1/ Get ready for a predictable #crypto pattern: in the coming months, we will see an increasing number of #Bitcoin maximalists tormenting “altcoin investors” for straying from the mother ship.

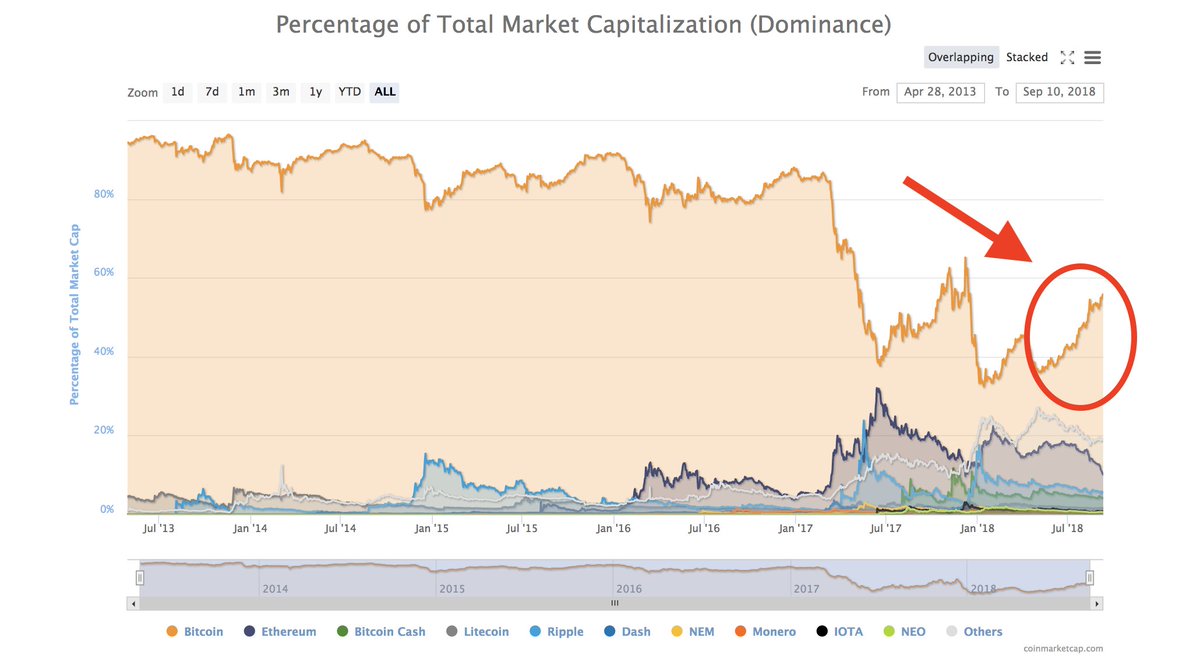

2/ The maximalist drum will get louder as we go deeper into the bear market, with #bitcoin falling less than most other coins, and its dominance index growing. coinmarketcap.com/charts/#domina…

3/ #Bitcoin is the benchmark after all, the market beta of crypto, with most everything oscillating at a higher amplitude than $BTC.

4/ That means when $BTC falls, most everything else falls more.

5/ Despite maximalists’ increasing comfort in deriding other cryptoassets, note that #bitcoin isn’t out of the woods yet, as we are left to wonder if $6,000 is the new $200.

6/ Regardless, as this bear market turns to consolidation it will consolidate around #bitcoin. $BTC then, will also likely kick off the next bull market (be careful of false starts).

7/ Note that some of #bitcoin's biggest bull markets have come the year after the coinbase reward halving.

November 2012 = 1st halving, 2013 a monster year.

July 2016 = 2nd halving, 2017 a monster year.

Summer 2020 = 3rd halving, 2021 a ???

November 2012 = 1st halving, 2013 a monster year.

July 2016 = 2nd halving, 2017 a monster year.

Summer 2020 = 3rd halving, 2021 a ???

8/ Initially, if #bitcoin really rips, it will suck the air (and liquidity) out of the room. It is, after all, the trading pair of choice for the entire crypto ecosystem.

9/ Therefore, if no one wants to sell #bitcoin because they see its momentum, then other #cryptoassets could fall on a relative basis at the early stages of the next bull market.

10/ As #bitcoin consolidates after a first leg up, traders will take profits into other cryptos, and so the small-to-mid cap #cryptoassets will rally.

11/ Then, the #cryptoasset investors that strayed from $BTC (at least the ones that stood their ground, likely by investing w/ real conviction in the team and the network's defensibility), will have their time in the sun.

12/ There will be some spectacular wins in the sans-#bitcoin space, and even some maximalists will turn a wayward eye (and maybe even some assets) to the riches being created by "altcoins."

13/ This oscillation will continue many times over, as traders go back and forth between #bitcoin (and potentially the large caps at that point), and the other smaller #cryptoassets.

14/ The thing that could throw this oscillation off the predictable pattern from years past is the increasing use of stablecoins + fiat integration, not to mention the new tax code which makes clear that crypto to crypto trading is taxable in the US.

15/ If traders can take profits into more stable assets, they might not rebalance from #bitcoin into the smaller #cryptos as much, instead choosing stablecoins or fiat. With the new tax code, more taxes = less incentive to trade.

16/ All of that said, by the *end* of the next bull market, I believe we will see #bitcoin’s dominance index lower than its low in the 2017 bull market (~32%). Long term downtrend.

17/ And remember:

Bear market = $BTC dominance index rising

Bull market = $BTC dominance index falling.

Bear market = $BTC dominance index rising

Bull market = $BTC dominance index falling.

18/ Last note, as this thread is predictably invoking plenty of maximalist trolling: all of the above is compatible with being bullish on #Bitcoin over the long term, which I am. But my bullishness is not dogmatically focused on a single asset.

• • •

Missing some Tweet in this thread? You can try to

force a refresh