Blackburn Rovers’ financial results for 2016/17 covered “a season to forget for #Rovers fans”, as the club was relegated from the Championship to League One with manager Owen Coyle replaced by Tony Mowbray. The good news is that they have immediately bounced back in 2017/18.

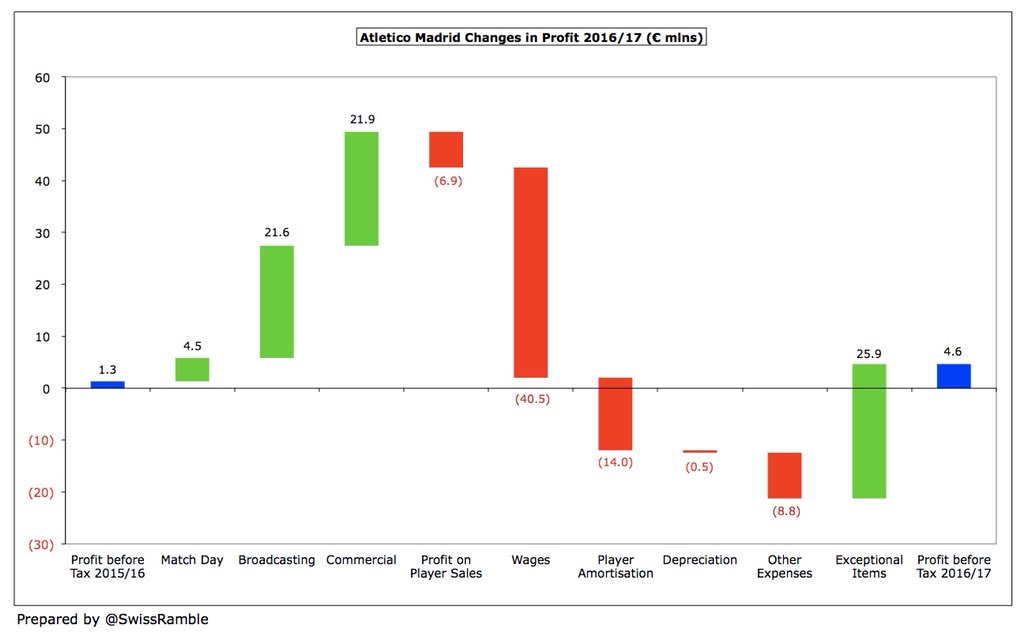

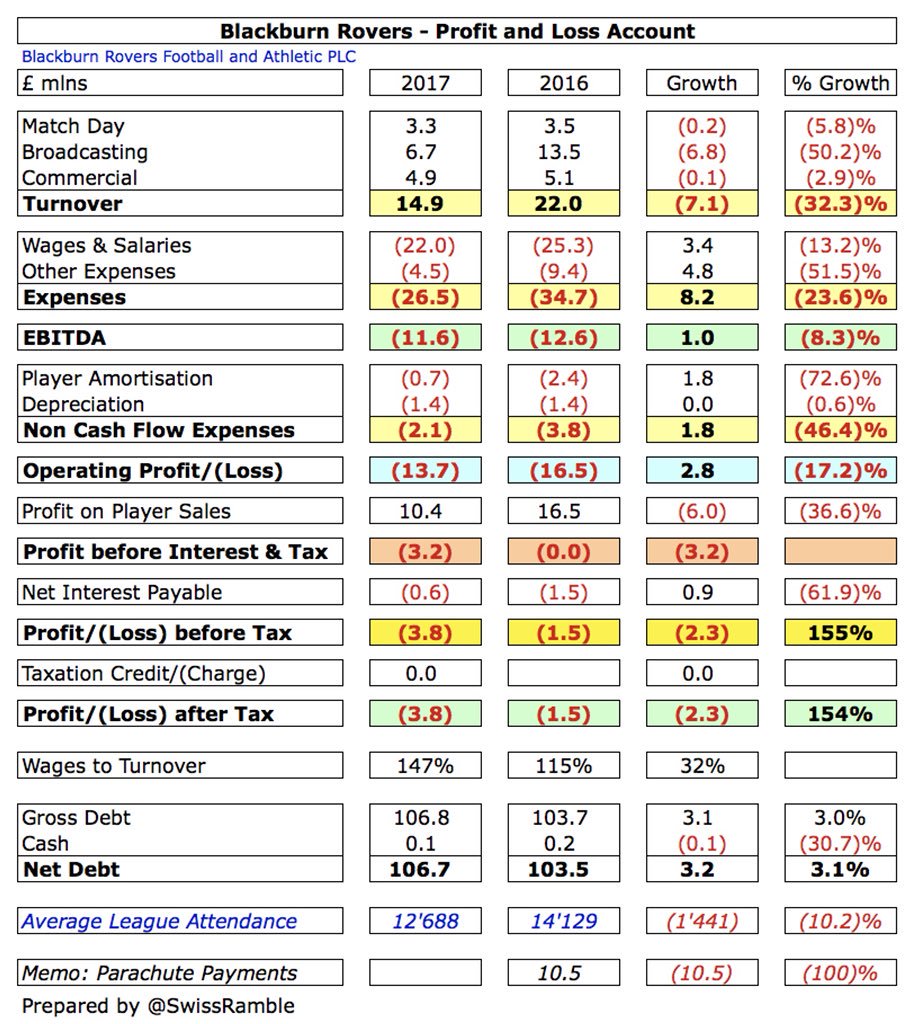

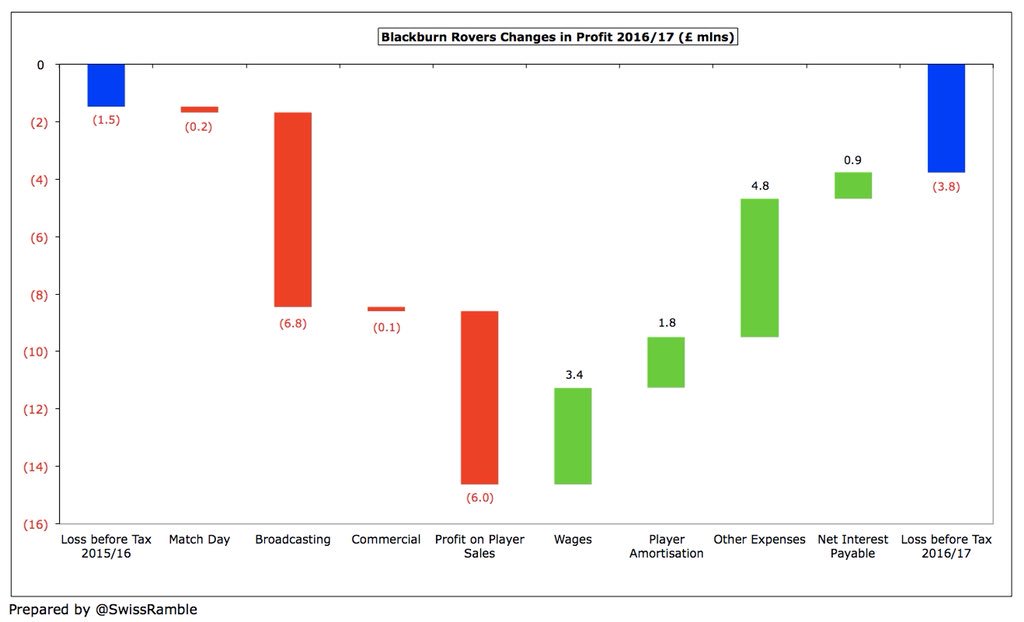

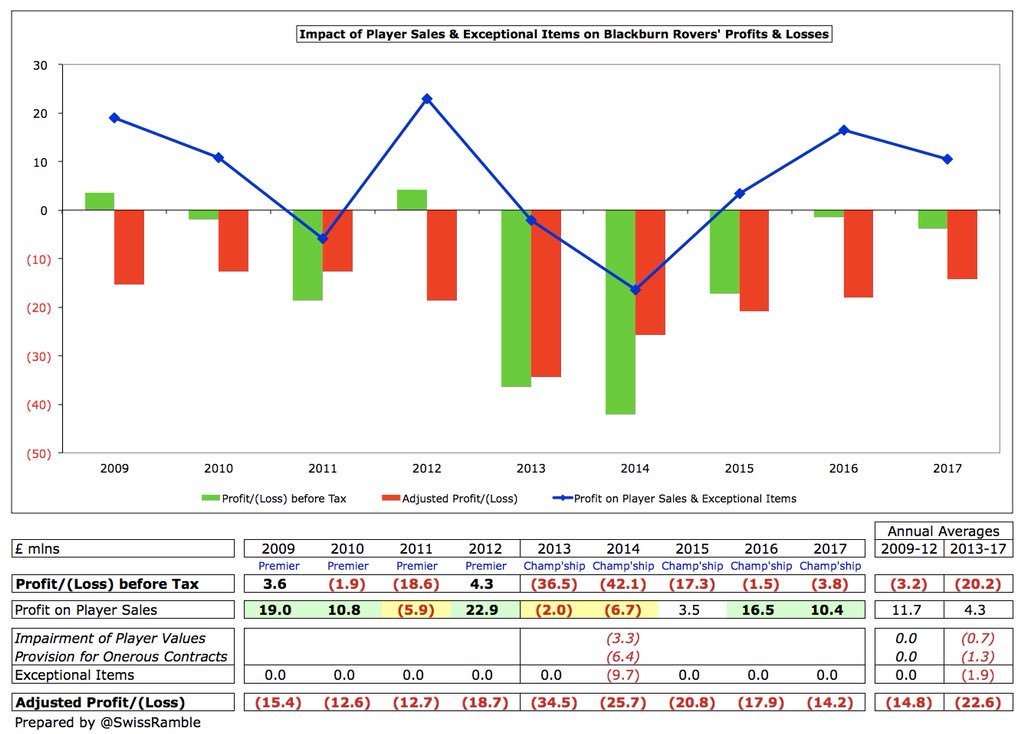

#Rovers loss worsened by £2.3m from £1.5m to £3.8m, mainly due to £7.1m (32%) reduction in revenue to £14.9m and £6.0m fall in profit on player sales to £10.4m, offset by cost cuts: wages £3.4m (13%) to £22.0m, other expenses £4.8m (51%) to £4.5m & player amortisation £1.8m.

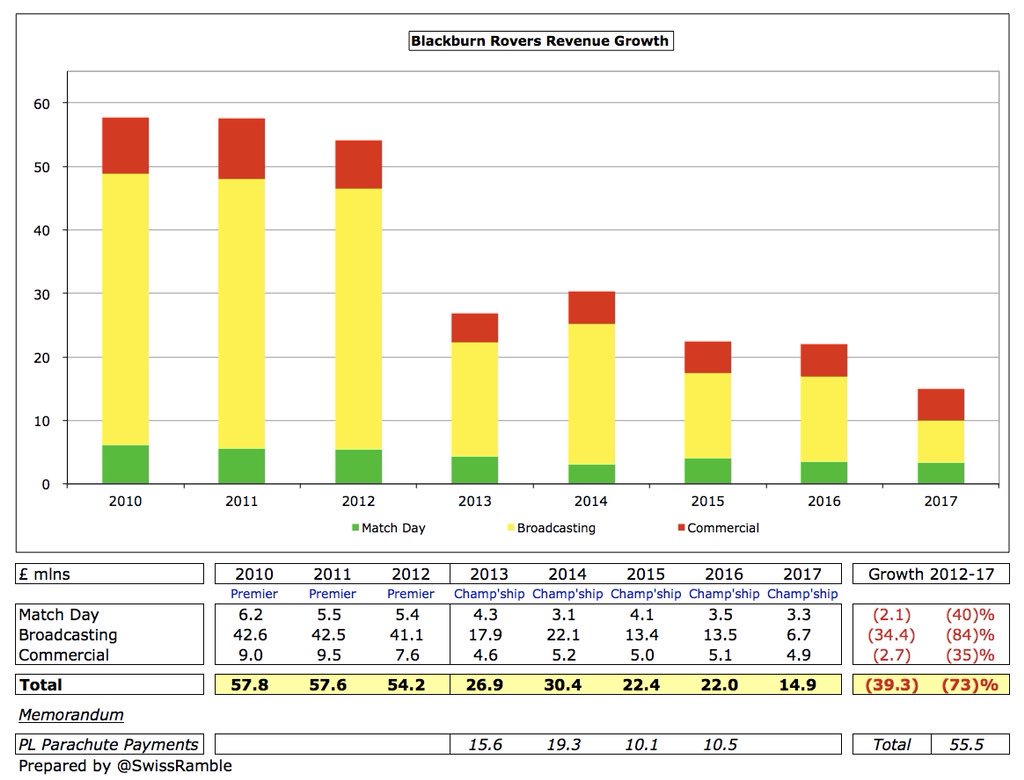

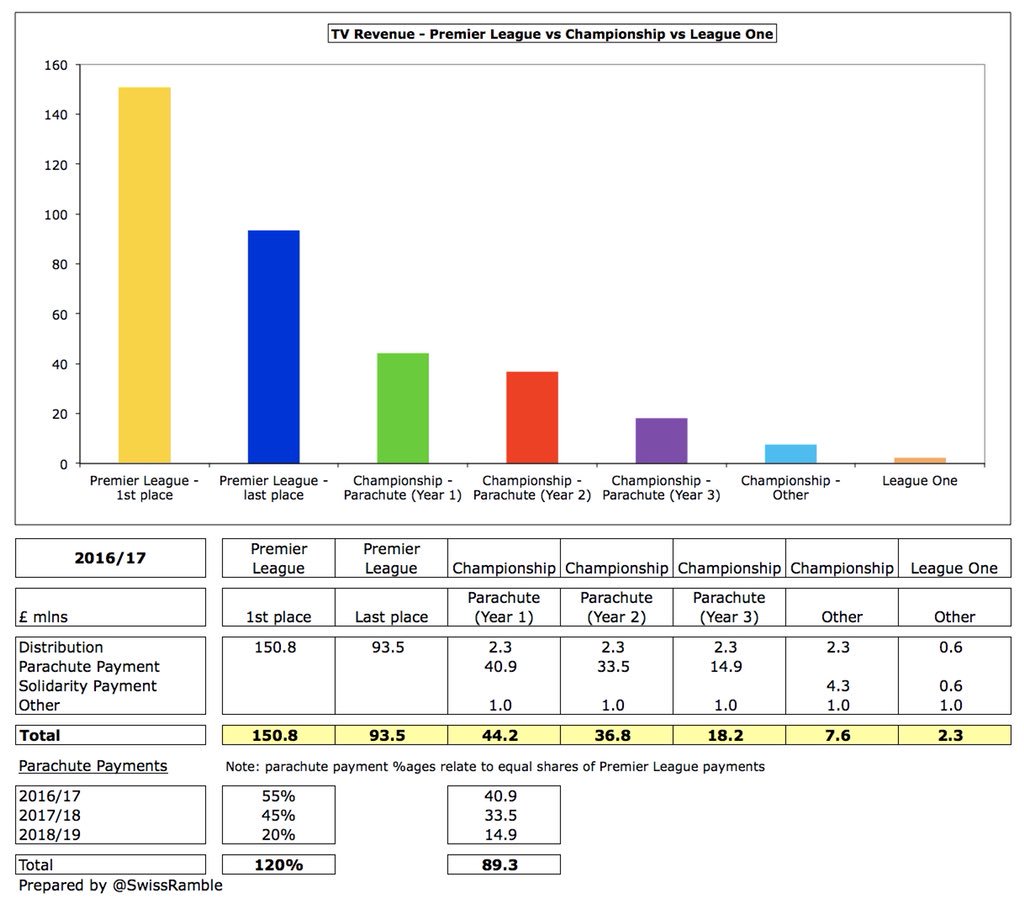

Main reason for what #Rovers Finance Director Mike Cheston described as “a significant drop in income” was the loss of parachute payments £10.5m, though the blow was softened by £4.3m solidarity payments. Match day and commercial slightly declined, by £0.2m & £0.1m respectively.

A major driver for the £4.8m decrease in #Rovers other expenses to £4.5m was higher one-off charges to owners Venky’s the previous season. In addition, interest payable on the overdraft and other loans fell £0.9m to £0.6m.

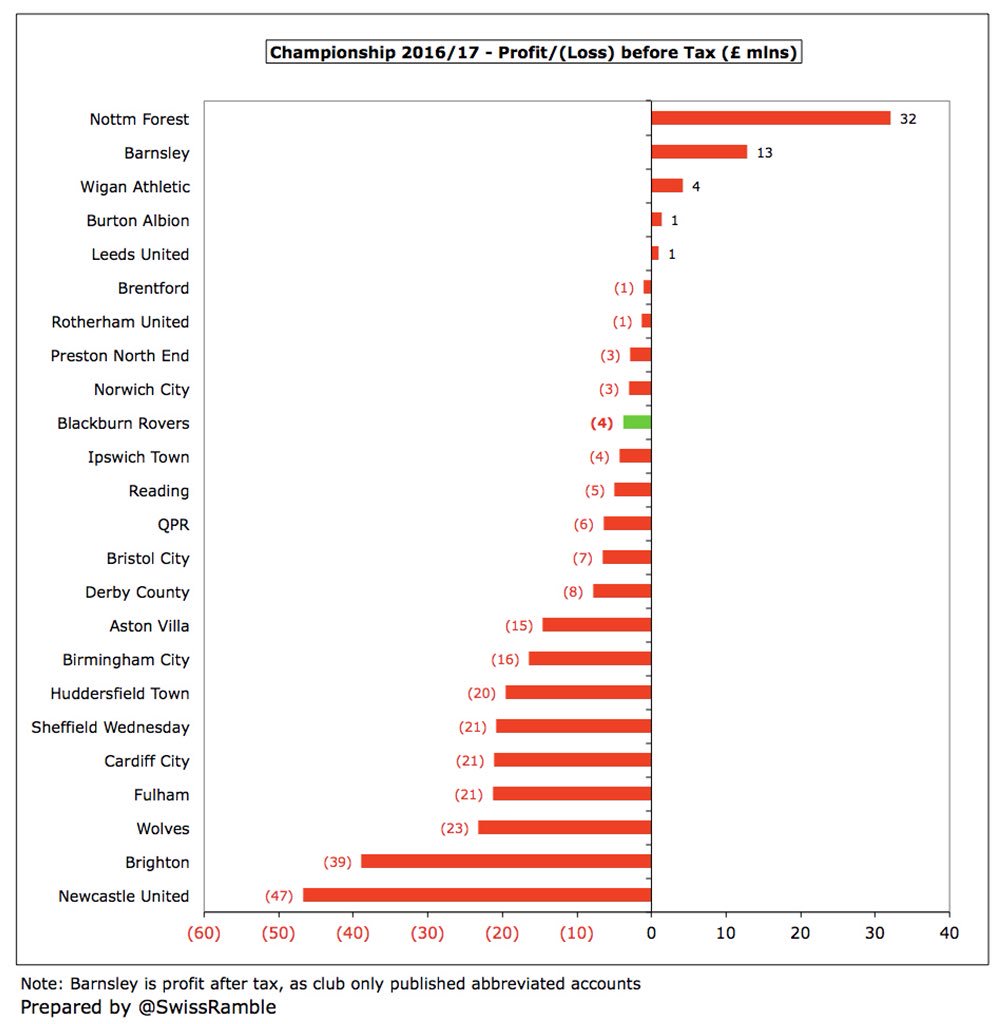

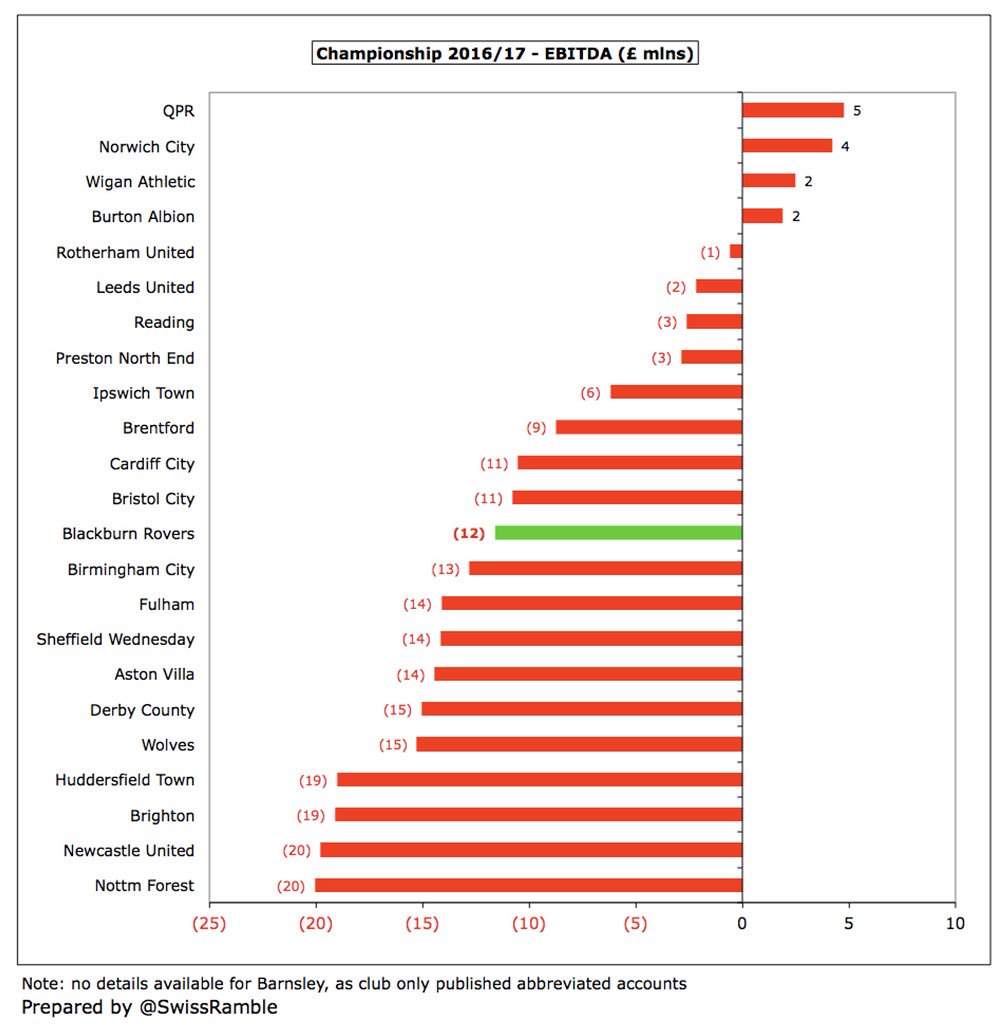

Despite #Rovers higher £4m loss, in terms of profitability this was actually the 10th best in the Championship. Almost all clubs in this ultra-competitive division lose money with any exceptions normally due to once-off items (high player sales, loan write-offs, etc).

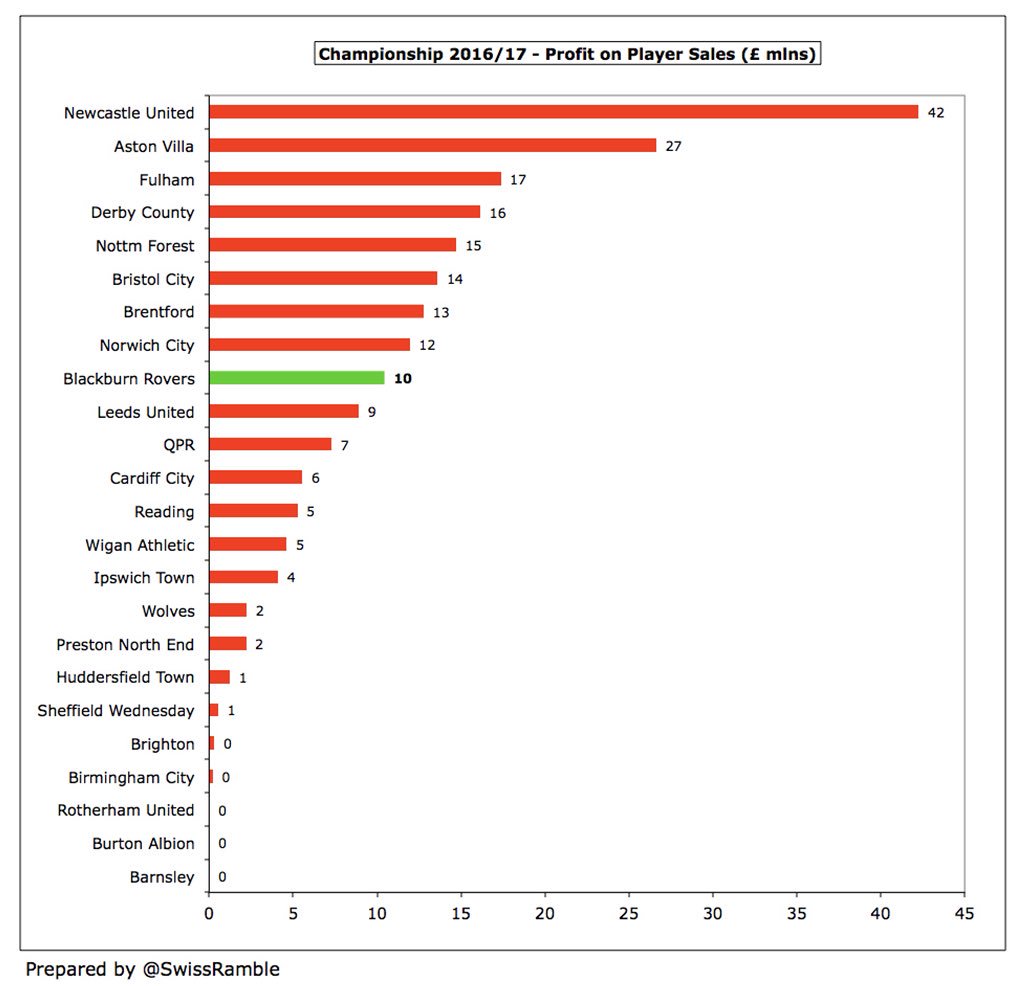

However, #Rovers loss would have been much higher without a “significant” £10m profit on player sales, including Grant Hanley to Newcastle, Shane Duffy to Brighton and Ben Marshall to Wolves.

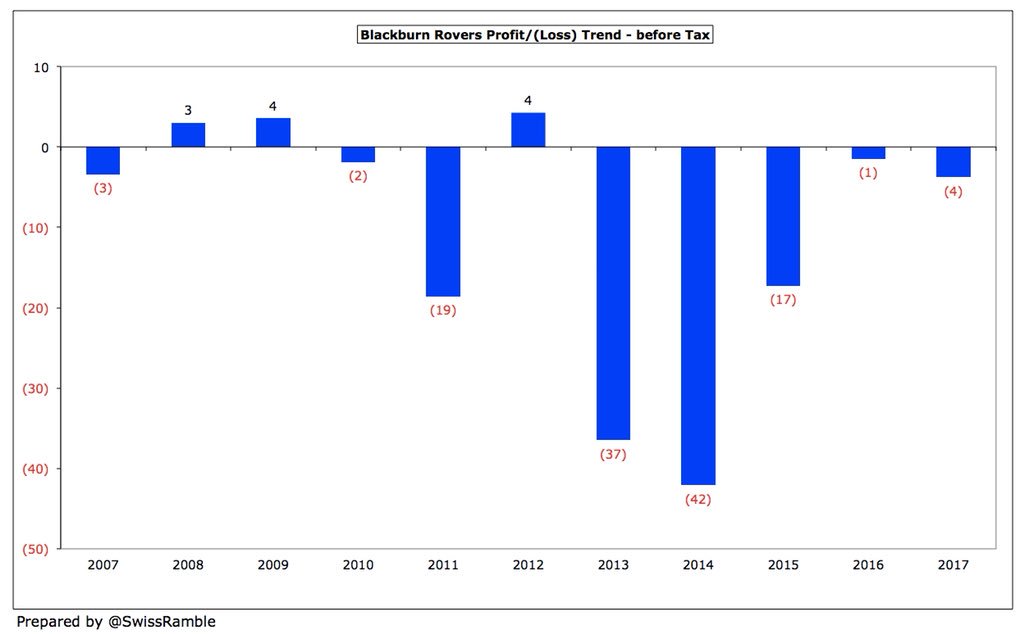

Last time #Rovers made a profit was 2012, their last season in the Premier League. Since Venky’s bought the club in November 2010, the club has accumulated £115m of losses, some achievement considering they have had 2 seasons in top flight followed by 4 with parachute payments.

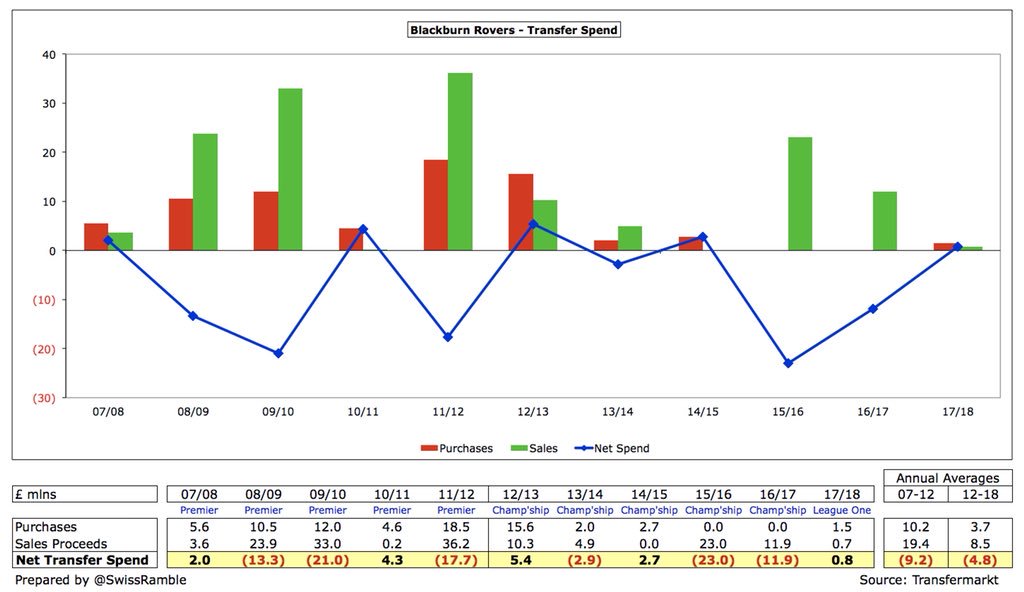

To be fair, losses were much lower in last 2 seasons, though this is largely due to player sales, including £16m in 2015/16 (mainly Jordan Rhodes to Boro, Rudy Gestede to Aston Villa). Unfortunately, accounts note that net transfer fees receivable since these accounts is zero.

The £42m record loss in 2014 highlighted how poor some of the player purchases were, as #Rovers actually made a £7m loss on player sales (third year in four this activity lost money). In addition, there were £10m of exceptional items: player value impairment & onerous contracts.

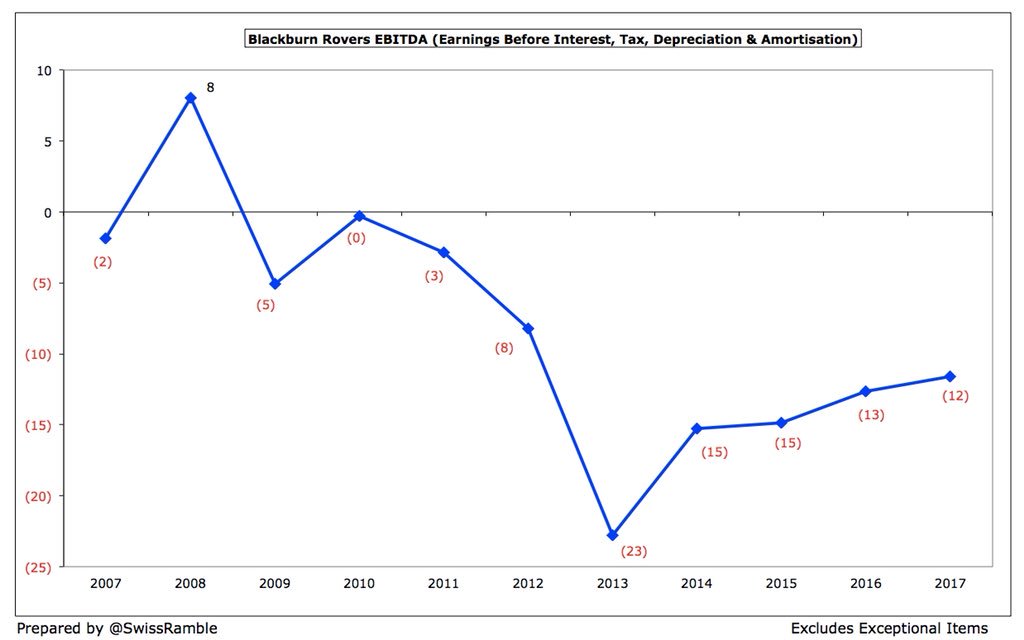

#Rovers EBITDA (Earnings Before Interest, Depreciation and Amortisation), which strips out player sales and non-cash items to give underlying profitability, steadily declined to £(23)m in 2013 before improving each year to £(12)m in 2017, albeit still negative.

In fairness, just four Championship clubs managed to achieve positive EBITDA in 2016/17, while #Rovers £(12)m was mid-table in the division, only around half of Nottingham Forest’s £(20)m.

#Rovers revenue has dropped £39m (73%) since relegation from the Premier League from £54m to £15m. In the first four years they benefited from a total of £55m parachute payments, but they lost this advantage in 2016/17. Revenue estimated to further fall to £10m in League One.

#Rovers £15m revenue was one of lowest in Championship, only ahead of Preston £13m, Rotherham £13m, Brentford £13m & Burton £11m. Relegated clubs were substantially higher: #NUFC £86m, #NCFC £75m & #AVFC £74m. On the other hand, #htafc secured promotion with similar revenue £16m.

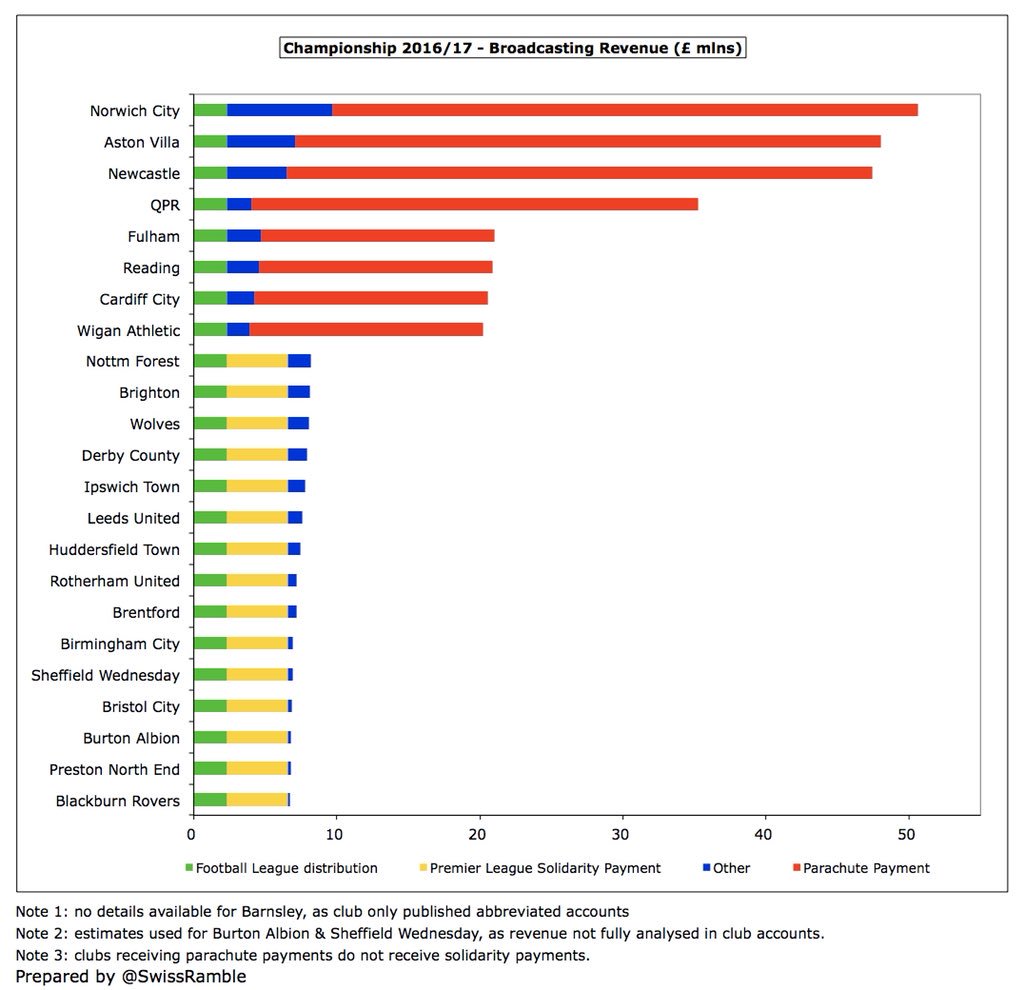

Of course, Championship revenue is greatly influenced by Premier League parachute payments, e.g. £41m to #NUFC, Aston Villa & Norwich in 16/17 (up from £26m in 15/16 thanks to the new three-year PL TV deal). #Rovers have now lost this benefit.

#Rovers broadcasting income halved, decreasing £6.8m from £13.5m to £6.7m, as £10.5m parachute payment was replaced by £4.3m solidarity payment from Premier League (up from £2.3m in 15/16). Most Championship clubs only receive £7-8m TV money, including £2.3m EFL distribution.

#Rovers TV money will fall again in League One to just over £2m. Looking at how Premier League TV deal has increased (with clubs receiving £95m to £150m), there could hardly have been a worse time for Blackburn to lose their Premier League status.

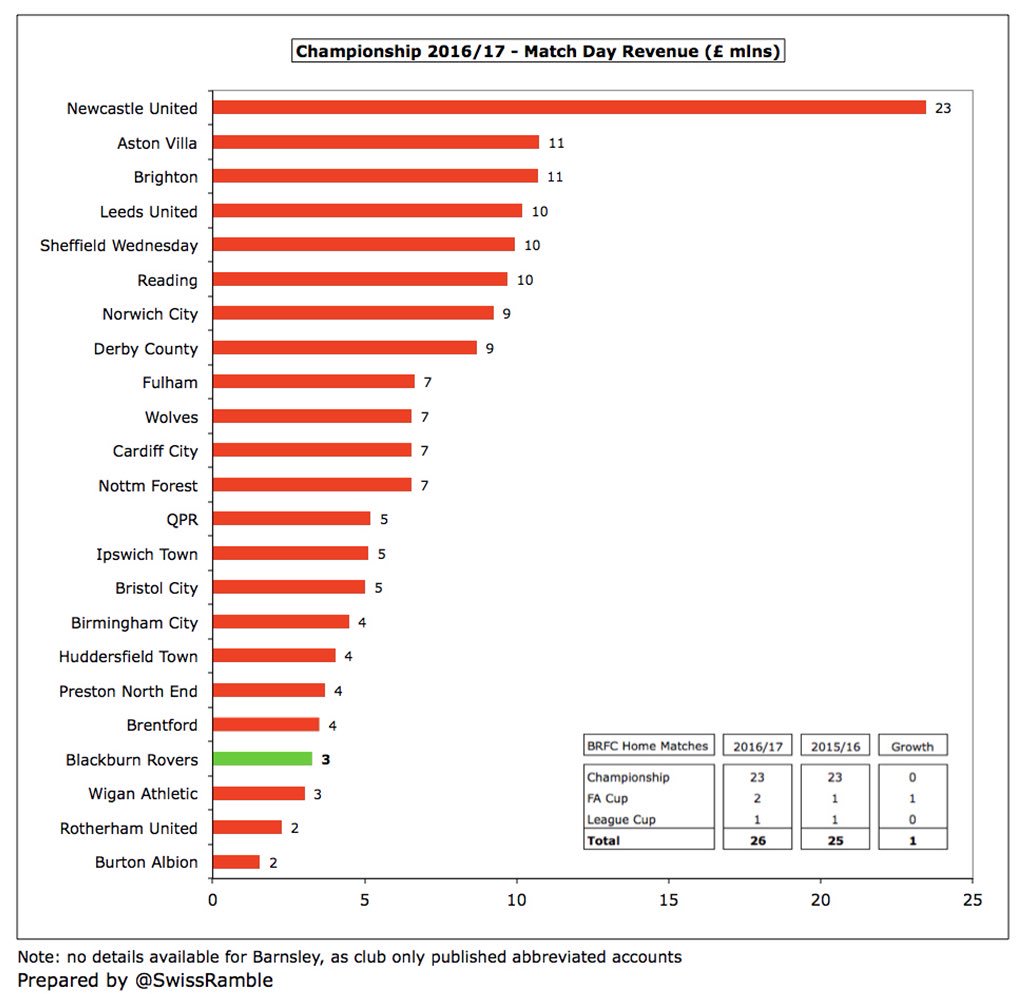

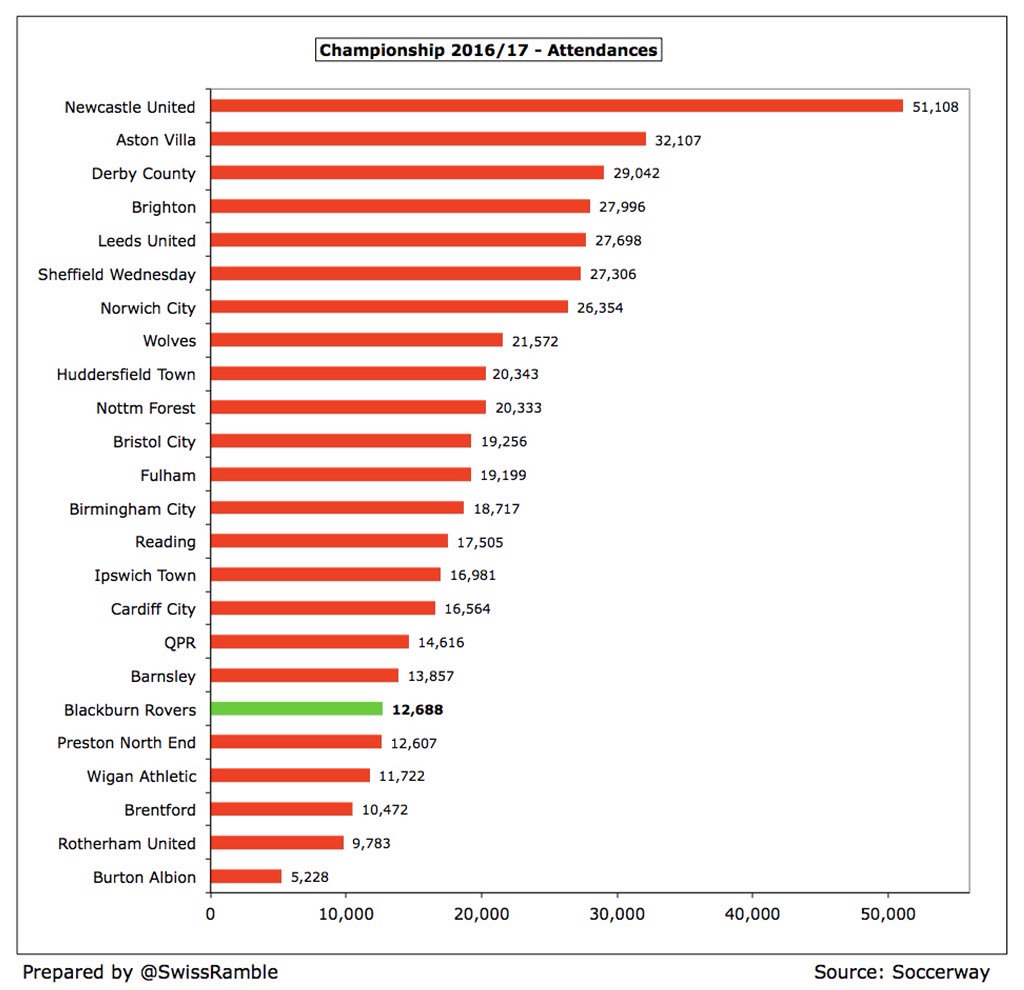

#Rovers match day revenue decreased £0.2m (6%) to £3.3m, even though there was one more home FA Cup game, as average attendance fell from 14,129 to 12,688. This was one of the smallest match day incomes in the Championship, only above Rotherham, Wigan & Burton.

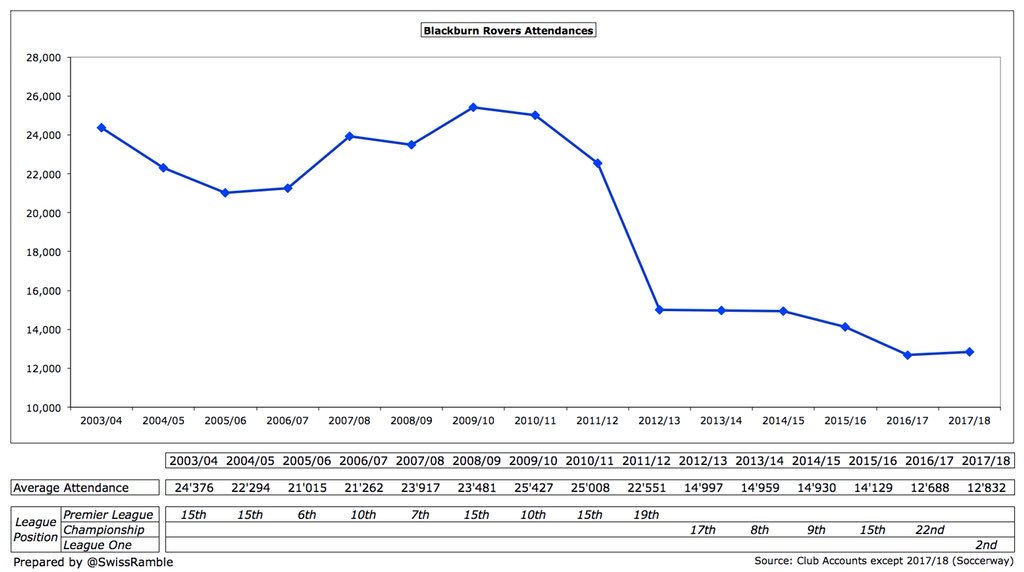

#Rovers crowds held up well in League One, actually showing a small increase to 12,832, though it should be noted that this is only around half of the 25,427 achieved in the Premier League in 2009/10 when Blackburn finished an impressive 10th.

#Rovers 12,688 attendance was one of the smallest in the Championship in 2016/17. It was miles behind the top two: Newcastle 51,106 and Aston Villa 32,107. Ticket prices have been increased for 2018/19 back in Championship “with FFP regulations to take into consideration”.

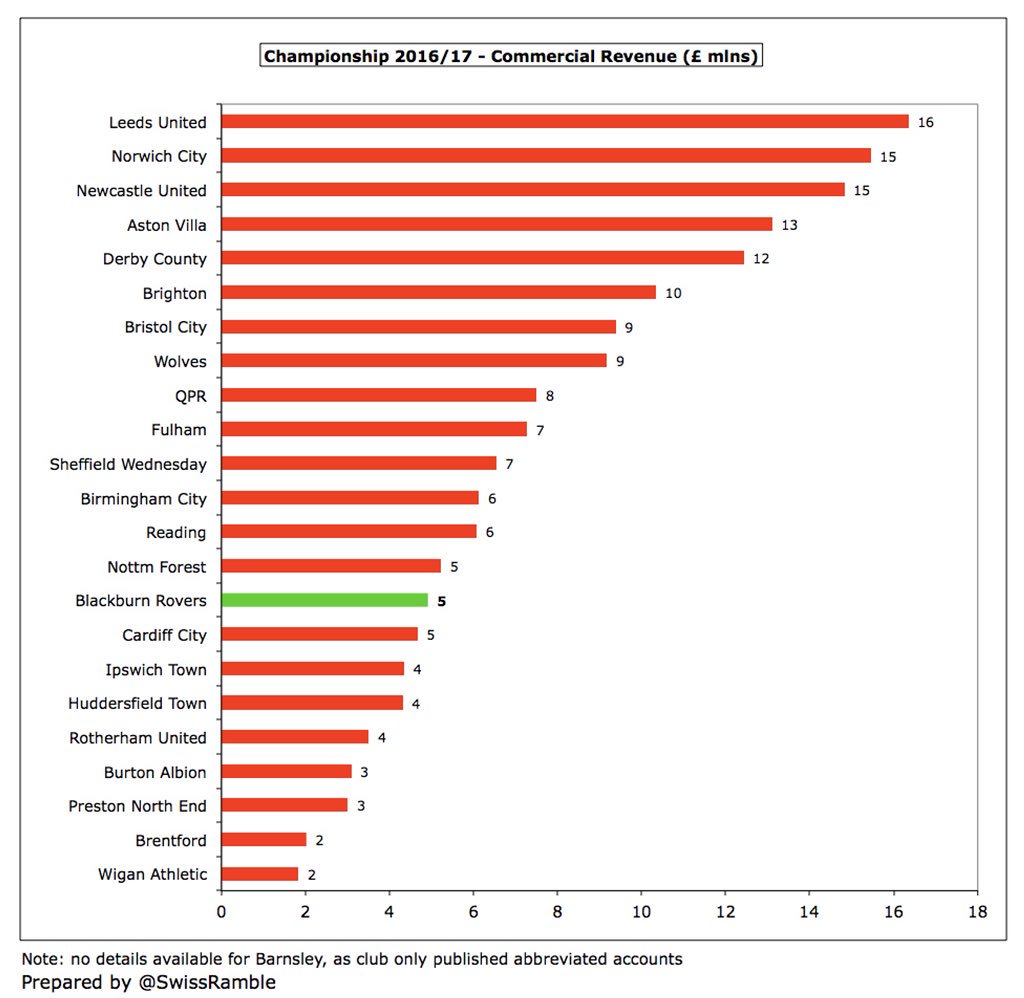

#Rovers commercial income fell £0.1m (3%) to £4.9m. This is in the lower half of the Championship, but around the same as Cardiff, who have just won promotion to the top flight. Since 2015/16 Blackburn have had Dafabet as shirt sponsor and Umbro for kit supplier.

A note in the accounts states that #Rovers received £3.7m from Venky’s for “costs incurred and services provided”. On the assumption that this is reported within commercial income, that would suggest that the remaining sponsorships are not overly lucrative.

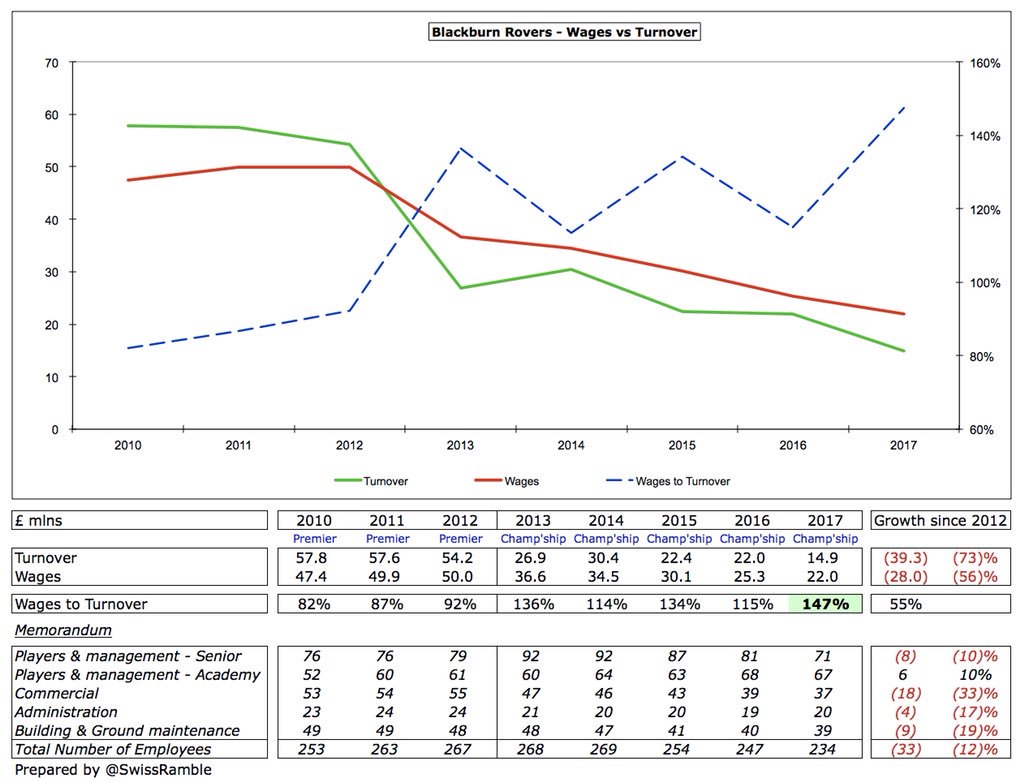

#Rovers wage bill decreased £3.4m (13%) to £22.0m. As Mike Cheston said, “The club has responded to reduced revenue levels by implementing reductions in wages.” These have more than halved since Premier League days, but the wages to turnover ratio was still up from 115% to 147%.

#Rovers £22m wage bill was in the bottom half of the Championship, way behind Newcastle £80m, Villa £61m & Norwich £55m. Also below some clubs not receiving parachute payments, such as Derby £35m, Brighton £31m, #SWFC £29m and #NFFC £29m.

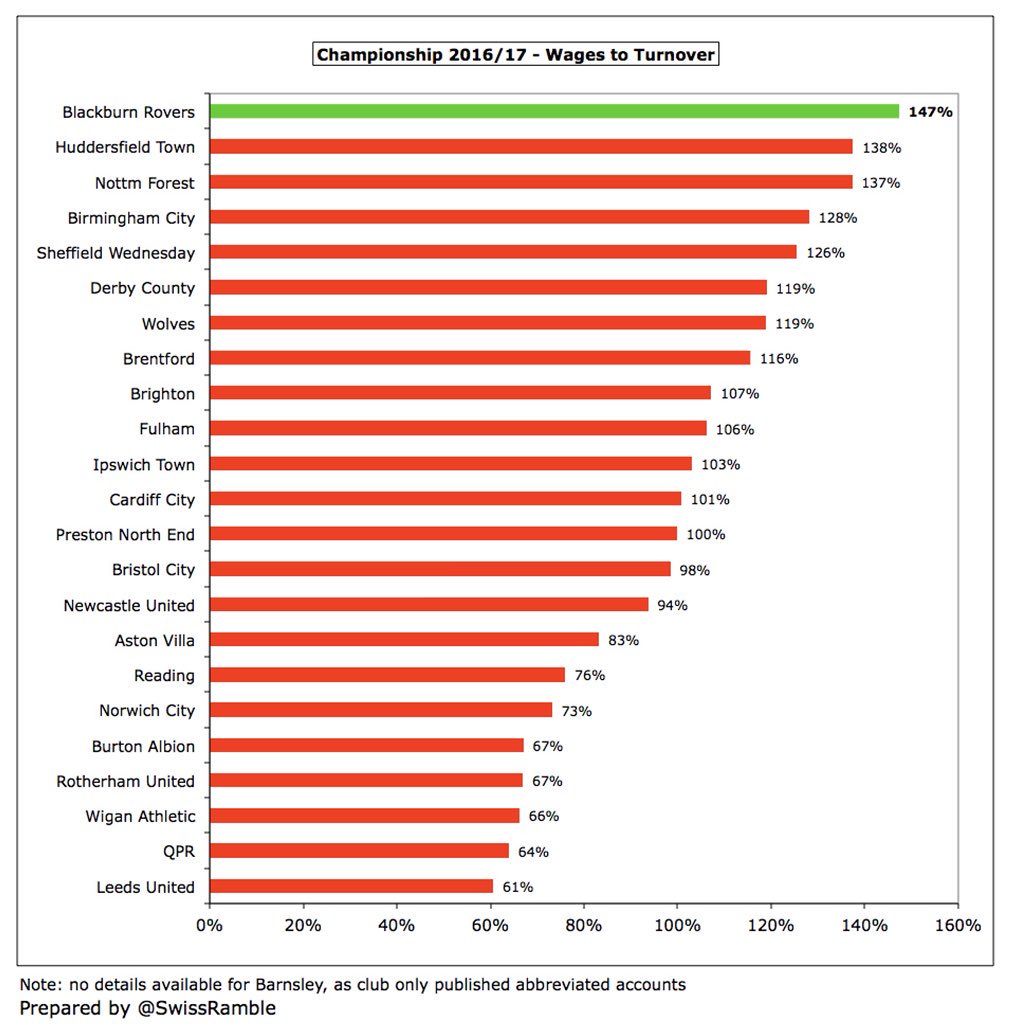

This highlights #Rovers dilemma, as their wages to turnover ratio of 147% was the highest (worst) in the Championship, despite the relatively low wage bill. That said, no fewer than 13 clubs in this division have ratios above 100%. Old, expensive contracts have largely finished.

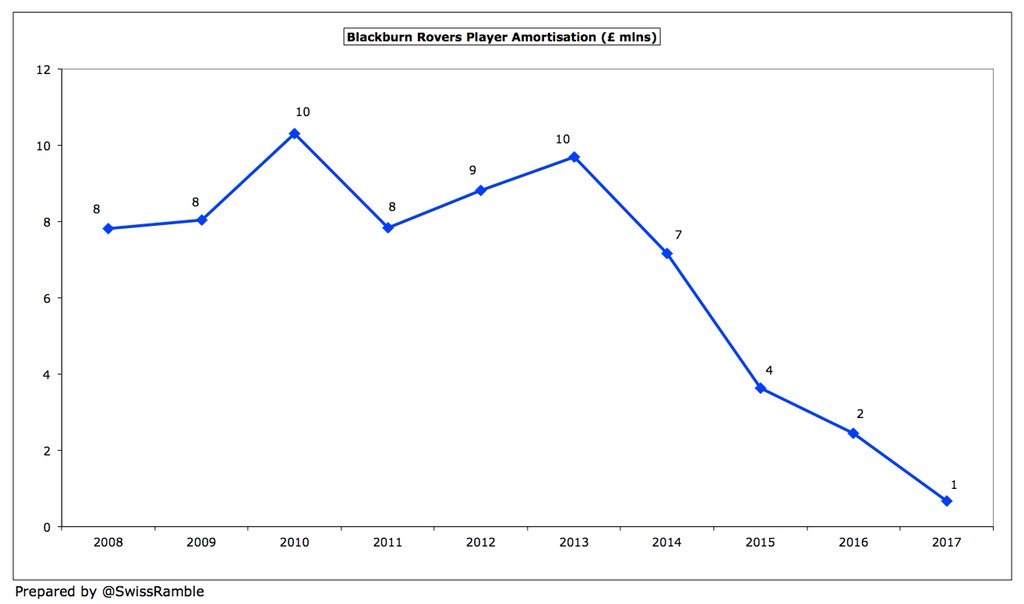

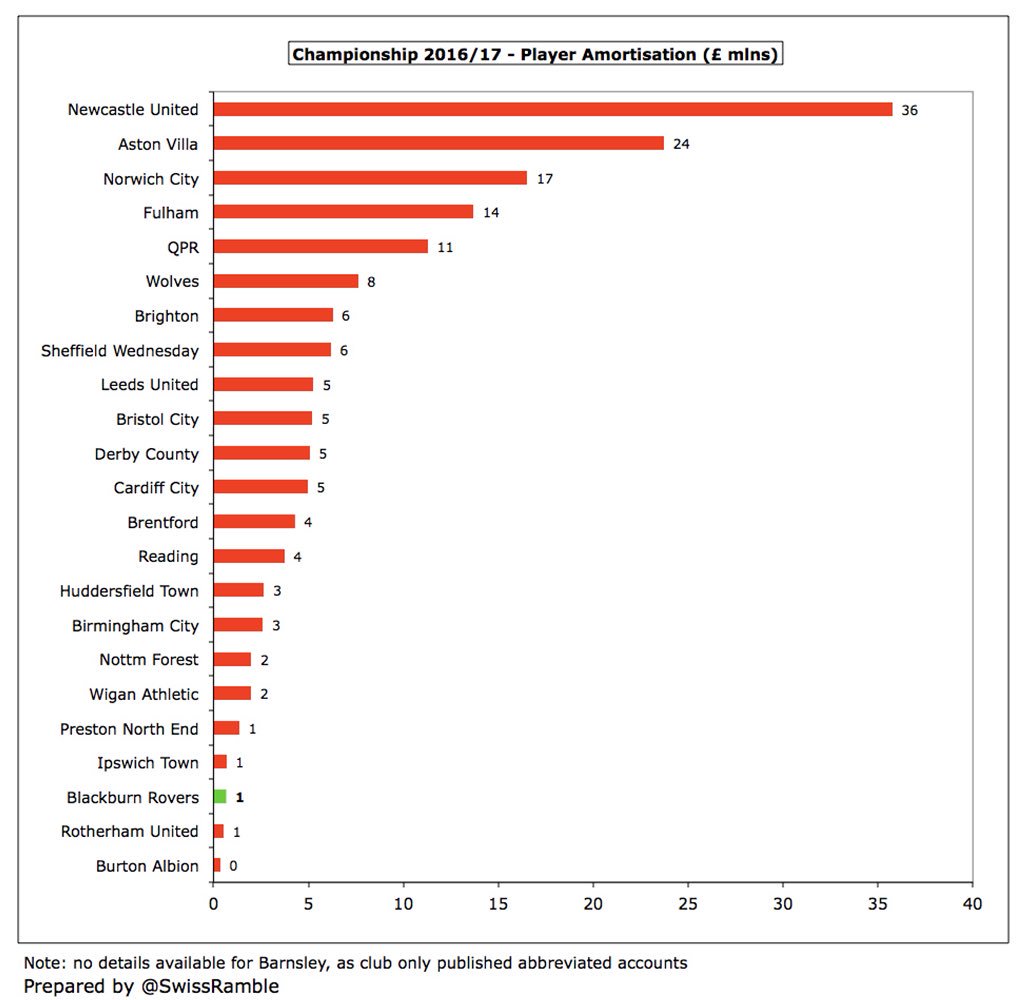

#Rovers player amortisation fell £1.8m (73%) to just £0.7m, continuing the decrease from £10m in 2013, the first year in the Championship following relegation. This is a reflection of the lack of recent investment in the playing squad.

Unsurprisingly, this was one of the lowest player amortisation expenses in the Championship, only higher than Rotherham United and Burton Albion. For some more context, it’s tiny in comparison to big-spending Newcastle £36m, Villa £24m and Norwich £17m.

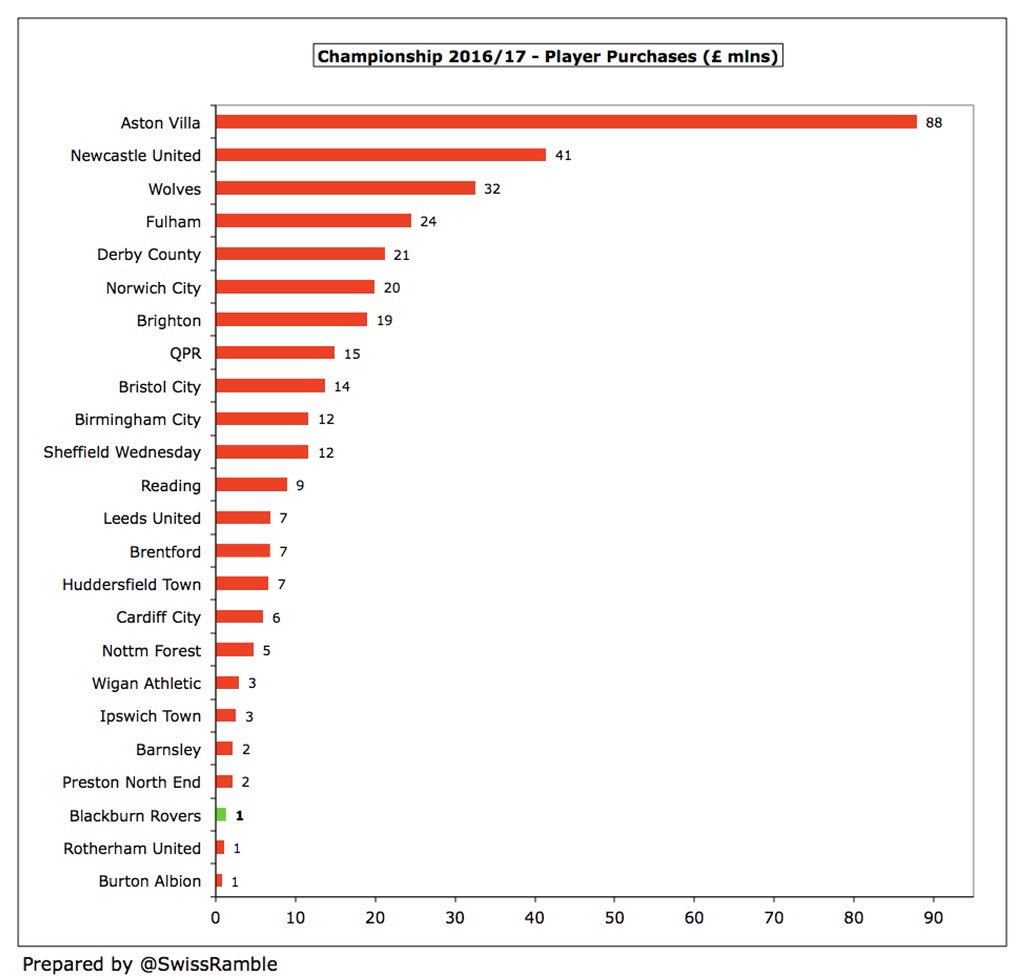

Although many players arrived at #Rovers in 2016/17, most were free transfers or loans. The club only spent £1m, so were massively outspent by clubs like Villa £88m, Wolves £32m & Fulham £24m. In fact, total spend of £8m in last 4 years combined is half of £16m spent in 2012/13.

Since relegation #Rovers averaged annual £5m net sales, less than last 4 years in top flight. However, this is because they have less valuable players to sell (average sales down from £19m to £8m), while gross spend has shrunk from £10m to £4m, partly due to FFP transfer embargo.

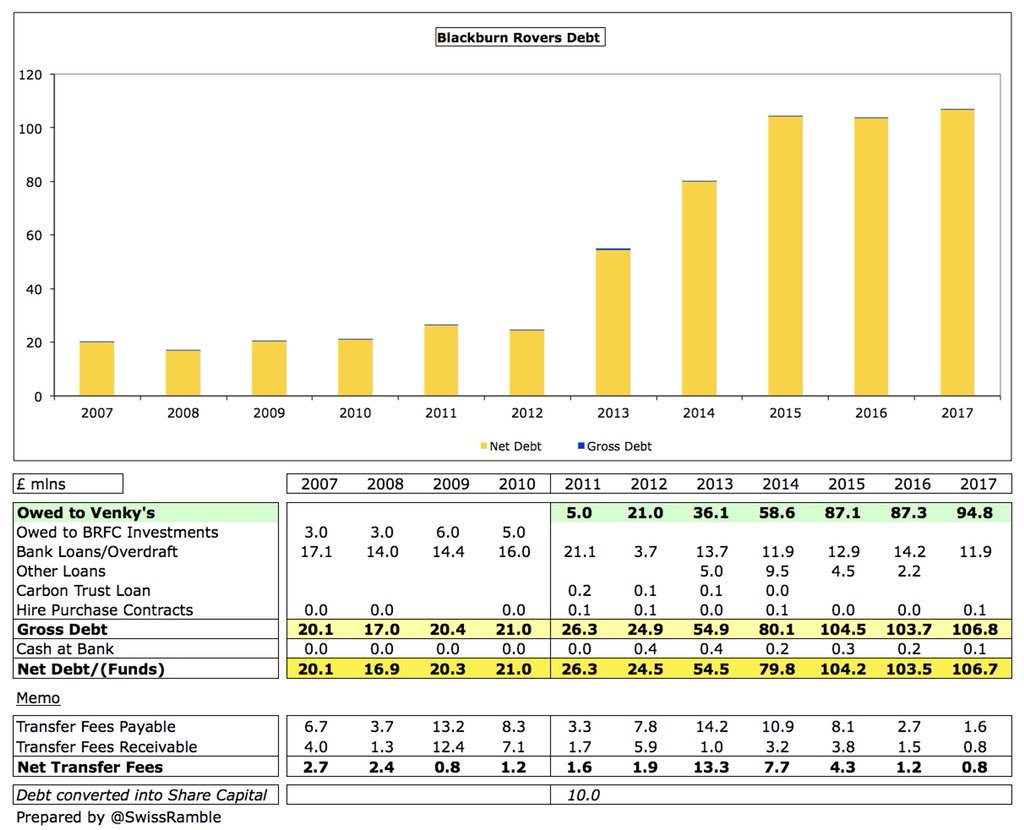

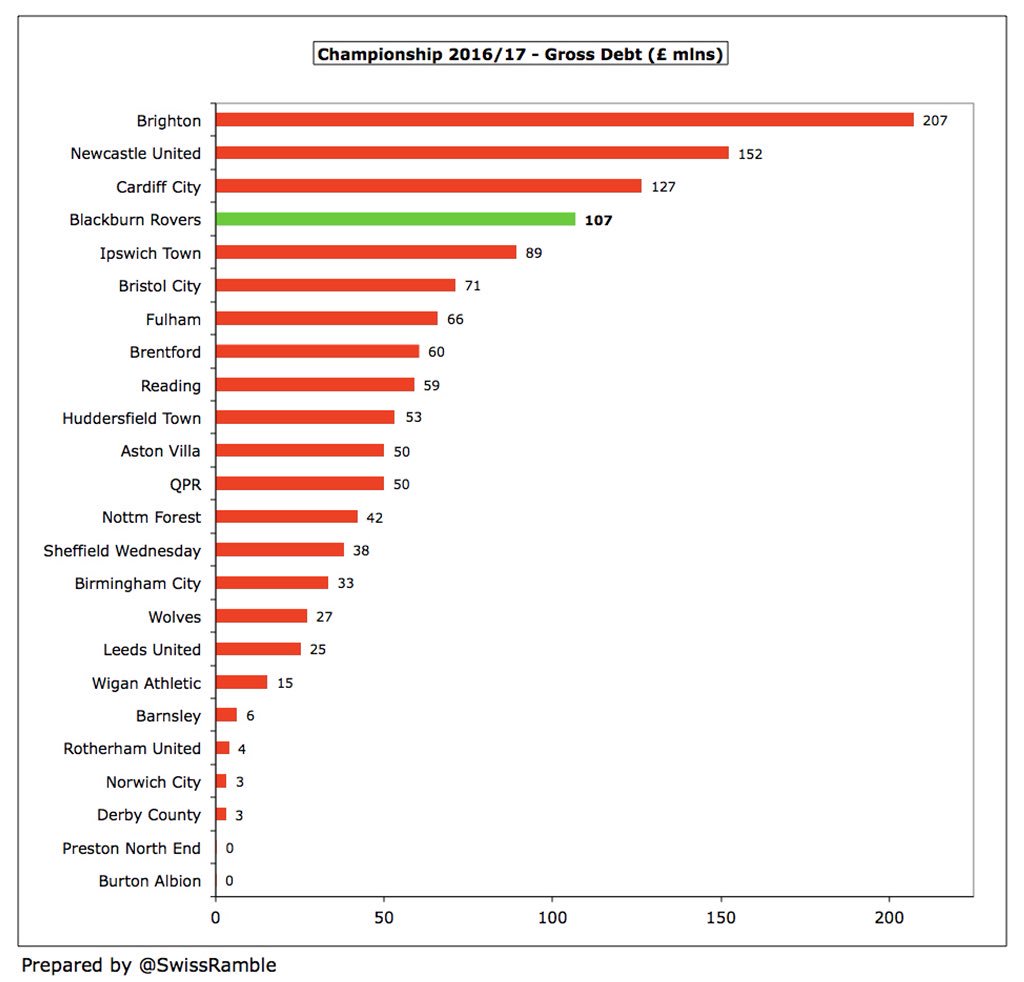

#Rovers debt increased from £104m to £107m, five times as much as the £21m that Venky’s inherited. The majority £95m is owed to the owners, up from previous year’s £87m, though there is also a £12m bank overdraft.

#Rovers £107m debt was the 4th highest in the Championship, below 3 clubs that have since been promoted to the Premier League: Brighton £207m (new stadium & training ground), Newcastle £152m and Cardiff City £127m.

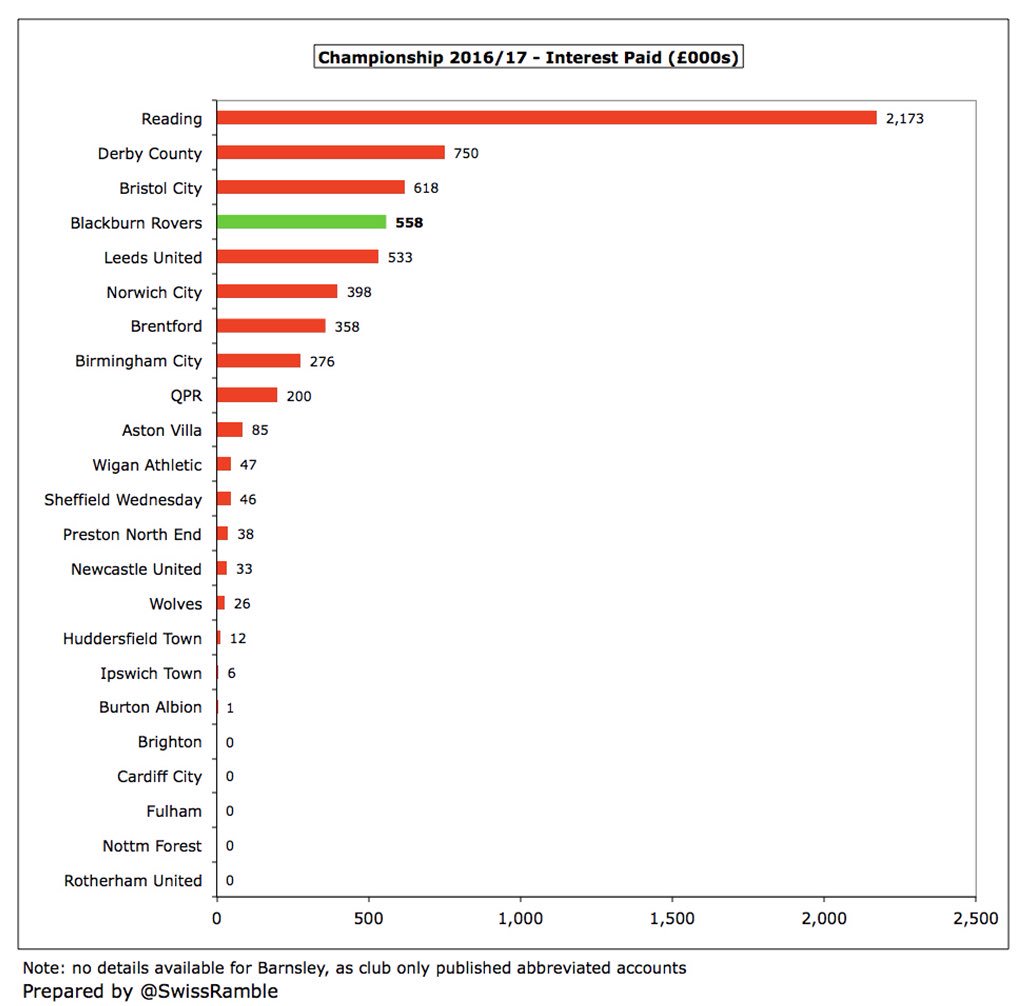

Although debt is high in the Championship, most is provided by owners who charge little or no interest. In this way, Venky’s loans are interest-free with no fixed date for repayment. However, #Rovers did pay £558k interest in 2016/17 on the overdraft (2.65% over 6 month LIBOR).

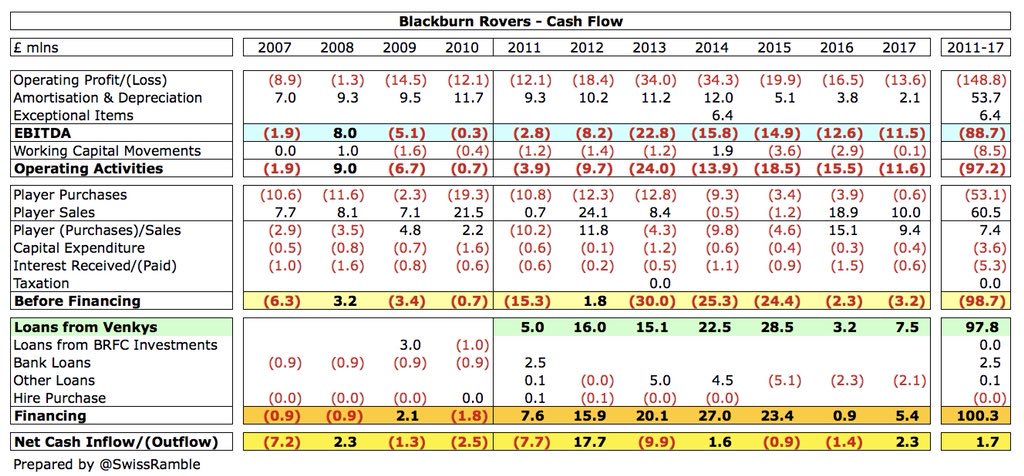

For the last 2 years #Rovers have largely compensated significant operating losses with player sales. After paying interest and other loans, the cash shortfall has been made good by additional loans from Venky’s.

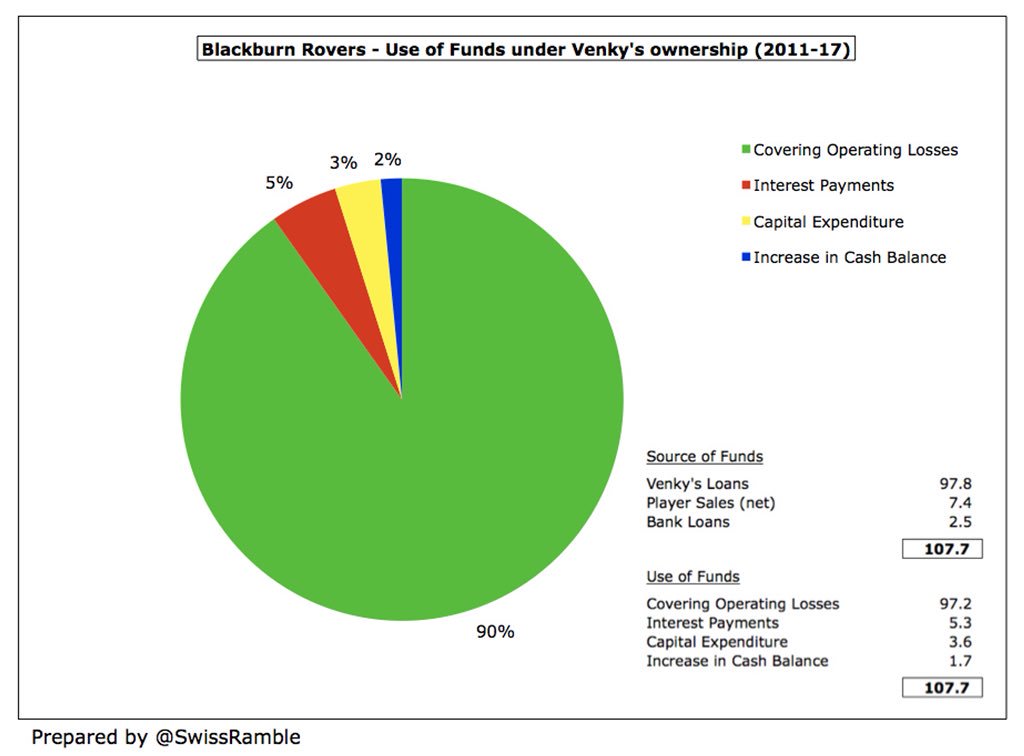

Since Venky’s bought the club, they have been #Rovers only real source of funds (though some money has come from player sales in recent years). This has essentially been used to cover £97m operating losses + £5m interest payments. Less than £4m invested in infrastructure.

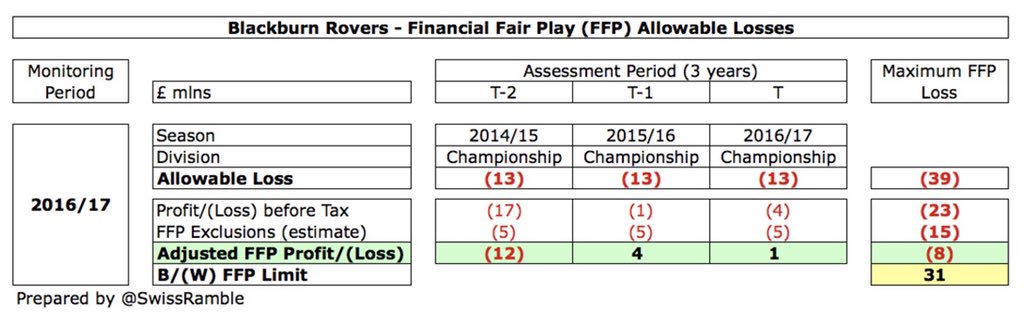

#Rovers were FFP compliant in 2016/17, as total losses were well within FFP £39m limit for the 3-year monitoring period, even before deducting allowable expenses for academy, community and infrastructure. In the past we’re given transfer embargo after breaching limit in 2013/14.

There is little doubt that Venky’s ownership has been fairly disastrous, despite them providing significant funds, as #Rovers went from an established Premier League club to League One. The immediate return under Mowbray gives some hope, but difficult to believe in these owners.

• • •

Missing some Tweet in this thread? You can try to

force a refresh