Discover and read the best of Twitter Threads about #Crypto

Most recents (24)

11/

Sounds good, right? But there's a catch... This change is FANTASTIC for the uber-wealthy.

For the 'merely' affluent taxpayer though? Not so much😕

Specifically, whereas Biden's proposed top rate didn't kick in until AGI exceeded $1 million, the bill would "re-align"...

Sounds good, right? But there's a catch... This change is FANTASTIC for the uber-wealthy.

For the 'merely' affluent taxpayer though? Not so much😕

Specifically, whereas Biden's proposed top rate didn't kick in until AGI exceeded $1 million, the bill would "re-align"...

12/

..the capital gains brackets with the ordinary income tax brackets (make them start at the same $ amounts).

Great for remembering where brackets begin, but...

...it means the top cap gains bracket would start at 'just' $400k for single filers and $450k for joint filers...

..the capital gains brackets with the ordinary income tax brackets (make them start at the same $ amounts).

Great for remembering where brackets begin, but...

...it means the top cap gains bracket would start at 'just' $400k for single filers and $450k for joint filers...

13/

So if you're income is $4 million and consists of a lot of capital gains, you have to be feeling pretty good right now.

But if your income is between $400k/$450k and $1 million and you have capital gains, you'd MUCH prefer the Biden plan to this bill (at least for this)

So if you're income is $4 million and consists of a lot of capital gains, you have to be feeling pretty good right now.

But if your income is between $400k/$450k and $1 million and you have capital gains, you'd MUCH prefer the Biden plan to this bill (at least for this)

0.0/ ETF FAQ.

My answers to some common questions about the SEC & the approval process for #bitcoin & #crypto ETFs. If you have a question I didn't address, feel free to ask here & I'll add on.

Thread.

My answers to some common questions about the SEC & the approval process for #bitcoin & #crypto ETFs. If you have a question I didn't address, feel free to ask here & I'll add on.

Thread.

1.0/ Q: "Who decides whether to approve or deny an ETF?"

The initial decision is made by SEC staff in the Division of Trading & Markets. If the staff denies an ETF proposal, the ETF sponsor can file an appeal, which will be decided by all of the SEC Commissioners.

The initial decision is made by SEC staff in the Division of Trading & Markets. If the staff denies an ETF proposal, the ETF sponsor can file an appeal, which will be decided by all of the SEC Commissioners.

2.0/ Q: "What's the process & timeline for the SEC to decide on an ETF?"

When a proposal is filed, the SEC publishes it in the Federal Register (the government's official journal) & solicits comments from the public. It then has 45 days to approve, deny, or delay a decision.

When a proposal is filed, the SEC publishes it in the Federal Register (the government's official journal) & solicits comments from the public. It then has 45 days to approve, deny, or delay a decision.

Friends this week calling me out of nowhere to ask about how to invest in #cannabis stocks. The same happened with #crypto in Dec/17- Jan/18.

To be fair, calls last year started rolling in waves in early December ... $XRP was still trading in the cents back then.

In January $XRP was briefly worth more than JP Morgan chase $JPMC, the largest bank in the world. $TLRY is now 1/6 the size of Altria (Philip Morris). It can continue going up for a while with all the media attention and retail investors diving in FOMO.

A prolonged bear market is the best thing #crypto could've asked for to expose projects that never planned to deliver in the first place.

The fumes of exchange listings, prominent partnerships, and events + conference appearances will only carry a #cryptonetwork so far.

The only way to survive over the long haul is to build things people use, and if you have a #cryptoasset, making sure the demand-side and/or supply-side relies on it to access/provision the service.

Provocative exploration of #crypto valuations that goes a layer deeper than all prior works, starting with the question of: “what do we value?” google.com/url?q=https://…

2/ #Cryptoassets will allow us “to develop multiple indices of valuation that reflect different social priorities the way that profit price reflects capitalism’s priorities.”

3/ The group of professors & thinkers that put together the piece will be holding a #cryptoeconomics workshop at @NYUStern on 9/26, event info here: medium.com/econaut/crypto…

0.0/ A lot of #crypto news today from the securities enforcement world:

- DOJ goes to trial on ICO-related securities fraud charges

- SEC charges broker-dealer & hedge fund with securities violations

- FINRA charges broker with fraud & dealing unregistered securities

Thread.

- DOJ goes to trial on ICO-related securities fraud charges

- SEC charges broker-dealer & hedge fund with securities violations

- FINRA charges broker with fraud & dealing unregistered securities

Thread.

1.0/ Let's start with DOJ. Today's news relates to a federal criminal case in the Eastern District of New York: United States v. Maksim Zaslavskiy.

Zaslavskiy was charged in November 2017 on three counts of securities fraud in connection with two ICOs: "REcoin" and "DRC."

Zaslavskiy was charged in November 2017 on three counts of securities fraud in connection with two ICOs: "REcoin" and "DRC."

1.1/ DOJ says Zaslavskiy lied to investors when he sold these ICOs.

According to the indictment, he told investors that both coins were backed by real world assets: he allegedly claimed REcoin was backed by real estate & DRC was backed by diamonds.

According to the indictment, he told investors that both coins were backed by real world assets: he allegedly claimed REcoin was backed by real estate & DRC was backed by diamonds.

Apropos of nothing, here is a thread with links to #crypto guidance from the US Treasury's Financial Crimes Enforcement Network, or #FinCEN

July 21, 2011, FinCEN clarifies what a money service business means gpo.gov/fdsys/pkg/FR-2…

March 18, 2013, FinCEN issues guidance with respect to using, exchanging, and administering virtual currency fincen.gov/sites/default/…

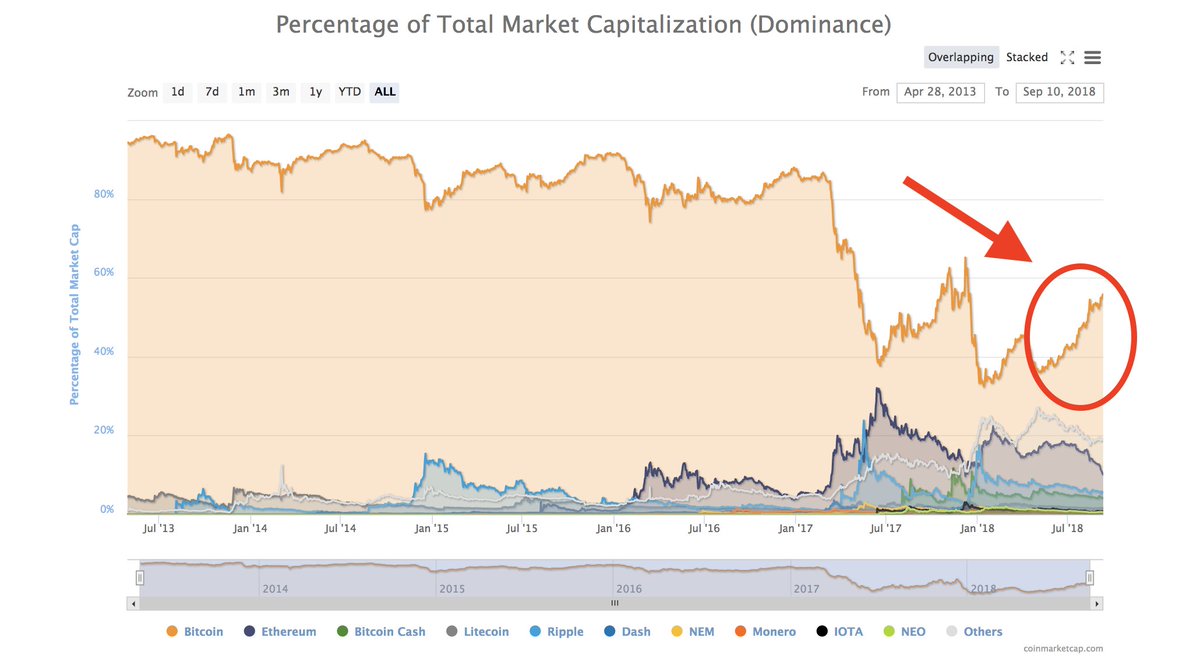

1/ Get ready for a predictable #crypto pattern: in the coming months, we will see an increasing number of #Bitcoin maximalists tormenting “altcoin investors” for straying from the mother ship.

2/ The maximalist drum will get louder as we go deeper into the bear market, with #bitcoin falling less than most other coins, and its dominance index growing. coinmarketcap.com/charts/#domina…

3/ #Bitcoin is the benchmark after all, the market beta of crypto, with most everything oscillating at a higher amplitude than $BTC.

Looking to #invest in the #Uranium space? 🌊🚢 For the average #investor the choices are limited in this tiny niche sector with only ~60 companies left standing, compared to over 500 during last #U3O8 Bull market. In this thread I will try to lay out some of your options... 🗂️

If you want lowest risk #investment in #uranium then best option is an unleveraged exchange-traded Fund that holds Physical #U3O8. ⚛️ In North America that's Uranium Participation (Canada: $U US: $URPTF) & in UK that's Yellow Cake PLC on London Stock Exchange (#AIM: $YCA) ✍🏼

1/ Per the analysis below, #bitcoin’s velocity thus far in 2018 has been ~3, about half that of 2016 and 2017.

2/ While a drop in velocity may seem problematic, it’s actually what you’d expect from a *reserve currency.*

3/ With a reserve currency, as confidence falls market wide more people will hold onto the reserve asset (in this case, #bitcoin), dropping its velocity.

Short/immediate term bullish. Mid term bearish. Long term bullish. Bear market is not even remotely over. #crypto

7150 is next resistance. As clear as a Buenos Aires summer sky. The plan is for 7150 to get run over. Exit then. I do not short resistance. Below 6850 either flat or short.

I'm in BTC and ETH trades at the moment. Enjoying the green but nothing spectacular. Alts are flying. Rarely trade alts, although sometimes do so. For two reasons: lack of time, and liquidity too low for my taste. That said when I trade alts I use the bitcoin chart as my guide.

1/ For years, people have been waiting and hoping for crypto's "Netscape" moment. The gateway to the web that brought the internet to the main stream.

IMHO, looking for the Netscape for the #crypto space is not a relevant or applicable analogy. Here's why...

IMHO, looking for the Netscape for the #crypto space is not a relevant or applicable analogy. Here's why...

2/ The way people imagine crypto's "Netscape moment" is very literal: as a window, gateway, or browser (just like Netscape) to easily acquire, save, and use crypto and access the decentralized web.

3/ But that sounds a lot like a wallet and exchange, which already exists. And yet, even with these onramps and "browsers" into crypto, we haven't had that "Netscape moment" people are hoping for in terms of mass adoption.

"It's the future of money because it's censorship resistant, deflationary and decentralized, so the da gov't can't print it! Sooo your savings are safe from inflation... OMG STORE OFF VAULEEE!!1 NOO REGULATIOOON"

Yeah. Tether.

But more importantly ... /1

Yeah. Tether.

But more importantly ... /1

Ya can take a boulder, paint some wheels on it, and call it "a futuristic automobile". Your newly invented "car", will be outside traffic laws, hence out of gov't control. GREAT! More power to you! ... /2

You've now become the weirdo pretending to drive on the interstate, while sitting on a painted boulder and screaming to everyone passing by: "Hey ignorant no-coiner! come and see the amazing future of unhindered driving!"

To understand where it all went downhill for you ... /3

To understand where it all went downhill for you ... /3

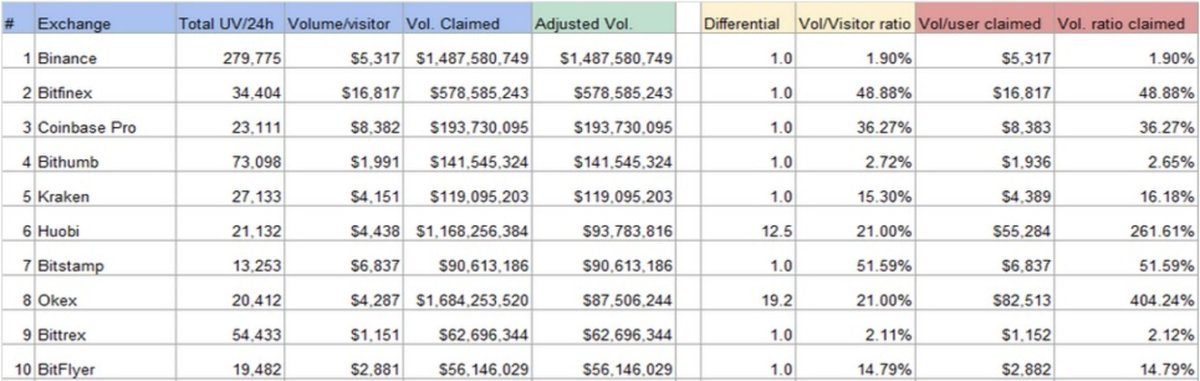

The exchange game is a brutal one. None of the #crypto exchanges I "grew up" with are even in the top 10 anymore, few are in the top 25. coinmarketcap.com/rankings/excha…

As people pointed out in the comments, wash trading has always been a problem in #crypto.

The "Blockchain Transparency Institute" developed a new system "to provide better transparency for the crypto sphere on true exchange volumes." blockchaintransparency.org/reports (h/t @MGilm0re)

The "Blockchain Transparency Institute" developed a new system "to provide better transparency for the crypto sphere on true exchange volumes." blockchaintransparency.org/reports (h/t @MGilm0re)

Proud to be among a growing list of @UCBerkeley @BerkeleyHaas leaders in #blockchain & #crypto. Pls add others! Go Bears!

@dawnsongtweets (Oasis)

@adamludwin (Chain)

@veradittakit (Pantera)

@MaxFangX (B@B, Dekrypt)

@ronenkirsh (B@B, Dekrypt)

@AshleyLannquist (MOBI, WEF)

...?

@dawnsongtweets (Oasis)

@adamludwin (Chain)

@veradittakit (Pantera)

@MaxFangX (B@B, Dekrypt)

@ronenkirsh (B@B, Dekrypt)

@AshleyLannquist (MOBI, WEF)

...?

Crypto moves of July & August are something to laugh about and make market participants throw everything but technicals & momentum out the window.

1st rally on fakenews about an ETF that won't happen

2nd crash on an ETF rejection that was no surprise

3rd crash on an ETF postponement that was no news

4th rally on failure to tank on ETF rejections that were no news

All very rational. #crypto

2nd crash on an ETF rejection that was no surprise

3rd crash on an ETF postponement that was no news

4th rally on failure to tank on ETF rejections that were no news

All very rational. #crypto

Should replace there "was not news" by "should have been no news". The market's inability to process information efficiently is one of the key points.

As of yet, no #cryptoasset is too big to fail-- not even #bitcoin.

Too big to fail applies in 2 areas

1) #Cryptoland, where the question is: will crypto be crippled if a core network suffers catastrophic failure (or slow fade 2 obsolescence)

2) Macro-land, where the question is: will global economies be severely affected if X #crypto goes down

1) #Cryptoland, where the question is: will crypto be crippled if a core network suffers catastrophic failure (or slow fade 2 obsolescence)

2) Macro-land, where the question is: will global economies be severely affected if X #crypto goes down

3/ In case #1, there's no doubt #cryptoland would go through a period of heavy puking if #Bitcoin or #Ethereum went down, and while a few #buidlers would defect, the majority would stay and adapt.

1/ In the early 2000s, @ideo pioneered a process for venture development referred to as the "3 Circles" of Desirability, Viability & Feasibility (ideou.com/blogs/inspirat…). #crypto has a long way to go across all, but right now it is really struggling with the first: Desirability.

2/ Desirability is the question of "Do people want it?" and asks, what is the unique value proposition? How do people hear about, learn, try, buy, use, love, and share it? What are its functional but also emotional benefits? How is it 10x better than the current user experience?

1/ What an honor to be part of this lively debate about #bitcoin vs #WallSt (incl #ETFs & @Bakkt) w/ @GamerAndy, @aantonop, @JonathanMohan & @S_Murphy_PhD. Mainstreaming, rehypothecation, price suppression, privacy, early adoption, Trojan horses, Black Monday, custodian theft...

2/ ...hear @aantonop & I talk about rehypothecation coming to #bitcoin & #crypto, whether it's legal vs fraud vs merely unethical, how it's a form of #fractionalreservebanking, how it relates to @OverstockCEO's prior discussions of #WallSt's "bezzle" & how big that bezzle is...

🔥 HOT TAKE 🔥 OVER HALF OF THE REMAINING NON-MINTED BITCOIN ARE ALREADY SPOKEN FOR.

Keep reading before you tell me I’m wrong.

👇👇👇

medium.com/coinshares/hal…

Keep reading before you tell me I’m wrong.

👇👇👇

medium.com/coinshares/hal…

2/ When I meet with legacy investors I often get asked “who in the world owns this stuff?” This is usually followed by “ok, and who will?”

What these people *really* want to understand is potential future demand, or the classic concept of Total Addressable Market (TAM).

What these people *really* want to understand is potential future demand, or the classic concept of Total Addressable Market (TAM).

3/ A few weeks ago I came across this survey from @ING_news -->

It caught my eye because for the first time I can remember - due to results and sample size (14,828) - I have what I need to build a data-driven base to start determining potential TAM.

It caught my eye because for the first time I can remember - due to results and sample size (14,828) - I have what I need to build a data-driven base to start determining potential TAM.

0/ Let's talk about @Ripple litigation & the slow journey toward answering the question: "is #XRP a security?"

Before you ask, I don't plan to discuss my own opinion on this issue. I'd rather leave that to the courts, as I'll explain here.

Thread.

Before you ask, I don't plan to discuss my own opinion on this issue. I'd rather leave that to the courts, as I'll explain here.

Thread.

1/ Ripple is currently defending four cases in California courts:

- Two state cases in San Mateo County, brought by plaintiffs Zakinov & Oconer

- Two federal cases in the Northern District of California, brought by Coffey & Greenwald

All four cases are securities class actions.

- Two state cases in San Mateo County, brought by plaintiffs Zakinov & Oconer

- Two federal cases in the Northern District of California, brought by Coffey & Greenwald

All four cases are securities class actions.

2/ The plaintiffs allege basically the same thing: XRP is a security and Ripple violated state & federal law by failing to register it before offering, promoting, and selling it to retail investors.

If you want more details, read the Zakinov complaint:

coindesk.com/another-invest…

If you want more details, read the Zakinov complaint:

coindesk.com/another-invest…

1/ Should we be that surprised with what's going on right now with #ETH and ICOs generally? This is what happens when you have $10B+ raised via ICOs in the last 12 months, no treasury management, no product (or users), and liquid/publicly traded market caps and "shares" (tokens).

2/ #crypto is great for the digital world, but for now (and some time), teams and their employees need fiat to pay for real, non-digital things like rent, food, services, transportation, etc.

3/ I expect this decline to last for another 3-6 months as a growing pipeline of teams both (A) have their non-fiat runways cut by 60-80%, which, if they raised enough for 2 years, is now only 4-9 months, and (B) need to extend their fiat runways by another 12-24 months to ship.