Discover and read the best of Twitter Threads about #cryptoasset

Most recents (9)

A prolonged bear market is the best thing #crypto could've asked for to expose projects that never planned to deliver in the first place.

The fumes of exchange listings, prominent partnerships, and events + conference appearances will only carry a #cryptonetwork so far.

The only way to survive over the long haul is to build things people use, and if you have a #cryptoasset, making sure the demand-side and/or supply-side relies on it to access/provision the service.

1/ Get ready for a predictable #crypto pattern: in the coming months, we will see an increasing number of #Bitcoin maximalists tormenting “altcoin investors” for straying from the mother ship.

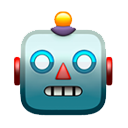

2/ The maximalist drum will get louder as we go deeper into the bear market, with #bitcoin falling less than most other coins, and its dominance index growing. coinmarketcap.com/charts/#domina…

3/ #Bitcoin is the benchmark after all, the market beta of crypto, with most everything oscillating at a higher amplitude than $BTC.

As of yet, no #cryptoasset is too big to fail-- not even #bitcoin.

Too big to fail applies in 2 areas

1) #Cryptoland, where the question is: will crypto be crippled if a core network suffers catastrophic failure (or slow fade 2 obsolescence)

2) Macro-land, where the question is: will global economies be severely affected if X #crypto goes down

1) #Cryptoland, where the question is: will crypto be crippled if a core network suffers catastrophic failure (or slow fade 2 obsolescence)

2) Macro-land, where the question is: will global economies be severely affected if X #crypto goes down

3/ In case #1, there's no doubt #cryptoland would go through a period of heavy puking if #Bitcoin or #Ethereum went down, and while a few #buidlers would defect, the majority would stay and adapt.

1/ Yesterday’s quarterly #crypto update by @DAR_crypto was filled w/ interesting data: t.sidekickopen24.com/e1t/c/5/f18dQh…

3/ Relative performance of small caps in a bear market shows you can’t supercharge your returns without taking on commensurate risk.

More people will own #cryptoassets than stocks.

1/ #Hodling is a lot harder than it looks, as it requires the choice of *no action* in an action-oriented culture.

2/ One of my favorite classes in college was called, "A Life of Contemplation vs Action," and it revealed humans repeatedly choose "action" over "no action," even when statistically "action" has clearly been proven to be the wrong choice.

3/ Take soccer goalies, for example. Statistically, they have better odds of blocking a penalty shot by staying in the middle of the goal (no action) and defending from there. Yet, the majority decide to jump right or left (action), decreasing their odds of success.

1/ @telegram chose, from a place of strength, to use a #cryptoasset as their monetization model, instead of an equity.

2/ @telegram's *choice* to say: #cryptoasset > #equity, is the single most important takeaway for me from the $TON sale.

1/ While I appreciate the work of @CoinMarketCap & the many other token data aggregators, it’s important to recognize none of them represent the entire #cryptoasset reality.

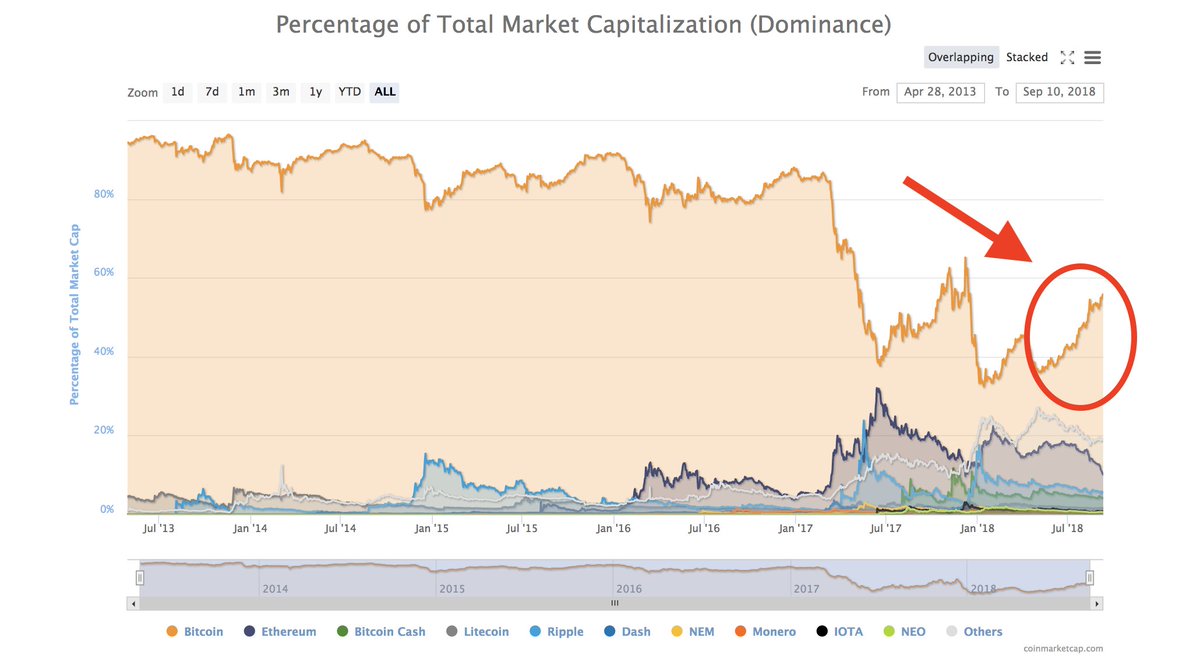

2/ When people new to the space first realize @CoinMarketCap has ~1,500 #cryptoassets listed, many will exclaim, “Wow, that’s a lot!” But in reality, that’s just the tip of the iceberg...

3/ consider, for example, that @wavesplatform has 12,297 #tokens that have been launched on its platform and trade on its internal DEX.

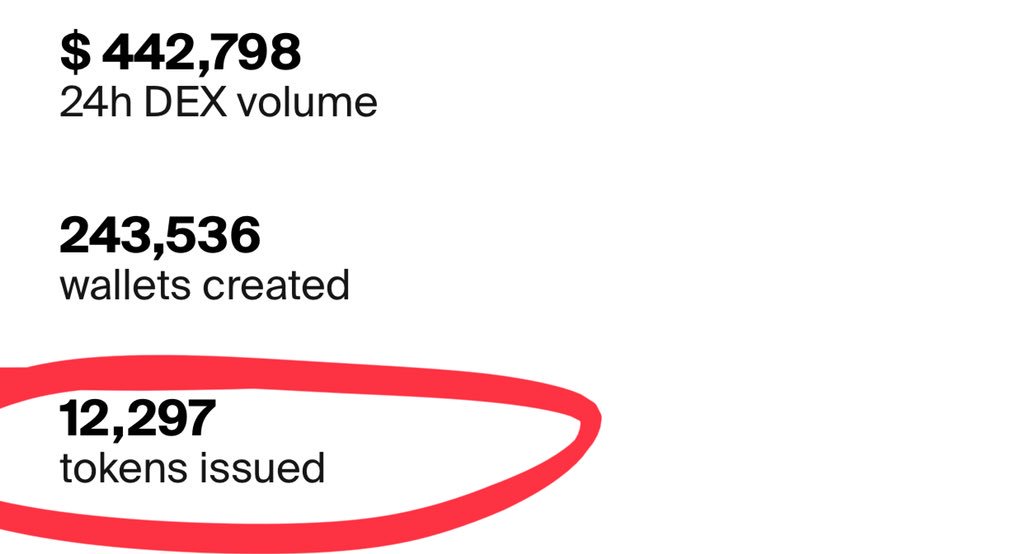

1/ Put together some informal thoughts on smart contract platforms for friends that I figured I should share. Clearly, this market is #Ethereum’s to lose.

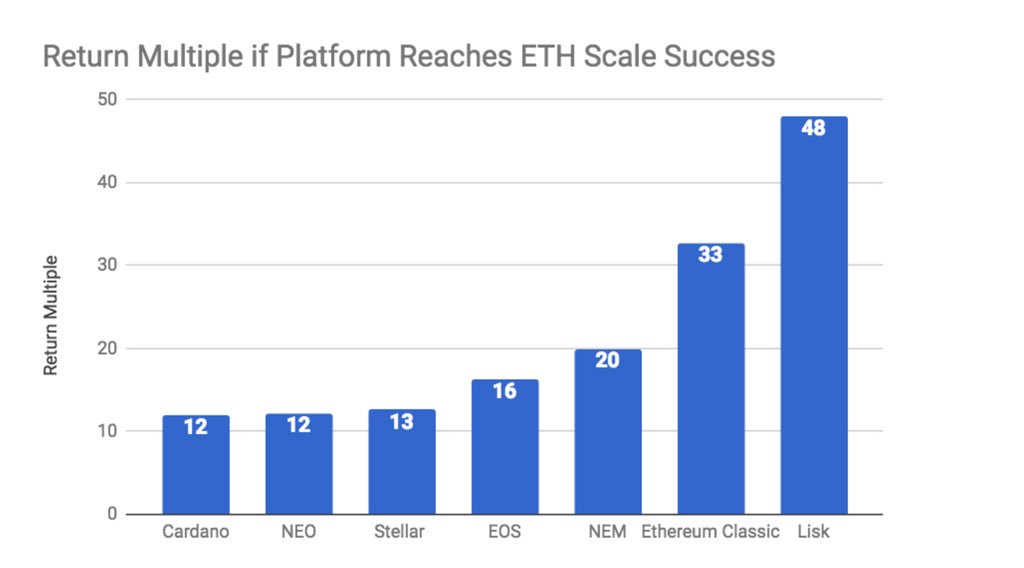

2/ The reward, however, for any smart contract platform that can achieve #Ethereum levels of success is significant. Makes the expected value of investments potentially positive, even if low odds.

3/ #Ethereum has a “feature gravity advantage” over the upstarts, and a proven willingness to move fast and avoid ossification. So long as scale doesn’t make things a quagmire, such flexible governance will suit $ETH well going forward.