Now that #crypto is lush with cash and talent, focused execution will separate the wheat from the chaff.

Users, developers and investors will only wait so long. Being a few months behind schedule is tolerable, but beyond that eyes start to wander to better executing alternatives.

Those alternatives then gain mindshare, creating a self-reinforcing cycle as user, developer and investor momentum builds. If the prior leader continues to not execute, this momentum can achieve escape velocity where the prior leader becomes the alternative and vice-versa.

I’m not pointing fingers at any particular #cryptonetwork. Lack of execution is an epidemic throughout the space right now given how distracting 2017 was. As a result, teams that do execute standout.

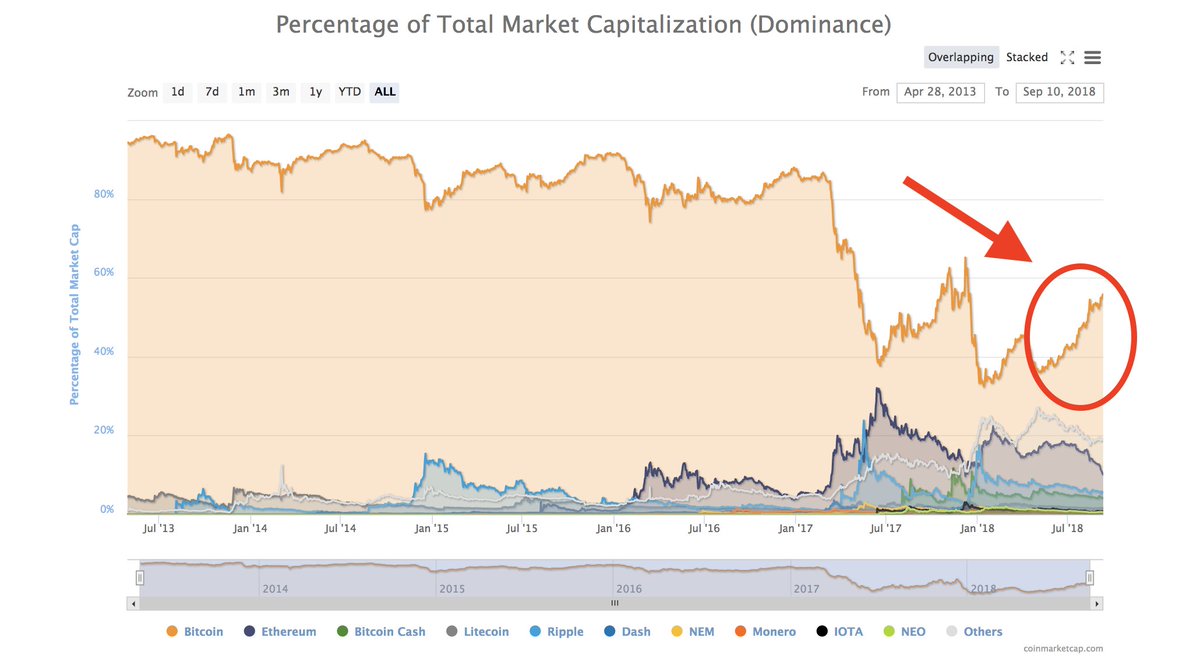

Given the small scale adoption of current crypto systems it’s too early to say anyone has locked down a market segment already, including #bitcoin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh