1/ #Hodling is a lot harder than it looks, as it requires the choice of *no action* in an action-oriented culture.

2/ One of my favorite classes in college was called, "A Life of Contemplation vs Action," and it revealed humans repeatedly choose "action" over "no action," even when statistically "action" has clearly been proven to be the wrong choice.

3/ Take soccer goalies, for example. Statistically, they have better odds of blocking a penalty shot by staying in the middle of the goal (no action) and defending from there. Yet, the majority decide to jump right or left (action), decreasing their odds of success.

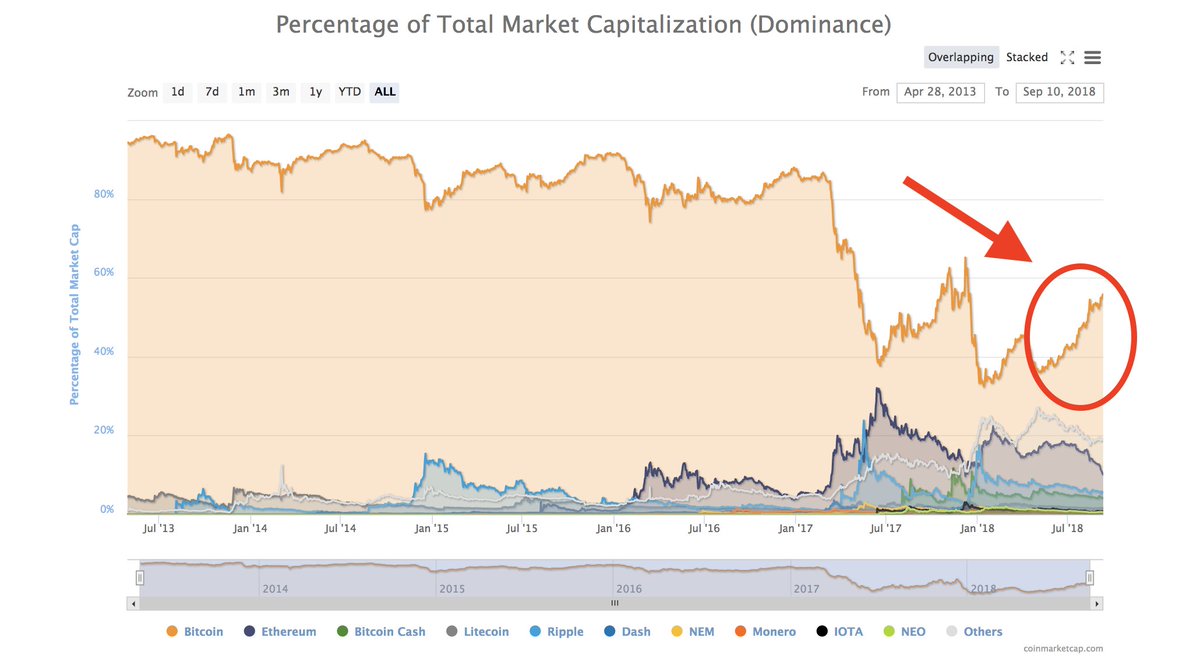

4/ I think of many retail #crypto traders like these soccer goalies. They would be better off buying once and #hodling (no action), yet they instead choose to jump right & left, counterproductive to their returns.

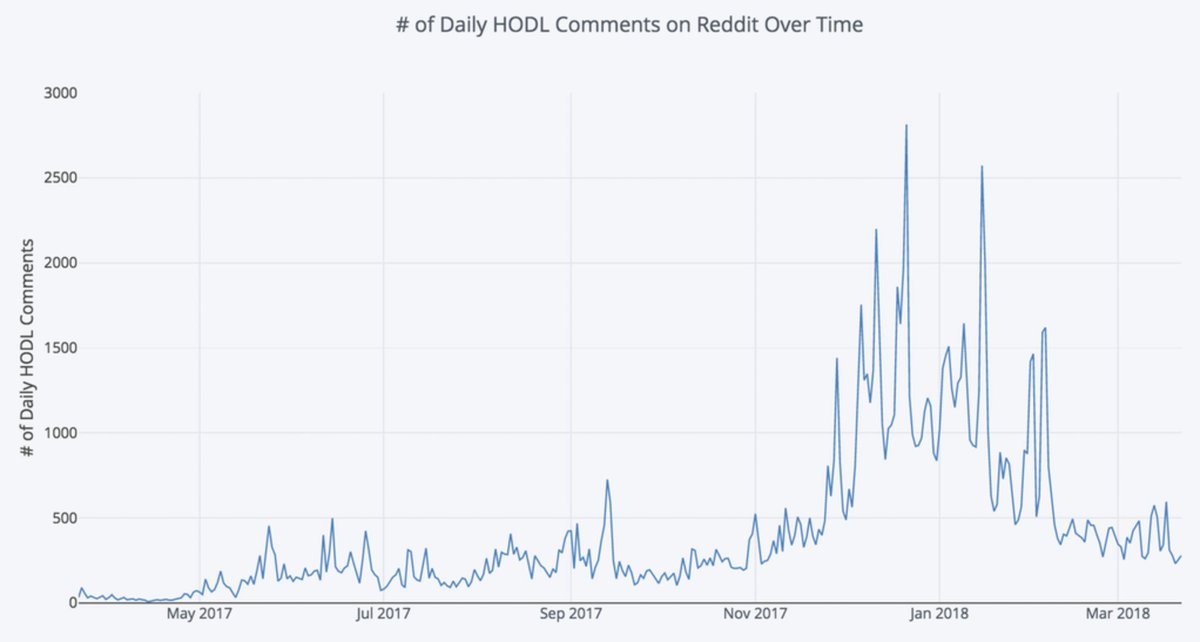

5/ And it's not that retail traders aren't aware of the power of #hodl. It's just that the battle cry is a lot more glorious when times are good than when times are bad, and the desire to "do something" when you're down 70% becomes extreme. reddit.com/r/dataisbeauti…

6/ When you #hodl for a 75% drop, that means your #cryptoasset has to go back up 4x in order for you to break even from where you were.

7/ Similar to long meditation sits, the "perceived agony" of sitting through such a #crypto drop becomes overwhelming, forcing people to break from their positions & "act" to remedy their perceived agony. Whereas if you sit long enough, you find the perceived agony is an illusion

8/ Of course, there is a limit to applying lessons from meditation to #crypto investing, especially for those #cryptoassets that were poorly chosen to begin with. #Hodling to zero is always a possibility.

9/ But, for those that develop a rooted conviction in the ideas and intentions behind #crypto, then #hodling (& using) becomes easy.

10/ It helps to be surrounded by hodlers too, which comes from spending time in #crypto. The more time you spend, the deeper down the rabbit hole you fall, ultimately finding yourself surrounded by those who are "so far gone" they wouldn't consider #hodling anything else 🙂

11/ Everything is, after all, just a vibration.

• • •

Missing some Tweet in this thread? You can try to

force a refresh