Discover and read the best of Twitter Threads about #Cryptoassets

Most recents (14)

1/ When studying non-fungible #cryptoassets, I'm seeing two types discussed: "functionals" and "investment instruments."

2/ "Functionals" are non-fungibles that are meant to be used, a means to access services like ticketing, voting, payment, and more. Best existing examples?

3/ "Investment instrument" non-fungibles are held for their store of value characteristics, be they solely digital things, or derivations of meatspace assets (real estate, art, cars, etc).

Provocative exploration of #crypto valuations that goes a layer deeper than all prior works, starting with the question of: “what do we value?” google.com/url?q=https://…

2/ #Cryptoassets will allow us “to develop multiple indices of valuation that reflect different social priorities the way that profit price reflects capitalism’s priorities.”

3/ The group of professors & thinkers that put together the piece will be holding a #cryptoeconomics workshop at @NYUStern on 9/26, event info here: medium.com/econaut/crypto…

1/ Get ready for a predictable #crypto pattern: in the coming months, we will see an increasing number of #Bitcoin maximalists tormenting “altcoin investors” for straying from the mother ship.

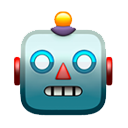

2/ The maximalist drum will get louder as we go deeper into the bear market, with #bitcoin falling less than most other coins, and its dominance index growing. coinmarketcap.com/charts/#domina…

3/ #Bitcoin is the benchmark after all, the market beta of crypto, with most everything oscillating at a higher amplitude than $BTC.

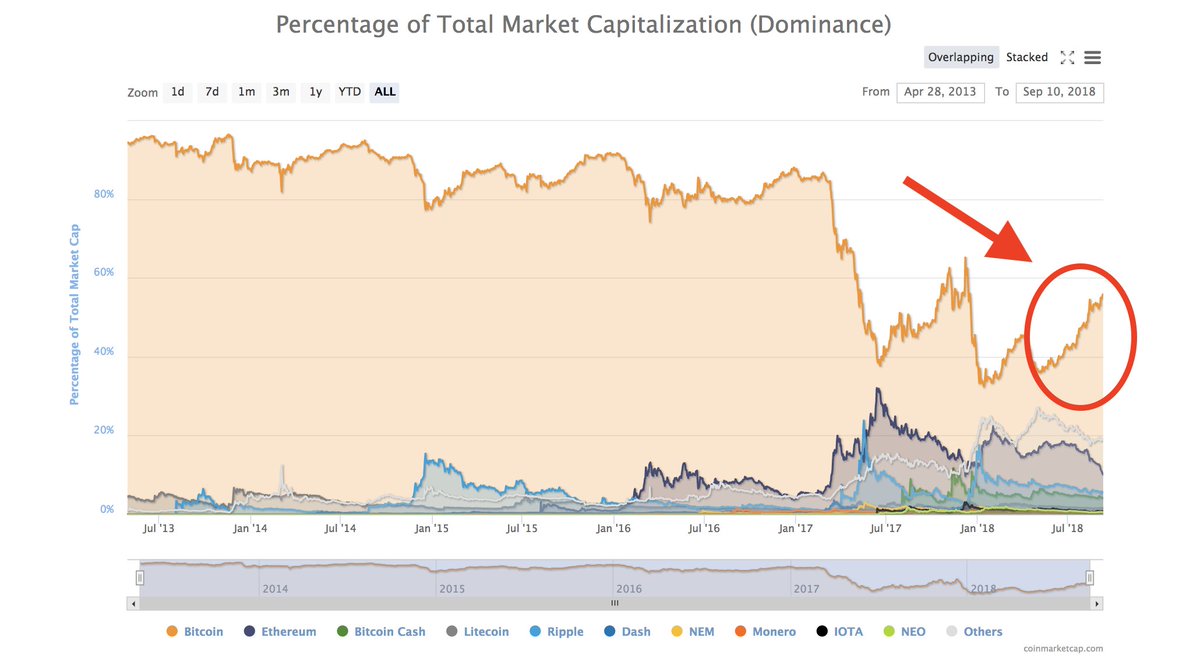

Majority of the time an index fund of *all* #cryptoassets produces better risk-adjusted returns than solely holding #bitcoin. medium.com/@xoelop/what-y… analysis via @xoelipedes

Somewhat obvious when you consider the effects of diversification & the moonshots this #crypto index includes, but good to see the concepts backed by data.

Given some of the concerns raised re: using all 1600+ #cryptoassets on @CoinMarketCap, would be good to see the same analysis for top 10/25/100, rebalanced annually + tax consideration.

original link didn't work, this one does: continuations.com/post/175471097…

Capitalism is a social construct, and as with all social constructs, it too will evolve or be replaced over time.

More people will own #cryptoassets than stocks.

I have no idea what it all says, so if anyone cares to enlighten @JackTatar and myself we’d be mighty grateful 🙃

Chinese, German and Portuguese translations still forthcoming, we’ll see if they have different covers too! FWIW, I’m not the designer of these, just the amused author.

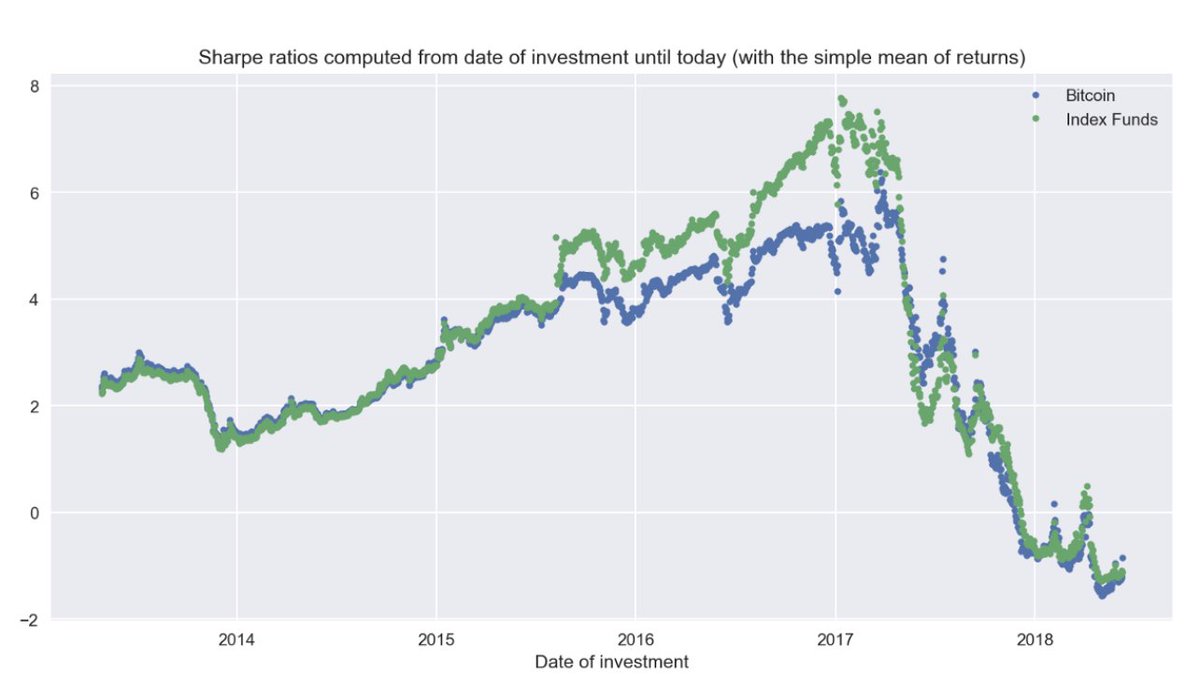

I often look @onchainfx using the "% down from ATH" filter, as the "least down" and "most down" both give valuable information. onchainfx.com

For the most part, in a bear market "least down" reveals tight-knit resilient communities, which can set them up to rebound quickly when sentiment turns.

"Most down" can either show you what was bad to begin with, or #cryptoassets that are being thrown out with the bathwater. For the latter, mean-reversion can be your friend.

1/ #Hodling is a lot harder than it looks, as it requires the choice of *no action* in an action-oriented culture.

2/ One of my favorite classes in college was called, "A Life of Contemplation vs Action," and it revealed humans repeatedly choose "action" over "no action," even when statistically "action" has clearly been proven to be the wrong choice.

3/ Take soccer goalies, for example. Statistically, they have better odds of blocking a penalty shot by staying in the middle of the goal (no action) and defending from there. Yet, the majority decide to jump right or left (action), decreasing their odds of success.

1/ There is a socio-financial transition taking place in the world.

2/ The organisation of our world into nation-states no longer ministers to the needs of humanity.

3/ Humanity yearns to be unified; yet our structures continue to divide us.

1/ While I appreciate the work of @CoinMarketCap & the many other token data aggregators, it’s important to recognize none of them represent the entire #cryptoasset reality.

2/ When people new to the space first realize @CoinMarketCap has ~1,500 #cryptoassets listed, many will exclaim, “Wow, that’s a lot!” But in reality, that’s just the tip of the iceberg...

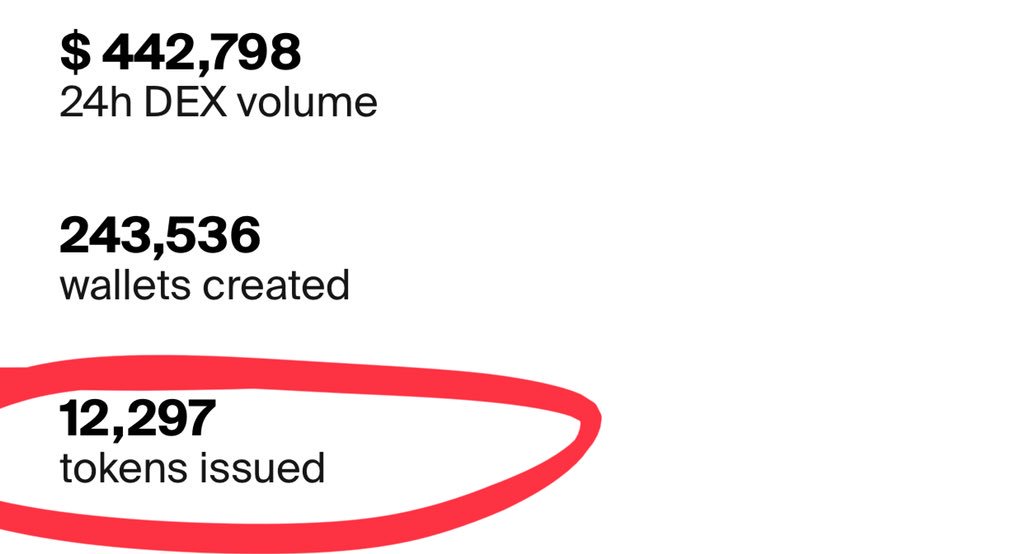

3/ consider, for example, that @wavesplatform has 12,297 #tokens that have been launched on its platform and trade on its internal DEX.

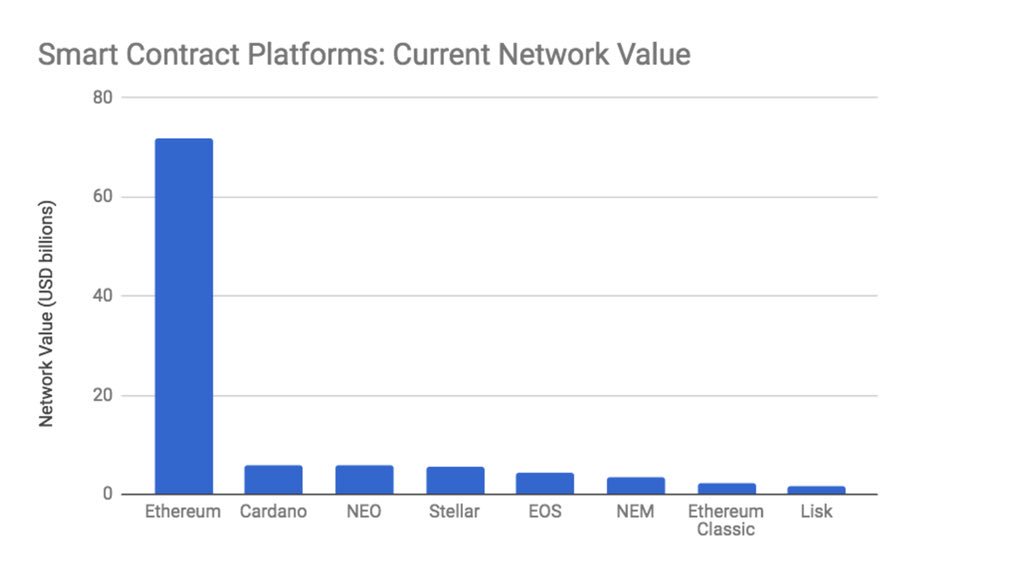

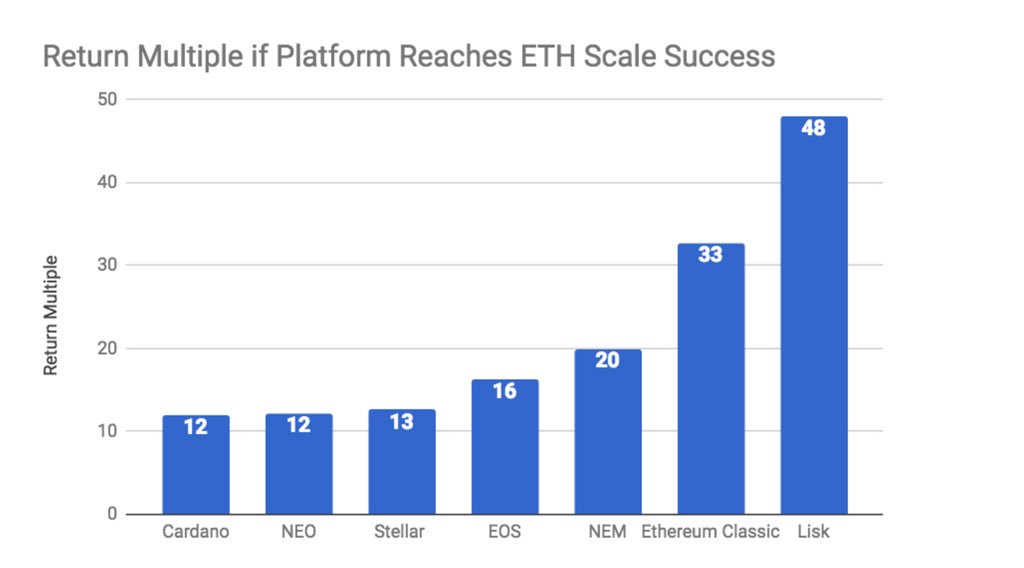

1/ Put together some informal thoughts on smart contract platforms for friends that I figured I should share. Clearly, this market is #Ethereum’s to lose.

2/ The reward, however, for any smart contract platform that can achieve #Ethereum levels of success is significant. Makes the expected value of investments potentially positive, even if low odds.

3/ #Ethereum has a “feature gravity advantage” over the upstarts, and a proven willingness to move fast and avoid ossification. So long as scale doesn’t make things a quagmire, such flexible governance will suit $ETH well going forward.

1/ Economists and traditional valuation experts claim that for most anything to be *valued* it must have cash flows.

2/ These experts then go on to say currencies can't be valued, they can only be *priced.*

3/ So then the "fundamental value" of stocks and other cash producing assets is based on currencies that have no fundamental value? Logic seems fragile at best, like building a castle with air.

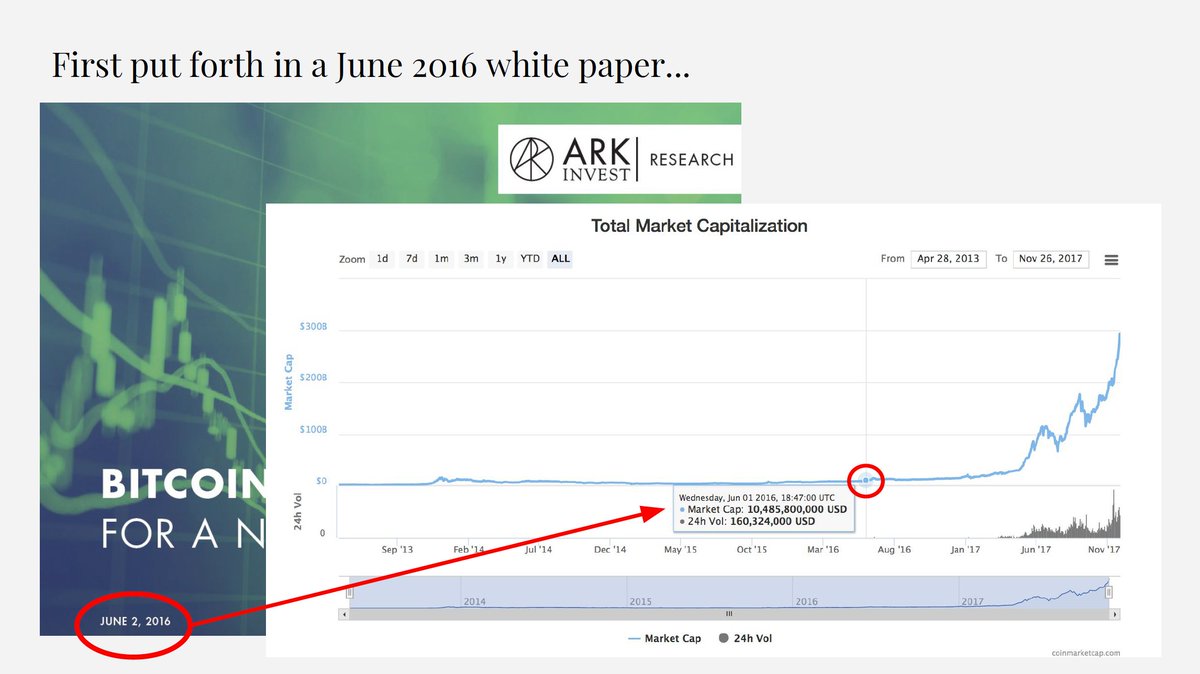

2/ The presentation was inspired by the 2016 white paper put out by @ARKInvest & @coinbase, which involved @WhiteAdamL, @wintonARK, @CathieDWood & myself. Link to whitepaper here: research.ark-invest.com/bitcoin-asset-…

3/ When the white paper came out in July 2016, it got fanfare from the #cryptocommunity, but many from #WallSt dismissed it b/c the aggregate network value of #cryptoassets was $10.5B at the time. Asset classes store trillions, #crypto would never get there...