1/ in markets, investor psychology is everything. i shared my thoughts on greed, investor psychology, shitcoin, and market cannibalization at @dezentral_io in berlin and wanted to share some of these ideas here...

option b: skip directly to slides here: slideshare.net/DCGCo/how-to-n…

option b: skip directly to slides here: slideshare.net/DCGCo/how-to-n…

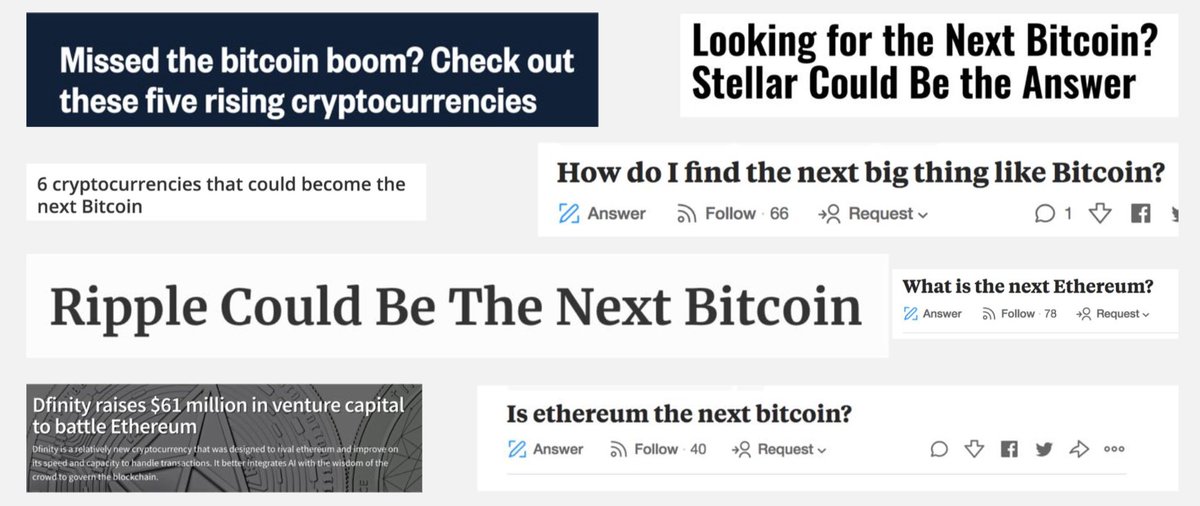

2/ investors in the crypto ecosystem saw everything go up and to the right. everyone in the market is feeling good, and worth a lot on paper. everyone outside the market is feeling FOMO, and wants in on some juicy returns. the narrative is "blockchain, make me money!"

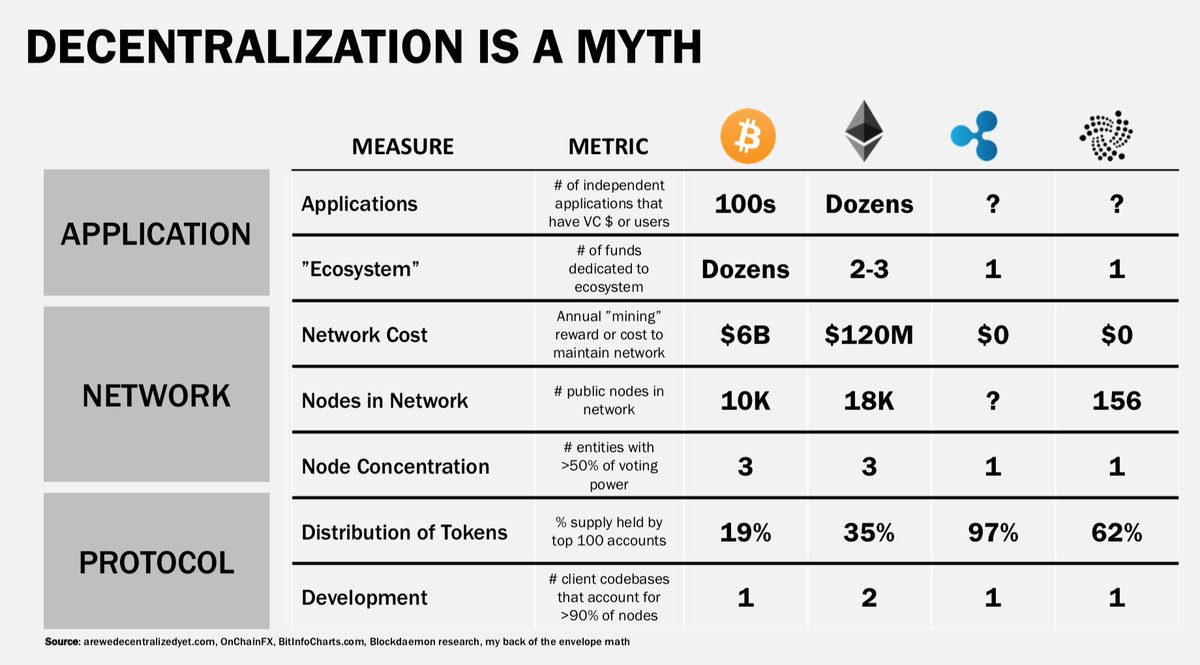

3/ everyone starts looking for the next #bitcoin, #ethereum, #ripple. people begin to believe that the market will go up and to the right forever, and investors flush with paper returns from the crypto casino rush to multiply their money at the shitcoin roulette wheel.

4/ but there's a pecking order at play here. bitcoin sits at the top. altcoins sit below. there's a big, old stinky pile of shitcoins, and then there's all the stuff people are trying to shove into the crypto universe that really doesn't belong in the same category.

5/ but the realities of this market are pretty interesting:

- raising money is still as easy as its ever been

- building shit is still as hard as its ever been

- any time there's even a mild market rally, more shitcoins flood the market and consume all value

how is this possible?

- raising money is still as easy as its ever been

- building shit is still as hard as its ever been

- any time there's even a mild market rally, more shitcoins flood the market and consume all value

how is this possible?

6/ simple. supply and demand. you have sellers and buyers who have to play the game. let's break it down.

on the sell side, issuers are going to continue pumping out tokens until the marginal cost of producing, marketing, and selling tokens > proceeds from sale

on the sell side, issuers are going to continue pumping out tokens until the marginal cost of producing, marketing, and selling tokens > proceeds from sale

7/ there are way too many projects being "tokenized." not to pick on Dentacoin, but this token for the dentistry industry with a very obscure value proposition had a peak market cap of $2.1 billion. it's now 1/20th of that - but still too much.

most ideas don't need a token.

most ideas don't need a token.

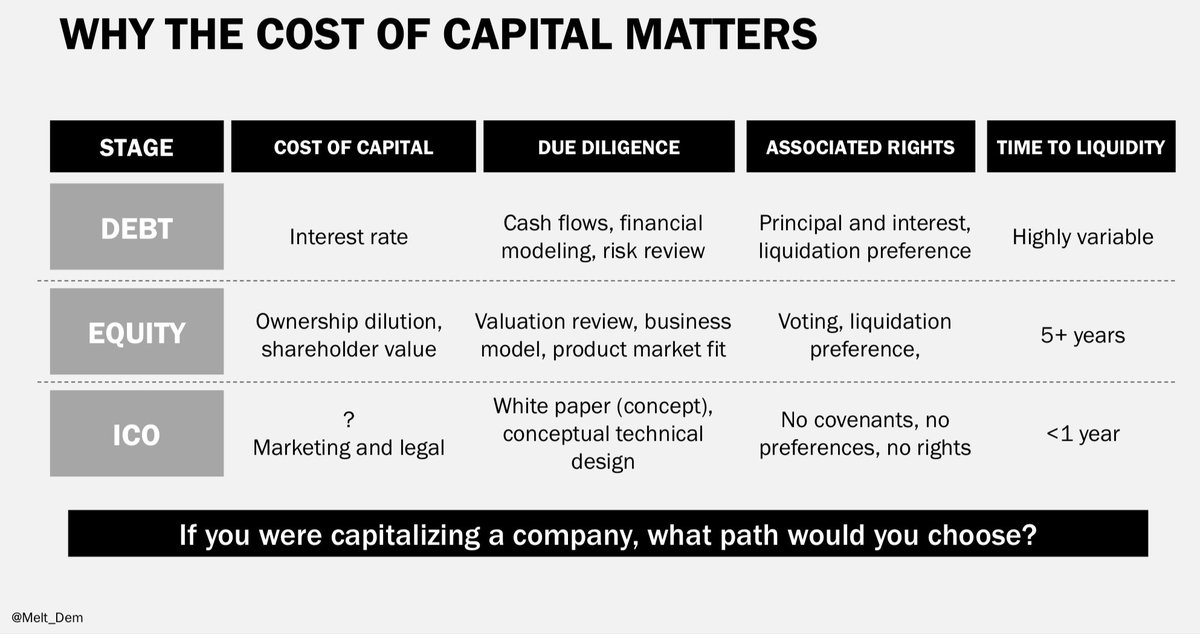

8/ it's way too easy to print your own money. the cost of capital matters a lot to founders, and raising token financing is the fastest, lowest cost, and least dilutive manner of fundraising. it comes with no accountability, no investor rights, and no obligations. irresistible!

9/ lastly, every project treats token holders (ie humans) like machines. as @_jillruth likes to say, tokenomics would have you believe if you put a token in a human, you get out a function. that's not how people work. no amount of free dentacoin will make me use dentacoin.

10/ so the sell side drivers are clear -

- every idea that can be tokenized has been or will be tokenized

- printing your own tokens is fast, cheap, and irresistible

- tokenomics are a poor and highly imperfect attempt to engineer human behavior like a logic function

- every idea that can be tokenized has been or will be tokenized

- printing your own tokens is fast, cheap, and irresistible

- tokenomics are a poor and highly imperfect attempt to engineer human behavior like a logic function

11/ let's move on to the *buy* side. so there's a lot of crap out there. even if no one is using these tokens, people keep buying them. why?

there are big pools of capital that were raised for crypto "funds." these funds need to keep allocating. and shitcoins still look sexy.

there are big pools of capital that were raised for crypto "funds." these funds need to keep allocating. and shitcoins still look sexy.

12/ it seems no investor is immune to the siren song of shitcoins, because the caliber (social signal + virtue signal value) of investors in the space keeps increasing. every month, it seems more brand names are openly disclosing their interest in buying shitcoins.

13/ looking at the macro landscape, it actually makes sense. there's increasing pressure on VCs, HFs, and other alternative asset managers. returns across asset classes are squeezed. everything feels overpriced. a few 100x crypto investments can make a fund. so why not try?

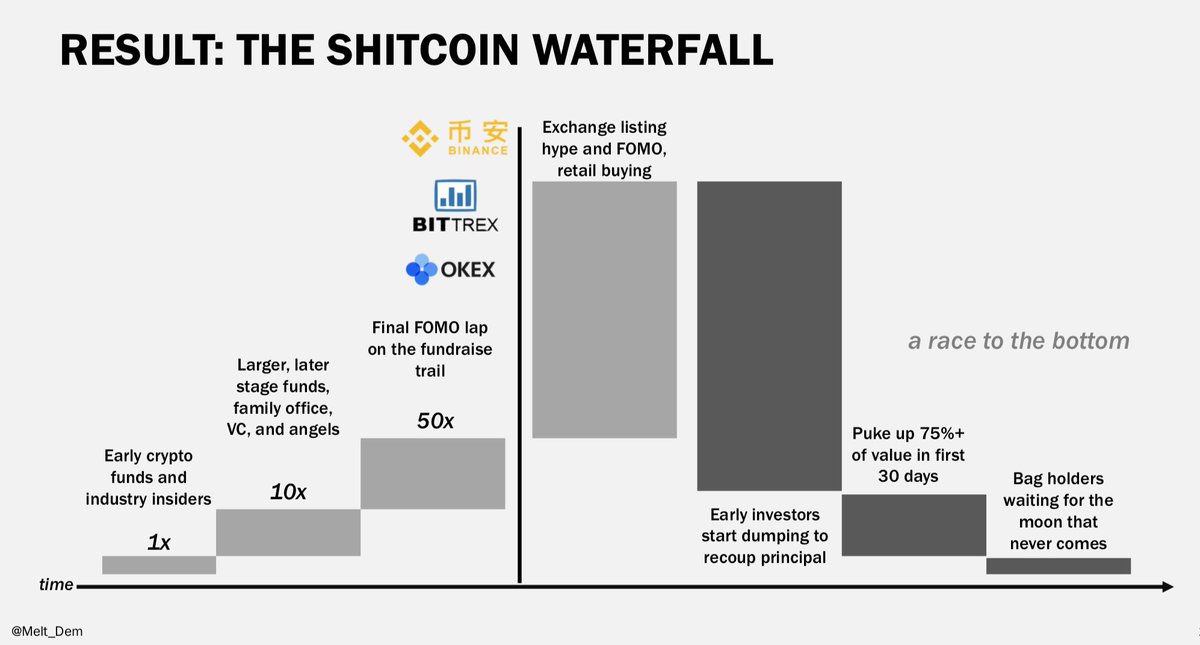

14/ so what do you get when a bunch of financially motivated speculators get their paws on tokens? the shitcoin waterfall.

as an investor - you can only control your entry price. so you enter at the lowest price and redeem your principal (and profit) as soon as possible.

as an investor - you can only control your entry price. so you enter at the lowest price and redeem your principal (and profit) as soon as possible.

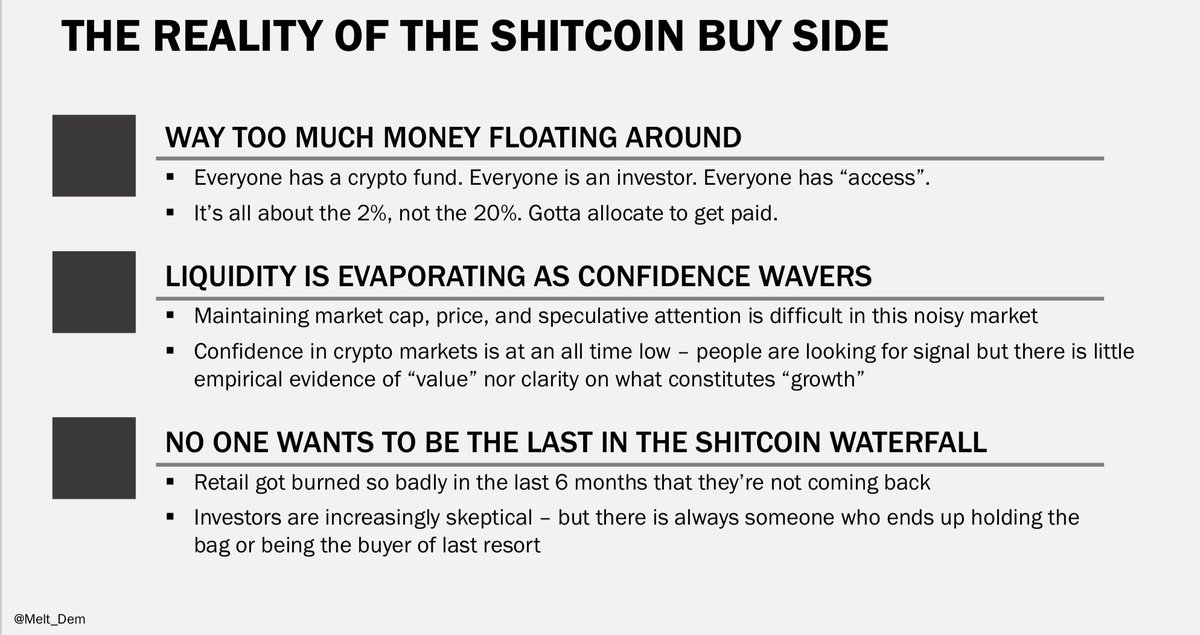

15/ so let's sum up the buy side:

- there's too much money floating around, and managers live for the 2, not the 20. gotta allocate to get paid.

- everyone wants to lock in profit, meaning no conviction and no HODL

- no one wants to be the buyer of last resort - and retail is out

- there's too much money floating around, and managers live for the 2, not the 20. gotta allocate to get paid.

- everyone wants to lock in profit, meaning no conviction and no HODL

- no one wants to be the buyer of last resort - and retail is out

16/ so here we are.

everyone who can sell a shitcoin will sell a shitcoin as long as there's money to be made.

everyone who can buy a shitcoin will buy a shitcoin as long as there's money to be made.

but market confidence is shot. issuers and investors alike are feeling the FEAR.

everyone who can sell a shitcoin will sell a shitcoin as long as there's money to be made.

everyone who can buy a shitcoin will buy a shitcoin as long as there's money to be made.

but market confidence is shot. issuers and investors alike are feeling the FEAR.

17/ we can see this in the market. as the unit of account for ICOs, $ETH is getting hit hard with the FEAR.

in the last month, $ETH has shed half its value

in the last quarter, $ETH has shed 3/4ths of its value

(yes, bitcoin has seen similar moves BUT over a different time frame)

in the last month, $ETH has shed half its value

in the last quarter, $ETH has shed 3/4ths of its value

(yes, bitcoin has seen similar moves BUT over a different time frame)

18/ so what now? a few ideas, from someone who bought more than a few shitcoins in her day.

on the sell side, projects should focus less on vanity metrics like price and fundraising and social signal investors and focus more on creating exciting, compelling user experiences

on the sell side, projects should focus less on vanity metrics like price and fundraising and social signal investors and focus more on creating exciting, compelling user experiences

19/ is the ICO really the best form to raise capital? i'm not sure. can we evolve the form factor to ensure the ends justify the means? are there capital formation strategies that keep incentives in check and minimize the ability to exploit the market?

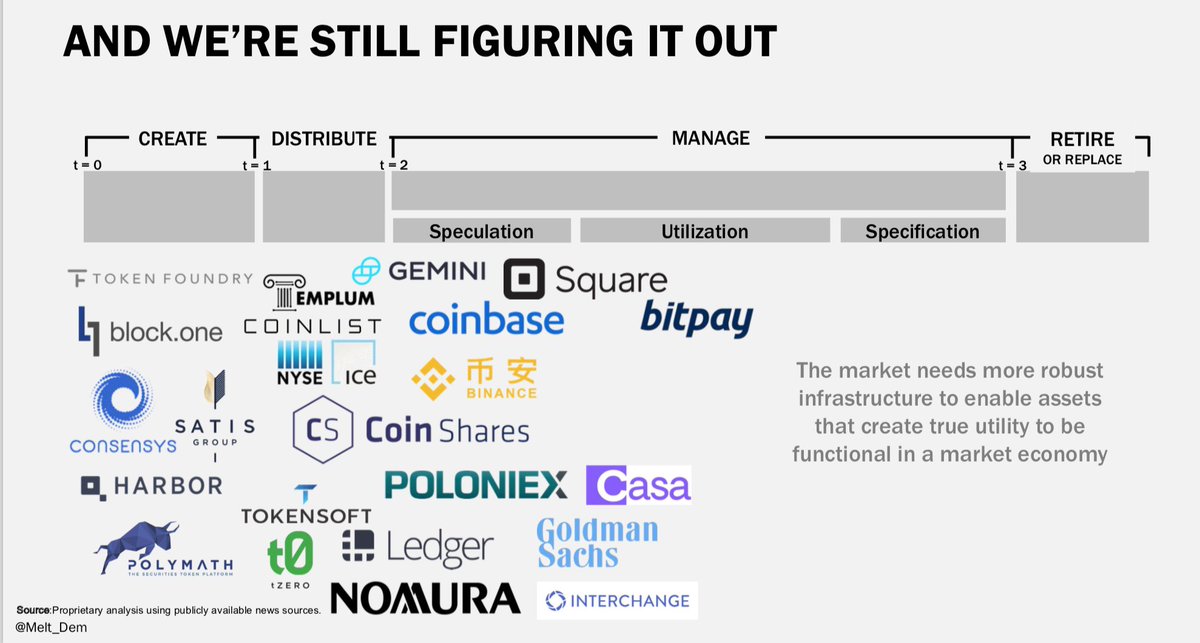

20/ i'm still really excited about cryptocurrencies, capitalizing protocols and projects in new ways, and building new types of networks without companies to rule them. but - it's still *so* early. we have so much work to do to move beyond speculation.

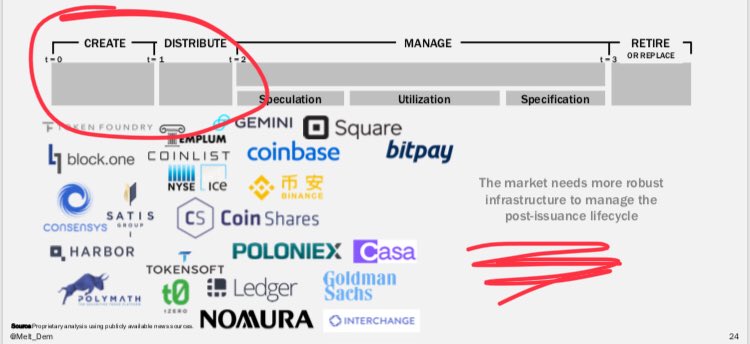

21/ for now, i'm spending a less time on "tokens" and more time thinking about "infrastructure" - who is going to build the stuff that helps make these tokens and networks usable, sustainable, and efficient. there's a wide open field. and a lot of money to be made...

22/ and lastly, using Fama and Coase's theory of the firm, we can start to implement better practices on both the buy side and the sell side to reduce the residual loss in the market. i'm focused heavily on thinking through what i could build here as a services business.

• • •

Missing some Tweet in this thread? You can try to

force a refresh