#Thread

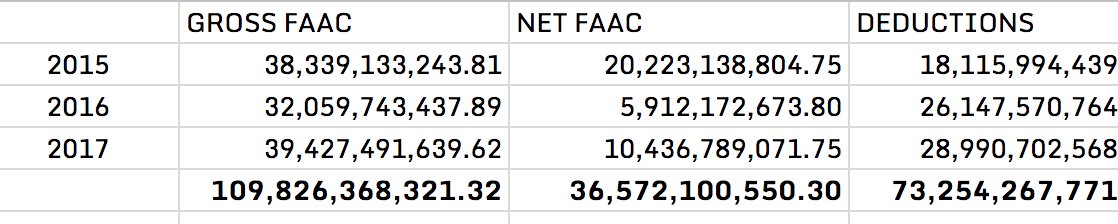

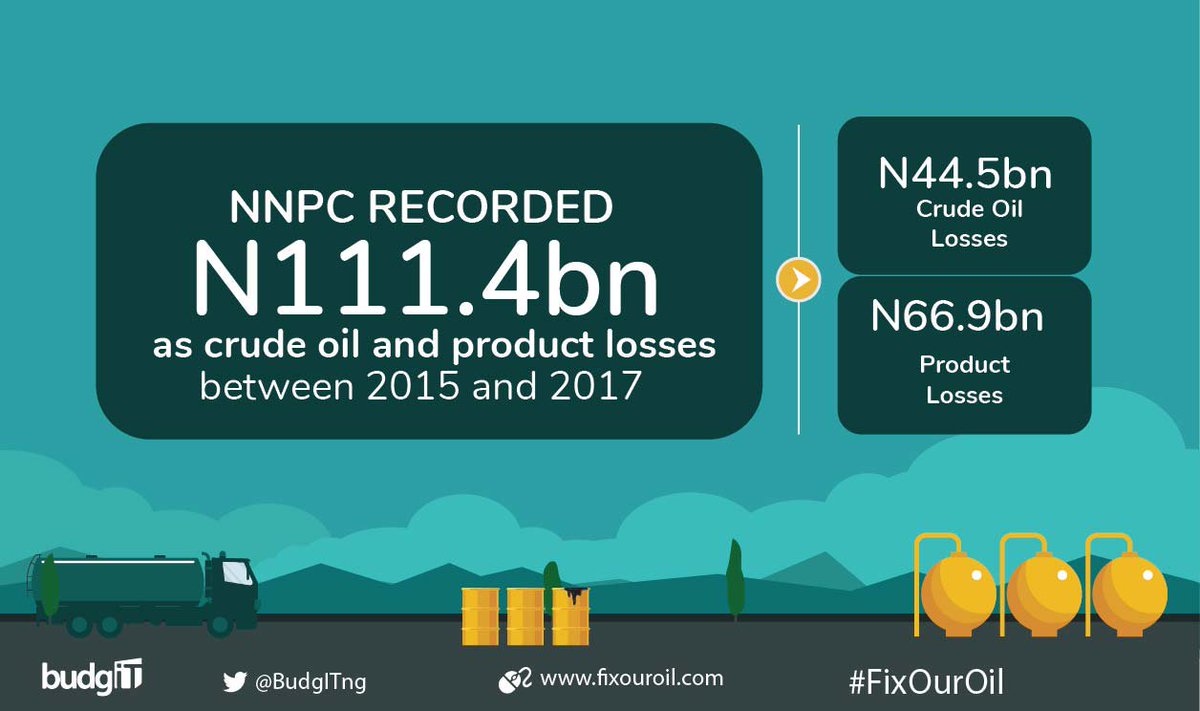

NNPC claims it lost N111.42 billion worth of crude oil and products in its custody between 2015 - 2017. This is separate from the N427 billion it claimed as financial losses incurred at its corporate headquarters alone, CHQ within the same period.

#FixOurOil

NNPC claims it lost N111.42 billion worth of crude oil and products in its custody between 2015 - 2017. This is separate from the N427 billion it claimed as financial losses incurred at its corporate headquarters alone, CHQ within the same period.

#FixOurOil

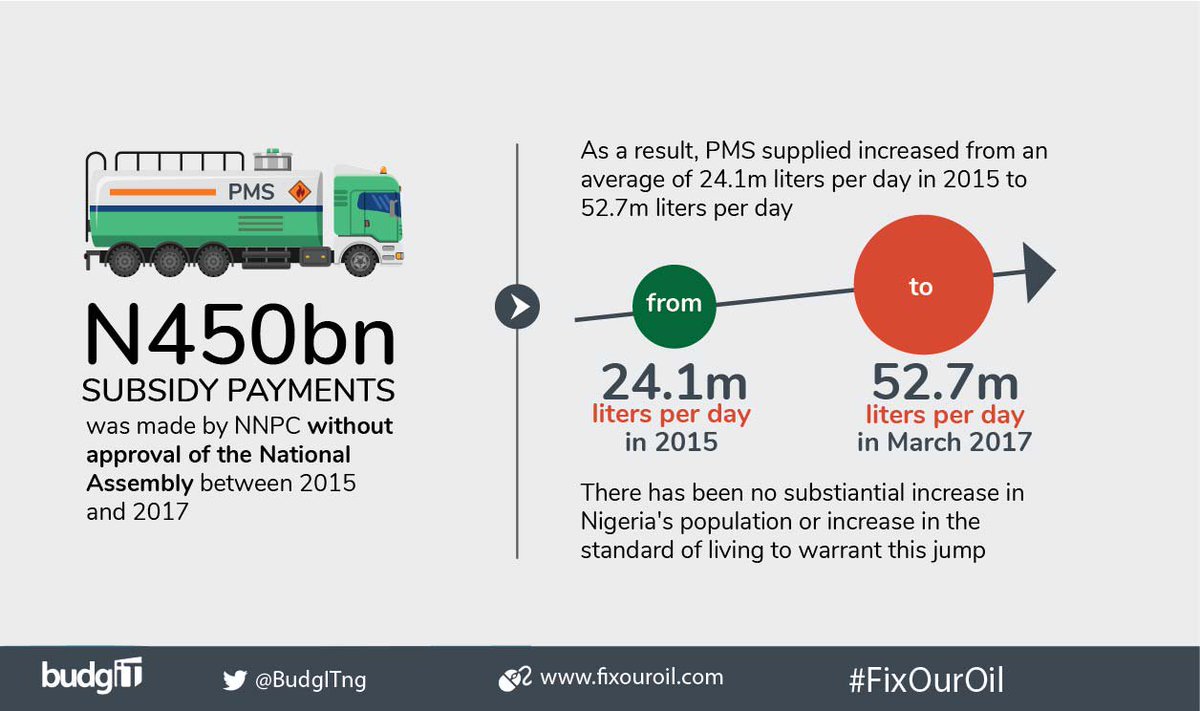

NNPC paid N450 billion as subsidy to oil marketers without approval of the National Assembly. As a result, PMS 'consumed' JUMPED from 24.1m litres/day to a peak of 52.7m liters/day in March 2017. The extra, cheap fuel is sent out for sale neighbouring countries.

#FixOurOil

#FixOurOil

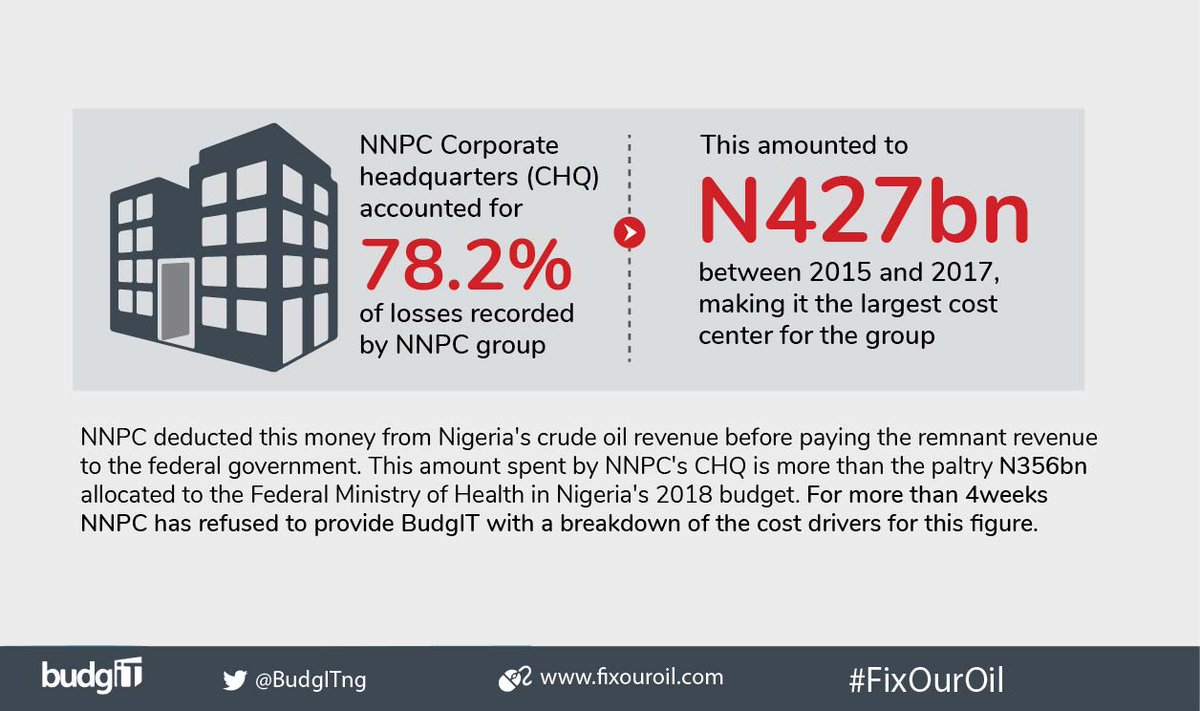

NNPC deducted N427 billion from Nigeria's crude oil revenue - without approval of the National Assembly @nassnigeria - to cover 'financial losses' at its corporate headquarters, CHQ alone between 2015 - 2017.

This is more than the 2018 budget for Health of N356bn.

#FixOurOil

This is more than the 2018 budget for Health of N356bn.

#FixOurOil

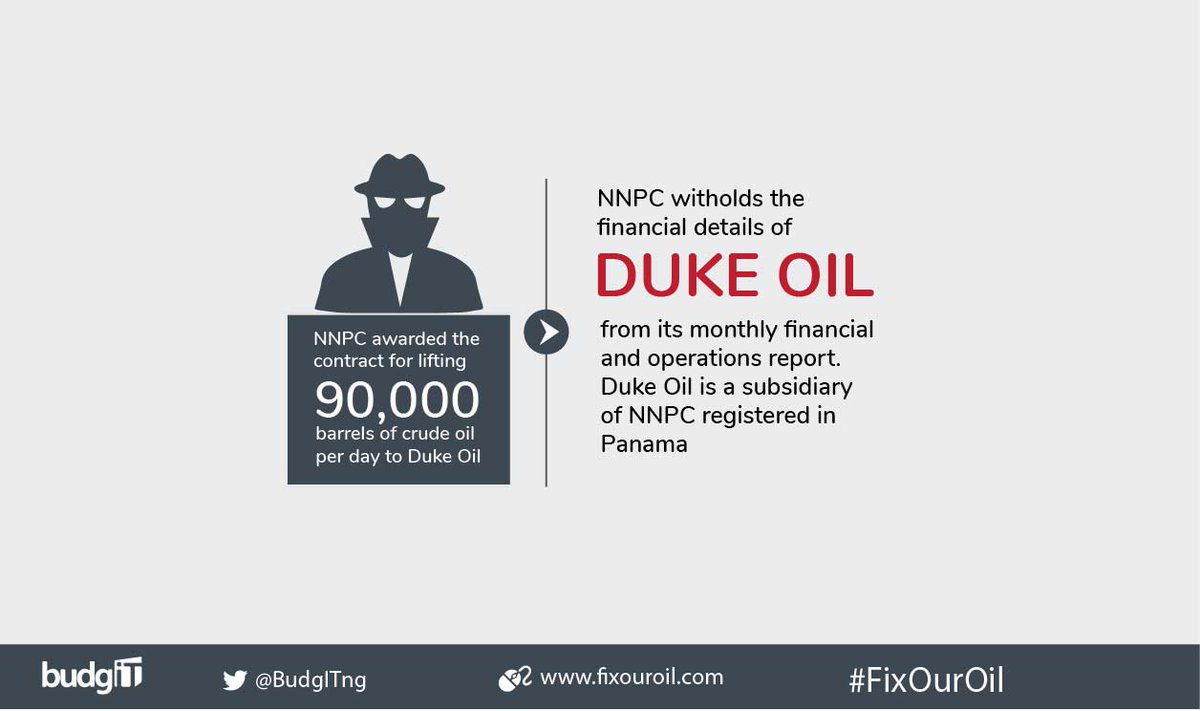

NNPC continues to ensure that the operational details of its subsidiary, Duke Oil remains opaque to citizens, with NNPC going the extra mile of registering Duke Oil in Panama - a country notorious for being a tax haven and an international hub for money laundering.

#FixOurOil

#FixOurOil

NNPC awarded Duke Oil contract to lift 90,000 barrels of crude oil daily but it has no physical office in Panama or Nigeria for such operations. It uses the office of a law firm, Arias, Fabrega & Fabrega located at Bank of America Building, 50th Street, Panama.

#FixOurOil

#FixOurOil

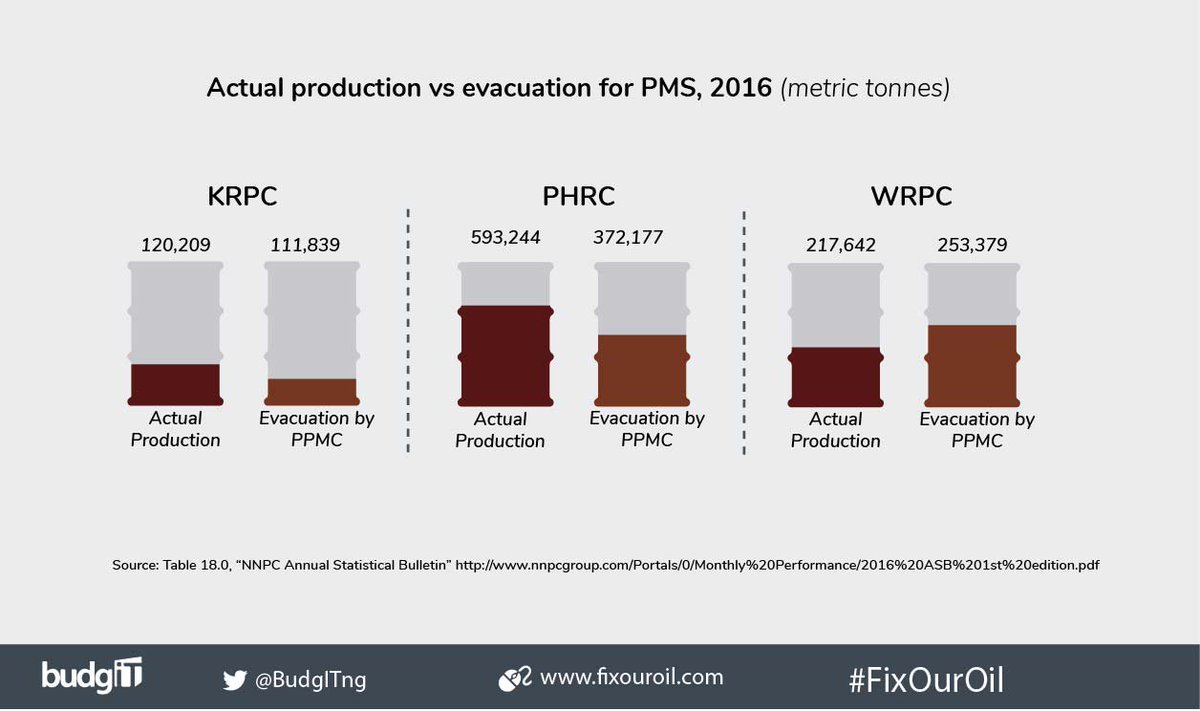

In 2016 it was observed that the three refineries processed 1.42m metric tonnes of crude between August and December 2016. However, there are no financial records from the NNPC of this in its reports.

#FixOurOil

#FixOurOil

There is always a discrepancy between actual volume of products produced at our refineries & volume evacuated by PPMC; with no record kept to account for the gap in its report.

#FixOurOil

#FixOurOil

• • •

Missing some Tweet in this thread? You can try to

force a refresh