A trip down memory lane... The earliest #bitcoin price chart I've found is from bitcoincharts.com of "Bitcoin Market". This was pre-MtGox. On May 25, 2010 #Bitcoin was trading at 0.3 cents. 1000 BTC was traded that day, for a 24hr volume of $3 USD. @cryptotwitter

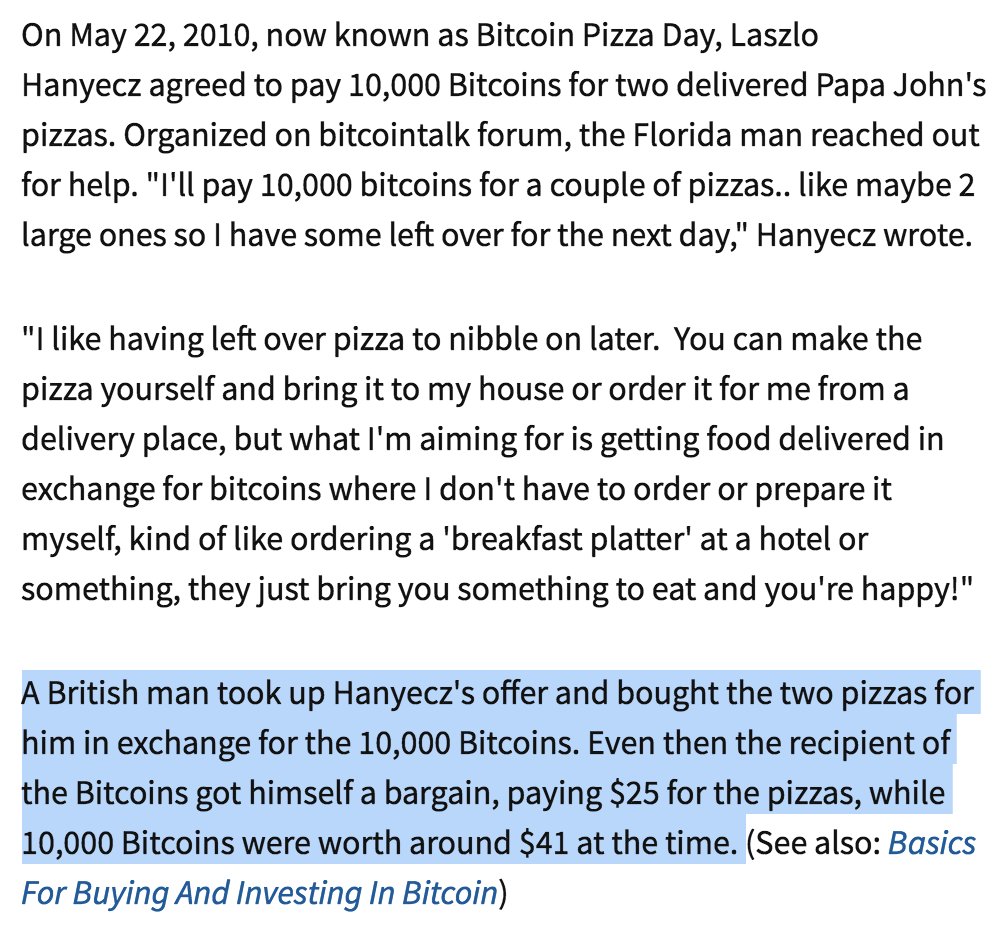

The famous Bitcoin Pizza Day was only 3 days earlier on 22 May 2010 when Laszlo Hanyecz paid 10,000 BTC for two Papa John's pizzas. 0.25 cents per BTC. Apparently the market rate was 0.41 cents per BTC. (via @Investopedia)

During 2010, pre Mt Gox, alongside BitcoinMarket.com, there was also The Bitcoin Exchange in operation. I'd love to see their price data to reconstruct the full price chart 2009-2018, if anyone has it.

I believe before that, during 2009, it was New Liberty Standard who acted as a BTC broker, publishing the daily BTC price based on electricity costs. The earliest price there was $0.000764 or 0.0764 cents per BTC on 5th October 2009.

If you had bought $1 worth of BTC on 5th October 2009 on this first recorded price. You would have $9.8m today. If you had HODLed of course. #cliche #line #i #know

I would love to hear stories about what it was like to buy Bitcoin from that era. The OGs of Bitcoin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh