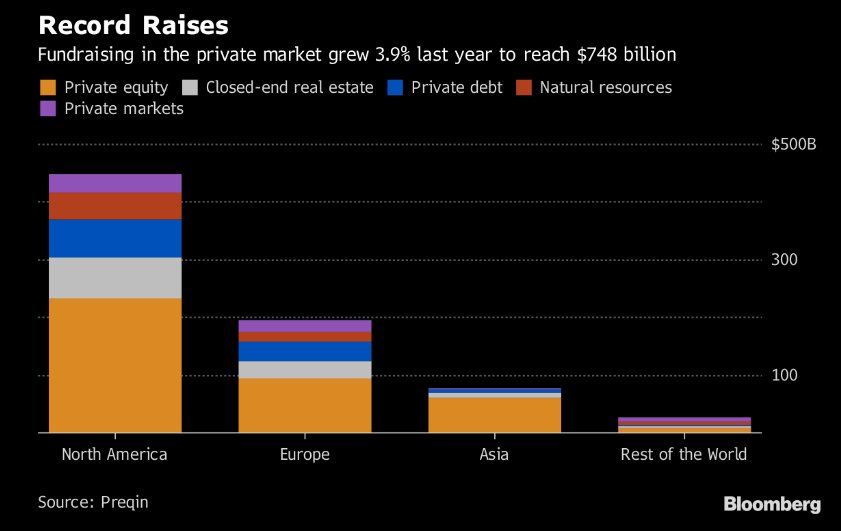

#SPX #Stocks (1) | Private asset managers raised a record $748 billion globally last year, according to Preqin data compiled and published in Mckinsey’s 2018 Global Private Markets Review - Bloomberg

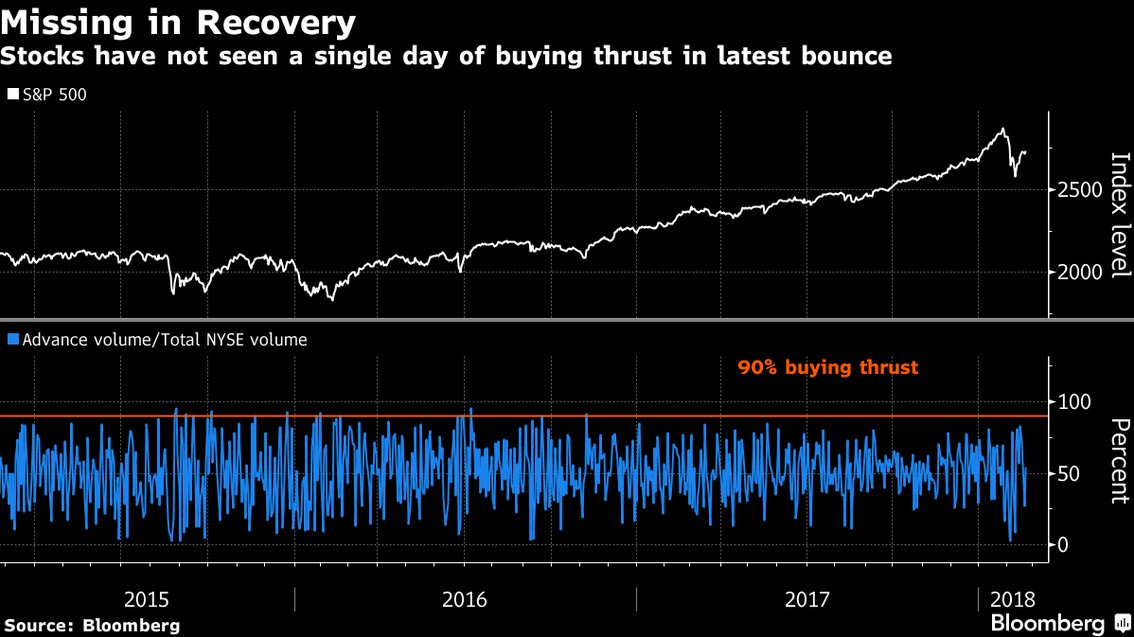

#SPX #Stocks (2) | Too Few Stocks Rebounding From Rout for Chart Gurus to Calm Down - Bloomberg - bloom.bg/2okxlsi

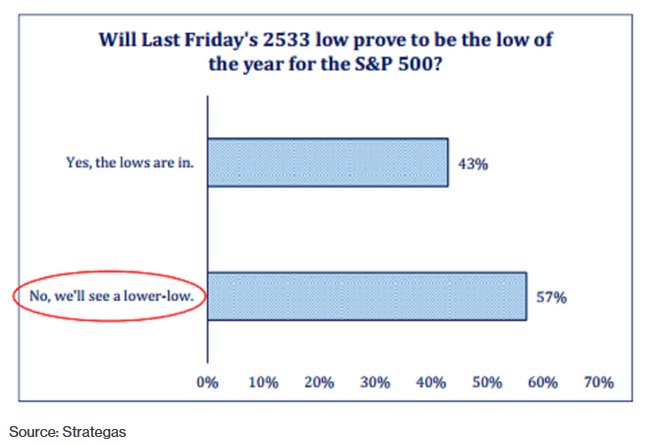

#SPX #Stocks (3) | Money Managers Think the Worst Is Yet to Come for S&P 500 - Bloomberg - bloom.bg/2EKSoPk

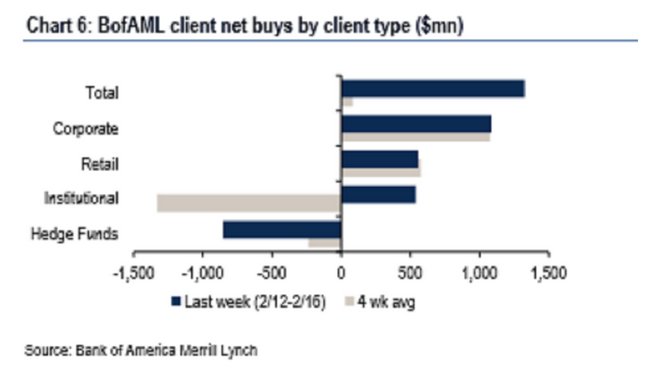

#SPX #Stocks (4) | Smart Money Went Back to Selling After S&P 500 Rebounded Last Week - Bloomberg - bloom.bg/2CEWa6S

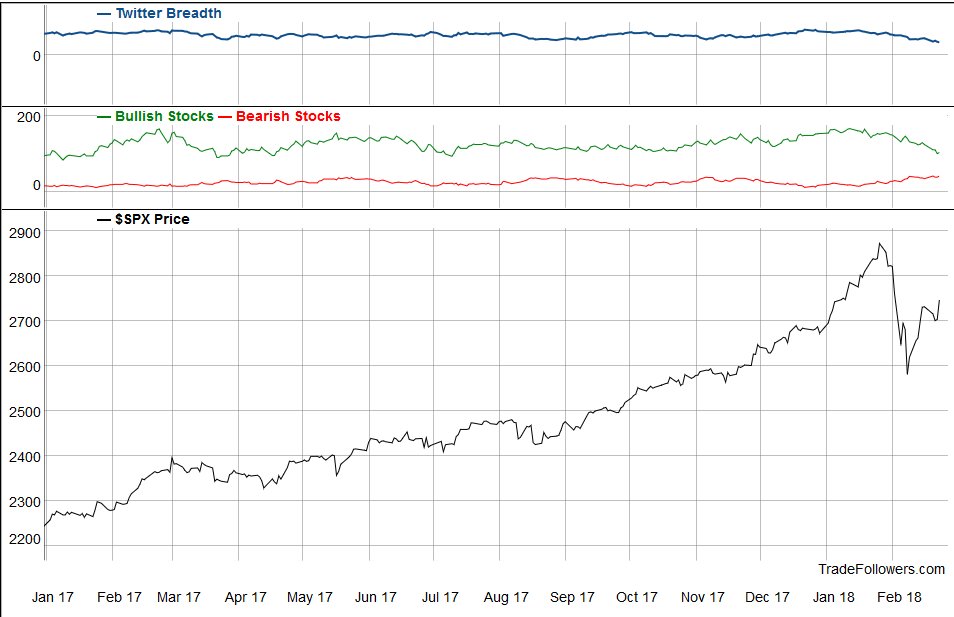

#SPX #Stocks (5) | Twitter Stock Market Breadth slowed down suggesting that retailers are less bullish after the recent selloff - TradeFollowers - bit.ly/2BRbhgR

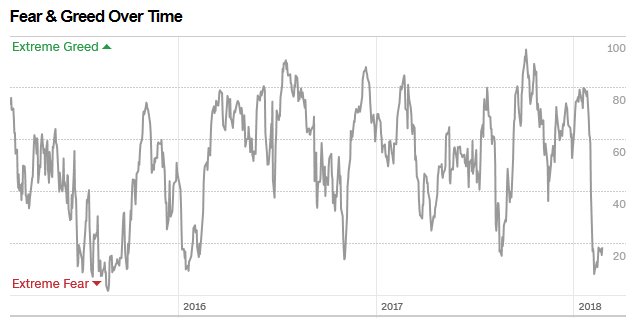

#SPX #Stocks (6) | The CNN Money Fear and Greed Index remained unchanged compared to last week (at 18), still in the “Extreme Greed Zone” - cnnmon.ie/1dYGl6T

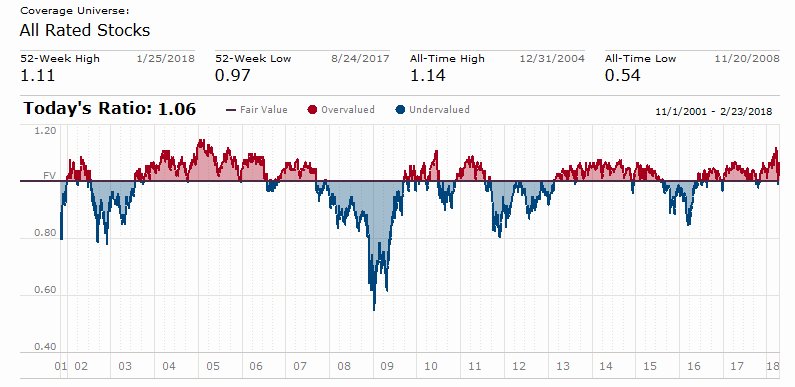

#SPX #Stocks (7) | Morningstar Fair Value Ratio ⬆ to 1.06 (vs 1.02 last week), still in the "Overvalued Zone" - bit.ly/2r8Q1M0

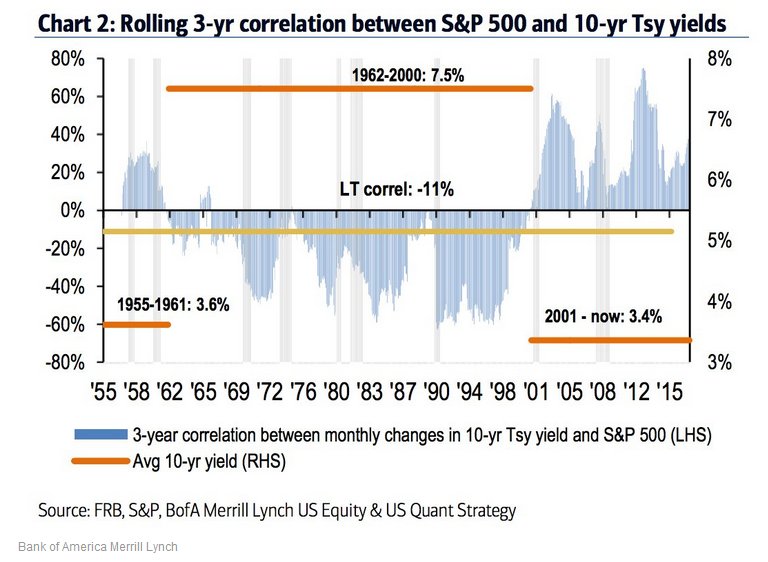

#SPX #Stocks #Bonds (8) | Bank of America strategists shatter a widespread myth about interest rates and stocks after being bombarded with questions - Business Insider - bit.ly/2GCRsch

#Bonds (9) | JPMorgan's Quants Warn Risks Are Growing for Bond Short-Squeeze - Bloomberg - bloom.bg/2FseL9n

• • •

Missing some Tweet in this thread? You can try to

force a refresh