How to get URL link on X (Twitter) App

https://twitter.com/arminvanbitcoin/status/963833194473836544?lang=en

https://twitter.com/PoliticalShort/status/1040804462523236352Since this is getting some attention, I want to explain what happened in more detail.

2/ The price level of all monetary goods is determined by (and only by) reservation demand. More precisely, the duration that the average unit of the monetary good is held in reserve.

2/ The price level of all monetary goods is determined by (and only by) reservation demand. More precisely, the duration that the average unit of the monetary good is held in reserve.

https://twitter.com/twobitidiot/status/10370914260798341122/ Let us not forget that reputation should be associated with the consequences of our actions. Erik and ShapeShift have earned the suspicion of people who care about #Bitcoin.

https://twitter.com/CryptoFinCon/status/10341002720695828482/ Have the conference organizers done a shred of due diligence on this person? There is no information at all on him before late 2017, then he suddenly shows up in a bunch of shady publications saying he was buying bitcoins in 2009 - all the articles have the same verbiage.

2/ A hard money standard provides an economic framework that lowers time preference across all of society; all fields of endeavor are affected, from philosophy to science, engineering and the arts.

2/ A hard money standard provides an economic framework that lowers time preference across all of society; all fields of endeavor are affected, from philosophy to science, engineering and the arts.

https://twitter.com/Excellion/status/1028426579158884352

https://twitter.com/real_vijay/status/10196021683309117442/ @stevekbannon has stated that "I like bitcoin. I own bitcoin":

https://twitter.com/naval/status/10197661153988935682/ In the tweet I quoted above you present a mathematical tautology that seems obvious, but I think when unpacked it's a lot less obvious than as presented. Let me, however, agree with you: someone who codes for a protocol and is HODLer is doing more than someone merely HODLing

https://twitter.com/real_vijay/status/953735809647116288?s=20

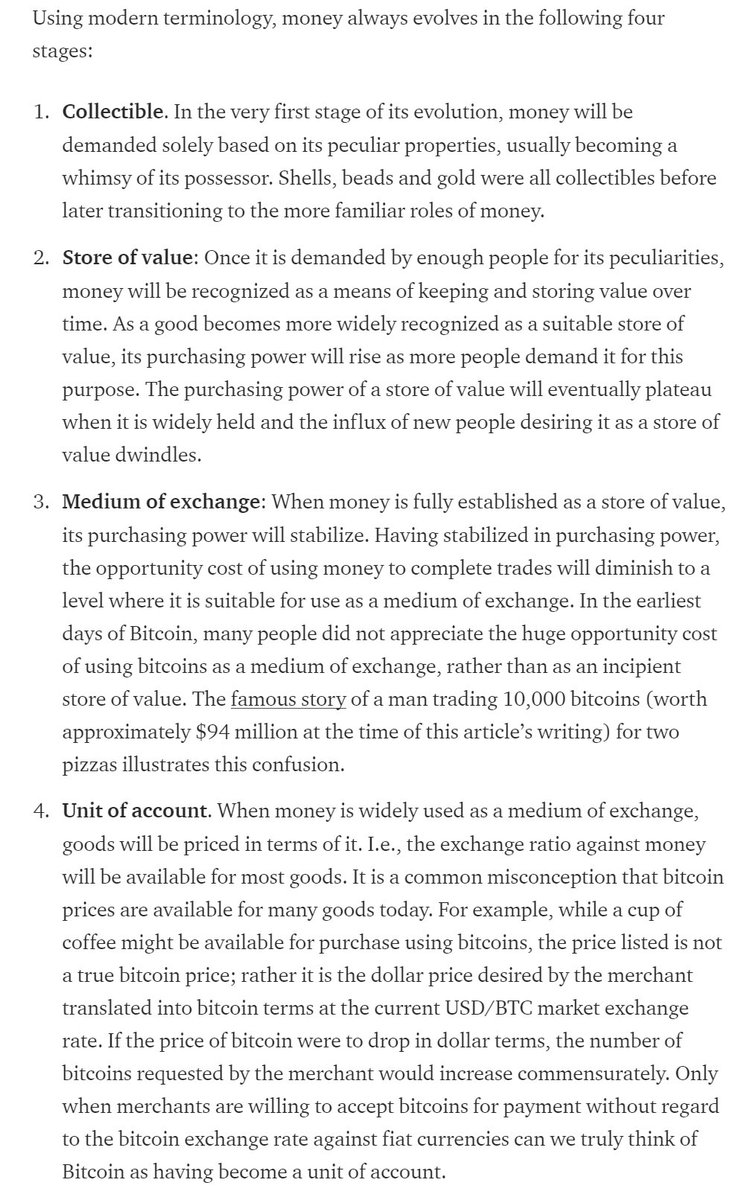

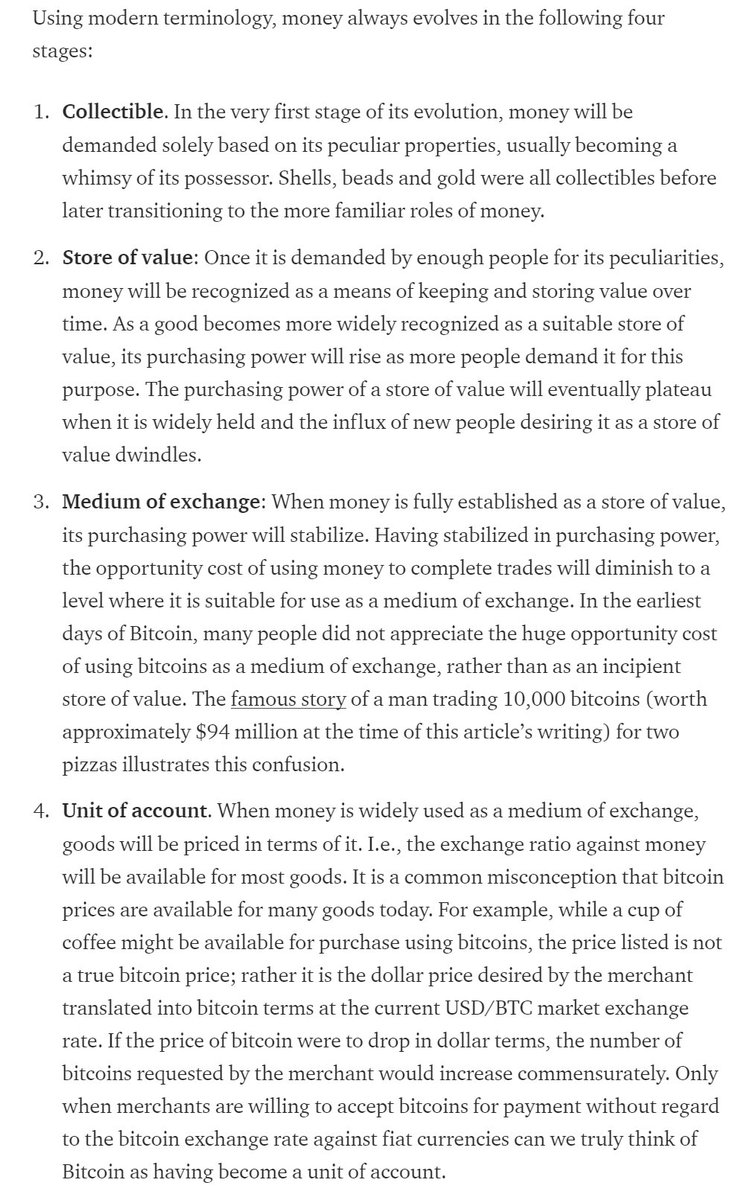

2/ No economic good can become a full fledged money without passing through the 4 stages of the evolution of money.

2/ No economic good can become a full fledged money without passing through the 4 stages of the evolution of money.https://twitter.com/real_vijay/status/916860034323169280

https://twitter.com/MustStopMurad/status/10098415990676725762/ Most of the value in an economy is in meat-space and this will always be the case. Any application that runs on Ethereum that touches meat-space cannot escape losing its decentralized properties and hence would be better run on a regular, much more efficient database.

https://twitter.com/real_vijay/status/9877669923869655042/ The process of monetization is the increasing distribution of the supply of a monetary good amongst a population. What matters is not the number of people who become owners per se, but how fully the supply itself is distributed.

2/ The misconception is that Bitcoin (or other cryptocurrencies) must be "useful" or used in exchange or "earned" for them to be valuable. "Buying and selling" *is* enough for Bitcoin at this stage of its evolution to becoming money.

External Tweet loading...

If nothing shows, it may have been deleted

by @balajis view original on Twitter

2/ The kernel of truth: Bitcoin is a new technology and nascent form of money. The future is uncertain so there are obviously risks to investing in it. Anyone with a shred of common sense already knew this.

External Tweet loading...

If nothing shows, it may have been deleted

by @VitalikButerin view original on Twitter