How to get URL link on X (Twitter) App

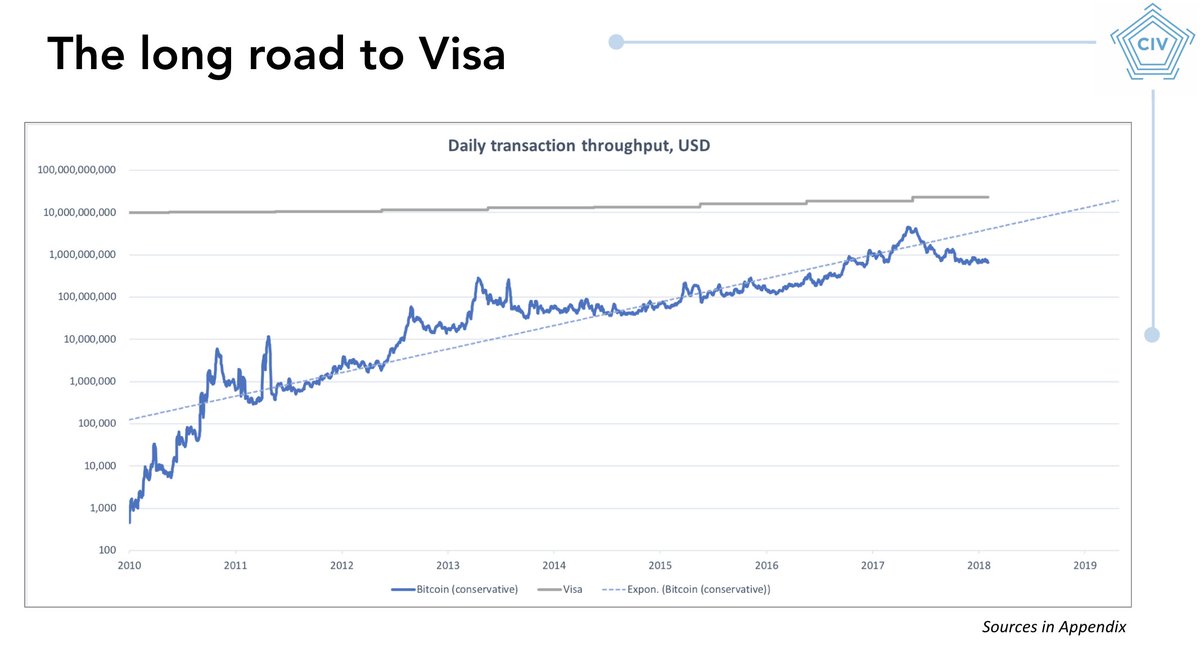

"We are within an order of magnitude away from Visanet throughput."

"We are within an order of magnitude away from Visanet throughput."

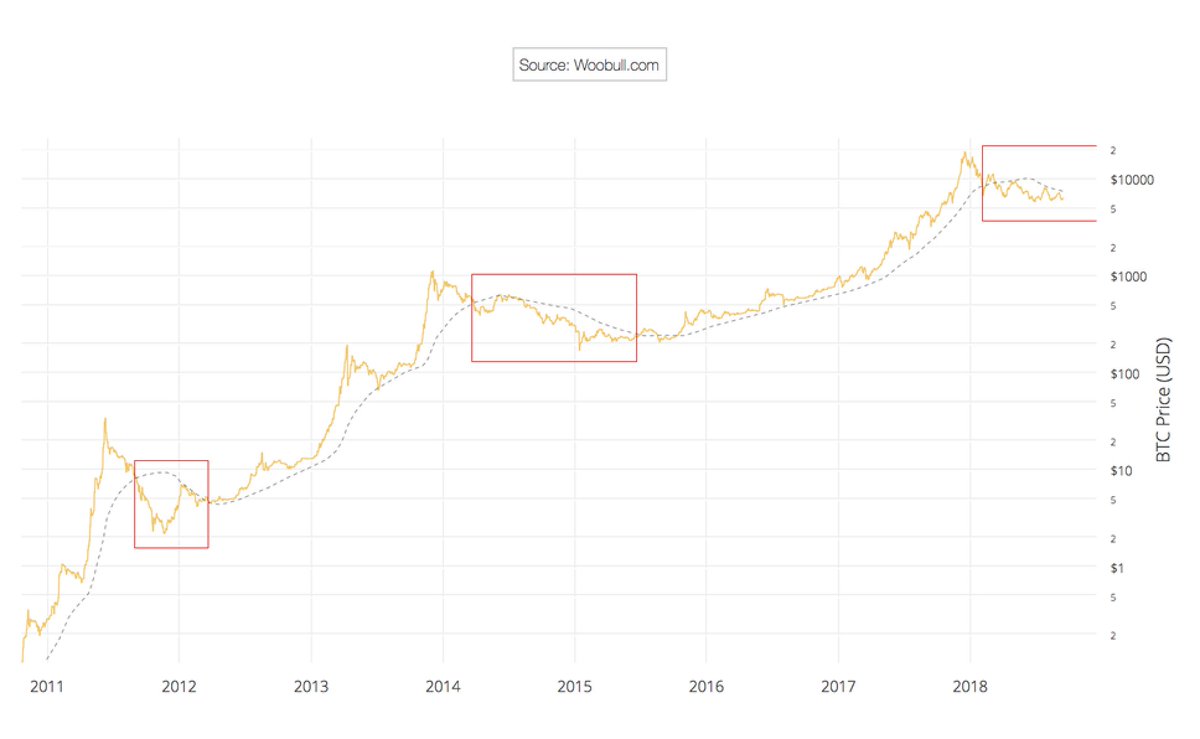

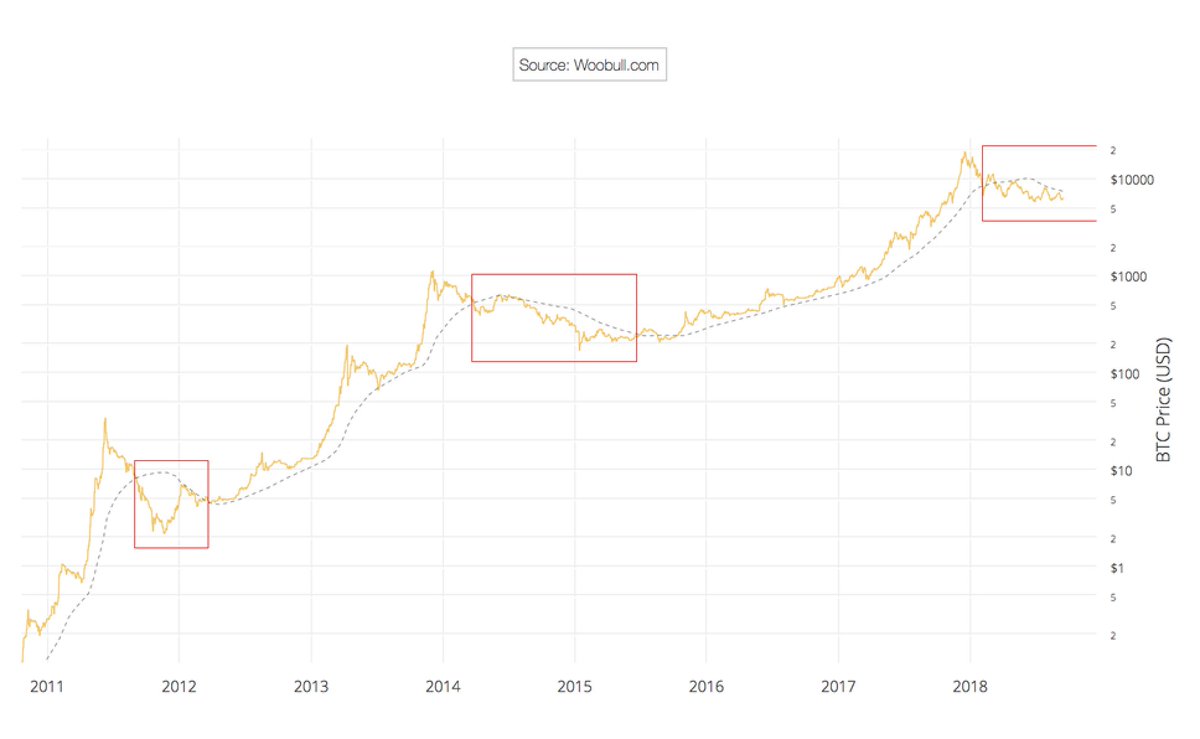

Let's check my fav long range indicator... NVT Ratio.

Let's check my fav long range indicator... NVT Ratio.

The 3rd dead kitten. Fractally speaking, I'm framing this last down leg as an oscillation around the main move. The green line is just magic crayons for short range TAs to determine, the retest target and rate of decline are the things I'm watching. NVT only mildly supports this.

The 3rd dead kitten. Fractally speaking, I'm framing this last down leg as an oscillation around the main move. The green line is just magic crayons for short range TAs to determine, the retest target and rate of decline are the things I'm watching. NVT only mildly supports this.

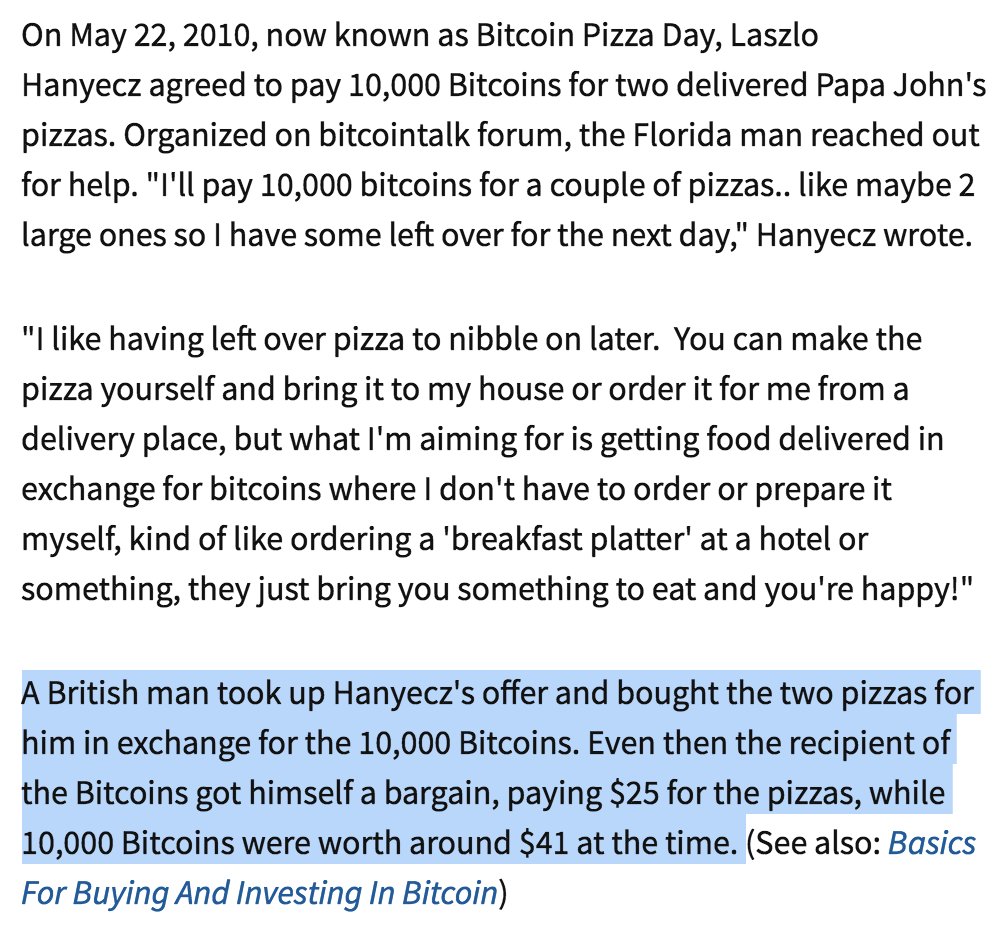

The famous Bitcoin Pizza Day was only 3 days earlier on 22 May 2010 when Laszlo Hanyecz paid 10,000 BTC for two Papa John's pizzas. 0.25 cents per BTC. Apparently the market rate was 0.41 cents per BTC. (via @Investopedia)

The famous Bitcoin Pizza Day was only 3 days earlier on 22 May 2010 when Laszlo Hanyecz paid 10,000 BTC for two Papa John's pizzas. 0.25 cents per BTC. Apparently the market rate was 0.41 cents per BTC. (via @Investopedia)

1) NVT Signal is still too high. We need more blockchain transactional activity to justify the current price, or the price to drop to reconcile the difference. To drive up transactional activity in a bear slide is very unlikely IMO. /2

1) NVT Signal is still too high. We need more blockchain transactional activity to justify the current price, or the price to drop to reconcile the difference. To drive up transactional activity in a bear slide is very unlikely IMO. /2

The question to ask is whether we can unwind from Dec 2017's mania in the $6k-$7k range, or that fails and we're forced to consolidate lower like in 2014. This was the moment of truth in 2014. When support broke and we were forced to unwind at the lower levels... /2

The question to ask is whether we can unwind from Dec 2017's mania in the $6k-$7k range, or that fails and we're forced to consolidate lower like in 2014. This was the moment of truth in 2014. When support broke and we were forced to unwind at the lower levels... /2

For example BTC lockup is only from store of value HODL investors. ETH is both this and ERC20 engineered lockup whereby ICO investors scoop ETH to pass to ICO projects who HODL them. Thus with the introduction of an ERC20 smart contract, you are engineering tokenomic lockup. /2

External Tweet loading...

If nothing shows, it may have been deleted

by @WayneVaughan view original on Twitter

I don’t come from Wall St. I’m not a formally trained analyst. My background comes from the world of emerging tech and startups. Hence my view and analysis tends to be outside of the box. /2

I don’t come from Wall St. I’m not a formally trained analyst. My background comes from the world of emerging tech and startups. Hence my view and analysis tends to be outside of the box. /2