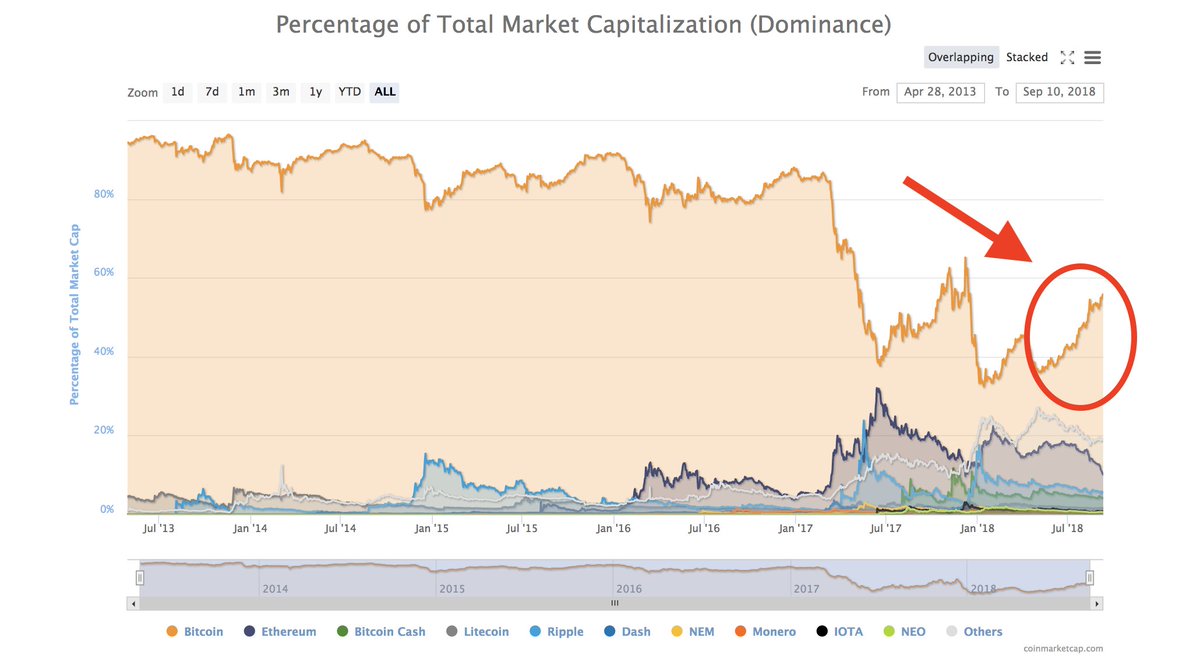

1/ While I appreciate the work of @CoinMarketCap & the many other token data aggregators, it’s important to recognize none of them represent the entire #cryptoasset reality.

2/ When people new to the space first realize @CoinMarketCap has ~1,500 #cryptoassets listed, many will exclaim, “Wow, that’s a lot!” But in reality, that’s just the tip of the iceberg...

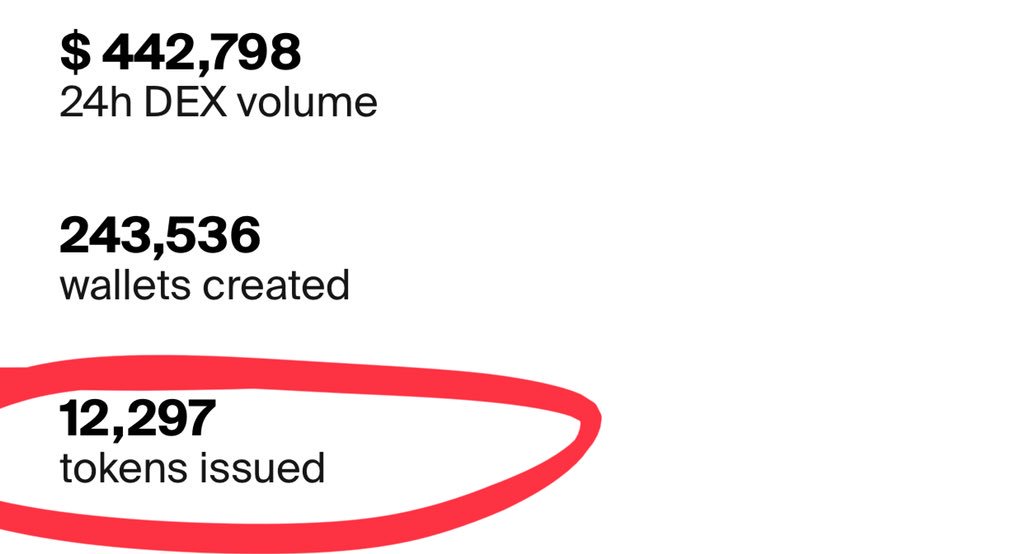

3/ consider, for example, that @wavesplatform has 12,297 #tokens that have been launched on its platform and trade on its internal DEX.

4/ regardless of what you think of the quality of any of these assets, the fact still remains that @wavesplatform has ~10x as many tokens listed on its DEX as @CoinMarketCap represents as the entire #cryptoasset reality.

5/ This is not a knock on @CoinMarketCap, nor an endorsement of @wavesplatform, but rather an example of how viral and sprawling activity & experimentation is within the #cryptoasset ecosystem.

6/ From a regulatory angle, this means we cannot approach #crypto from a centralized perspective. It would be like trying to patch an oil tanker’s hull with bubble gum.

7/ I mean this with zero incendiary tone: #cryptoassets cannot be controlled—as software spawned assets, they move too fast.

8/ We must come up with 21st century regulatory mechanisms to place guardrails on a 21st century asset class.

9/ of course, there are many learnings #crypto can borrow from when we were dealing with the birth of other asset classes, such as equities in the 17th century—or perhaps more applicable, ways in which we regulated the internet on a supranational basis (eg, ICANN)

10/ and the toxic attitude toward regulators and the state has to go if we want to take #crypto mainstream.

11/ Anarchists and libertarians can call me a sell-out, but the state *always* plays a role in any technological revolution. Just ask @CarlotaPrzPerez.

12/ in short, #crypto evolves at a speed unlike any other asset class, placing it outside the control of any nation-state & requiring a dynamic regulatory approach. We, the industry, must welcome working w/ regulators, as opposed to knee-jerk categorizing them as the enemy.

13/ Neither #crypto, nor the regulators, are going away 🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh