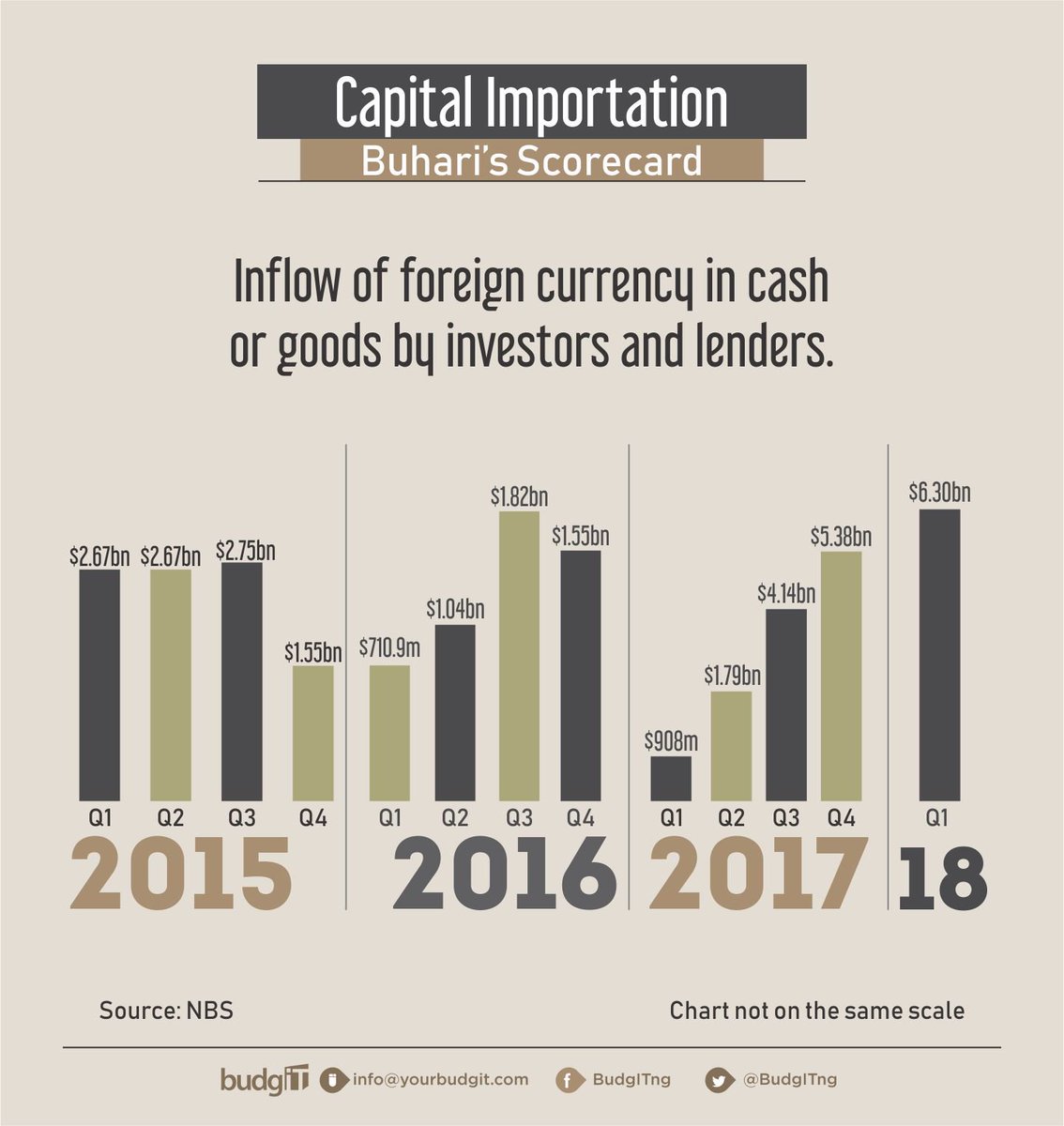

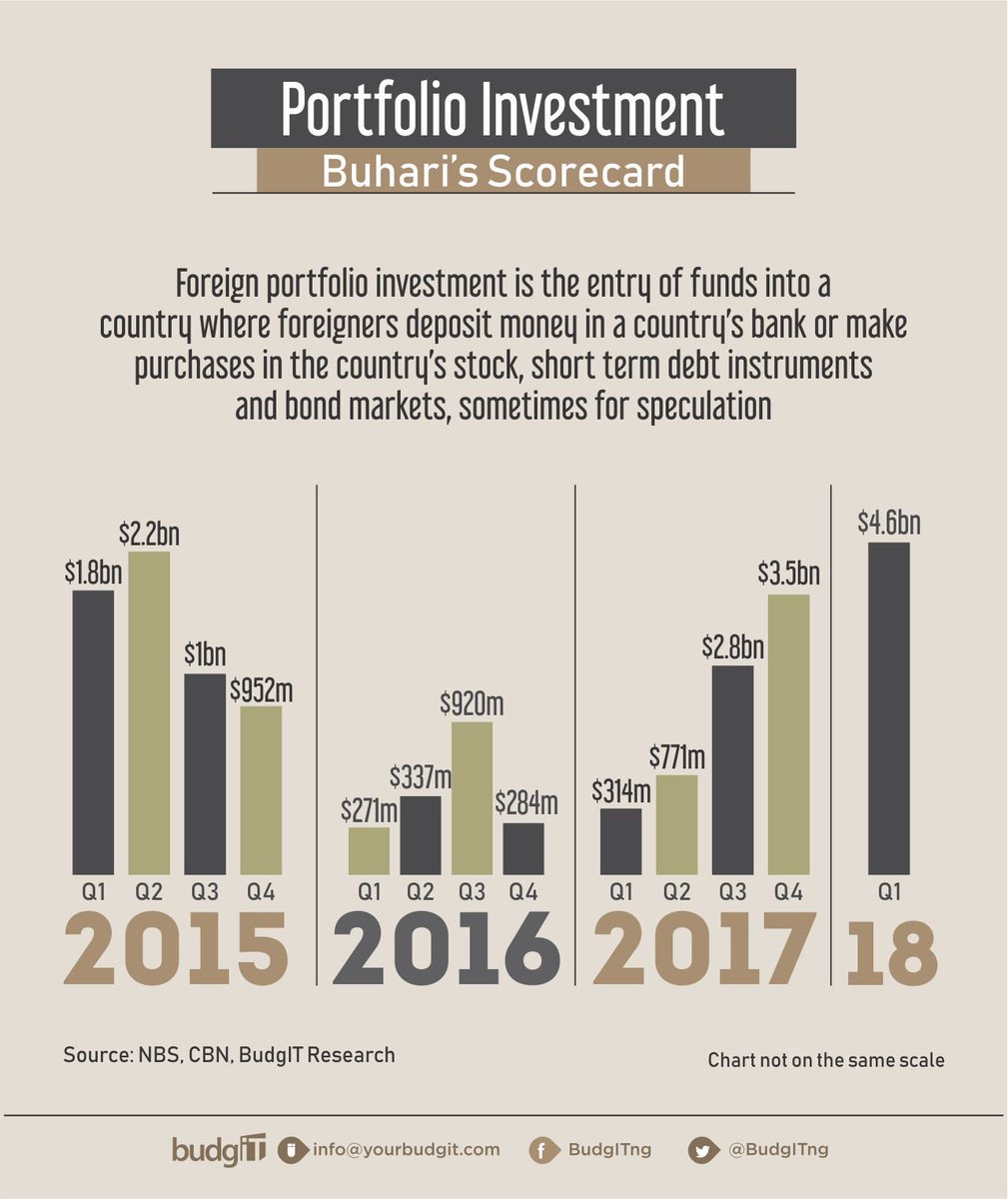

Capital importation numbers are rising. From the poor numbers of 2017, Nigeria sees a rise in inflows of foreign currency by investors and lenders. What is powering this? See next tweet.

*Charts not drawn to general scale.

#DemocracyDay

*Charts not drawn to general scale.

#DemocracyDay

Portfolio Investments have been the driver of investments in Nigeria. Since Q3 2017, there has been an inflow of “hot money” into Nigeria.

*Charts not drawn to general scale.

#DemocracyDay

*Charts not drawn to general scale.

#DemocracyDay

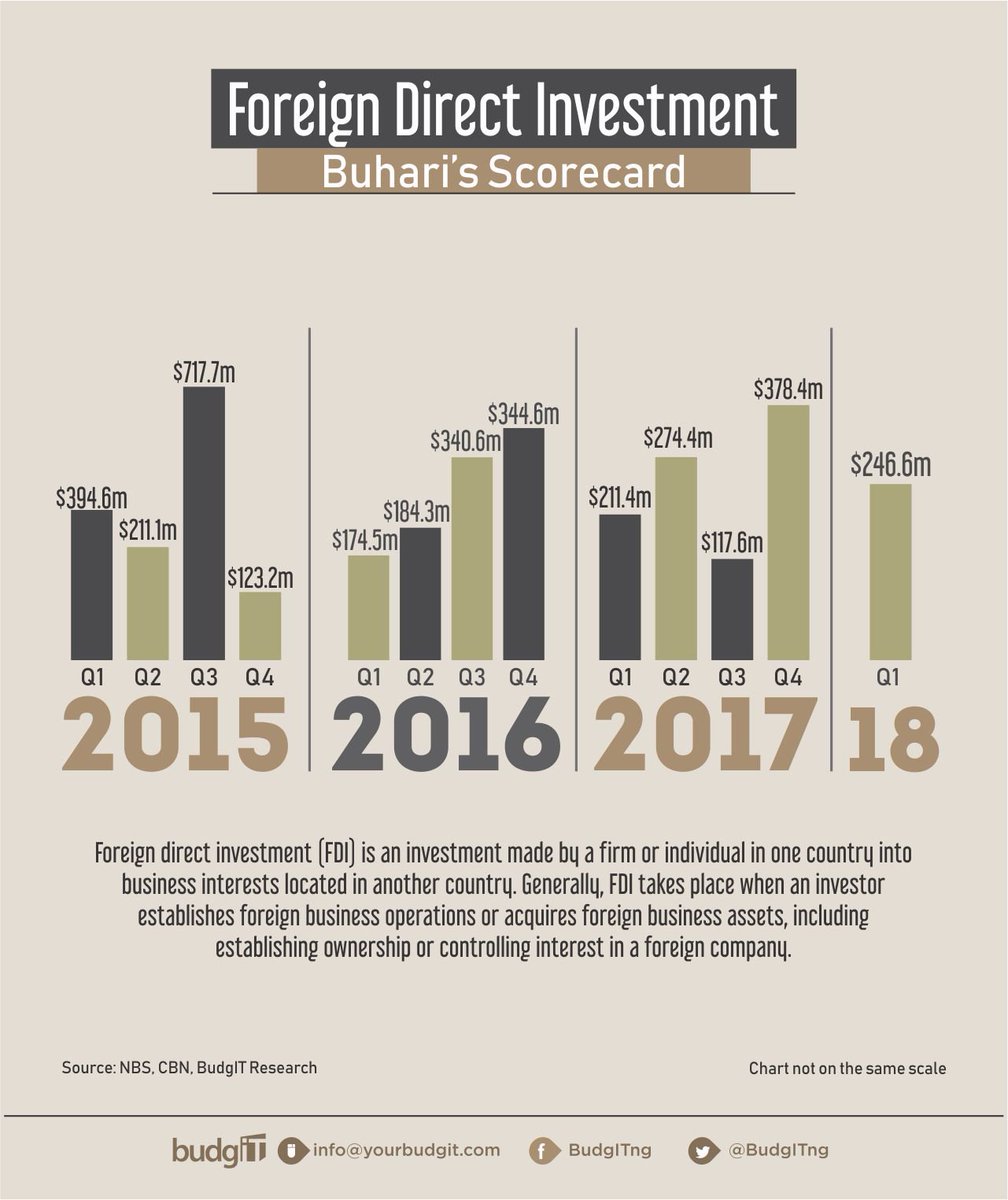

However, Nigeria still performs low in sticky foreign direct investments that can transform the economy on the long term. After the rapid rise of Q3 2015, what can Nigeria do to be an investment destination?

*Charts not drawn to general scale.

#DemocracyDay

*Charts not drawn to general scale.

#DemocracyDay

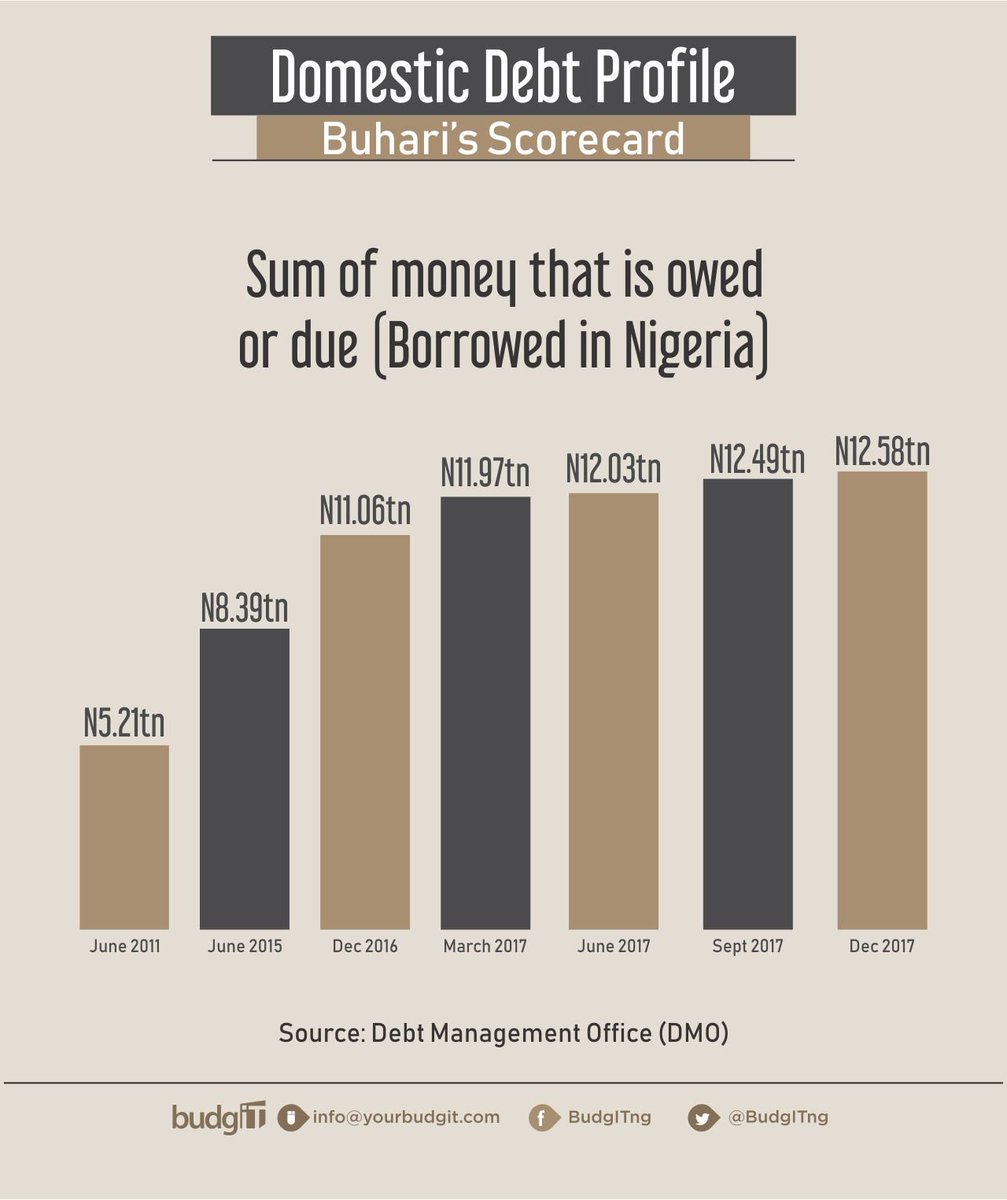

Domestic debts are rising as FG has added N4tn to the internally-sourced debt. External debts have also increased from $10.3bn in June 2015 to $18.9bn as at December 2017. This puts the total debt addition at N6.6tn as at December 2017.

#DemocracyDay

#DemocracyDay

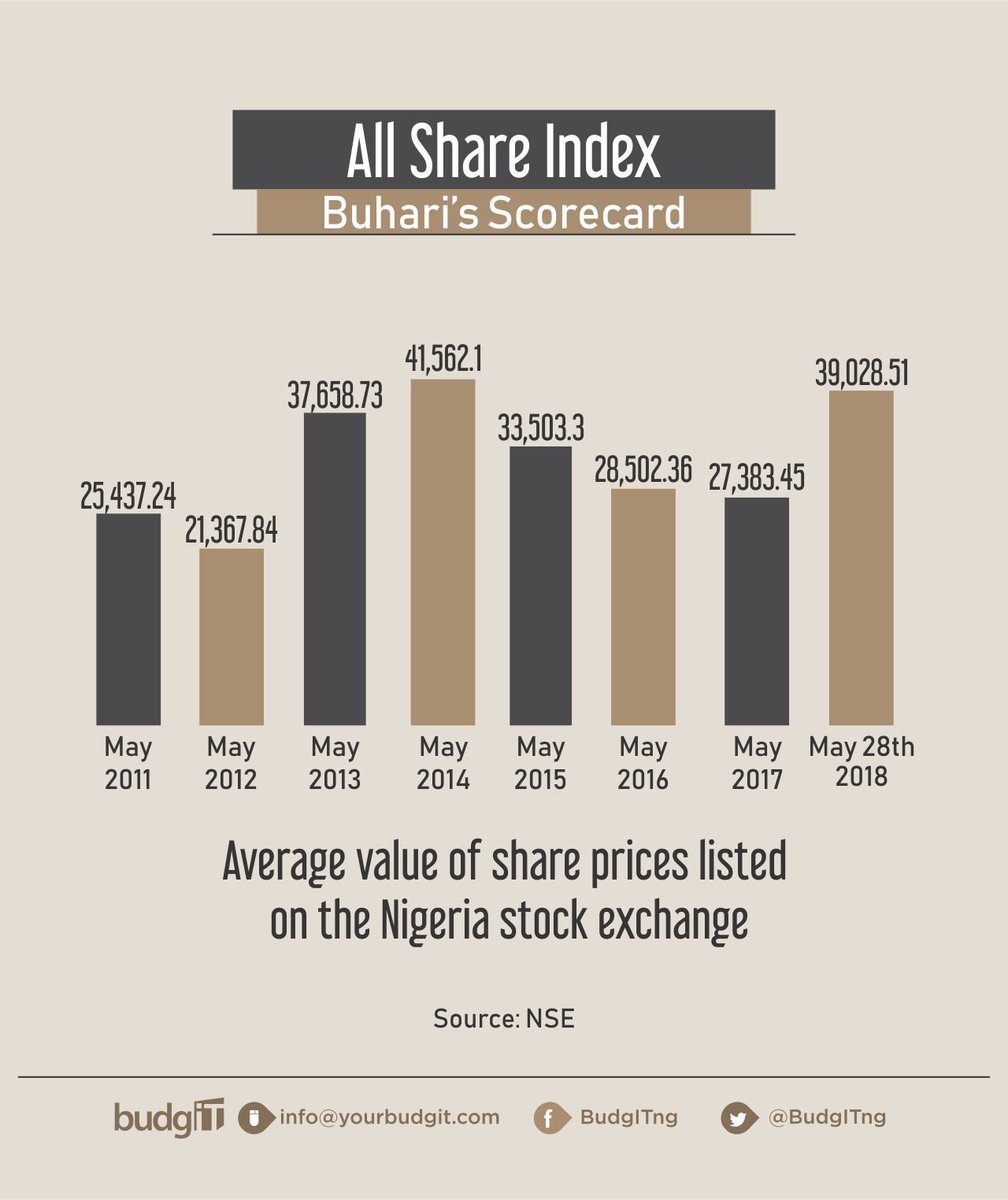

The stock market has been a magnet for portfolio investors due to its strong performance after a slump in 2016.

#DemocracyDay

#DemocracyDay

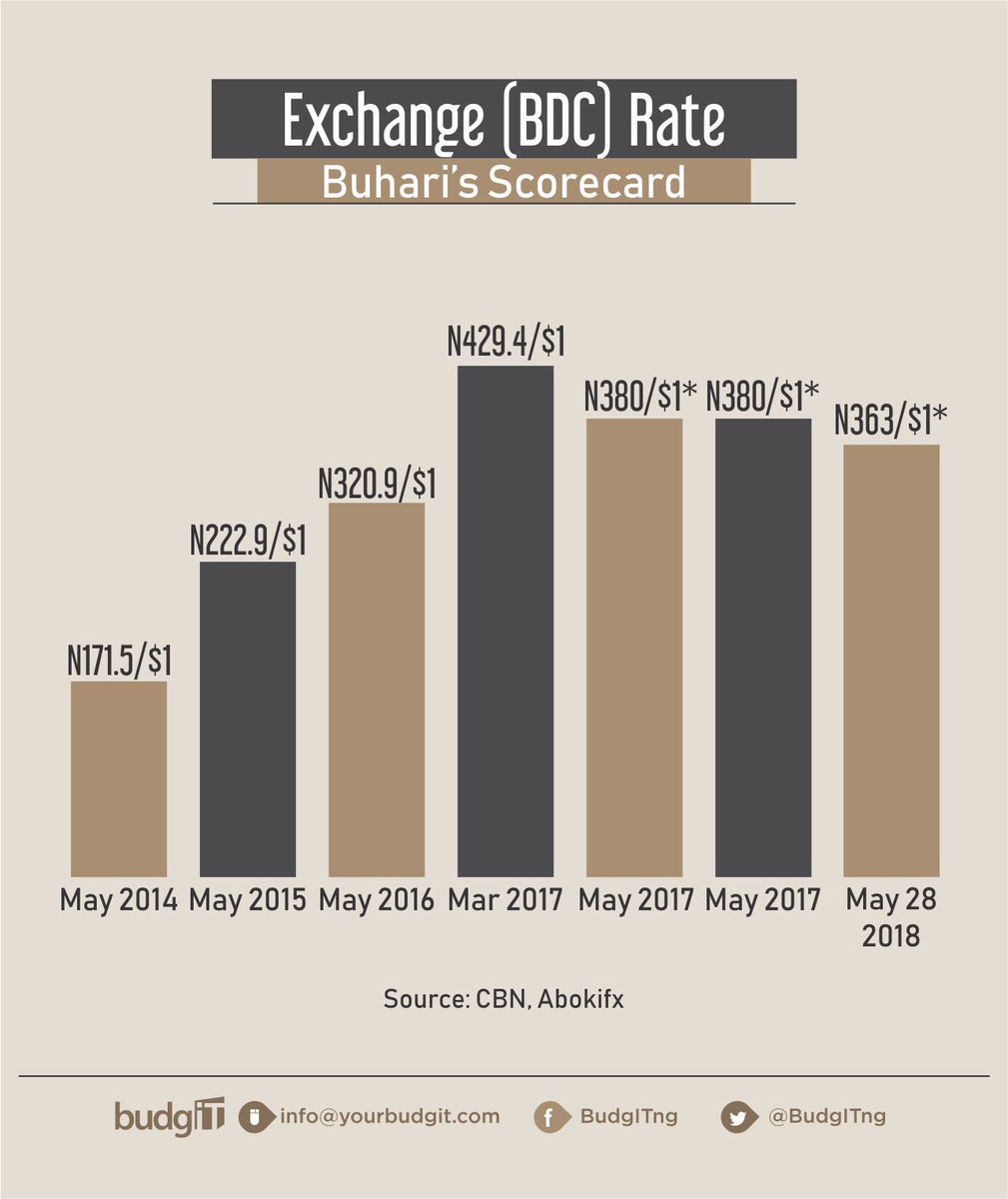

Parallel markets exchange rates have stood at N363 to 1 USD, after a spike to N429.4/$ in March 2017. The Central Bank still quotes N305 as its exchange rates.

#DemocracyDay

#DemocracyDay

Finally, the external reserves have risen from the ashes of $26.3bn as at end of 2016 to $47.75bn as at May 21, 2018.

#DemocracyDay

What's your take in terms of the performance of the economy?

#DemocracyDay

What's your take in terms of the performance of the economy?

• • •

Missing some Tweet in this thread? You can try to

force a refresh