Partner @placeholdervc; co-author #Cryptoassets 📔; formerly led crypto @ARKinvest. Xeets not financial advice. Disclaimer: https://t.co/Xp0VJsuufc

2 subscribers

How to get URL link on X (Twitter) App

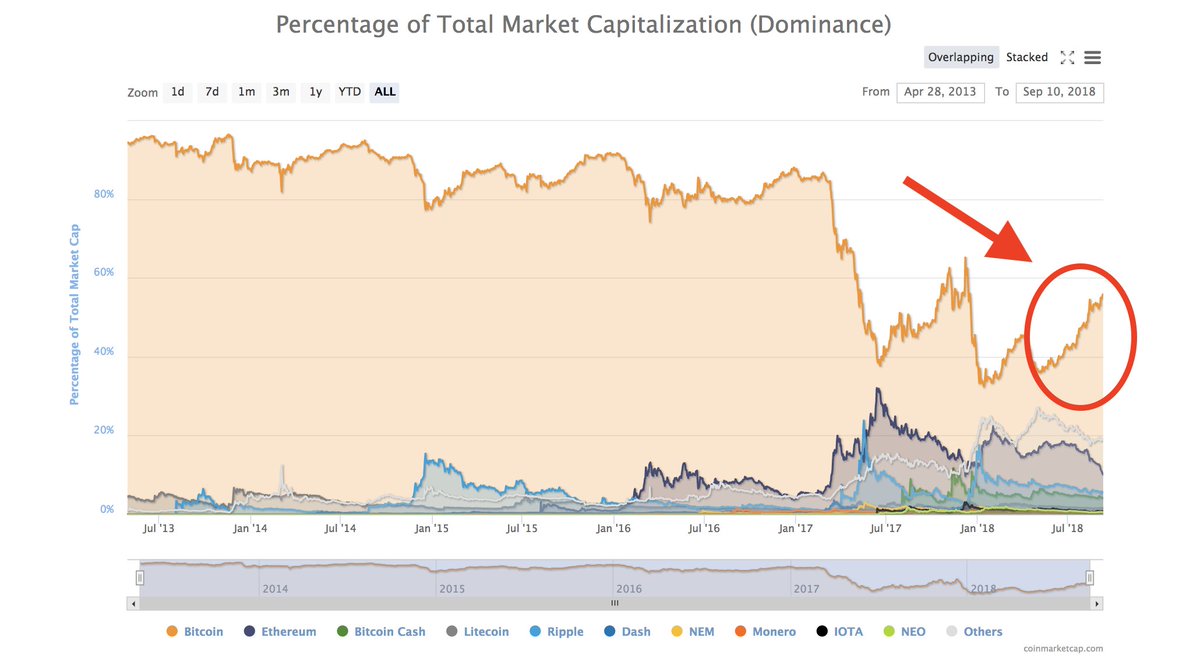

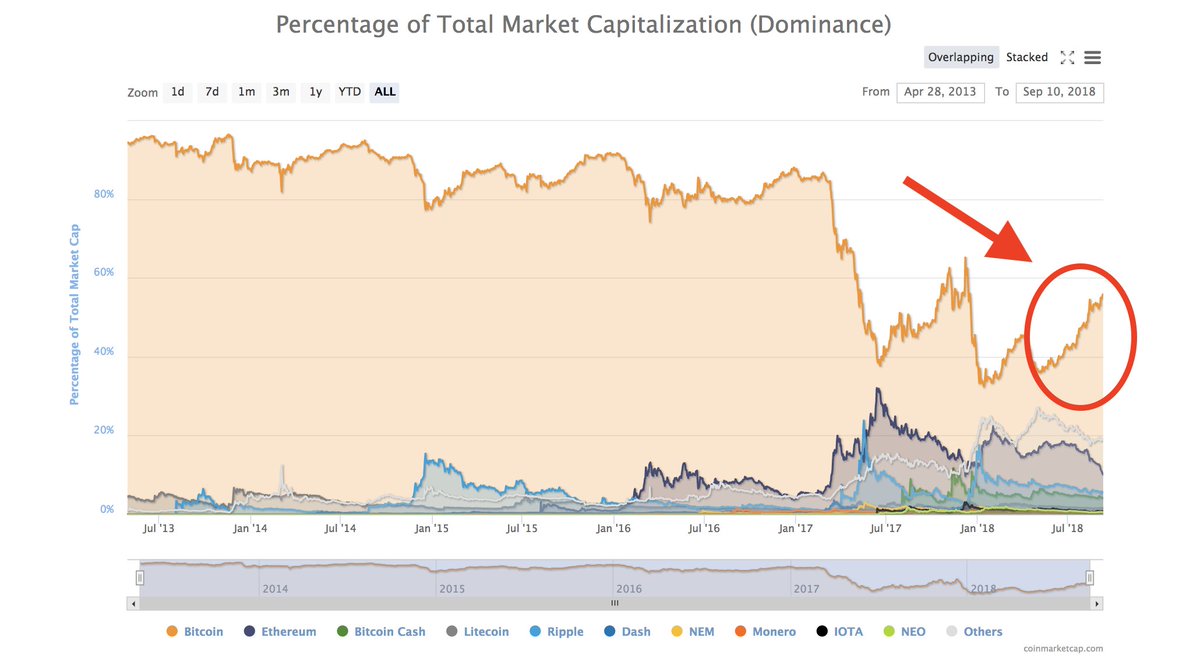

https://twitter.com/NodarJ/status/10374323094888038402/ While a drop in velocity may seem problematic, it’s actually what you’d expect from a *reserve currency.*

2/ The interesting thing with outstanding short positions as an indicator is it can simultaneously be interpreted in opposite ways.

2/ The interesting thing with outstanding short positions as an indicator is it can simultaneously be interpreted in opposite ways.

"DaC encourages workers to find dignity in leisure or in human interactions outside the digital economy, while DaL views data work as a new source of 'digital dignity.'" papers.ssrn.com/sol3/papers.cf…

"DaC encourages workers to find dignity in leisure or in human interactions outside the digital economy, while DaL views data work as a new source of 'digital dignity.'" papers.ssrn.com/sol3/papers.cf…

For example, @bittrex #28, @Poloniex #38 -- never used Bitfinex or that would've been my top 10-er.

For example, @bittrex #28, @Poloniex #38 -- never used Bitfinex or that would've been my top 10-er.

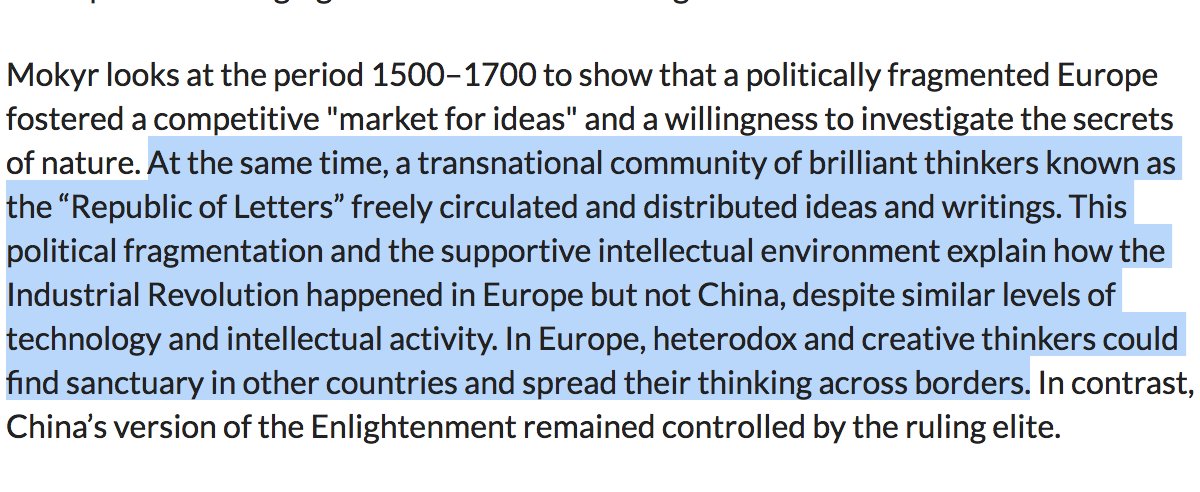

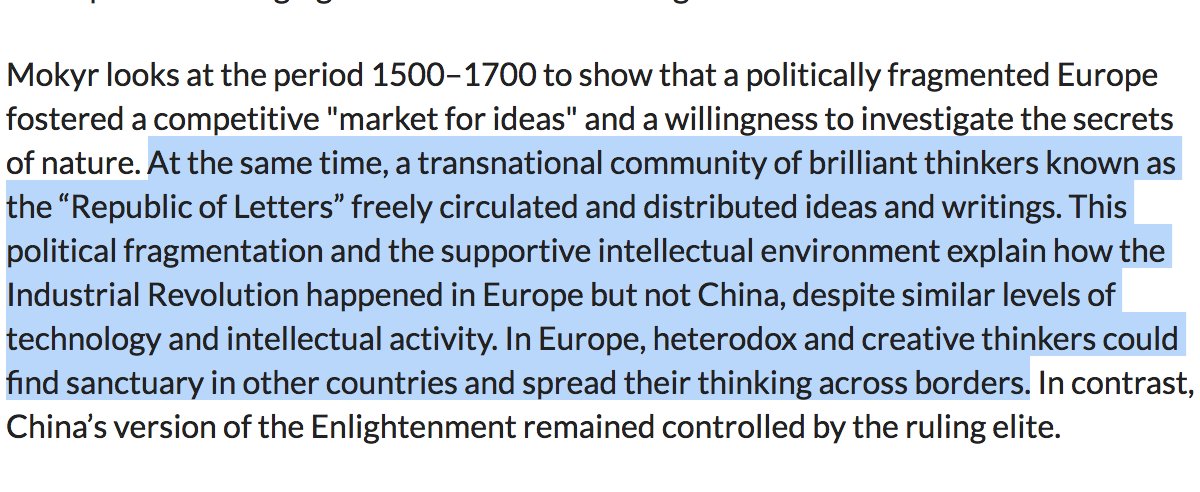

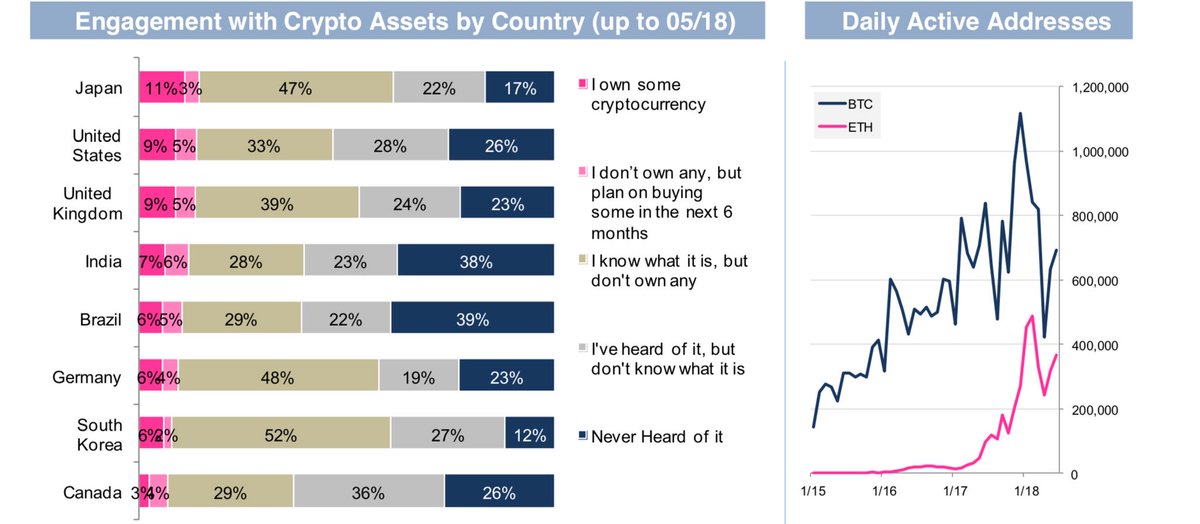

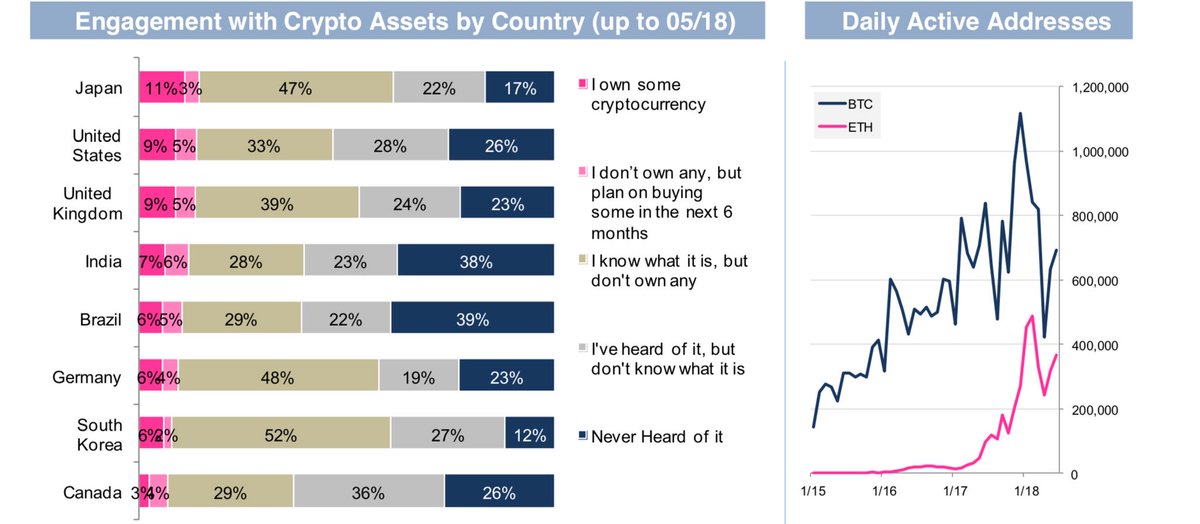

2/ Global diversification of thinkers is key for #crypto as it breeds resilience to any nation's attempt at intellectual censorship.

2/ Global diversification of thinkers is key for #crypto as it breeds resilience to any nation's attempt at intellectual censorship.

2/ Succinct narrative of 3 waves of #crypto funding:

2/ Succinct narrative of 3 waves of #crypto funding:

2/ Median #crypto returns by size:

2/ Median #crypto returns by size:

original link didn't work, this one does: continuations.com/post/175471097…

original link didn't work, this one does: continuations.com/post/175471097…