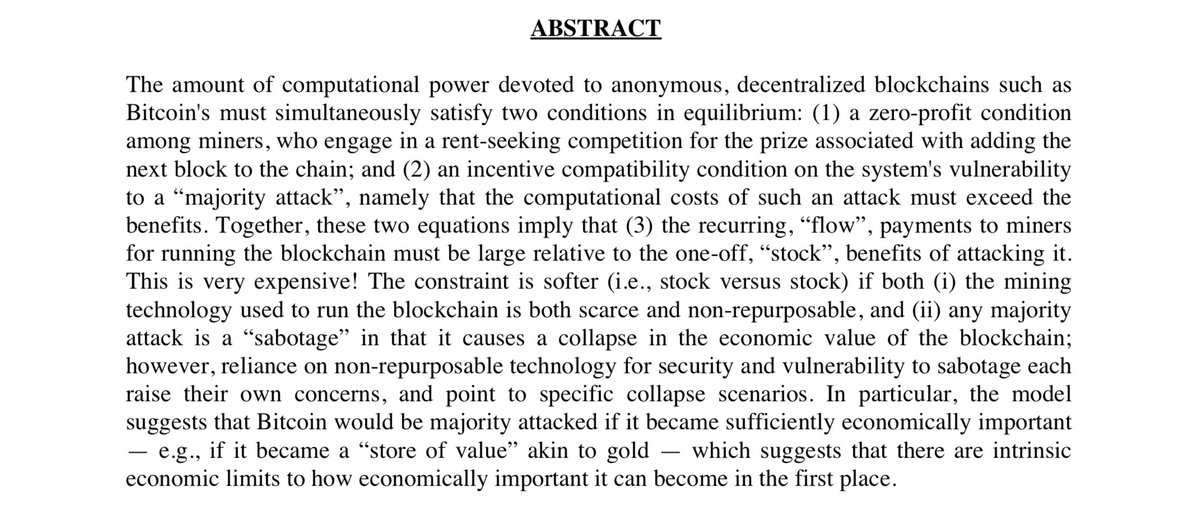

One of the most robust explorations I've read on the economic & game theoretic limits of #Bitcoin & #PoW more broadly: nber.org/papers/w24717

Sorry for the paywall, but the paper is well worth the $5. Makes me think of hybrid #PoW & #PoS as a potential solution (part of the thinking around our $DCR investment), as research for pure #PoS is ongoing.

Paper confirmed my concerns around what on-chain transaction fees may have to be when the coinbase reward goes to zero (to accomodate 0% rate of inflation). Depending on assumptions: $18,700 to $37,400 to $108,700 per txn.

Some may respond, "but lightning network." Lightning network fees won't do a good job of compensating miners, which are the ones vulnerable in the attacks explored by the paper (and that we as a community should be worried about).

I raise all of these points in the best interest of #Bitcoin, not to attack & tear it down. It's open source software, it *can* change, and we can't assume Satoshi got it all right.

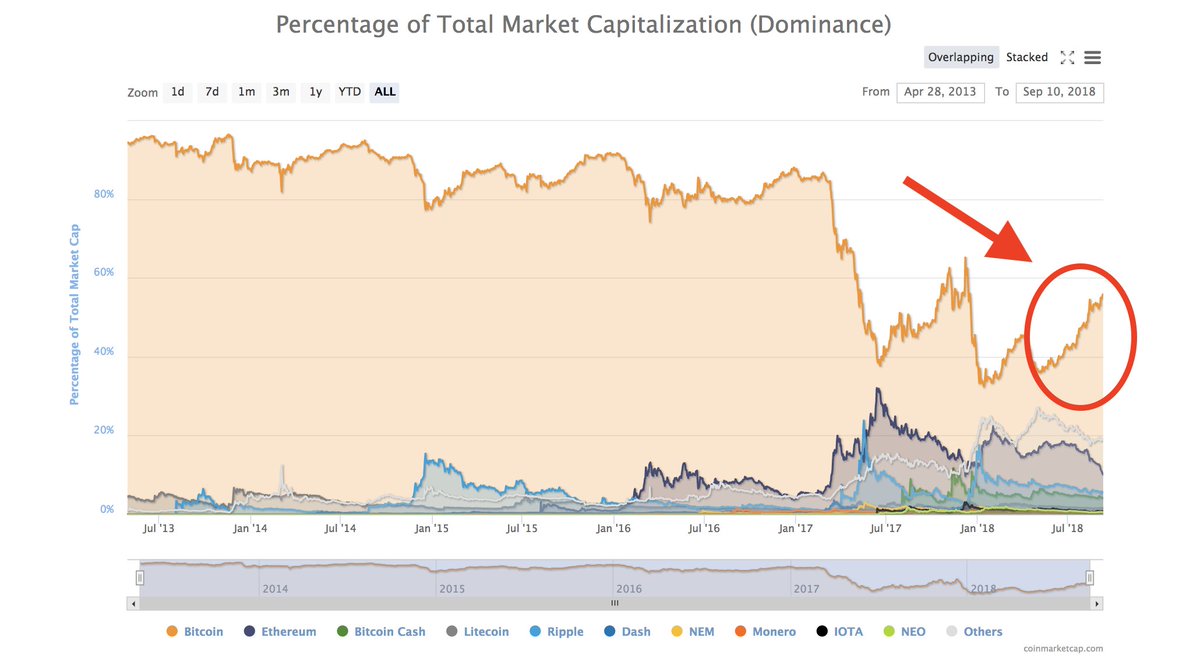

If concerns around #PoW's viability @ 0% rates of inflation continue to be ignored, then people will diversify into SoV alternatives that contemplate different consensus mechanisms (eg, @decredproject) or long-tail inflation (eg, #Monero). Some have already 🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh