Leeds United’s 2016/17 financial results covered a season when they finished 7th in the Championship under former head coach Garry Monk, thus just missing out on the play-offs #LUFC

2016/17 also saw Massimo Cellino’s three-year reign come to an end, as fellow Italian Andrea Radrizzani first bought a 50% stake in December 2016 before taking 100% ownership in May 2017. He reportedly paid £45m to acquire #LUFC.

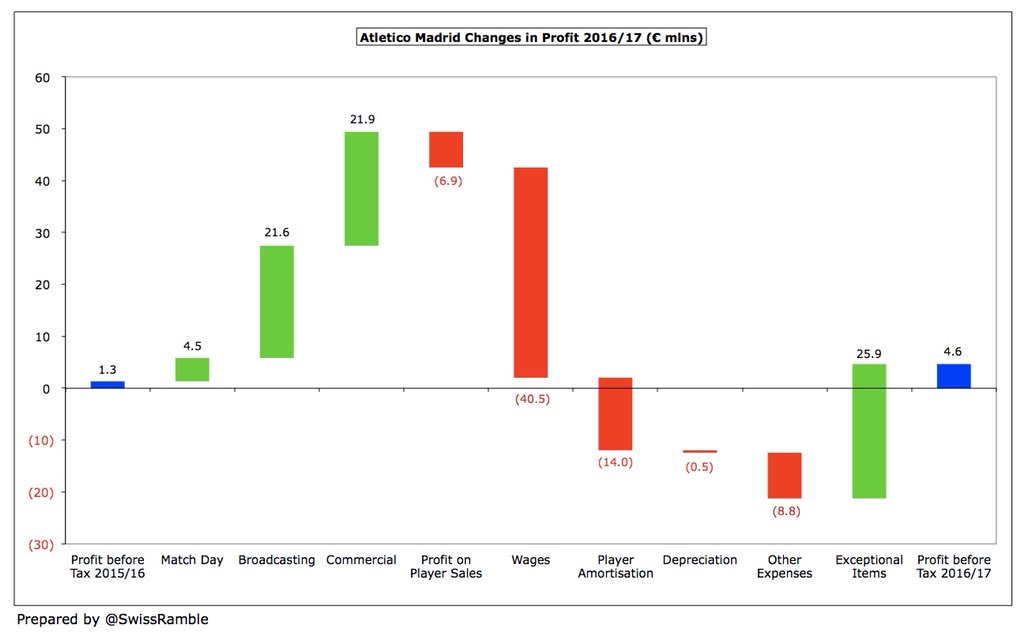

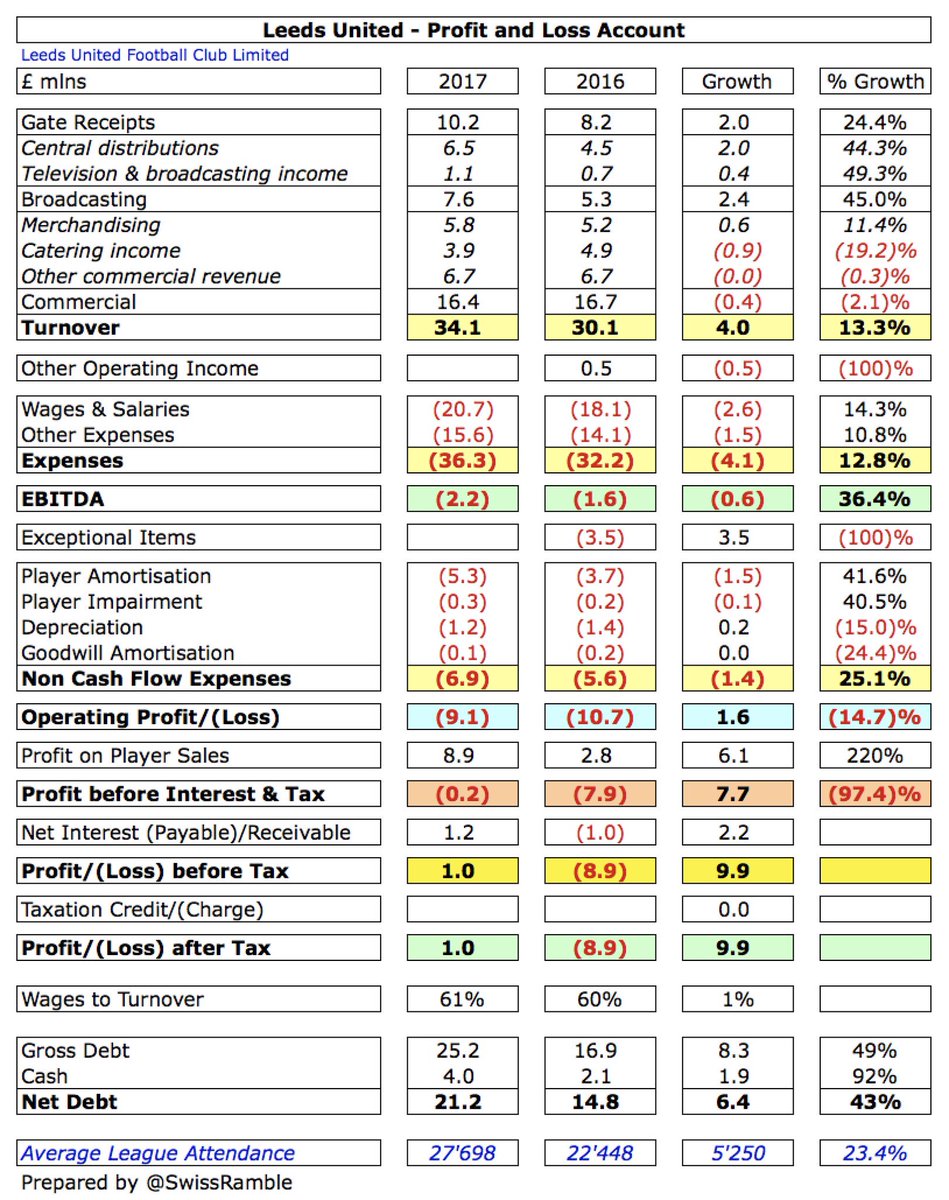

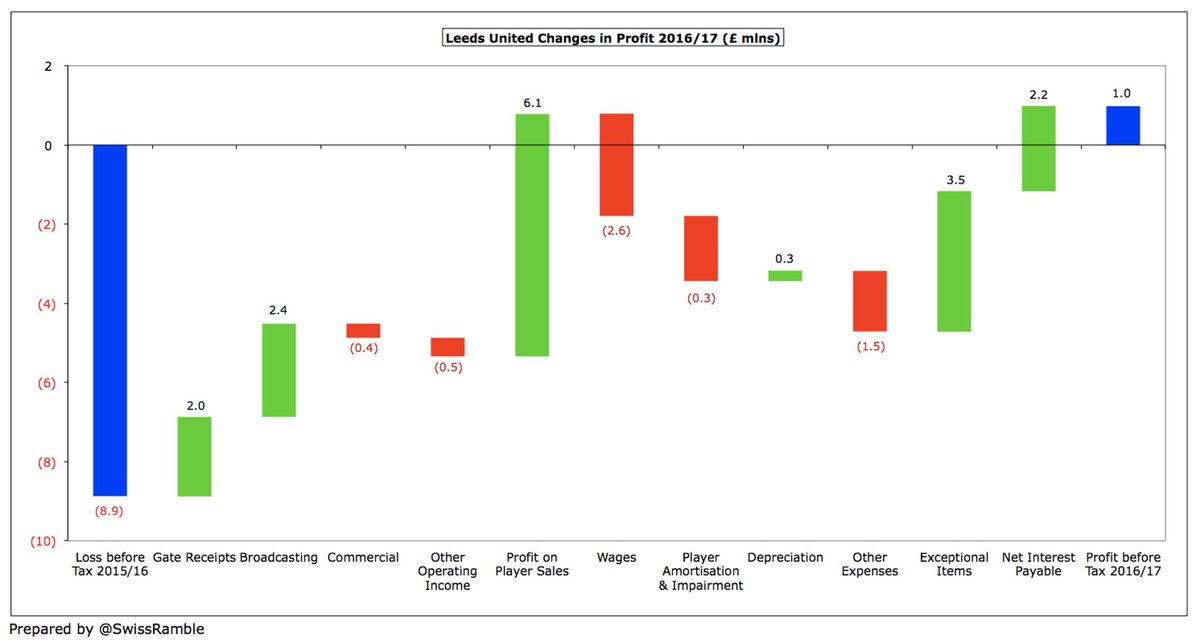

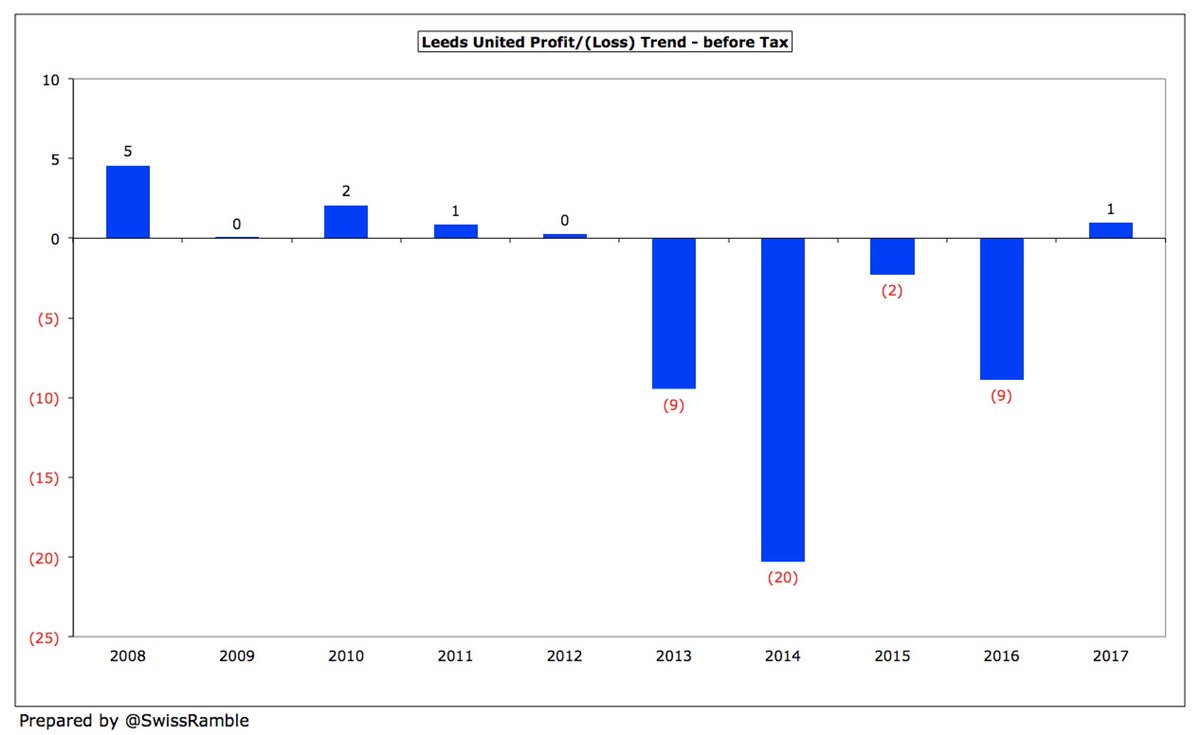

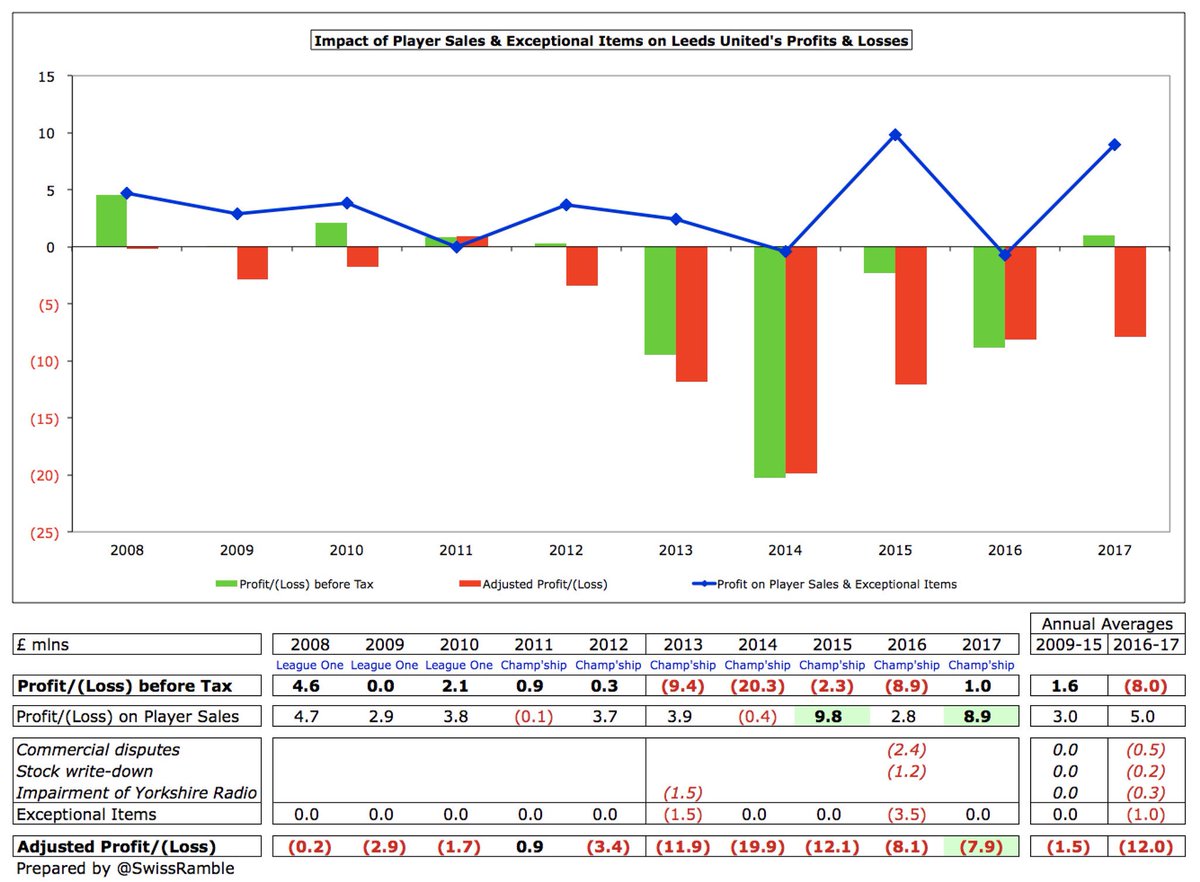

#LUFC reported a £1m profit, around £10m better than the previous season’s £8.9m loss, mainly due to £6.1m increase in profit on player sales to £8.9m, though revenue also rose £4m (13%) to £34.1m.

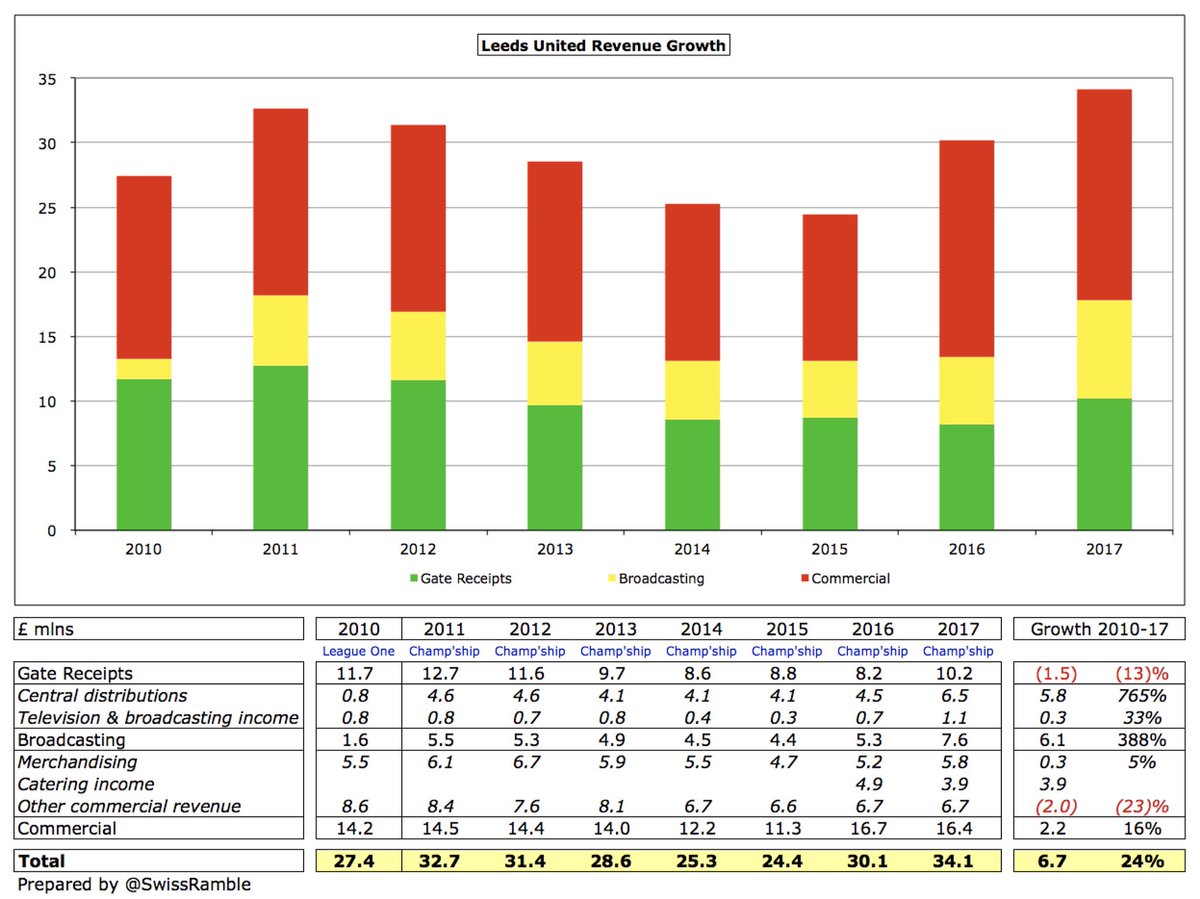

Main reasons for #LUFC revenue growth were: (a) the Premier League solidarity payment, up from £2.3m to £4.3m, which meant broadcasting income rose £2.4m (45%) to £7.6m; (b) gate receipts, up £2m (24%) to £10.4m. However, total commercial fell £0.4m (2%) to £16.4m.

This was offset by #LUFC cost growth: wages £2.6m (14%) to £20.7m, player amortisation/impairment £1.6m to £5.6m and other expenses £1.5m to £15.6m. On the other hand, no repeat of 2015/16 £3.5m exceptional items (mainly for termination of Macron kit deal and stock write-down).

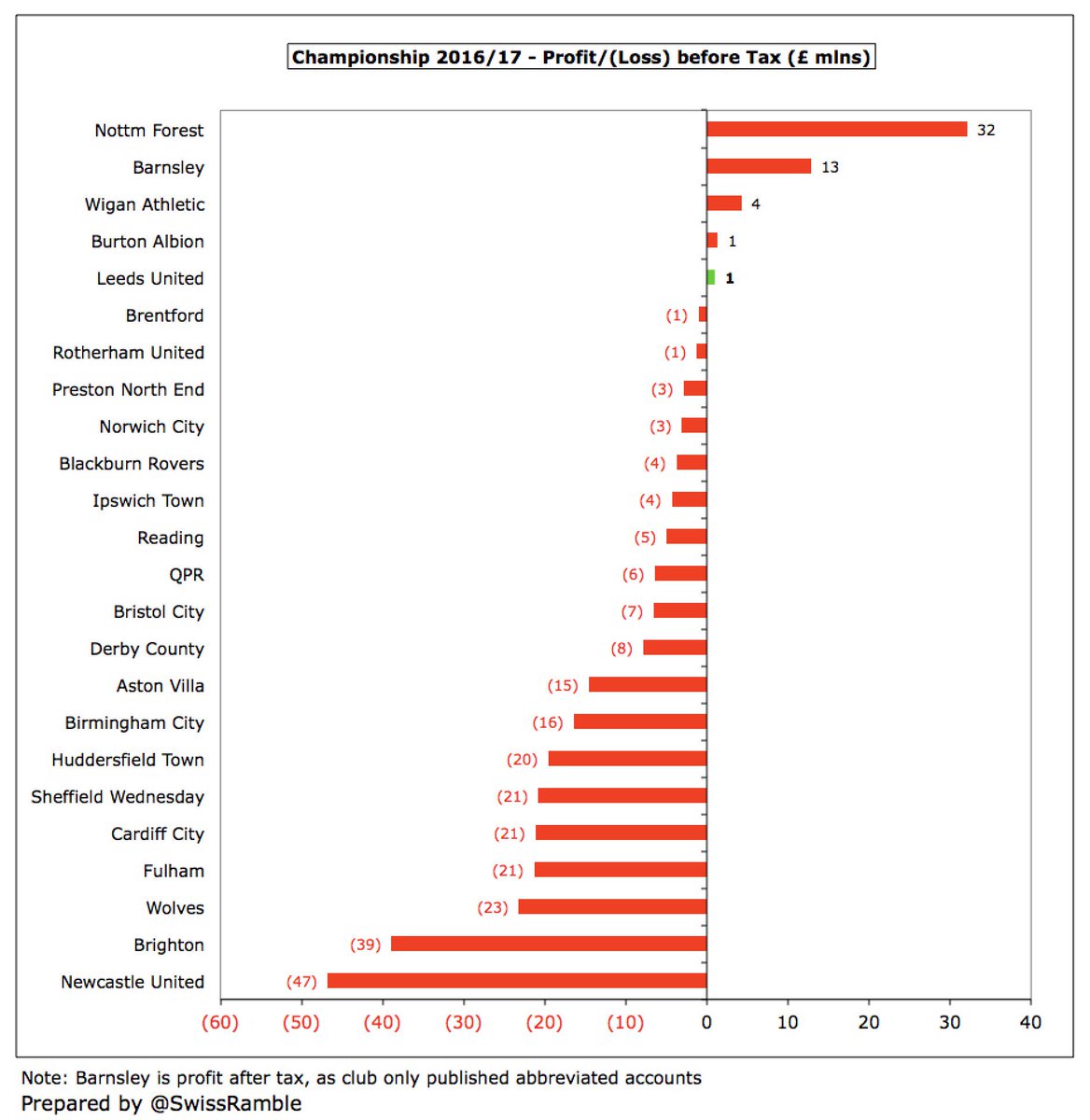

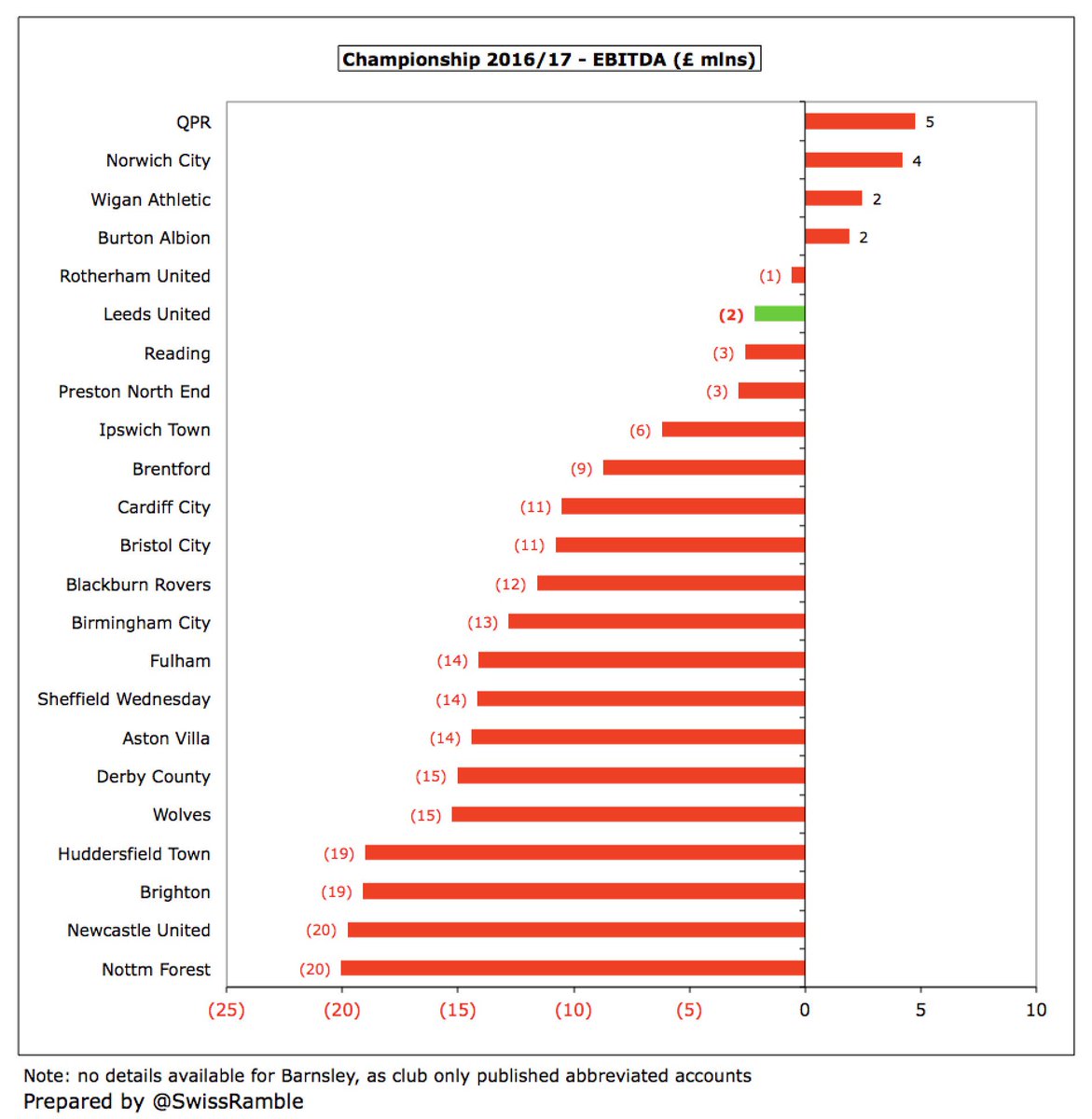

#LUFC were one of only 5 clubs to make a profit in the Championship. Almost all clubs in this very competitive division lose money. Any exceptions are normally due to once-off items such as high player sales. Both #NFFC and Barnsley benefited from loan write-offs in 2016/17.

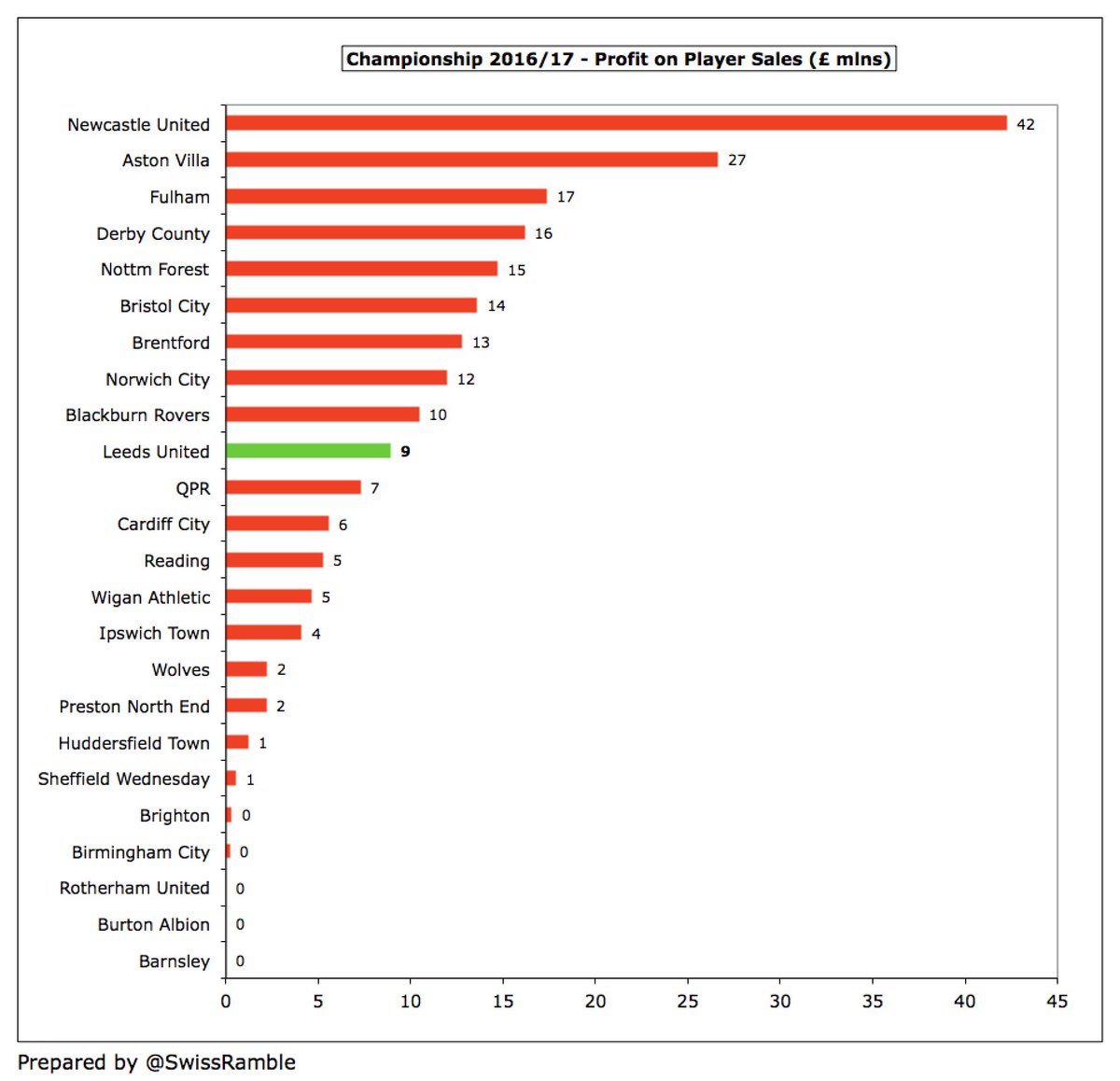

However, #LUFC would have made a similar loss to 2015/16 without £9m profit on player sales, mainly arising from Lewis Cook’s move to Bournemouth. This was the 10th highest in the Championship, though a long way below Newcastle £42m, Aston Villa £27m and Fulham £17m.

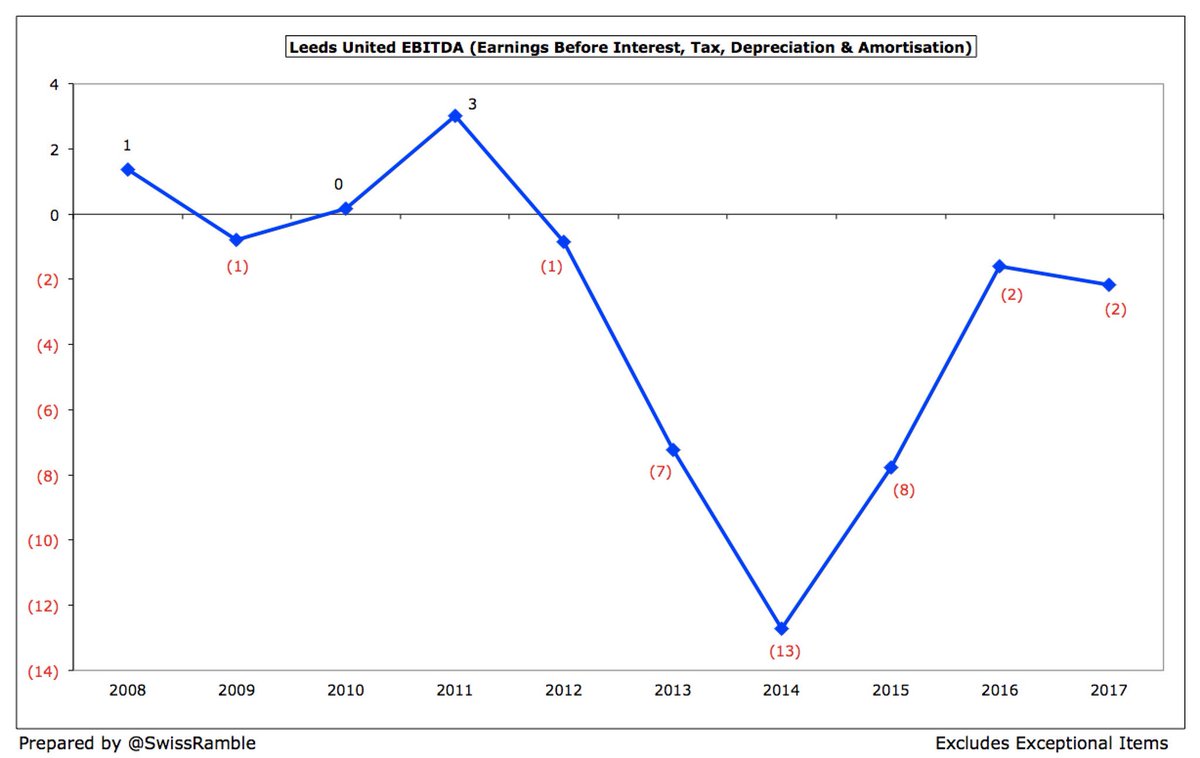

#LUFC have been profitable six times in the last 10 years, though the 2016/17 £1m profit was the first since 2011/12. In the intervening 4 years Leeds lost a total of £41m, averaging £10m a year, though the bottom line has significantly improved since the £20m loss in 2013/14.

Improvement in #LUFC finances is partly due to player sales, e.g. £10m in 14/15 (Ross McCormack to Fulham). This should again be the case in 2017/18, when the lucrative sales of Chris Wood and Charlie Taylor to Burnley should help deliver a player trading profit of around £20m.

#LUFC EBITDA (Earnings Before Interest, Depreciation and Amortisation), which strips out player sales and non-cash items to give underlying profitability, has improved from £(13)m low in 2014, but is still negative at £(2)m.

In fairness, only four Championship clubs managed to achieve positive EBITDA in 2016/17, so #LUFC £(2)m was actually 6th best in the division. For some context, it’s a lot better than promoted clubs, around £(20)m, though they were adversely impacted by hefty promotion bonuses.

Much of #LUFC recent revenue growth is due to bringing catering back in-house, so 2016 included £4.9m (net increase £3.8m, as Compass paid club £1.1m commission in 2015). Revenue has grown by a quarter in the seven seasons since promotion from League One, mainly central TV deals.

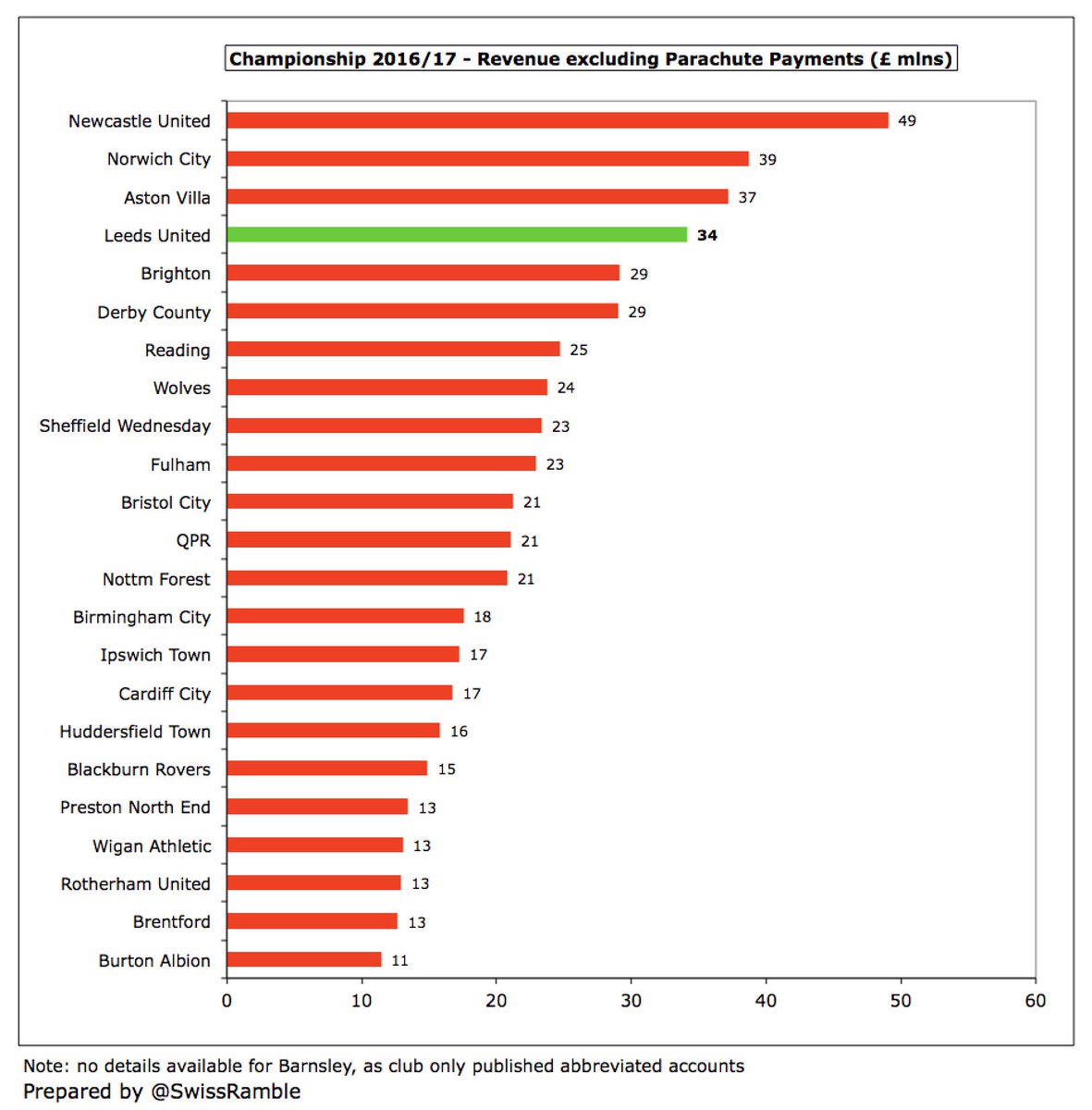

#LUFC £34m revenue was 7th highest in the Championship in 2016/17, exactly in line with their league position, though significantly lower than the three clubs relegated from the Premier League the previous season: #NUFC £86m, #NCFC £75m and #AVFC £74m.

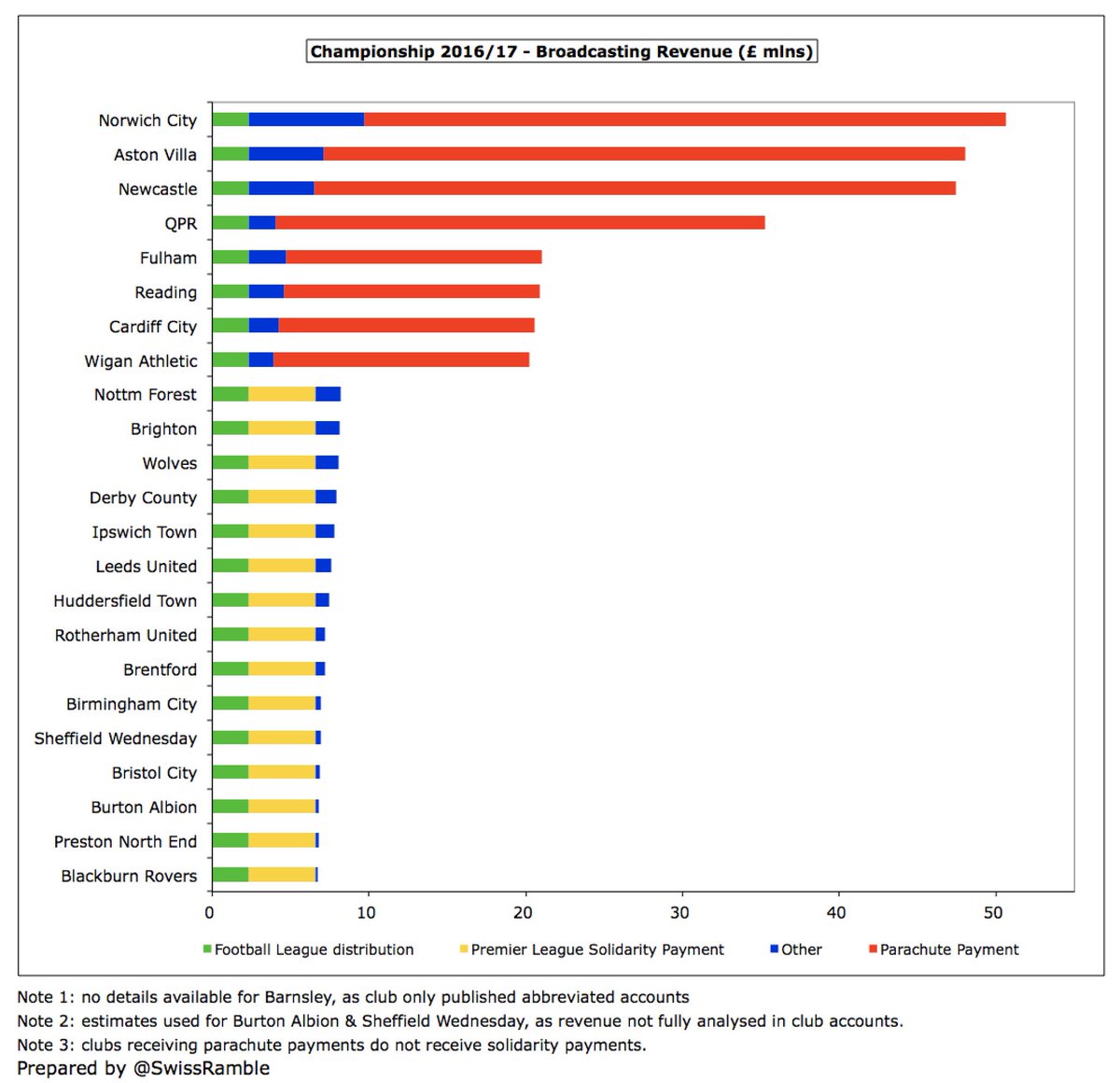

Championship revenue is hugely influenced by Premier League parachute payments with #NUFC, #AVFC & #NCFC receiving £41m in 16/17 (up from £26m in 15/16 thanks to new TV deal). Former coach Paul Heckingbottom: “You’ve got to overhaul clubs which have a lot more financial clout.”

#LUFC have the highest revenue of clubs not receiving a parachute payment £34m, just ahead of promoted Brighton £29m. However, even if parachutes were excluded, Leeds revenue would still have been below Newcastle £49m, Norwich £39m and Aston Villa £37m.

#LUFC TV income was up £2.4m to £7.6m, as PL solidarity payment rose from £2.3m to £4.3m, thanks to new 3-year TV deal. Most Championship clubs receive £7-8m TV money, including £2.3m EFL distribution. Leeds benefited from being shown live 20 times (£100k home game, £10k away).

Looking at how the Premier League TV deal has increased (with clubs receiving £95m to £150m in 2016/17) helps explain why so many Championship clubs “go for it”, as the rewards for promotion are so lucrative. However, it’s still a risky gamble, as seen by Villa’s recent problems.

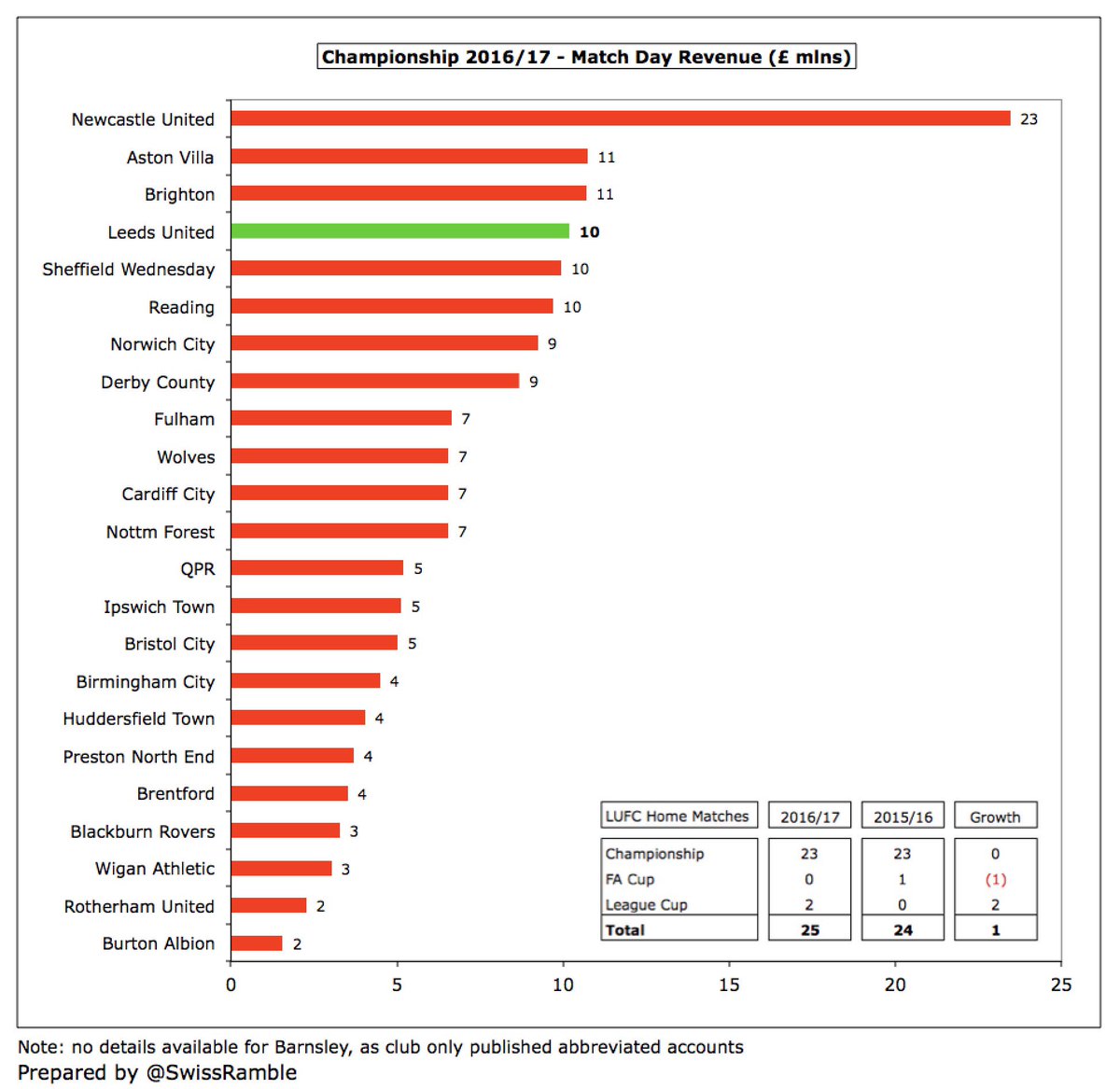

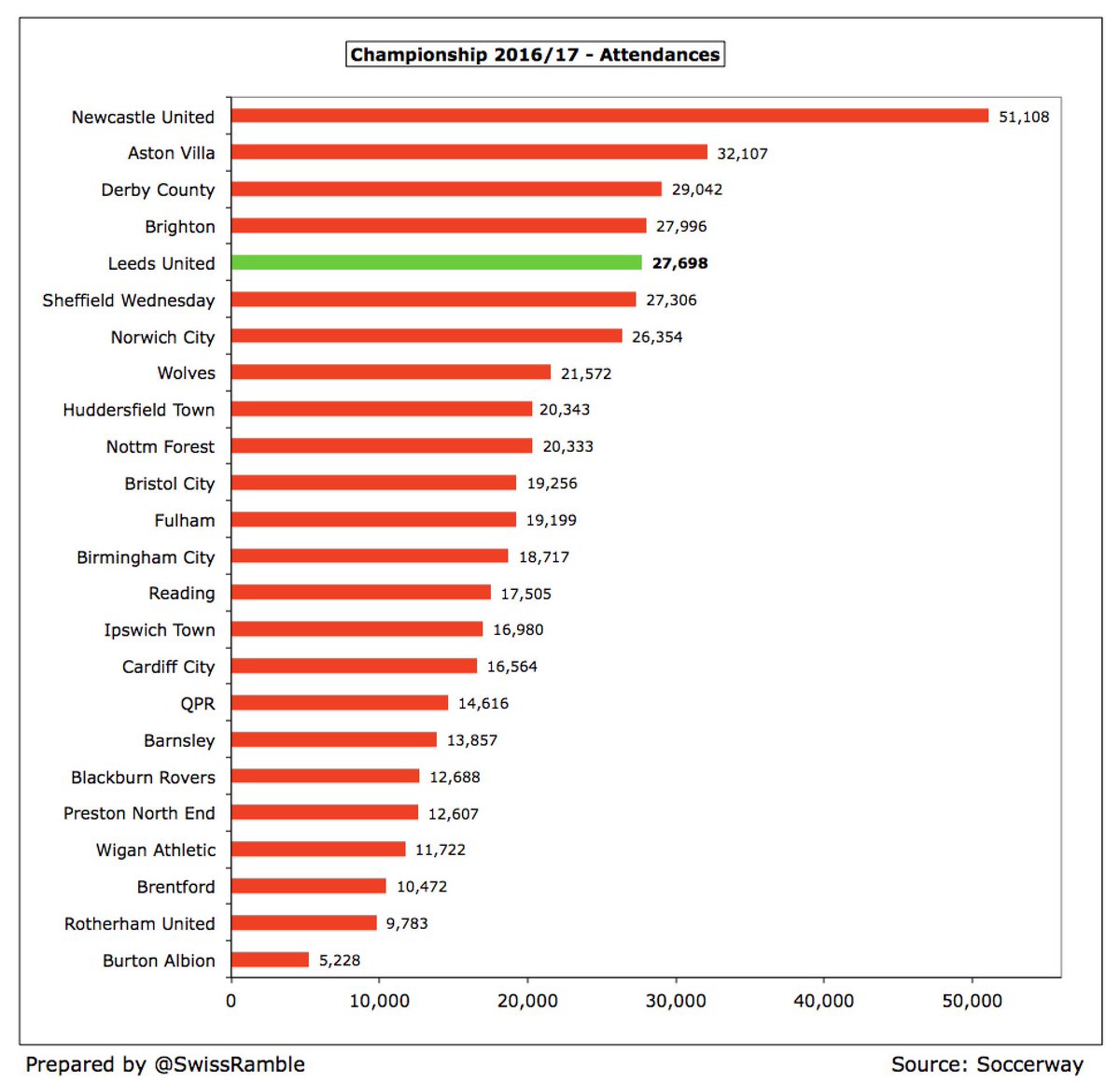

#LUFC gate receipts increased £2m (24%) to £10.2m, as average attendance “dramatically grew” from 22,448 to 27,698 and there was one more Cup game staged at Elland Road. This was the 4th highest match day income in Championship, only below #NUFC £23m, #AVFC & #BHAFC (both £11m).

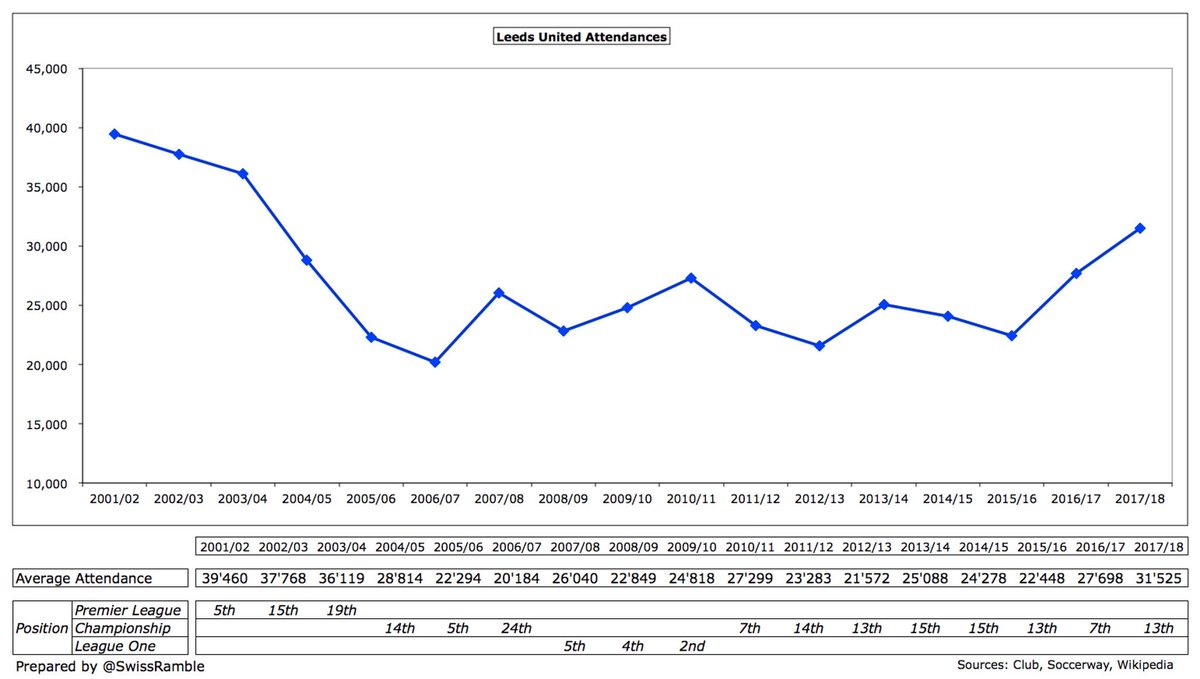

#LUFC attendance further rose in 2017/18 to 31,525, thanks to “record breaking” season ticket sales. Club’s potential shown by near 40,000 crowds in Premier League. For 2016/17 they had to repay 25% of season ticket price, as they failed to reach play-offs, costing around £1.5m.

#LUFC 27,698 attendance was 5th highest in the Championship in 2016/17, behind Newcastle 51,108, Villa 32,107, Derby 29,042 and Brighton 27,996. Club froze season ticket prices in 17/18 and 18/19 (though only for “early birds”).

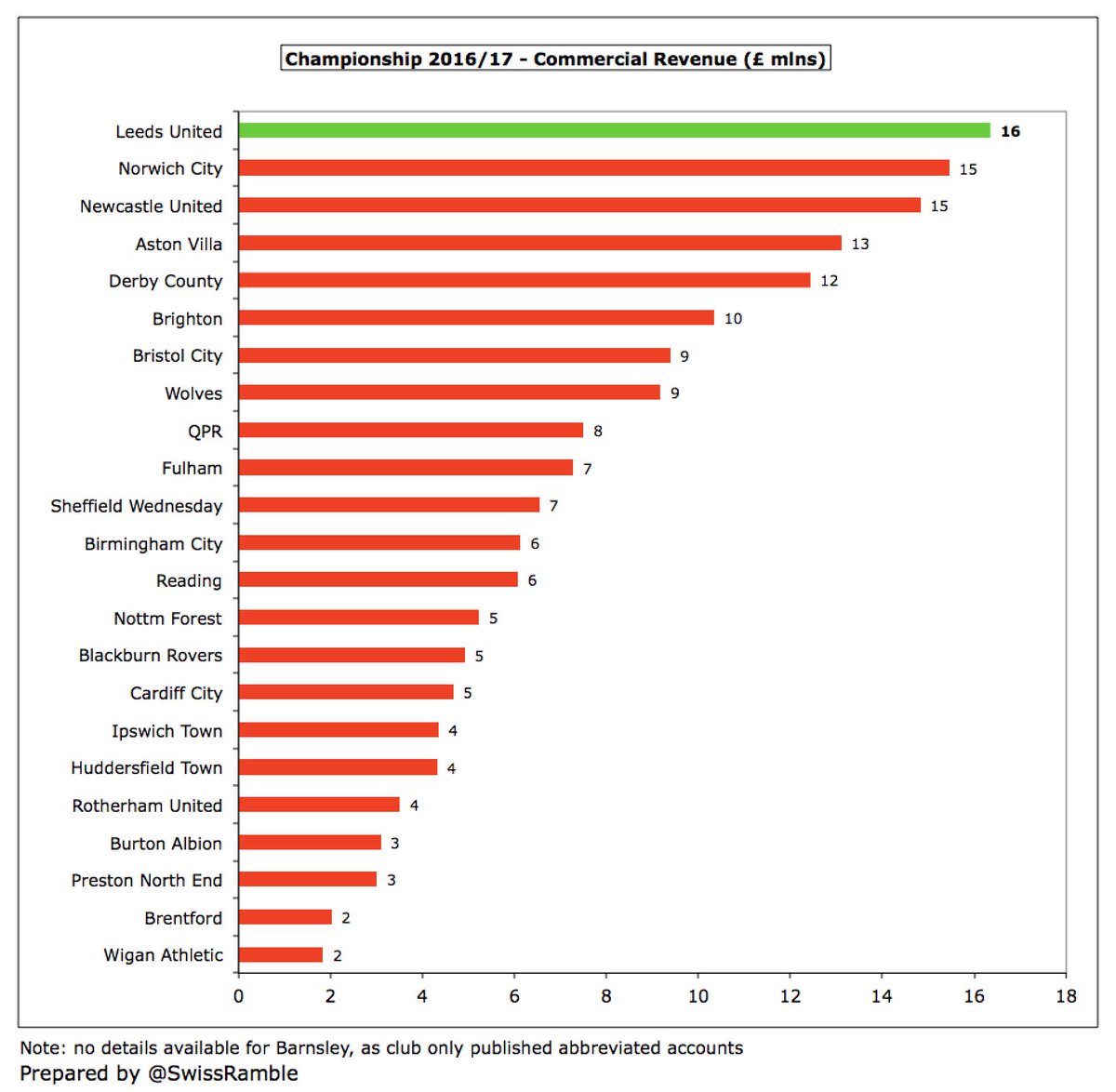

#LUFC commercial income fell £0.4m (2%) to £16.4m, as a £1m decrease in catering income to £3.9m offset a £0.6m increase in merchandising to £5.8m, largely due to the 5-year Kappa deal signed in 2015/16. A new shirt sponsor, 32Red, came on board in 16/17 with a 3-year agreement.

Despite the fall, #LUFC £16m commercial income was still the highest in the Championship, just ahead of Norwich and Newcastle (both £15m). There is talk that this revenue stream has further grown (by around 25%) in 2017/18.

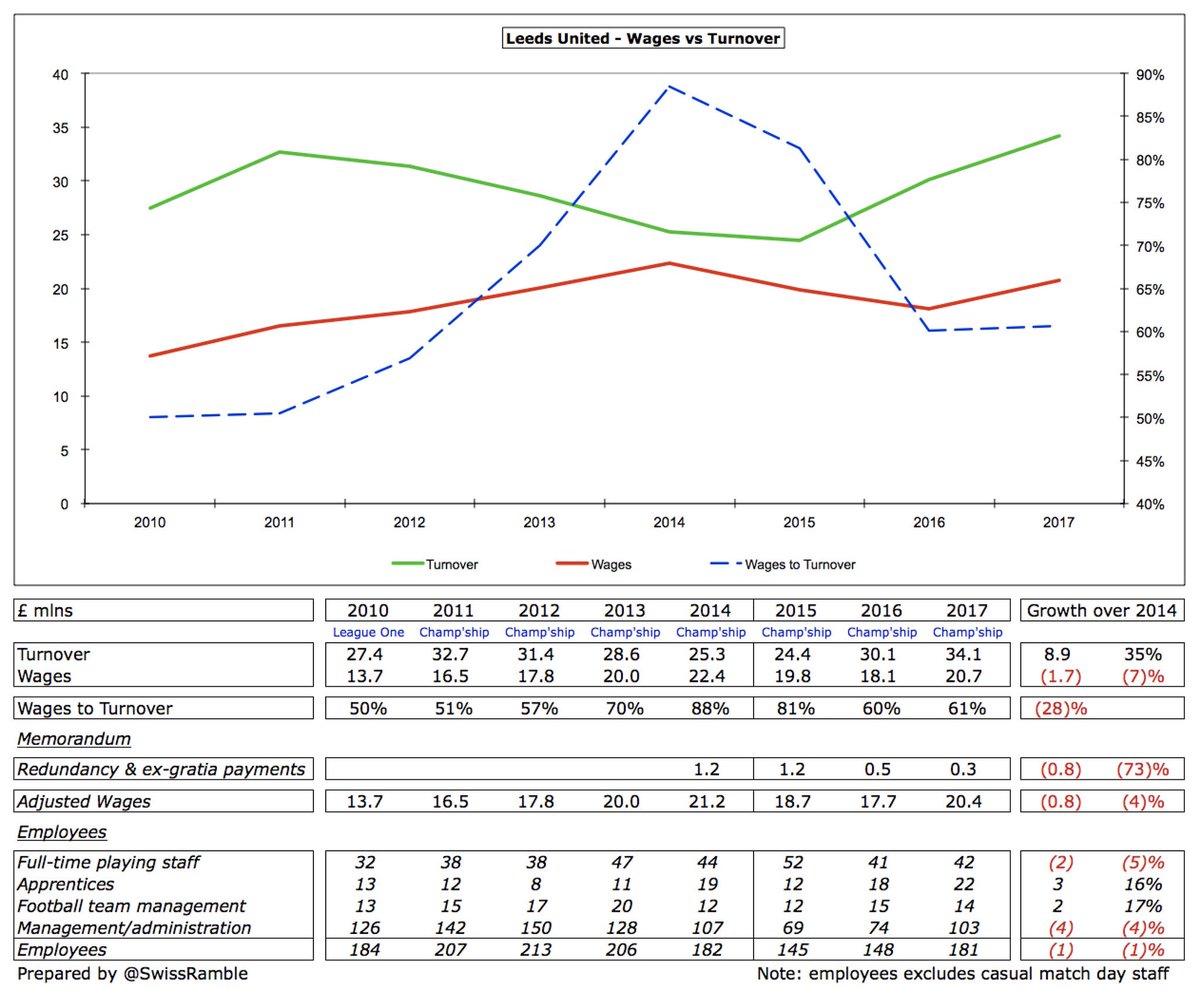

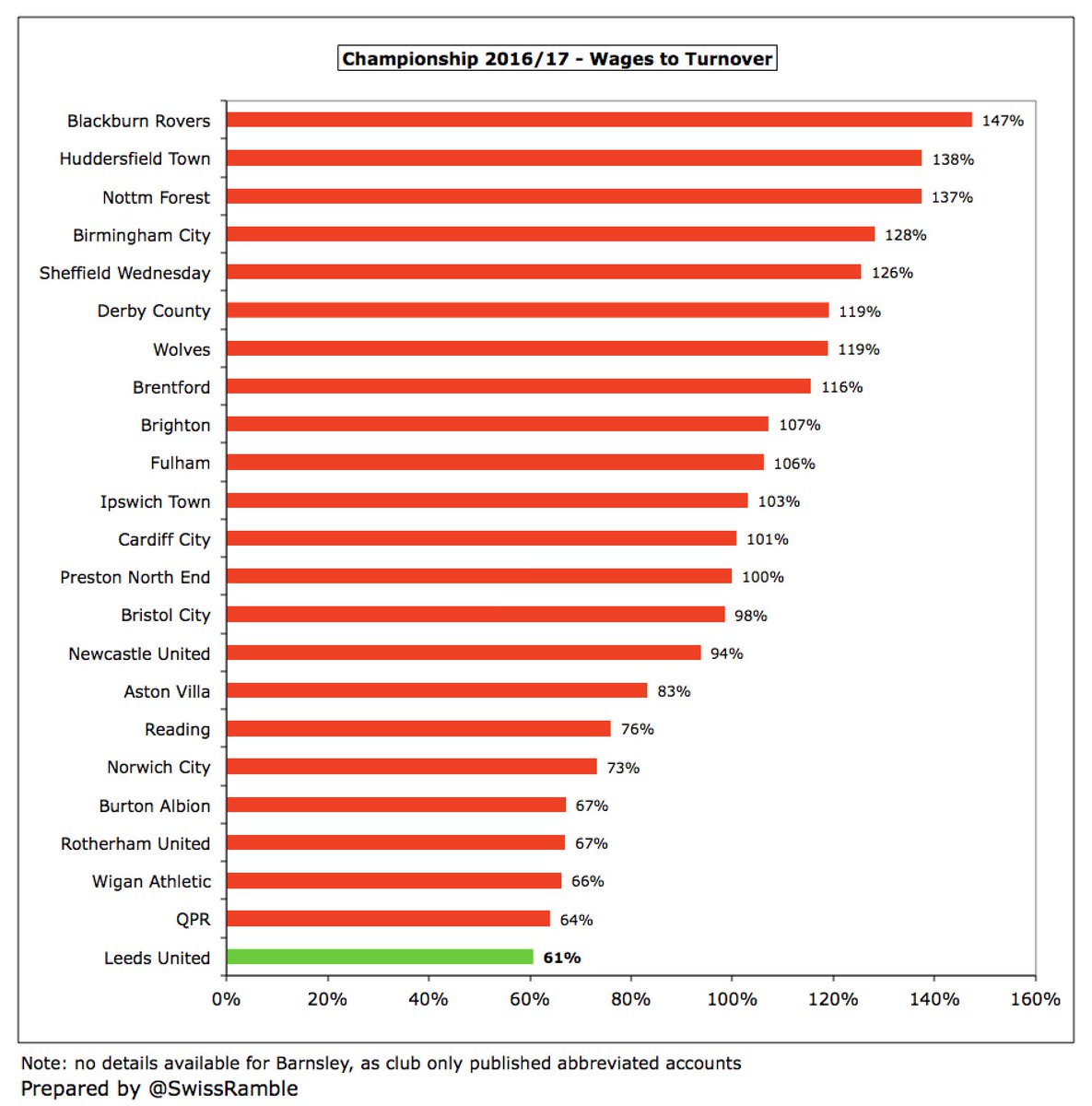

#LUFC wage bill grew £2.6m (14%) to £20.7m, though wages to turnover ratio only rose slightly from 60% to 61%, around £1m on first team squad, while some due to 29 increase in management/admin headcount. Still 7% below £22.4m peak in 2014, while revenue is up 35% in same period.

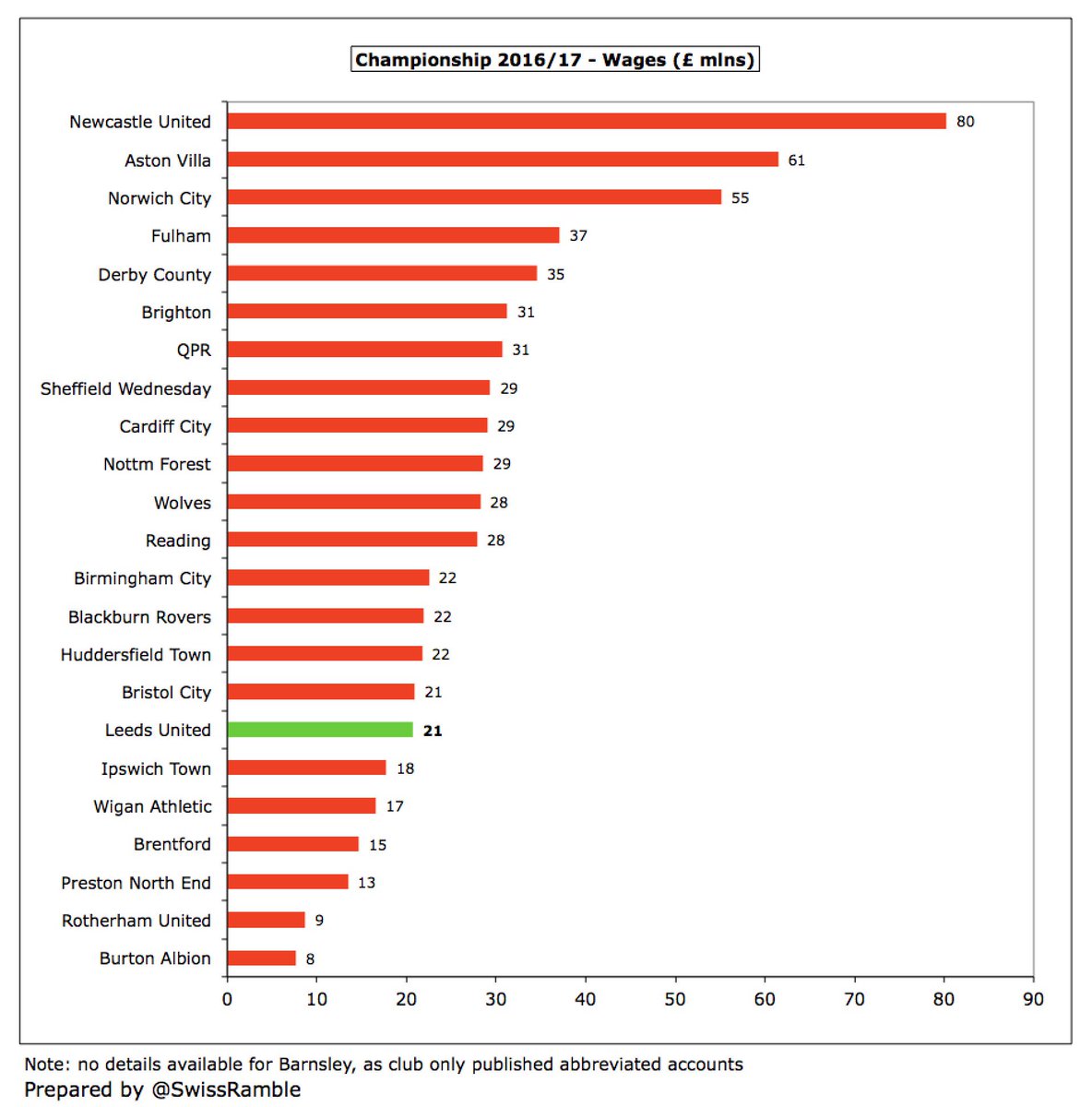

#LUFC £21m wage bill was only 17th highest in the Championship, way behind Newcastle £80m, Villa £61m & Norwich £55m and many clubs not receiving parachute payments, e.g. Derby £35m & Brighton £31m. This substantial gap underlines the competitive challenge to reach the play-offs.

#LUFC have the lowest wages to turnover ratio in the Championship at 61%. Much lower than previous years, partly due to catering income brought in-house. No fewer than 13 clubs pay more in wages than their revenue. Worth noting that Leeds wage bill up £7m in 17/18 per Radrizzani.

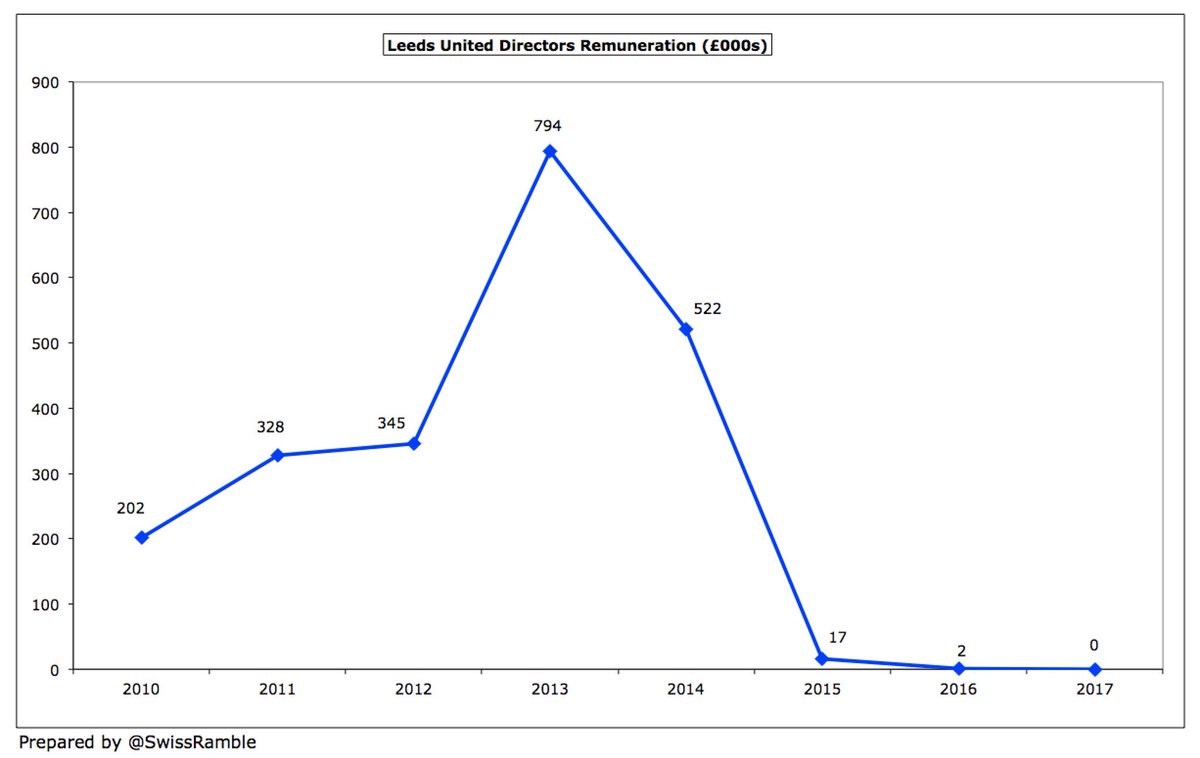

Hardly anything paid to #LUFC directors in the last three years. Recently peaked at £794,000 in 2013 during the Ken Bates/David Haigh era.

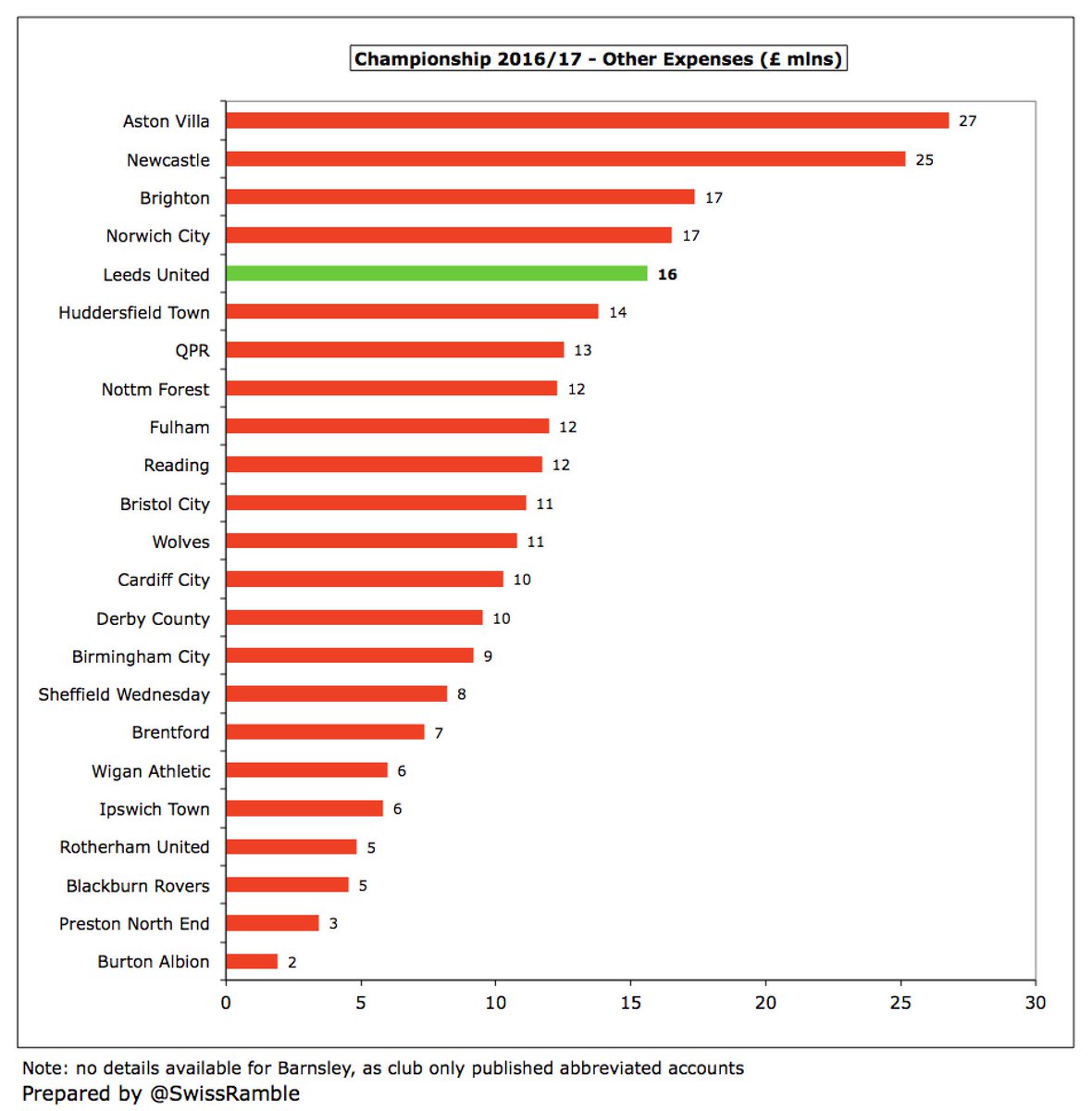

Unlike wages, #LUFC £16m other expenses were one of highest in Championship, partly due to £2.1m rent on Elland Road and Thorp Arch training ground. However, Radrizzani bought the stadium back on 28 June 2017 via Greenfield Investment Pte Ltd, so this should fall to £0.8m.

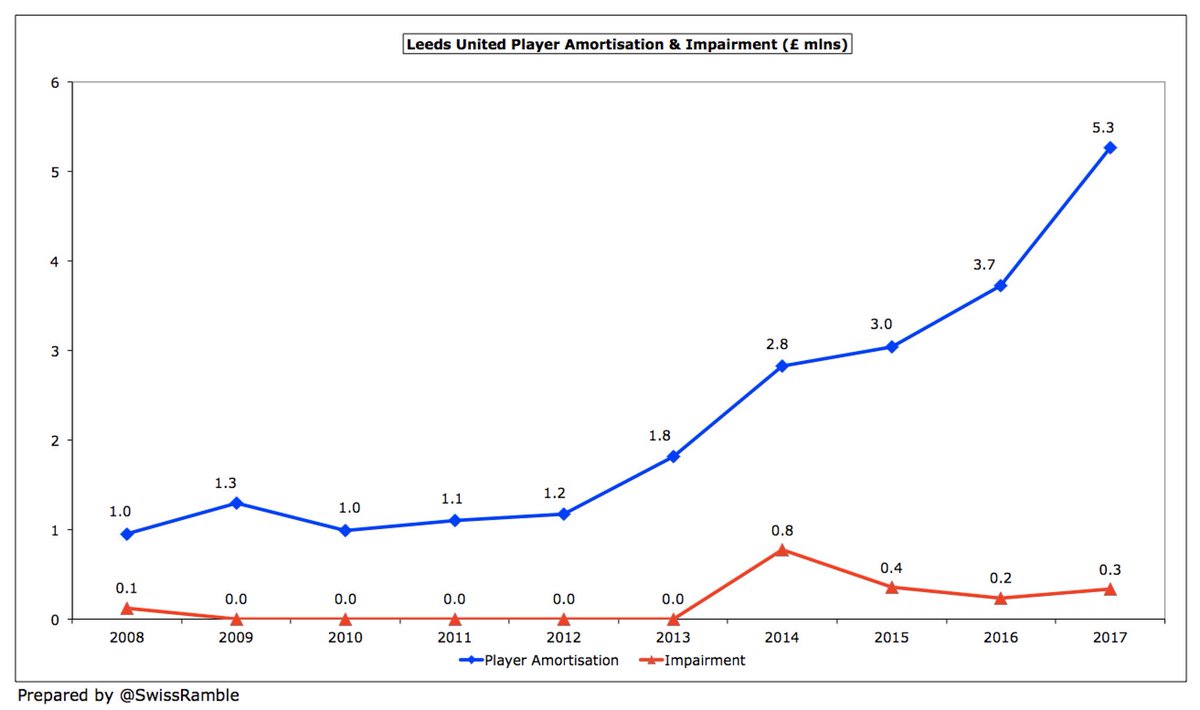

#LUFC player amortisation has risen steadily from £1.0m in 2010 to £5.3m in 2017, reflecting increased spending in the transfer market. There has also been £1.7m of impairment (write-down of player values) in the last 4 years.

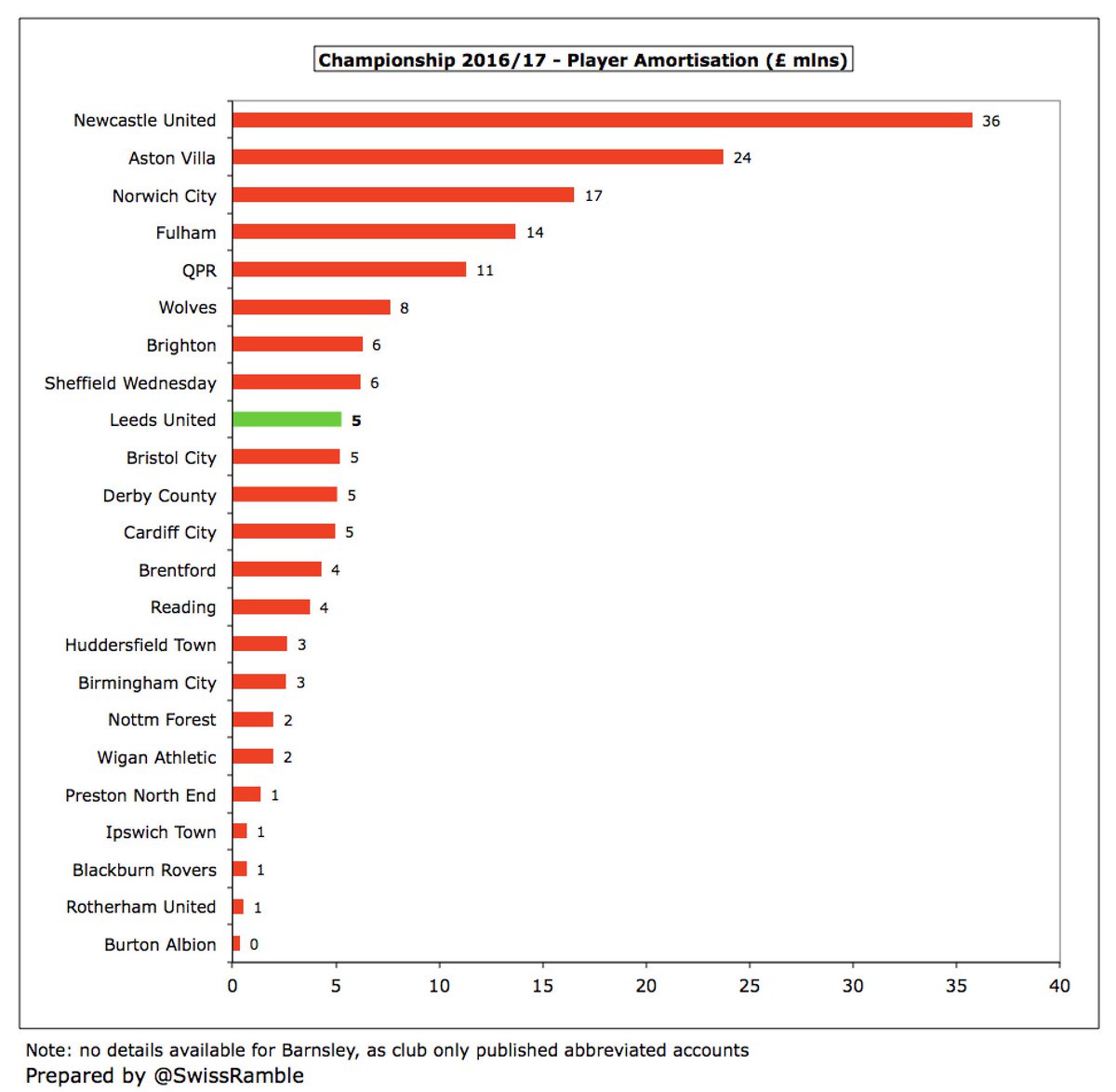

Following this growth #LUFC £5m player amortisation was 9th highest in the Championship, though it was still pretty small in comparison to (relatively) big-spending clubs like Newcastle £36m, Aston Villa £24m and Norwich £17m.

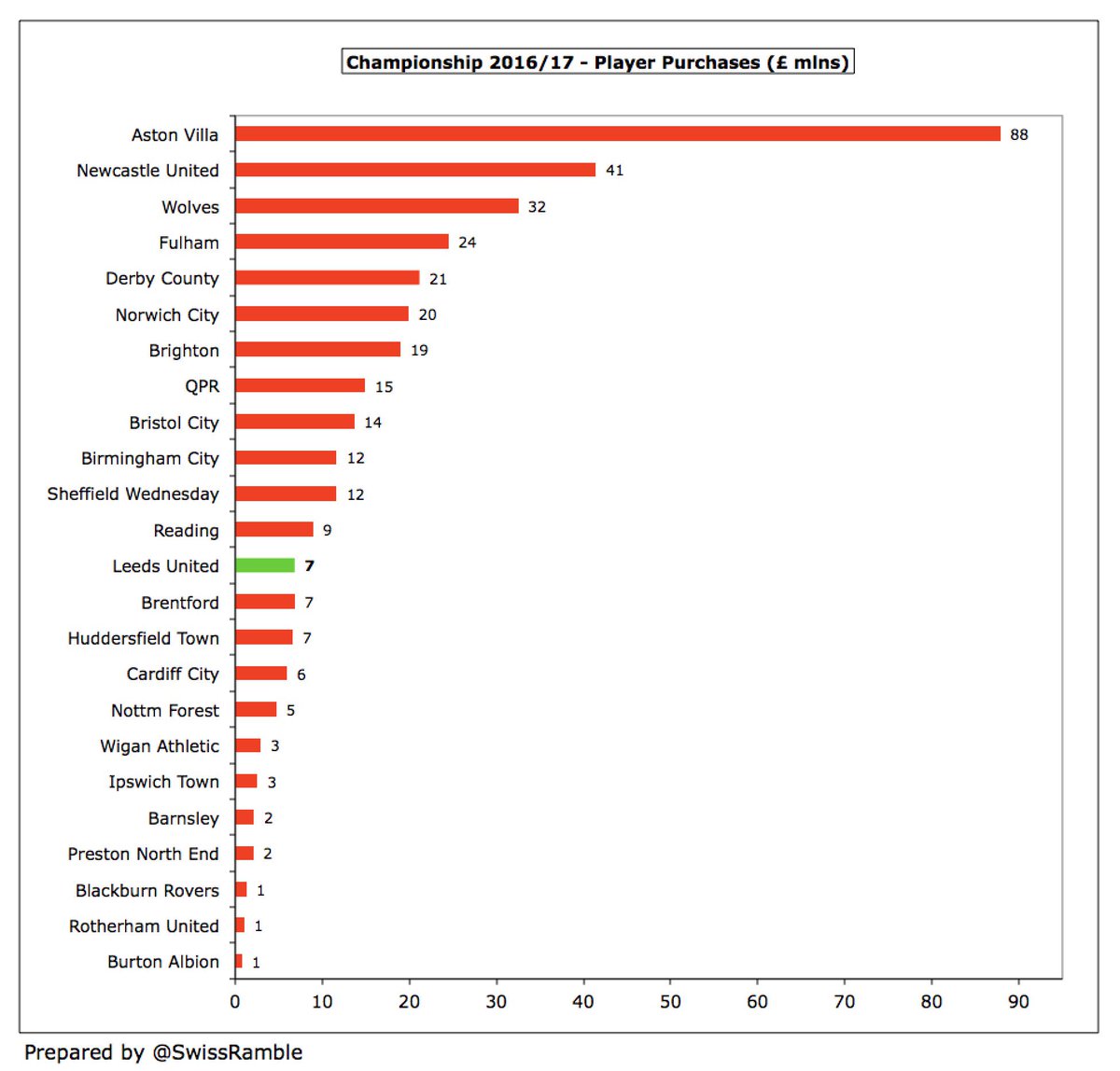

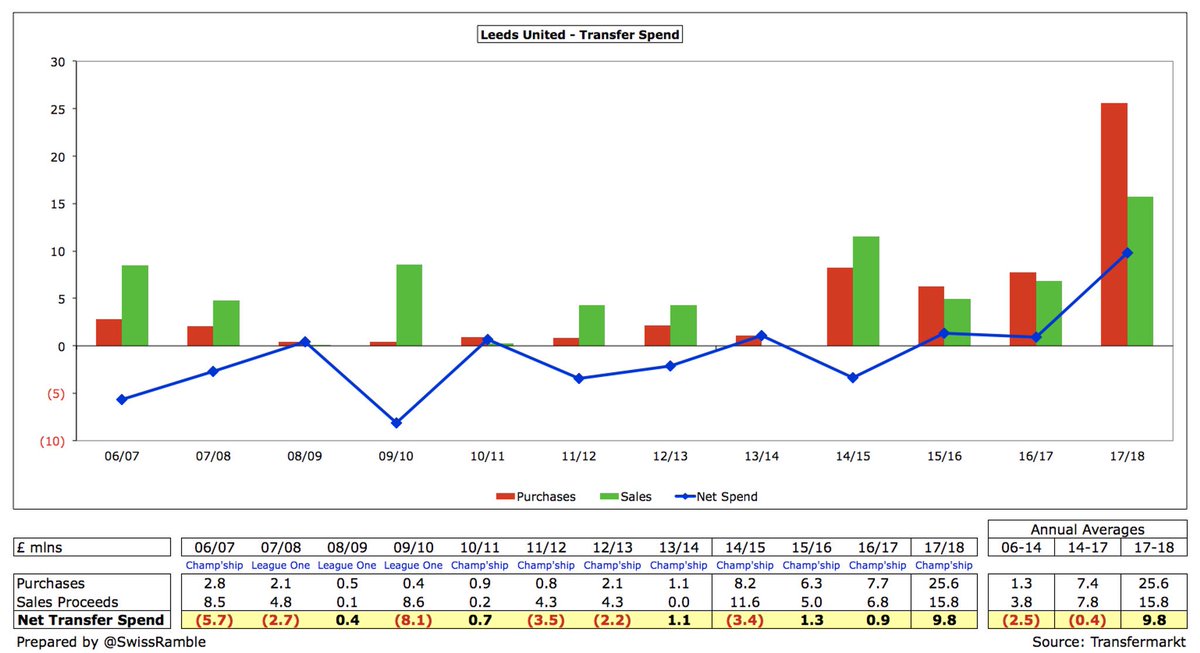

#LUFC had £7m player purchases in 2016/17 (Kemar Roofe, Marcus Antonsson, Liam Bridcutt & Luke Ayling), about the same as the previous two seasons (each £6m), so they were massively outspent by clubs like Aston Villa £88m, Newcastle £41m, Wolves £32m, Fulham £24m and Derby £21m.

Radrizzani has loosened the purse strings since his arrival at #LUFC with £26m gross spend in 2017/18, considerably more than £7m annual average under Cellino. Player sales have also increased from £8m to £16m, leaving a net spend of £10m, compared to breaking-even.

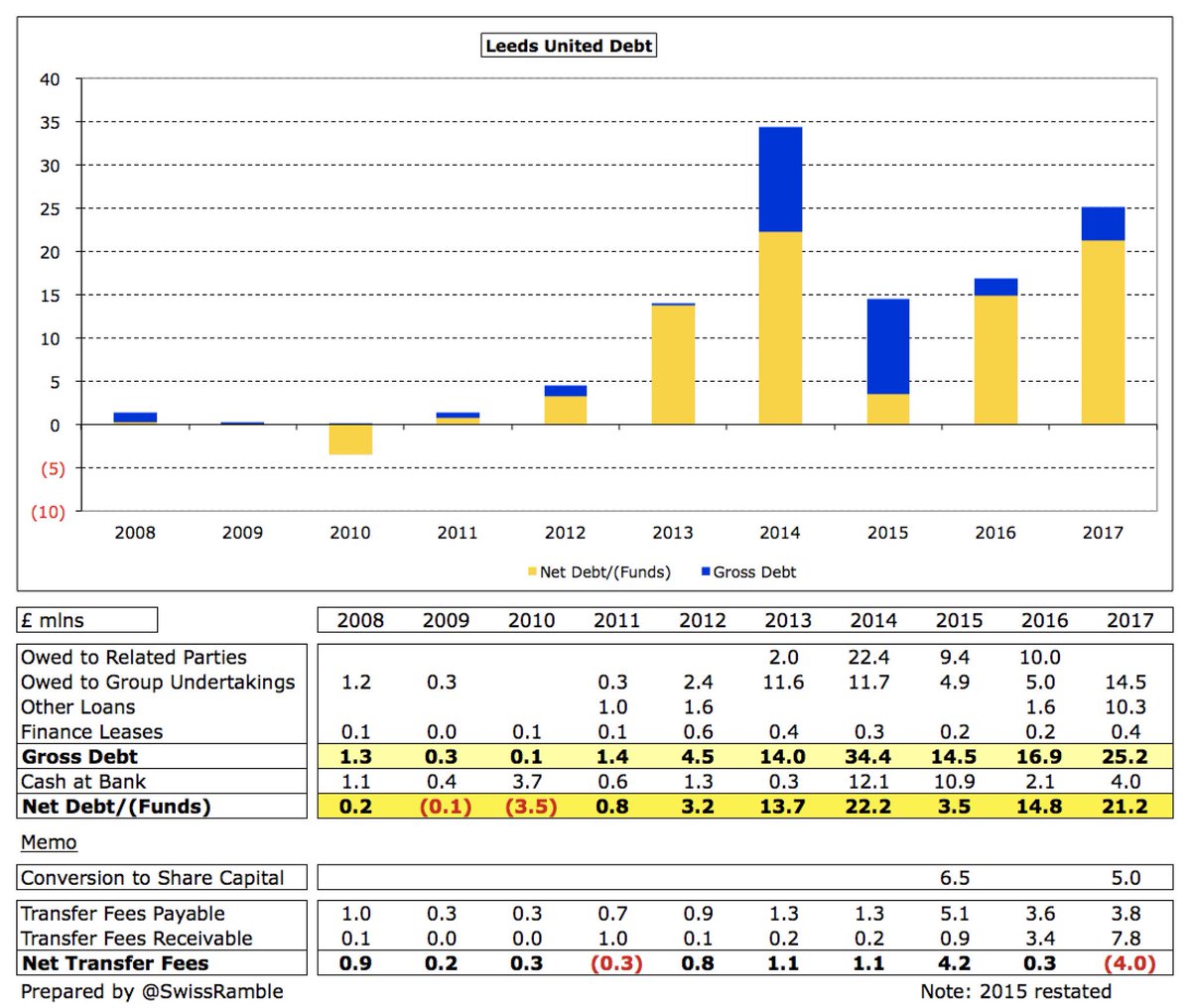

#LUFC gross debt rose from £17m to £25m, including £14.5m from Radrizzani, partly used to pay-off half of £17m loan from previous owners GFH (remainder is contested). Converted £5m of debt to Eleonora Sport Ltd into shares, while it is understood £8.8m converted in May 2018.

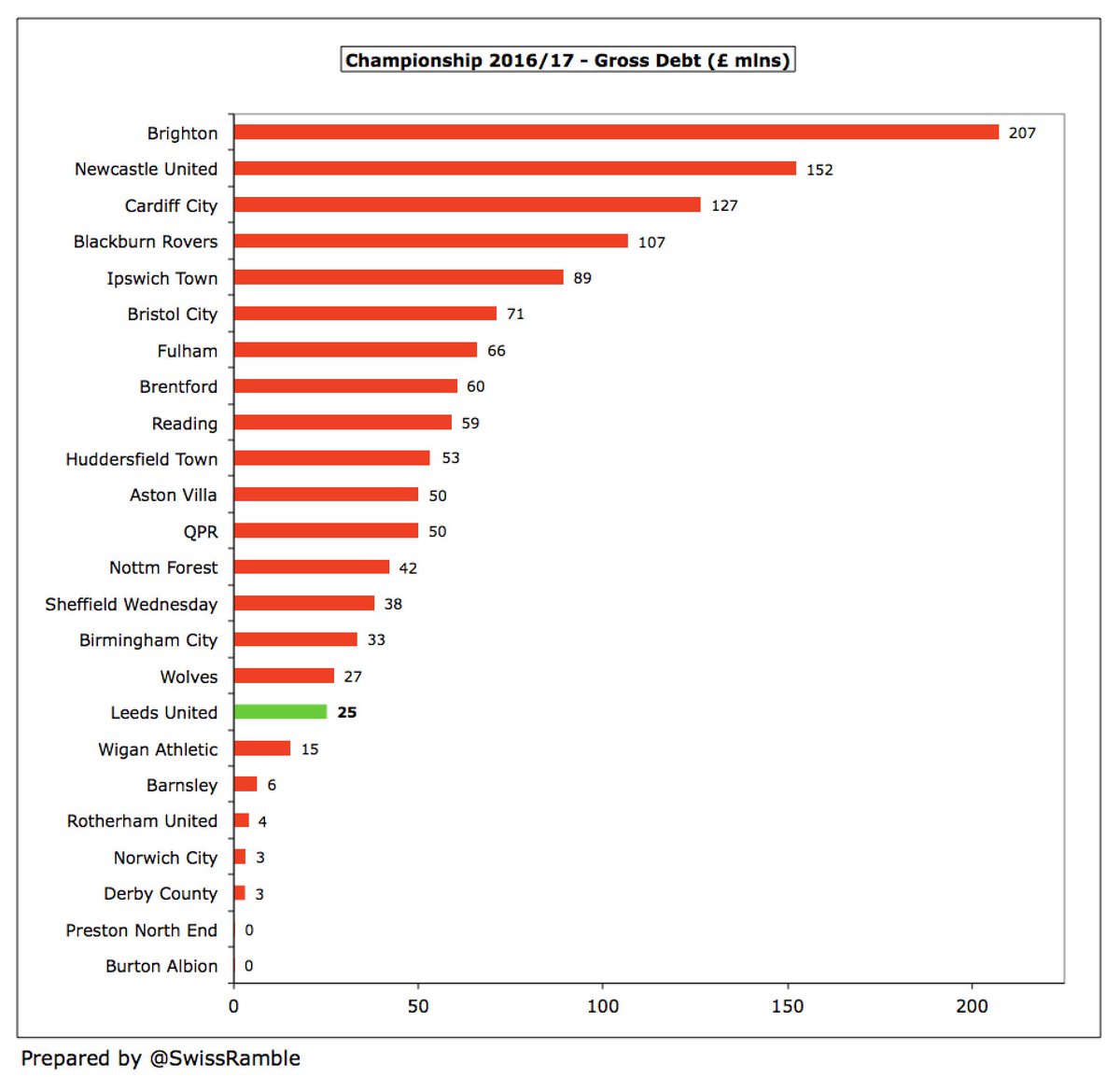

#LUFC £25m debt was among the smallest in the Championship, far below 3 clubs that have since been promoted to the Premier League (Brighton £207m, Newcastle £152m & Cardiff £127m). Worth noting £24m of contingent liabilities, dependent on promotion, player appearances, etc.

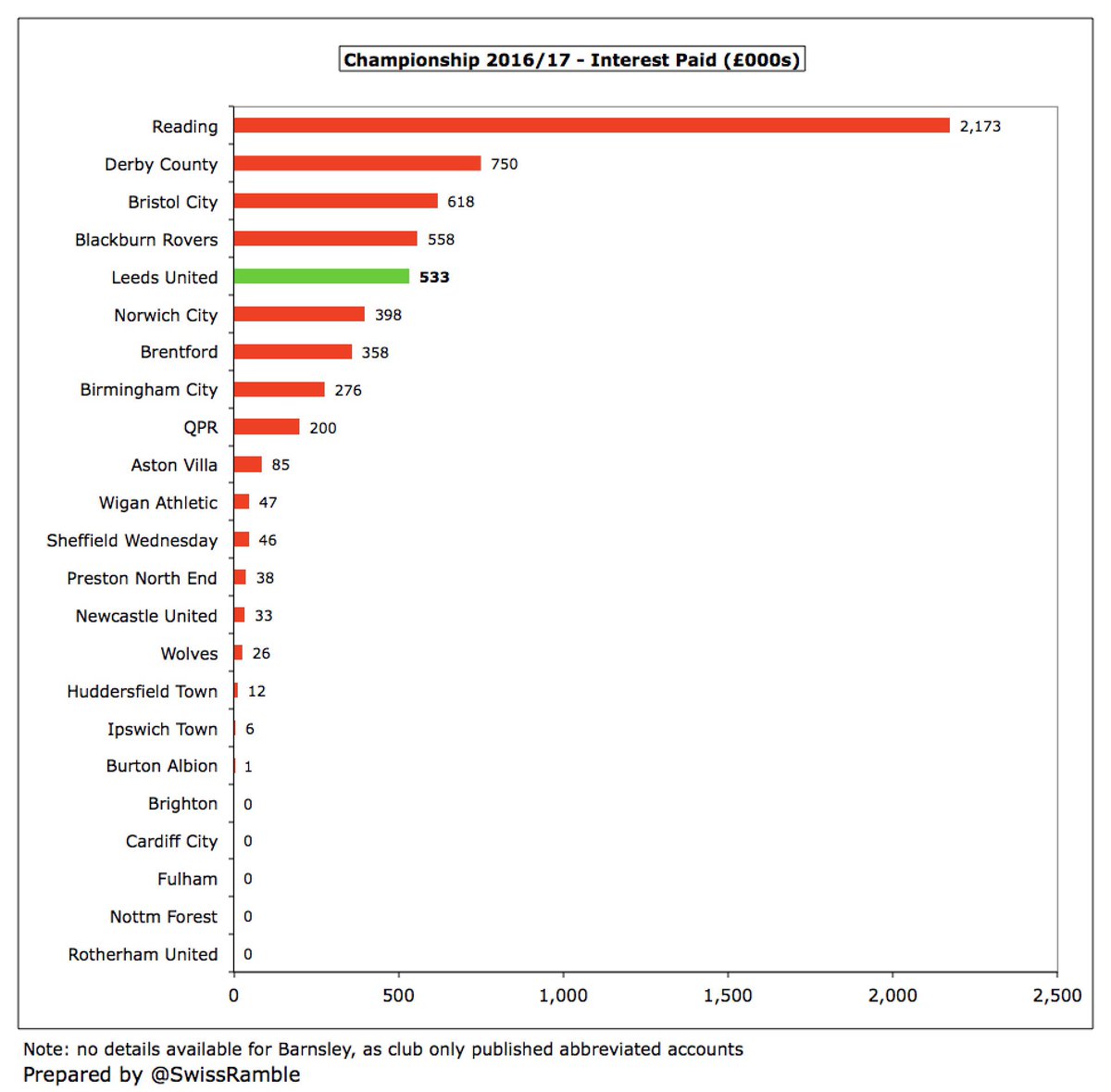

Although debt is high in the Championship, most is provided by owners who charge little or no interest. That said, #LUFC £533k interest payment in 2016/17 was the 5th highest in the division.

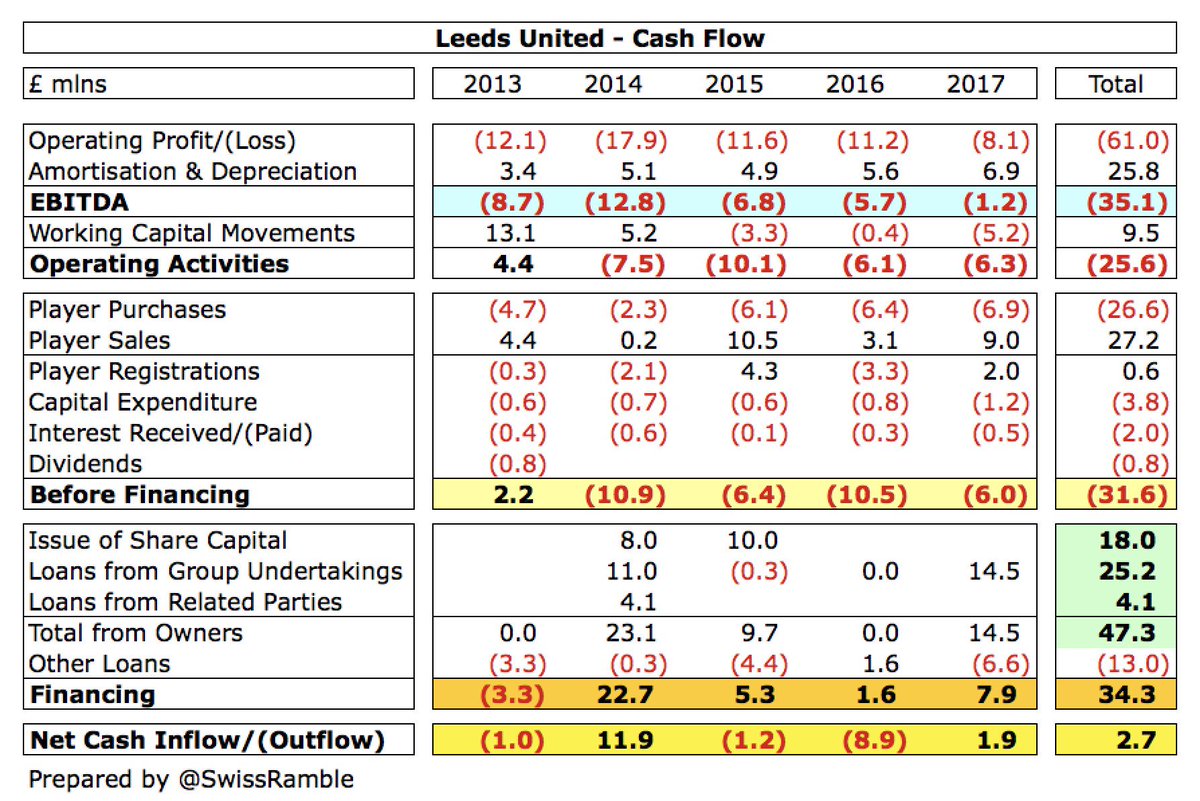

From a cash perspective #LUFC lost £6m from operating activities in 2016/17. £8.5m was spent on repaying a historical loan, £1.2m on infrastructure and £0.5m interest payments. This was largely funded by Radrizzani’s £14.5m loan, £2m from another loan & £2m (net) player sales.

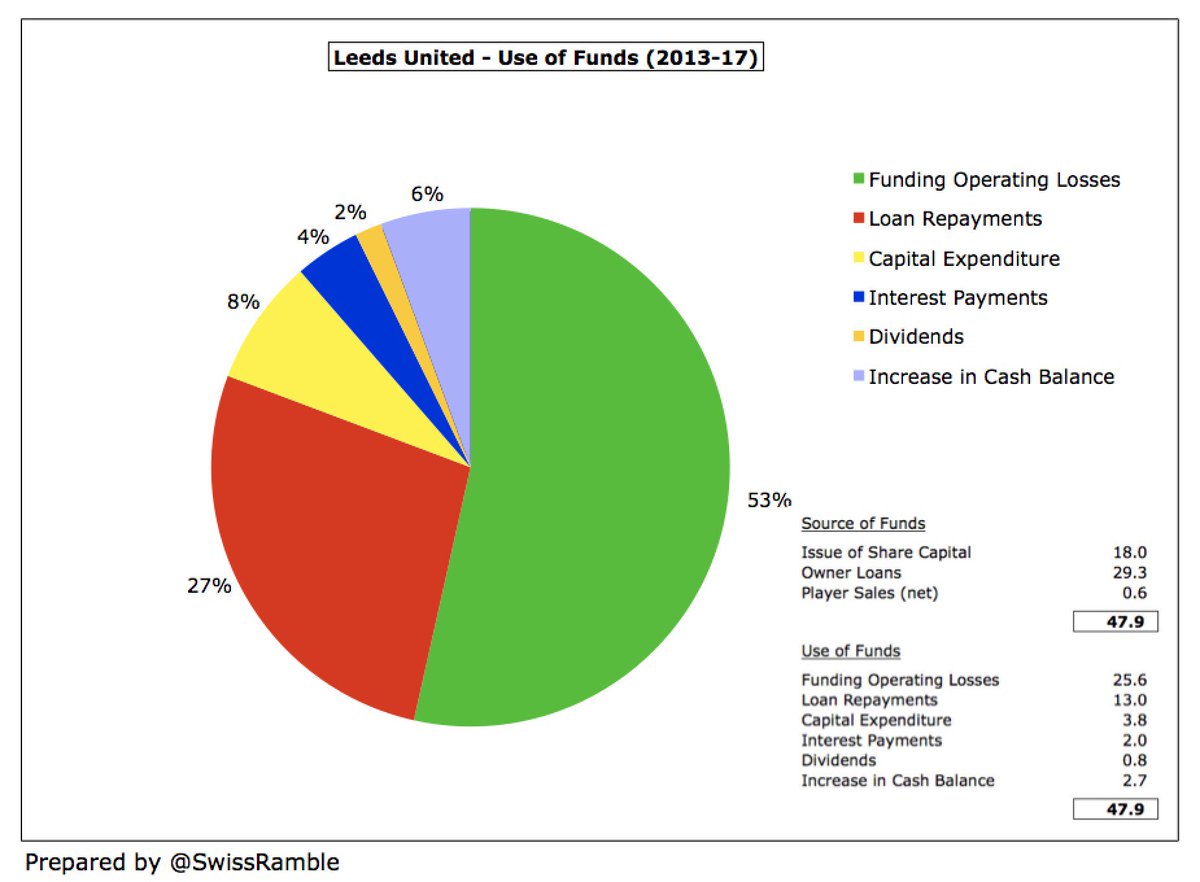

In the last 5 years #LUFC has received £47m funding from owners (£29m loans & £18m share capital). This has mainly been spent on funding operating losses £26m with £16m going on loan repayments £13m, interest £2m and dividends £1m. Only £4m capex, while player trading broke-even.

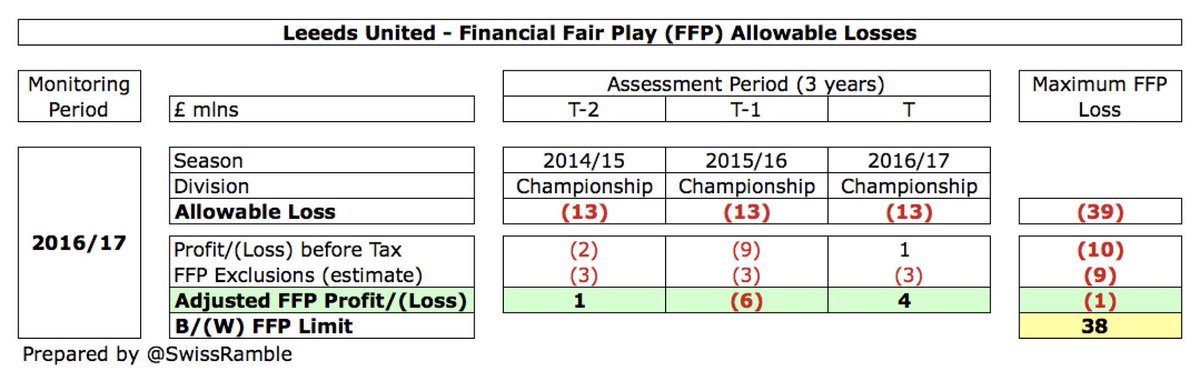

Although #LUFC suffered a transfer embargo in 2015 for breaching FFP rules, they are now comfortably within the £39m maximum loss over the 3-year monitoring period ending in 2016/17, even before deducting allowable expenses for academy, community & infrastructure (£3m a year).

One intriguing development at #LUFC is a partnership with 49ers Enterprises, the investment entity behind the American Football team San Francisco 49ers. It is believed they have taken a 10% stake in Leeds with funds invested used to “improve results on the pitch”.

Under previous owners #LUFC have adopted a prudent strategy (with an uncompetitive wage bill), but it looks like Radrizzani may be more expansive. The club has a much better FFP position than most, but it remains to be seen whether Leeds do invest – and whether they invest well.

• • •

Missing some Tweet in this thread? You can try to

force a refresh