Discover and read the best of Twitter Threads about #ethereum

Most recents (24)

#Ethereum miners are starting to realize the value of their $ETH doesn't come from transactions. 1/

2/ In fact, including everything into the current state and/or archival blockchain, increases miners' cost.

The connection they might have made is all the dapps and other silly stuff isn't where the value comes from, the value comes from marketing.

The connection they might have made is all the dapps and other silly stuff isn't where the value comes from, the value comes from marketing.

3/ The success of ethereum's marketing is only partly correlated w/ the number of transactions. There needs to be enough volume to support the narrative, but not too much to make it extremely hard to stay synced.

1/ @alexhevans recently dug into the numbers behind forks of #Bitcoin, #Ethereum, #Monero & #Zcash.

Main conclusion: Value can’t be forked away as easily as people like to think. placeholder.vc/blog/2018/9/17…

Main conclusion: Value can’t be forked away as easily as people like to think. placeholder.vc/blog/2018/9/17…

2/ Secondary conclusion: Despite parent #cryptonetworks retaining users, devs & value, the child forks trade at (puzzling) relative valuation premiums.

3/ To follow are graphs and conclusions from @alexhevans that are relevant to specific actors or ratios (if you're not a fan of long form writing 😉)

1/ #Ethereum is crashing (not just in USD terms but in BTC terms); has the demand for a decentralized world computer disappeared, or is something else at play? Let's consider the fundamentals from an economic point of view.

2/ The price level of all monetary goods is determined by (and only by) reservation demand. More precisely, the duration that the average unit of the monetary good is held in reserve.

3/ At one extreme you have a good like gold that is stored in vaults in perpetuity because of a widely held belief that it will retain its value long into the future.

Gold has a very high reservation demand which is why it has a market cap of over seven trillion dollars.

Gold has a very high reservation demand which is why it has a market cap of over seven trillion dollars.

1/ in markets, investor psychology is everything. i shared my thoughts on greed, investor psychology, shitcoin, and market cannibalization at @dezentral_io in berlin and wanted to share some of these ideas here...

option b: skip directly to slides here: slideshare.net/DCGCo/how-to-n…

option b: skip directly to slides here: slideshare.net/DCGCo/how-to-n…

As of yet, no #cryptoasset is too big to fail-- not even #bitcoin.

Too big to fail applies in 2 areas

1) #Cryptoland, where the question is: will crypto be crippled if a core network suffers catastrophic failure (or slow fade 2 obsolescence)

2) Macro-land, where the question is: will global economies be severely affected if X #crypto goes down

1) #Cryptoland, where the question is: will crypto be crippled if a core network suffers catastrophic failure (or slow fade 2 obsolescence)

2) Macro-land, where the question is: will global economies be severely affected if X #crypto goes down

3/ In case #1, there's no doubt #cryptoland would go through a period of heavy puking if #Bitcoin or #Ethereum went down, and while a few #buidlers would defect, the majority would stay and adapt.

I'm convinced that all of the smart people in #ethereum have to know it's an outright scam at this point, and probably have for a long time.

The only question is, how to unwind their positions of 10s of millions of ether?

The only question is, how to unwind their positions of 10s of millions of ether?

They want you to think the #ethereum network is viable by stringing you along on this decade long wild goose chase for PoS. They'll happily sell you their bags as they move onto their next scam.

1/ Hey #CryptoTwitter, grab a glass of vino and come sit by the fire so we can discuss your narrow-minded views on FAT PROTOCOL THEORY.

See what I did there -- how I juxtaposed "narrow" with "fat"?

No?

Just shut up and drink your wine. 👇

See what I did there -- how I juxtaposed "narrow" with "fat"?

No?

Just shut up and drink your wine. 👇

2/ First, let's acknowledge it as a "theory" even though it wasn't clearly labelled as such.

A theory is just a plausible principle offered to explain phenomena.

A theory is just a plausible principle offered to explain phenomena.

A 75 tweets long tweetstorm by @VitalikButerin on Casper. Interesting at many levels. Timing is providential. $ETH needs its community to rally and pull together to stop & reverse the sell-off. PoS would be bullish for prices by creating a new use for existing coins. #Ethereum

Another providential appearance from a key player of the Ethereum community: @ConsenSys. From yesterday. Seems key stakeholders are just as worried as other holders, and acting on it. This is good. Communicating with the marketplace is crucial. #Ethereum

media.consensys.net/40-ethereum-ap…

media.consensys.net/40-ethereum-ap…

This piece by Jonathan covers the $ETH defense subject succinctly. Great read.

1/ It seems like a lot of approaches to blockchain-based smart contracts, recognizing that "code is law" was unworkable, are going to the opposite extreme where smart contracts will be easily stoppable through administrator-type privileges, and claiming that this is necessary

2/ to ensure legal compliance. If that is true, then the benefits of deploying a smart contract to a public blockchain (vs. someone's server) are modest. By far the biggest benefit dreamed of by cypherpunks for blockchain-based smart contracts was always their potential

3/ to reduce both ex ante and ex post transaction costs by establishing an "unstoppable" arrangement on a world computer where (assuming good ex ante due diligence into the code), the parties had close to 100% certainty that the code would execute and the funds would flow.

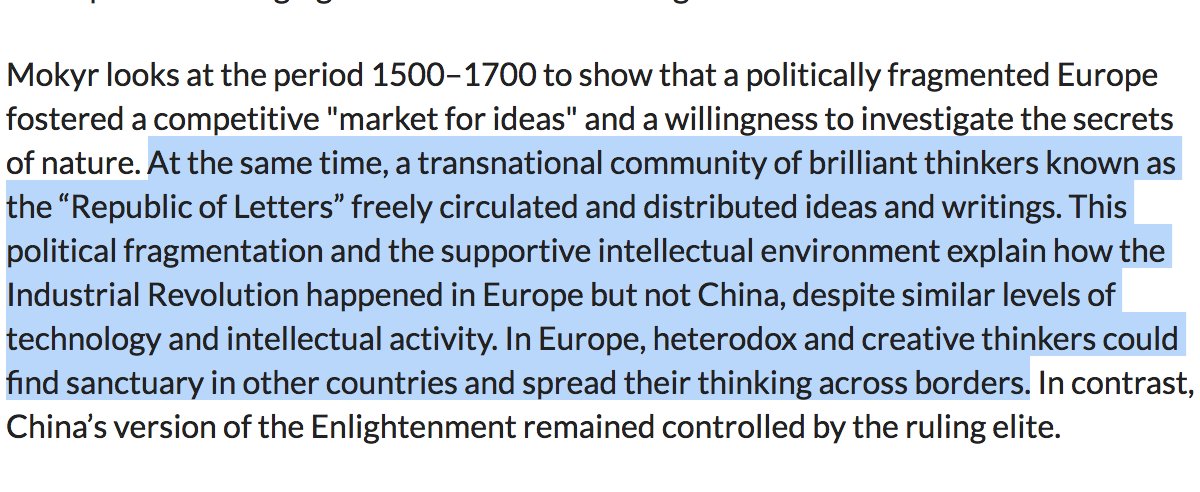

1/ #Crypto has created a *Republic of Value* reminiscent of the “Republic of Letters,” which some claim seeded the Enlightenment & Industrial Revolution. press.princeton.edu/titles/10835.h…

2/ Global diversification of thinkers is key for #crypto as it breeds resilience to any nation's attempt at intellectual censorship.

3/ People ask, “What happens if the gov seizes mining equipment? Or bans crypto transactions? Or..." But banning minds from thinking and tinkering has proven near-impossible over time.

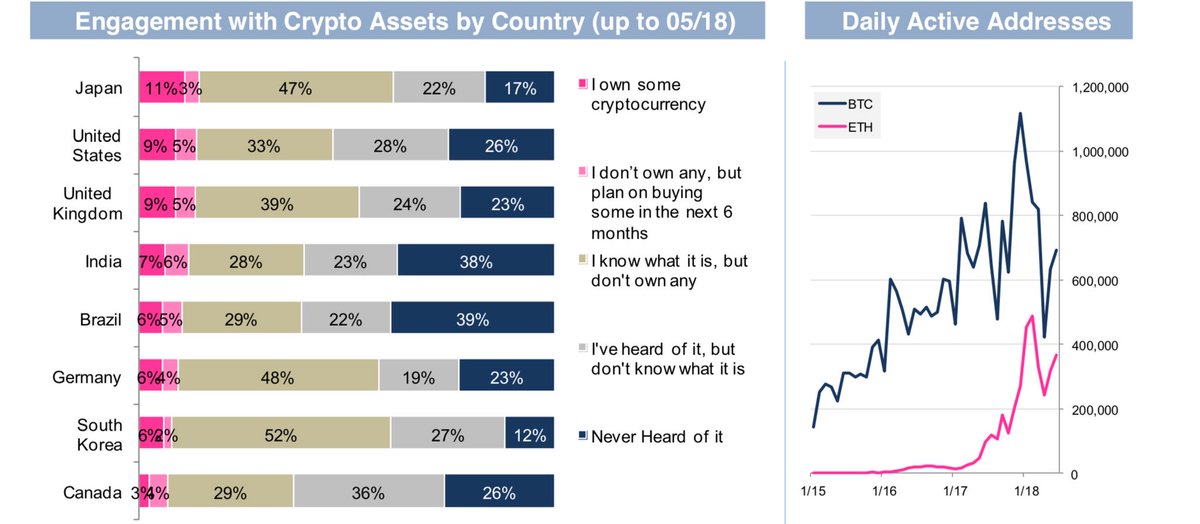

Monster 100+ page #crypto report from @AutonoFinTech: next.autonomous.com/crypto-utopia/ First takeaway graph shows crypto-penetration per country, Japan in the lead w/ 83% awareness

2/ Succinct narrative of 3 waves of #crypto funding:

Bitcoin startups, Enterprise blockchain, ICOs.

#ICO funding in 2018 nearing double that of 2017.

Bitcoin startups, Enterprise blockchain, ICOs.

#ICO funding in 2018 nearing double that of 2017.

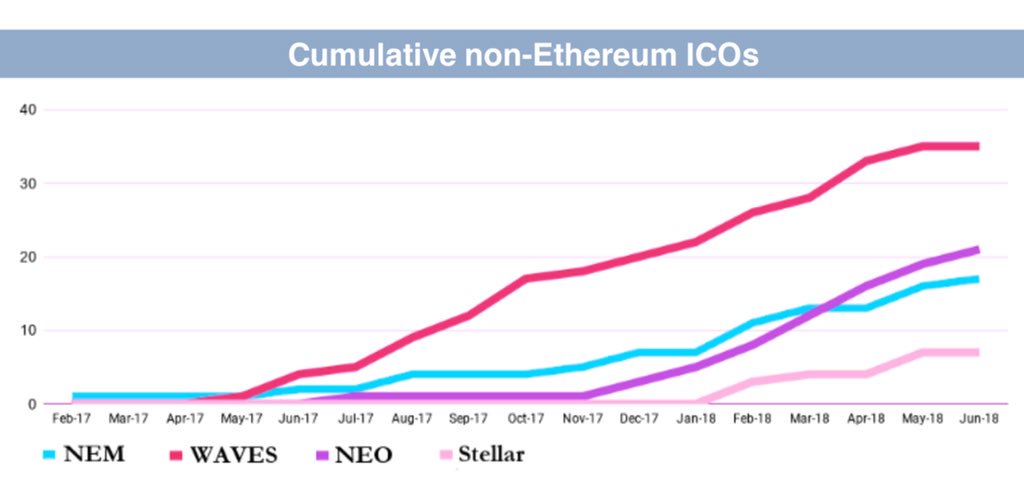

3/ Smart contract platforms other than #Ethereum are growing... but w/ the top (@wavesplatform) at ~30 ICOs, all still pale in comparison.

Is some taking bets on this exact time getting flooded on the #ethereum network?

This probably won't be pretty.

*someone

I was wrong about the #ETH price two years ago, because I saw this, and other weaknesses, in its very design. It simply doesn't work.

Marketing false claims is getting harder to maintain.

Marketing false claims is getting harder to maintain.

We've seen a slow shift in #Ethereum's marketing strategy.

World computer -> unstoppable code -> rich statefulness -> ICO platform -> dapp platform -> etc.

Now it's, "ethereum has the most devs" or "solutions will be found to its problems, because it has the most developers."

World computer -> unstoppable code -> rich statefulness -> ICO platform -> dapp platform -> etc.

Now it's, "ethereum has the most devs" or "solutions will be found to its problems, because it has the most developers."

It doesn't matter the quantity of devs you throw at the problem, as some over-exposed $ETH hedge funds will tell you (especially if the "blockchain devs" can't launch their little pet products).

It's *quality* over quantity, on a basic design that works.

It's *quality* over quantity, on a basic design that works.

Today we're at #FOSD, talking about the future of software development with influential individuals in the fields of #MLonCode, #QuantumComputing, and #blockchain technologies.

Follow this thread for live tweeting!

Follow this thread for live tweeting!

PSA: If you think the #EOS launch was chaotic, wait until #TRON launches in a couple of days... I also happened to have reviewed the entire $TRX codebase.

My eyes hurt.

They should rebrand to "TRON: the Frankenstein of crypto." Learn more 👇

My eyes hurt.

They should rebrand to "TRON: the Frankenstein of crypto." Learn more 👇

Justin Sun loves bashing on #Ethereum, which is hilarious, since the majority of Java-Tron's codebase is based on the EthereumJ library - one of the most buggy implementations of the Ethereum protocol. They tried to hide this, but failed: github.com/tronprotocol/j…

Unsurprisingly, the highly marketed Tron Virtual Machine is a FIFO implementation of the Ethereum Virtual Machine, which makes sense given the use of EthereumJ, but once again it was announced as an original and miraculous piece of software.

A thread on devs + daily active users (DAUs) 👇

- #Ethereum code school CryptoZombies trained 208k+ users and is growing by 30k+/mo

- Truffle has 580k dls, up 56% last 3 mo

- MetaMask has >1m users

- GitHub lists 14k $ETH-based repos and 220k commits

- 1500+ dapps are in dev

/1

- #Ethereum code school CryptoZombies trained 208k+ users and is growing by 30k+/mo

- Truffle has 580k dls, up 56% last 3 mo

- MetaMask has >1m users

- GitHub lists 14k $ETH-based repos and 220k commits

- 1500+ dapps are in dev

/1

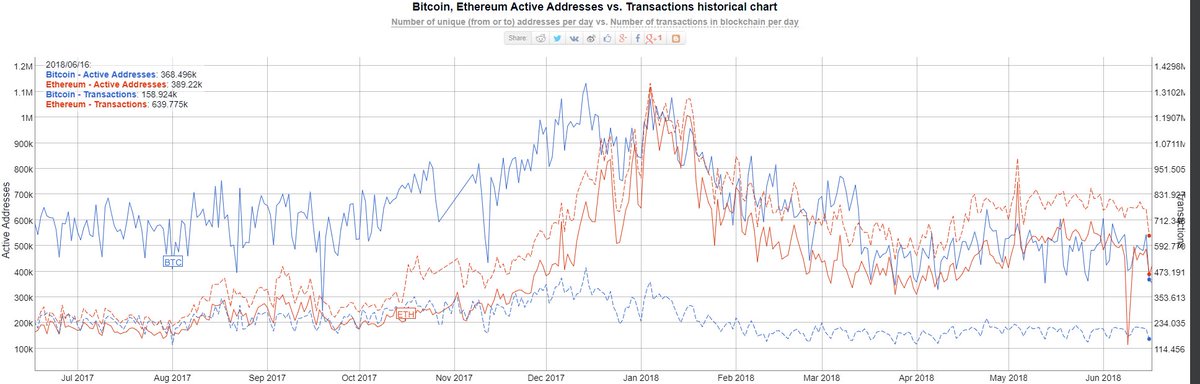

- ETH does more tx and active addresses than BTC

- No, batching doesn't make up the dif in tx

- Of the top 100 tokens by MC, 94% are built on Ethereum

- EEA boasts 500+ members

- Brazil, Canada, Zug, Chile, Dubai, and Estonia are experimenting w/ government apps on Ethereum

/2

- No, batching doesn't make up the dif in tx

- Of the top 100 tokens by MC, 94% are built on Ethereum

- EEA boasts 500+ members

- Brazil, Canada, Zug, Chile, Dubai, and Estonia are experimenting w/ government apps on Ethereum

/2

On the topic of daily act addr (DAA):

Value transfer is a use case and those *transacting value daily* are DAUs you morons.

Fundraising with $ETH = MOE.

By DAA, Ethereum has as many or more users than BTC.

/3

Value transfer is a use case and those *transacting value daily* are DAUs you morons.

Fundraising with $ETH = MOE.

By DAA, Ethereum has as many or more users than BTC.

/3

Great analysis of the Canadian Securities Administrators new guidance on ICOs and securities by @Osler_Law. Summary:

- Most ICOs/SAFT (utility tokens) are securities

- Same approach as SEC

- No new regs: existing secutiries rules apply

- Enforcement coming

Read comments below👇

- Most ICOs/SAFT (utility tokens) are securities

- Same approach as SEC

- No new regs: existing secutiries rules apply

- Enforcement coming

Read comments below👇

"Most token offerings are subject to Canadian securities laws and that regulators will continue to take enforcement action against projects and businesses that engage in token offerings without complying with applicable securities laws"

BTC maximalists who remained untainted 😎

BTC maximalists who remained untainted 😎

- regulators are monitoring the crypto-asset space

- understand commonly used token offering models (...) adopted to minimize Canadian securities laws.

- SAFTs, air drops from foreign jurisdictions

- nonetheless be subject to Canadian securities laws

Can't hide from mounties!

- understand commonly used token offering models (...) adopted to minimize Canadian securities laws.

- SAFTs, air drops from foreign jurisdictions

- nonetheless be subject to Canadian securities laws

Can't hide from mounties!

1/ Great post about on- vs off-chain governance!

One contention:

I’m not certain exit costs from blockchains are low.

To explain we need to define two types of exits:

1. Individual user exit

2. Group exit by forking

One contention:

I’m not certain exit costs from blockchains are low.

To explain we need to define two types of exits:

1. Individual user exit

2. Group exit by forking

2/ In individual exit, costs are lower but not necessarily “low”.

There needs to be another option. And that option needs to hold enough of the fundamental properties that you value to exit.

And what about network effects?

There needs to be another option. And that option needs to hold enough of the fundamental properties that you value to exit.

And what about network effects?

3/ In a potential future where an SC protocol like #Ethereum hosts 1000s of apps, exiting may mean exiting the entire ecosystem.

Interoperability b/w chains may lower this cost and the cost is lower still for non-SC “currency only” chains, but the cost is not necessarily “low”.

Interoperability b/w chains may lower this cost and the cost is lower still for non-SC “currency only” chains, but the cost is not necessarily “low”.

/1

Some interesting comments from SEC Chairman Jay Clayton during talk about #cryptocurrency regulation at Princeton. #ClaytonCrypto #Ethereum #Bitcoin

1. SEC is starting from the principle that DLT has incredible promise

bit.ly/2FqmEuN

bit.ly/2q7hqhX

Some interesting comments from SEC Chairman Jay Clayton during talk about #cryptocurrency regulation at Princeton. #ClaytonCrypto #Ethereum #Bitcoin

1. SEC is starting from the principle that DLT has incredible promise

bit.ly/2FqmEuN

bit.ly/2q7hqhX

/2. SEC are still trying to wrap their heads around this -- "where does our jurisdiction begin?"

bit.ly/2JlDMEx

bit.ly/2uRpgBa

bit.ly/2JlDMEx

bit.ly/2uRpgBa

/3. However, they need to enforce regulation to actually prevent regulation from becoming too severe due to the immense risk of fraud in crypto

bit.ly/2IuZdSf

bit.ly/2IuZdSf

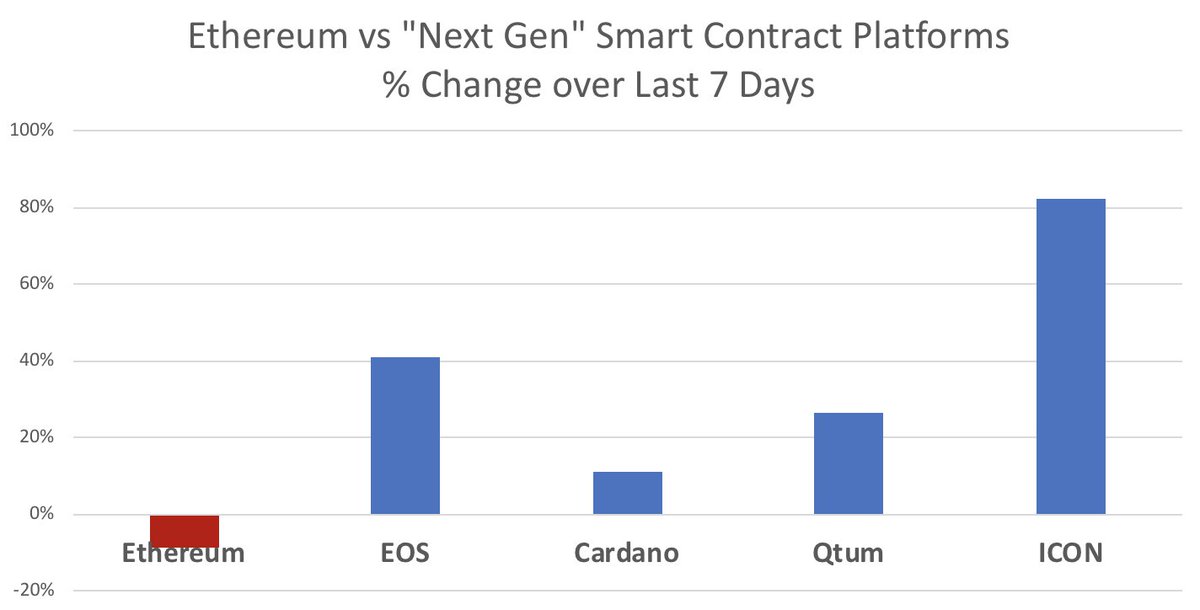

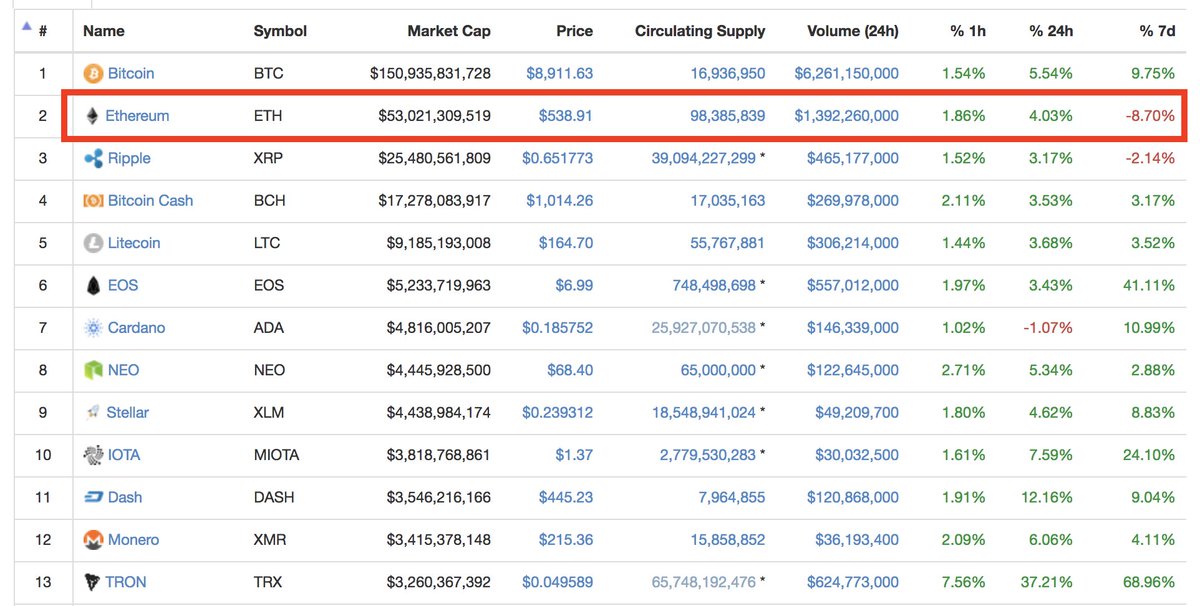

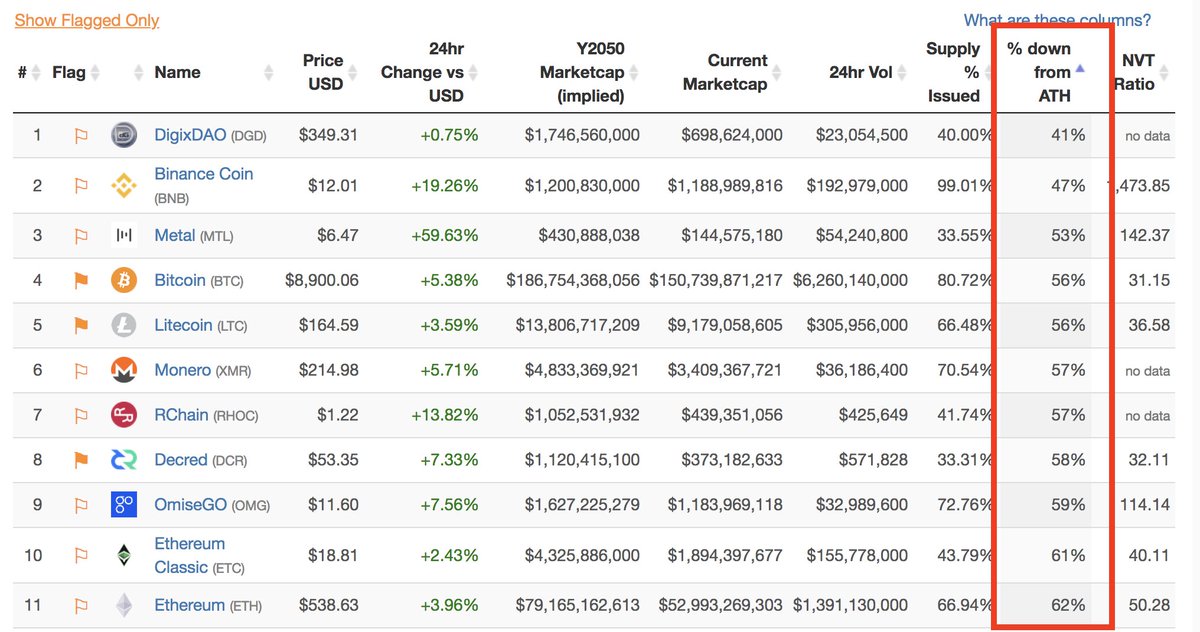

1/ #Ethereum is noticeably soft while many of its "next gen" competitors are showing strong bounces after brutal falls. coinmarketcap.com/all/views/all/

2/ #Ethereum's softness also clear in the context of the top 10. In stark contrast to how this bear market started, where $ETH was one of the most resilient assets.

3/ To be fair, #Ethereum is still down less from its all-time high than its aforementioned "next gen" competitors.

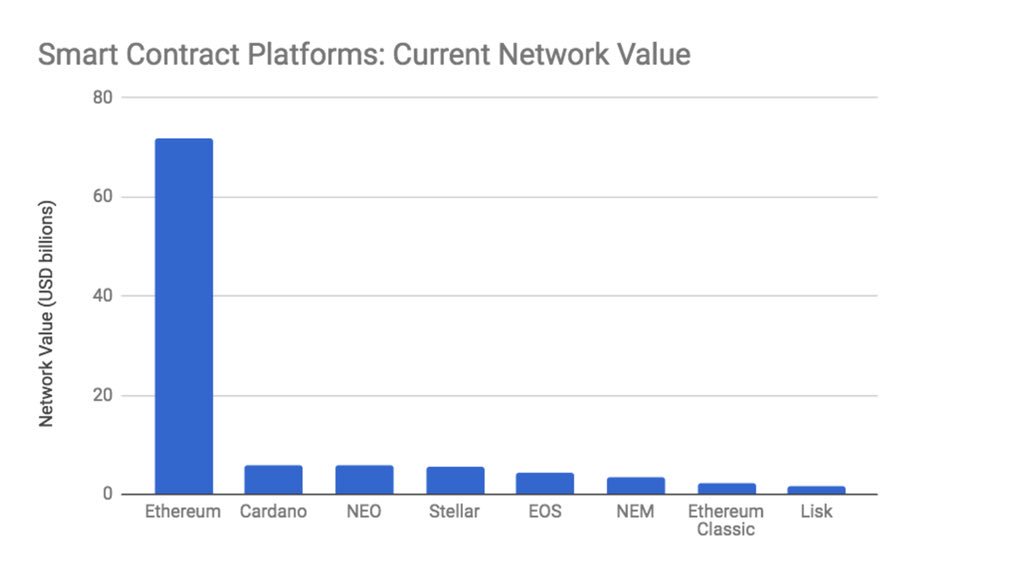

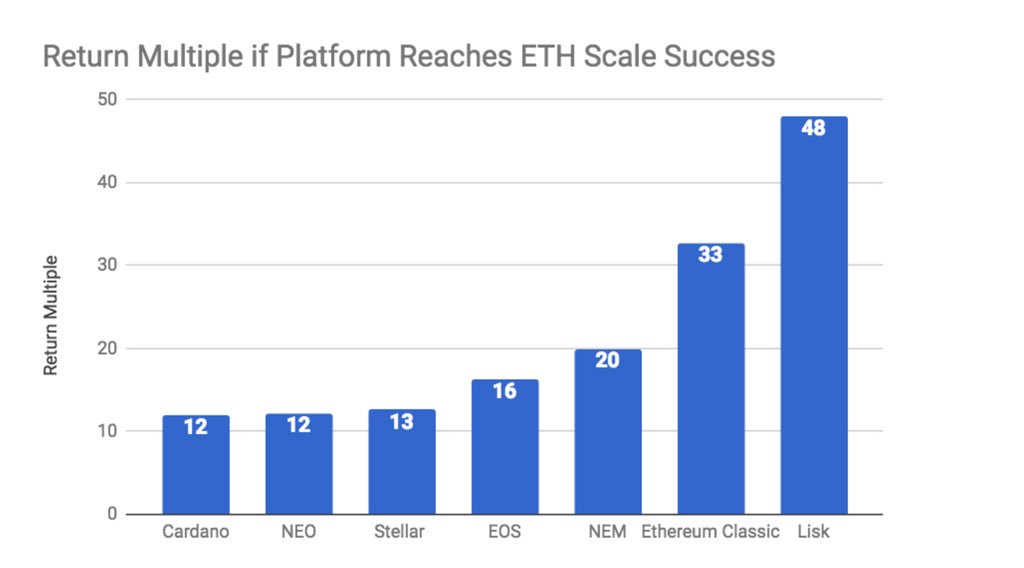

1/ Put together some informal thoughts on smart contract platforms for friends that I figured I should share. Clearly, this market is #Ethereum’s to lose.

2/ The reward, however, for any smart contract platform that can achieve #Ethereum levels of success is significant. Makes the expected value of investments potentially positive, even if low odds.

3/ #Ethereum has a “feature gravity advantage” over the upstarts, and a proven willingness to move fast and avoid ossification. So long as scale doesn’t make things a quagmire, such flexible governance will suit $ETH well going forward.

Lo que sabemos del #Petro hasta ahora, en los próximos tweets:

- Token será representado con el acrónimo $PTR

- Emisión máxima sería de 100.000.000 de $PTR

- Preventa comenzó ayer 20 de febrero y terminaría el 19 de marzo

- Venta pública pautada para iniciar el 20 de marzo

- Token será representado con el acrónimo $PTR

- Emisión máxima sería de 100.000.000 de $PTR

- Preventa comenzó ayer 20 de febrero y terminaría el 19 de marzo

- Venta pública pautada para iniciar el 20 de marzo

- Preventa estaba pautada en #Ethereum con un token ERC-20

- Maduro y manual oficial del comprador afirman que la preventa será en #NEM

- Hay contratos de ICO en ambas cadenas, Ethereum: etherscan.io/token/0x3341b1…; y NEM: explorer.ournem.com/?#/s_account?a…; No se sabe si son oficiales

- Maduro y manual oficial del comprador afirman que la preventa será en #NEM

- Hay contratos de ICO en ambas cadenas, Ethereum: etherscan.io/token/0x3341b1…; y NEM: explorer.ournem.com/?#/s_account?a…; No se sabe si son oficiales

- El registro para el ICO es engorroso y presenta problemas

- Maduro afirmó que $735 millones han sido invertidos en el ICO, no hay manera de confirmar pues aceptan transferencias bancarias

- Miembros de @NEMofficial aseguran no haberse reunido con el gobierno, como éste indicó

- Maduro afirmó que $735 millones han sido invertidos en el ICO, no hay manera de confirmar pues aceptan transferencias bancarias

- Miembros de @NEMofficial aseguran no haberse reunido con el gobierno, como éste indicó

Here's a sneakpeek to helping protect people on Twitter from #ethereum scams that have recently become big profit.

Finding soooo many holy shit. Only 7 accounts in this whitelist too :/

And another...

1/ My vision with #prologcoin is as follows:

Imagine a standard Prolog environment with a command line prompt.

And then you share a state with your peers. This state is an implicit endless growing query.

Imagine a standard Prolog environment with a command line prompt.

And then you share a state with your peers. This state is an implicit endless growing query.

2/ From this query it follows that if it is true, so is any subsequence of it. The goal is then to support full validation on certain subsequences (e.g. your wallet can be fully validated.)

3/ If we use Mimblewimble as the base (economic) transactions, we can also prune this query further (following the special axioms that Mimblewimble transaction cut-through gives us.)