Discover and read the best of Twitter Threads about #stocks

Most recents (6)

Looking to #invest in the #Uranium space? 🌊🚢 For the average #investor the choices are limited in this tiny niche sector with only ~60 companies left standing, compared to over 500 during last #U3O8 Bull market. In this thread I will try to lay out some of your options... 🗂️

If you want lowest risk #investment in #uranium then best option is an unleveraged exchange-traded Fund that holds Physical #U3O8. ⚛️ In North America that's Uranium Participation (Canada: $U US: $URPTF) & in UK that's Yellow Cake PLC on London Stock Exchange (#AIM: $YCA) ✍🏼

POWELL: THERE DOESN'T SEEM TO BE ELEVATED RISK OF OVERHEATING - pump it up #stocks

Gold feeling it too. Nothing like a Fed driven nudge.

First Trump now the Fed nudging the USD down. Good news for EM currencies and stocks.

This day in 1935, Wiley Post (famed Texas aviator) and Will Rogers (Okie, highest paid Hollywood actor and humorist) crashed their self-built/hybrid plane into the water near Point Barrow, Alaska; both died instantly.

I'm going to share some Will Rogers quotes in his honor.

I'm going to share some Will Rogers quotes in his honor.

1/n Global equities Q2 2018 recap: Despite concerns on trade, US monetary tightening, curve flattening, and rising oil prices, global equities were flat in Q2. (source HSBC Equity Research) #stocks

2/n US and Norway were the only two major markets to rise in USD terms. Eurozone fell 4%, EM 10% (worst since Q3 2015). The 6% rise in the DXY USD was the key driver. Brazil was the worst performing market globally, down 27%, as political concerns weighed.

3/n Valuation multiples broadly stable over Q2. MSCI ACWI PE is at 14.9x. This is 9% below start of 2018, and back below the long-term average of 15.7x.

US PE at 16.8x

Europe PE at 13.8x

EM PE at 11.4x

US PE at 16.8x

Europe PE at 13.8x

EM PE at 11.4x

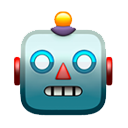

#SPX #Stocks (1) | Private asset managers raised a record $748 billion globally last year, according to Preqin data compiled and published in Mckinsey’s 2018 Global Private Markets Review - Bloomberg

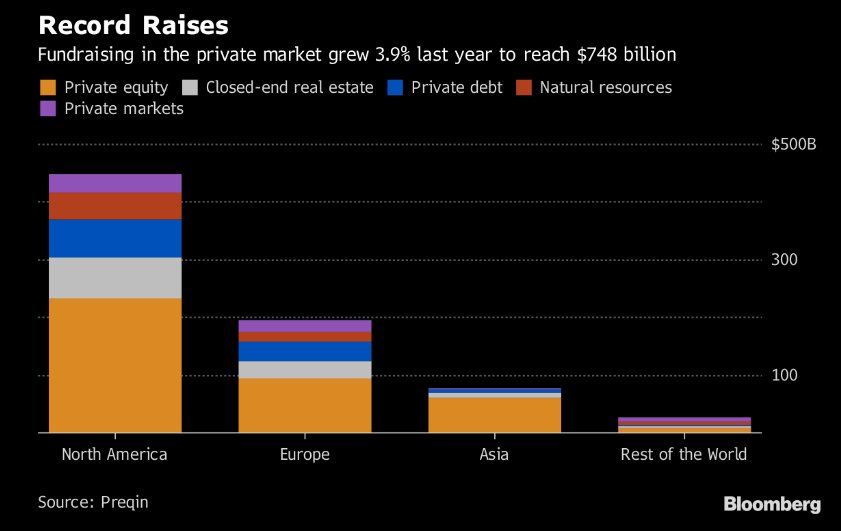

#SPX #Stocks (2) | Too Few Stocks Rebounding From Rout for Chart Gurus to Calm Down - Bloomberg - bloom.bg/2okxlsi

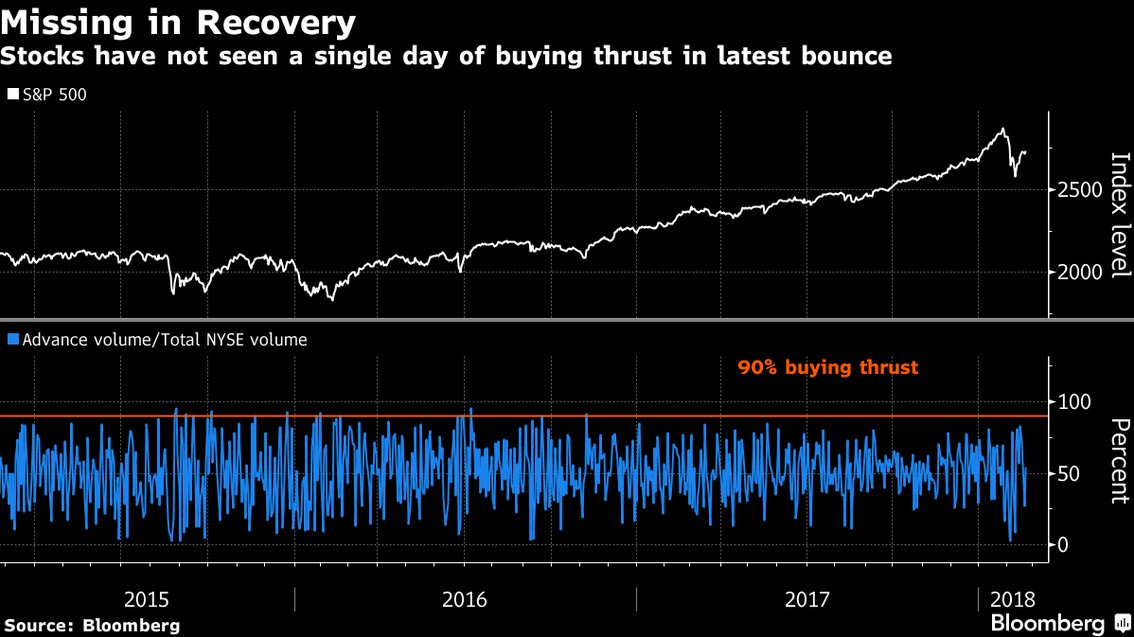

#SPX #Stocks (3) | Money Managers Think the Worst Is Yet to Come for S&P 500 - Bloomberg - bloom.bg/2EKSoPk

#StockMarket - While there are #Multibaggers there can be #Multifailures as well. Here is a thread on key mistakes that may happen during the journey. I have been thru all these mistakes myself.....

1. Leverage can be key mistake that usually happen either when we get carried away in euphoria or are finding shortcuts during early part of journey. Even if you need to take leverage, it should be based on your net worth, risk profile and in right stocks.

#NoShortcuts

#NoShortcuts

2. Selling too early just because it has run up too much too fast. Till there is a visibility of business potential and company growth path, one should ride the growth as maximum as possible.

#StayPut

#StayPut