How to get URL link on X (Twitter) App

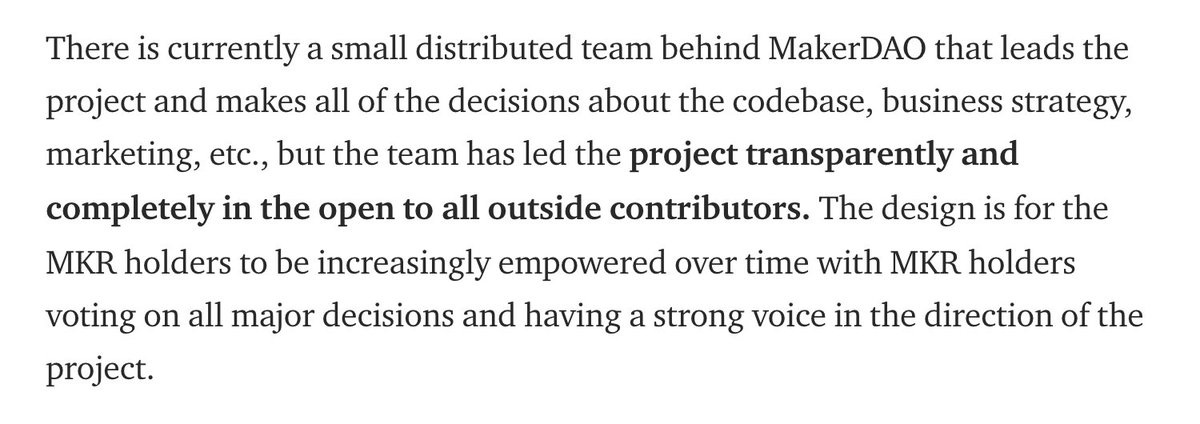

https://twitter.com/MakerDAO/status/10442100951591690242/ according to a blog post, the $15M will be used to fund the next 3 years of operating costs. i'm sure people think this is a great sign for the project - being able to recruit high quality capital. but, i think this is a massive failure in governance and project management.

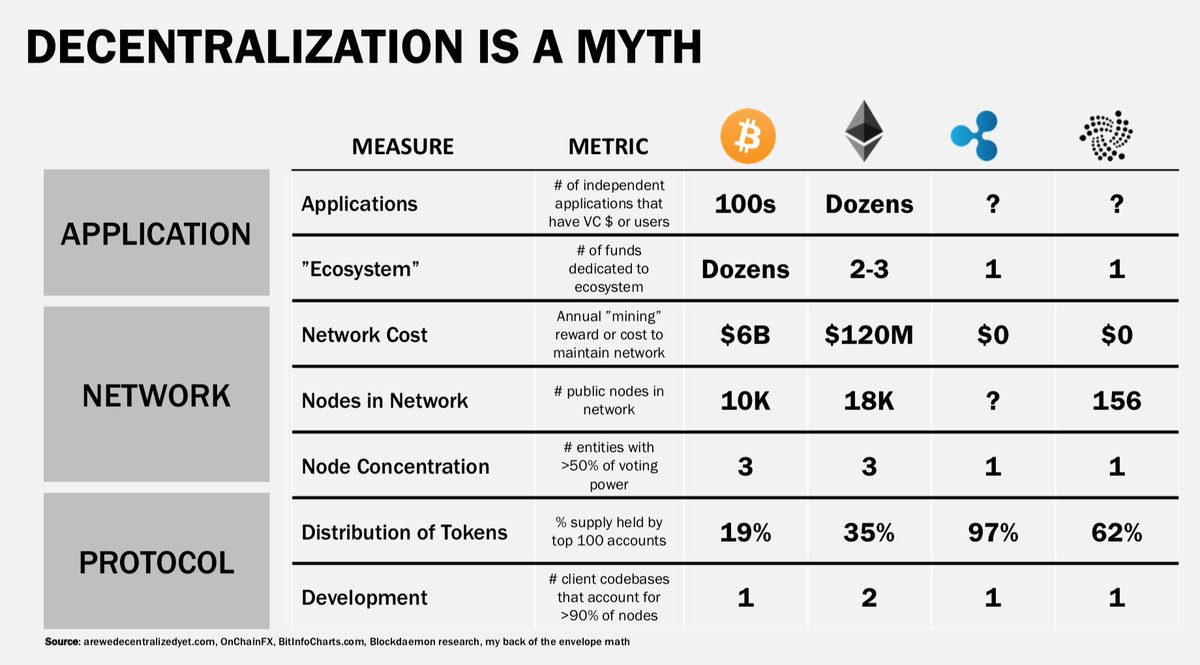

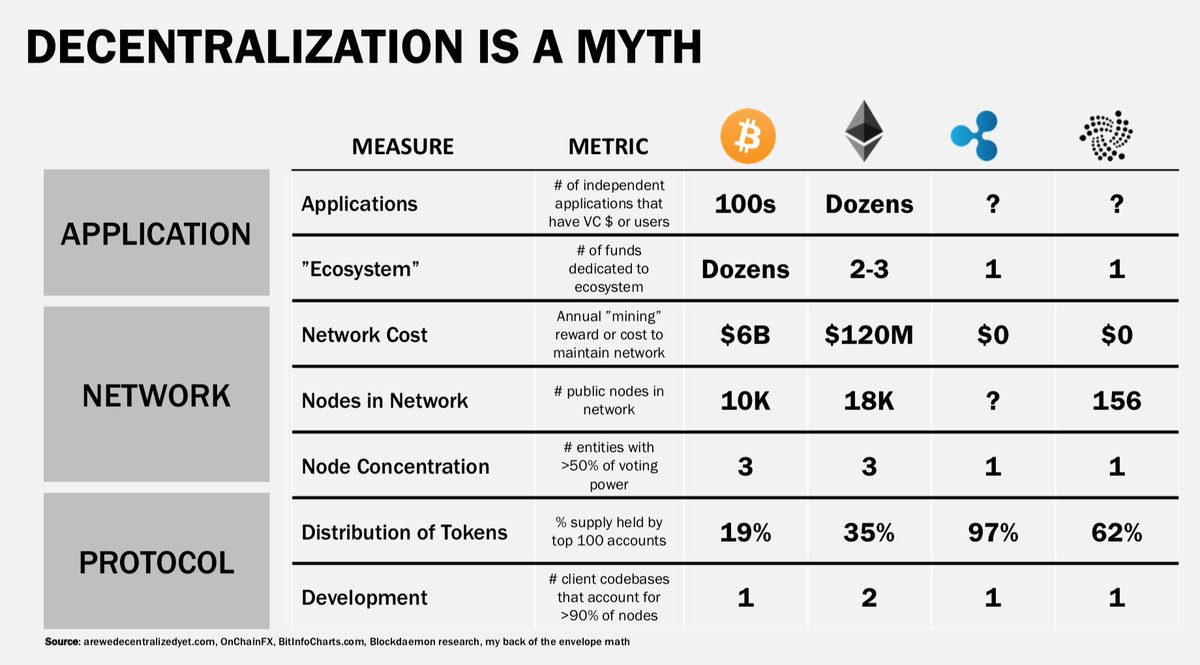

2/ a good chunk of the data comes from arewedecentralizedyet.com - the brainchild of @ummjackson - who was continuously harassed by some of the projects on his site that are... ummm... clearly not "decentralized" in any manner while marketing that narrative ad nauseum

2/ a good chunk of the data comes from arewedecentralizedyet.com - the brainchild of @ummjackson - who was continuously harassed by some of the projects on his site that are... ummm... clearly not "decentralized" in any manner while marketing that narrative ad nauseum

2/ i’ve been spending the last six months deeply immersed in the institutional investor community. for simplicity, let’s say the US cohort of “institutional” investors - or the TAM - for tokens is $28 trillion in AUM. (ignore new demand creation)

2/ i’ve been spending the last six months deeply immersed in the institutional investor community. for simplicity, let’s say the US cohort of “institutional” investors - or the TAM - for tokens is $28 trillion in AUM. (ignore new demand creation)

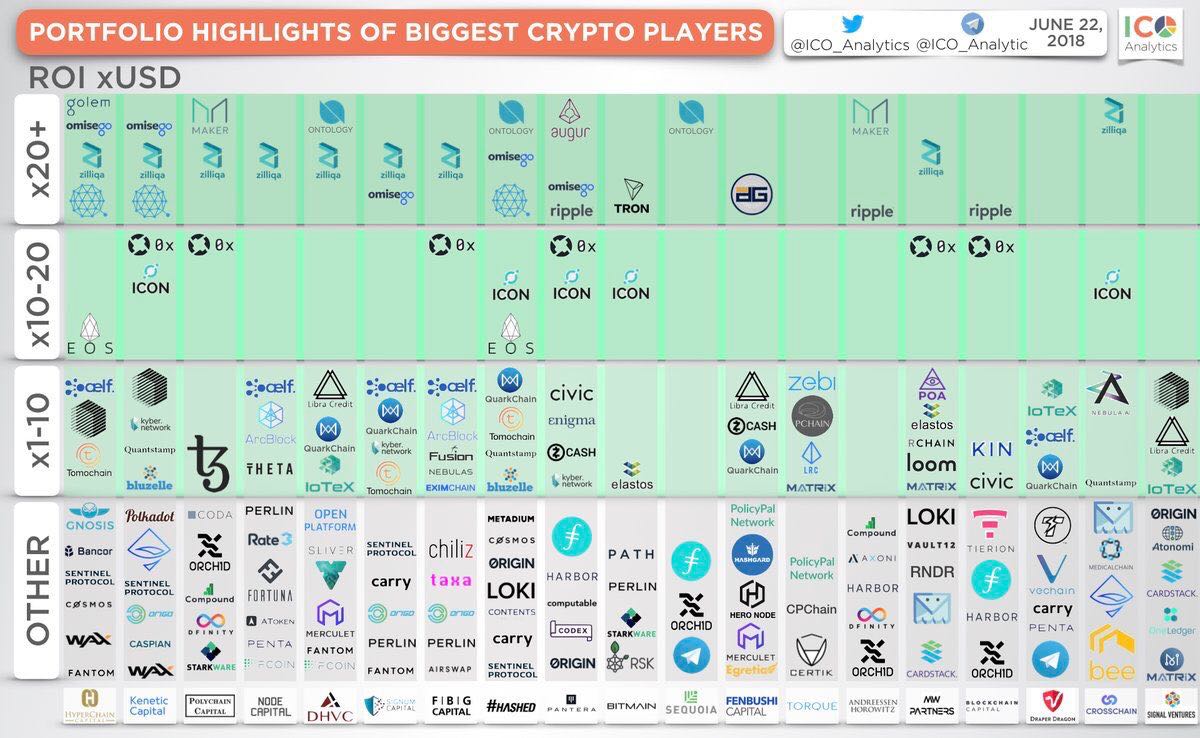

https://twitter.com/twobitidiot/status/10210212292543979532/ part of being a VC is finding great companies that are likely to create a lot of value. a lot of being a VC is about controlling your entry price (as low as possible) and maximizing your exit price (as high as possible) to juice your return multiple.