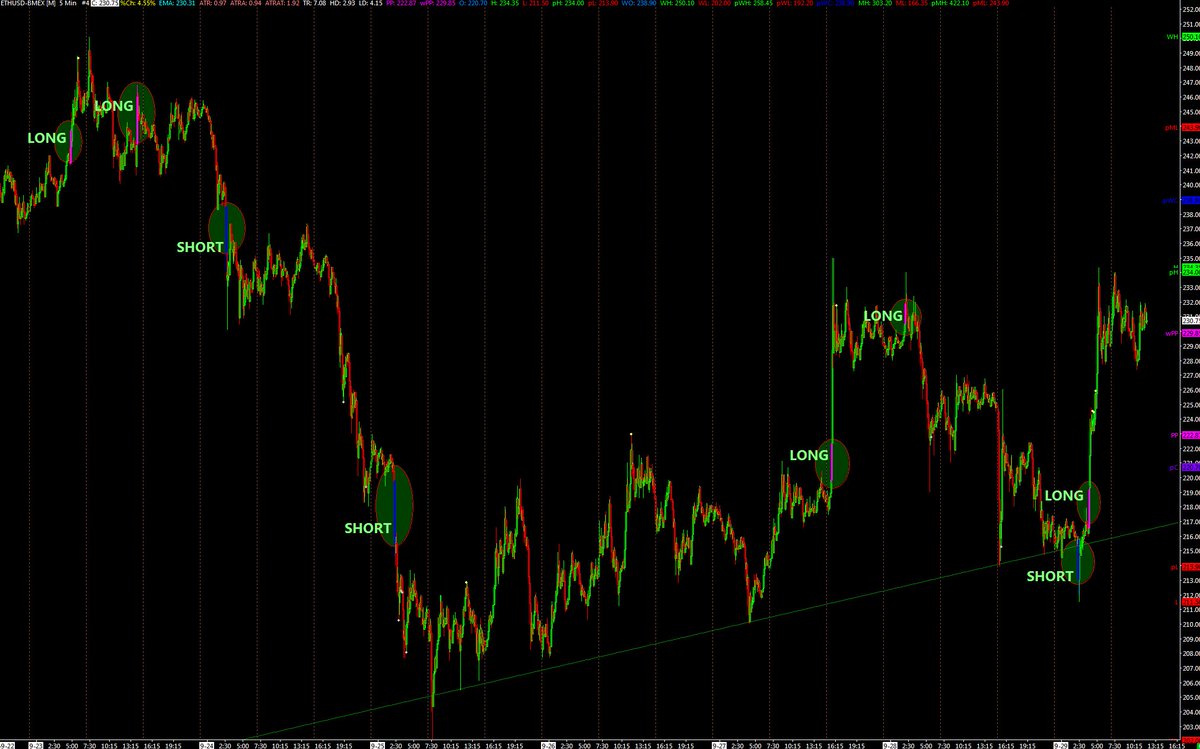

Gorgeous crypto reversal underway, particularly so on $ETH given how undersold it was, although the setup was cleaner on $BTC. Ideal long entries in my book:

- ETH: 1840-1920 EST $264-$270

- BTC: 1500-1930 EST $6100-$6170

#trading

- ETH: 1840-1920 EST $264-$270

- BTC: 1500-1930 EST $6100-$6170

#trading

Setup described as a strong drop that slowly rolls over, upwards. Ideal longs come in the 61.8%-70% reversal, ideally on a 2nd push towards a prior failed attempt to break higher - looking to trade the breakout of the prior failed attempt. Don't want to be dogmatic about the %s.

This may sound like a lot of work, requiring too much chart watching. But it is not so, as these kind of reversals do not happen that often.

Zero need to catch the bottom and suffer like a self-aware animal awaiting the slaughterhouse. That said, catching bottoms is definitively more rewarding when it works - obviously.

Last night's $ETH evisceration is something I would have normally bought as a falling knife trade IF $BTC were in freefall as well and had breaken support long ago, which didn't happen, as 5750/5850 held.

Some may be upset for not buying the bottom, thinking "I had so many hours, why didn't I buy and fill my bags?" That's pointless hindsight thinking. Should be simple to realize $BTC surprisingly held the bottom, and it breaking down would have unleashed hell.

I know of successful traders that consistently trade this setup using the MACD histogram going above zero as their trigger. It may make things easier for some, by providing a clear trigger point.

Adding color on the short side. Great short last night on the 2015 EST breakout, IMO, if a trader takes that short and for whatever reason doesn't take profit, trader must exit no later than breakeven. Shorting $275-280 and letting it go in the red is unforgivable.

Didn't take profit and gave a big winner back? Limits too far off and then got sloppy? (it happens) One should either manually or automatically move stops to breakeven after trade is X% in the money, to save oneself from a bad loss.

Letting a big winner turn into a loser can cause long-lasting psychological damage and wreak havoc with future trades.

All of this greatly depends on position size, which depends on stop loss, which depends on time frame i.e. if trading a small position using wide stops on the daily chart, $15-30 on ETH and $200-400 on BTC represent noise. One can then ignore intraday charts.

If the latter is not clear feel free to shoot me a DM.

FIN/

FIN/

• • •

Missing some Tweet in this thread? You can try to

force a refresh