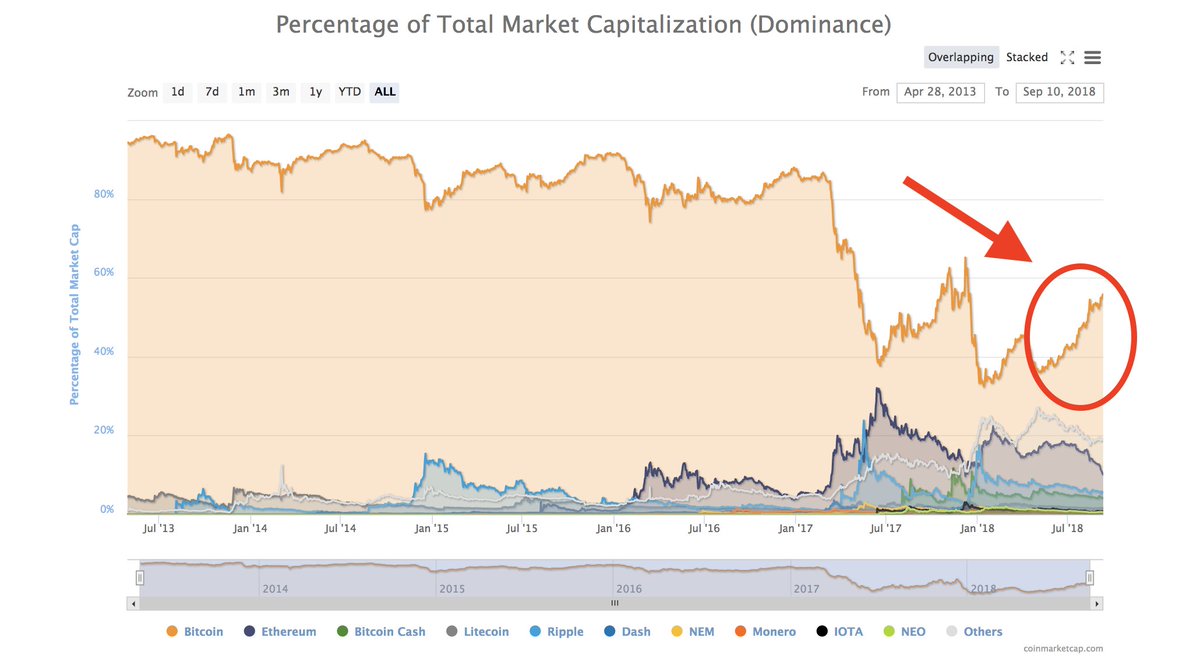

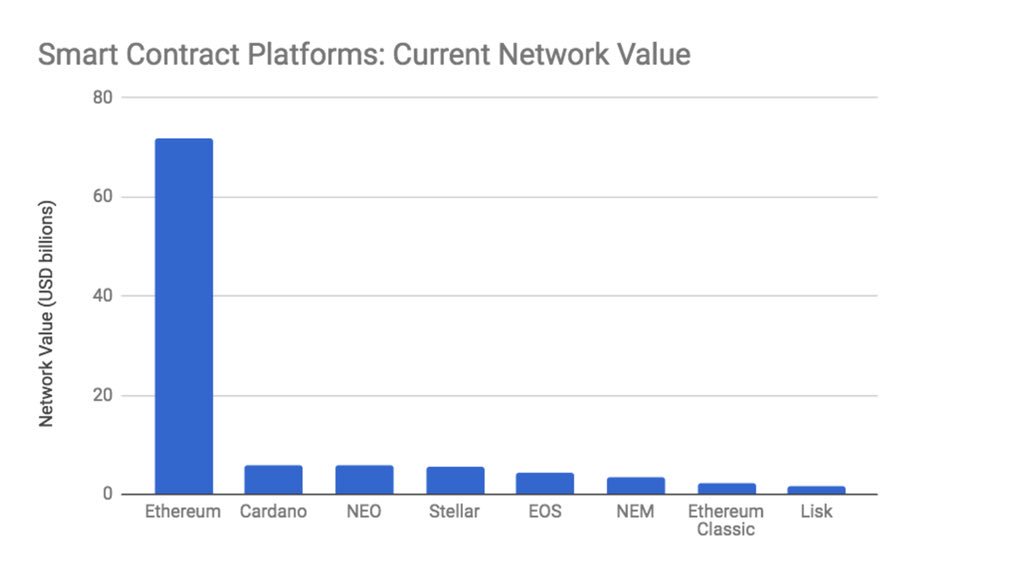

1/ Put together some informal thoughts on smart contract platforms for friends that I figured I should share. Clearly, this market is #Ethereum’s to lose.

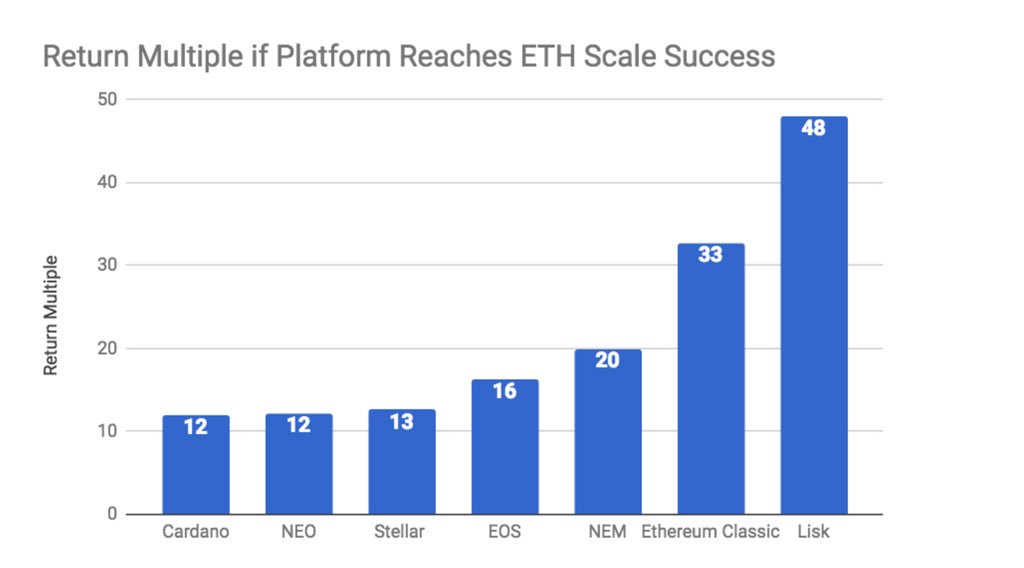

2/ The reward, however, for any smart contract platform that can achieve #Ethereum levels of success is significant. Makes the expected value of investments potentially positive, even if low odds.

3/ #Ethereum has a “feature gravity advantage” over the upstarts, and a proven willingness to move fast and avoid ossification. So long as scale doesn’t make things a quagmire, such flexible governance will suit $ETH well going forward.

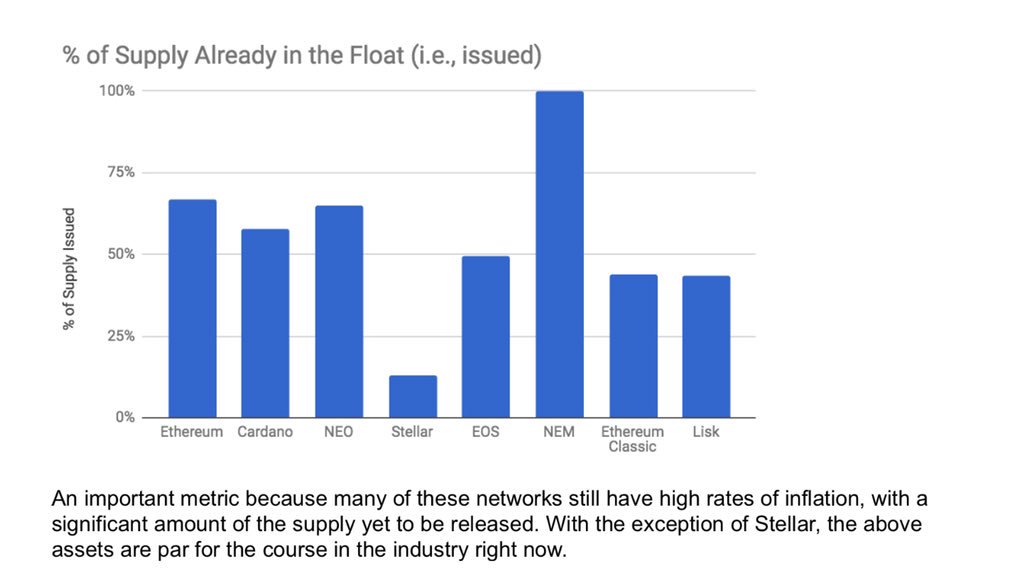

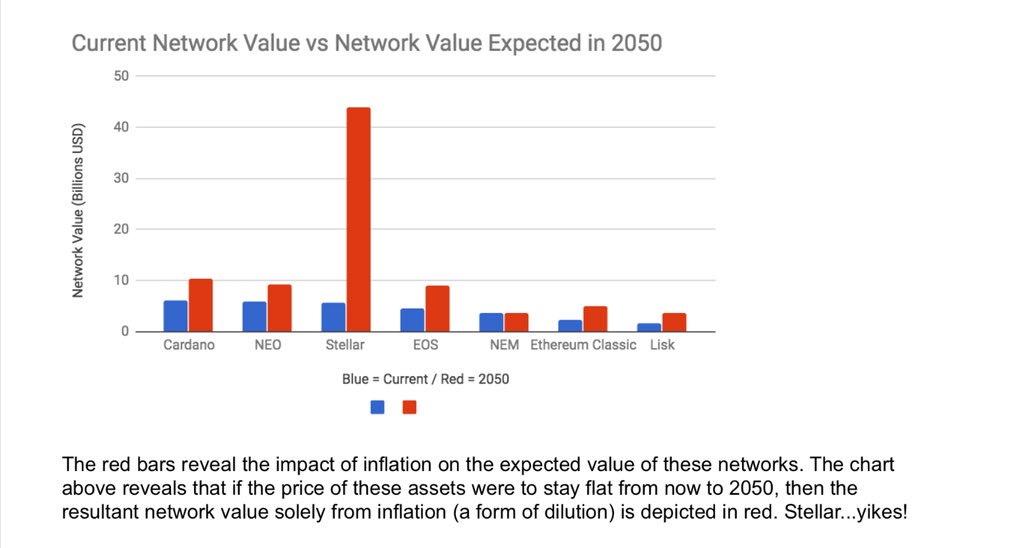

4/ an important consideration in this space is always the #cryptoasset’s supply schedule, and thereby future dilution for token holders.

5/ Most smart contract platforms have issued about 50% of their tokens, give or take, with the notable exception of Stellar.

6/ The red bars reveal the impact of inflation on the expected value of these #cryptonetworks. Chart reveals that if the price of these assets were to stay flat from now to 2050, then the resultant network value solely from inflation (a form of dilution) is depicted.

7/ Lots left to be said, but the good stuff always happens in conversation 🙂 data was sourced from @onchainfx

8/ Last thing, it’s unlikely smart contract platforms is a winner-takes-most market. Too many trade offs between performance, security, flexibility, etc, that devs will gravitate toward the platform that best suits their dapp.

9/ Furthermore, abstracting interoperability a layer above smart contract platforms + off-chain functionality like @Truebitprotocol, @keep_project, etc, may ultimately commoditize these platforms, save for the ones that become massive “reserve #cryptoassets”

• • •

Missing some Tweet in this thread? You can try to

force a refresh